TIDMBMN

RNS Number : 3620D

Bushveld Minerals Limited

21 June 2023

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement

21 June 2023

Bushveld Minerals Limited

("Bushveld Minerals" "Bushveld" or the "Company")

Full Year Results for the 12-month Period Ended 31 December

2022

Bushveld Minerals Limited (AIM: BMN), the integrated primary

vanadium producer and energy storage solutions provider, is pleased

to announce its full year results for the year ended 31 December

2022.

FY2022 Financial Highlights

-- Revenue of US$148.4 million (2021: US$106.9 million).

-- Underlying EBITDA(1) of US$22.3 million and adjusted

EBITDA(1) loss of US$1.7 million (2021: Underlying EBITDA loss

US$7.5 million and adjusted EBITDA loss of US$9.9 million).

-- Impairment losses of US$24.0 million (2021: US$2.4 million)

of which US$$17.2 million relates to Vanchem. The Group previously

recognised US$60.6 million gain on bargain purchase on the

acquisition of Vanchem in 2019.

-- Net loss of US$35.4 million (2021: US$34.2 million).

-- Free cash flow(2) of US$14.6 million (2021: negative US$19.3 million).

-- Cash and cash equivalents of US$10.9 million (2021: US$15.4 million).

-- Net debt of US$79.5 million (2021:US$68.9 million).

-- Net debt excluding the Orion Production Financing Agreement

US$44.4 million (2021:US$35.4 million).

1. Adjusted EBITDA is EBITDA, excluding the Group's share of losses from joint ventures and the remeasurement of financial liabilities. Underlying EBITDA is Adjusted EBITDA excluding impairment charges.

2. Free cash flow defined as operating cash flow less sustaining capital.

Management Changes

-- In a separate announcement published today, the Board

announced that Craig W. Coltman will be appointed as Chief

Executive and will join the Board of the Company with effect from

01 July 2023, the date on which Fortune Mojapelo will step down as

Chief Executive.

Group Priorities and Outlook

-- The Group has made significant progress with the legal

documentation to refinance its existing convertible loan note with

Orion Mine Finance ("Orion") of c.US$45 million (capital plus

interest).

-- On track to meet 2023 production guidance of between 4,200

mtV and 4,500 mtV, and weighted average production cash cost (C1)

guidance of between US$26.1kgV and US$27.0/kgV, (ZAR447/kgV and

438/kgV).

-- Bushveld Electrolyte plant (BELCO) and the Vametco hybrid

mini-grid to be fully operational during the second half of

2023.

-- Complete the Bushveld Energy carve-out.

Analyst conference call and presentation

Bushveld Minerals' Chairman, Michael Kirkwood, Chief Executive

Officer, Fortune Mojapelo, Finance Director, Tanya Chikanza and

Chief Executive designate, Craig W. Coltman will host a conference

call and presentation today at 12:00 PM BST (13:00 SAST), to

discuss the 2022 full year results and management changes with

analysts. Participants may join the call by dialling:

Tel: United Kingdom: +44 (0) 33 0551 0200; South Africa: +27 800

980 512; USA Local: +1 786 697 3501

Password: Quote Bushveld - Full Year when prompted by the operator

Alternatively, the presentation can be accessed as a webcast

here:

https://stream.brrmedia.co.uk/broadcast/6426b8b94b959ac1b1e40d18

Annual Report

The Annual Report for the year ended 31 December 2022 will be

available on the Company's website on Friday 23 June 2023 at the

following link: http://www.bushveldminerals.com/financial-reports/

. A further announcement will be made by the Company once hard

copies of the Annual Reports have been dispatched to

shareholders.

S

Enquiries: info@bushveldminerals.com

+27 (0) 11 268

Bushveld Minerals Limited 6555

Fortune Mojapelo, Chief Executive

Chika Edeh, Head of Investor

Relations

SP Angel Corporate Finance Nominated Adviser +44 (0) 20 3470

LLP & Broker 0470

Richard Morrison / Charlie

Bouverat

Grant Baker / Richard Parlons

RBC Capital Markets +44 (0) 20 7653

Jonathan Hardy / Caitlin Leopold Joint Broker 4000

Tavistock Financial PR

+44 (0) 207 920

Gareth Tredway / Tara Vivian-Neal 3150

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a low-cost, vertically integrated primary

vanadium producer. It is one of only three operating primary

vanadium producers, owning 2 of the world's 4 operating primary

vanadium processing facilities. In 2022, the Company produced more

than 3,800 mtV, representing approximately three per cent of the

global vanadium market. With a diversified vanadium product

portfolio serving the needs of the steel, energy and chemical

sectors, the Company participates in the entire vanadium value

chain through its two main pillars: Bushveld Vanadium, which mines

and processes vanadium ore; and Bushveld Energy, an energy storage

solutions provider. Bushveld Vanadium is targeting to materially

grow its vanadium production and achieve an annualised steady state

production run rate of between 5,000 mtVp.a. and 5,400 mtVp.a.

Bushveld Energy is focused on developing and promoting the role

of vanadium in the growing global energy storage market through the

advancement of vanadium-based energy storage systems, specifically

Vanadium Redox Flow Batteries ( " VRFBs " ).

Detailed information on the Company and progress to date can be

accessed on the website www.bushveldminerals.com

Chairman's Statement

Abundant opportunity constrained by several challenges

TO OUR SHAREHOLDERS,

I am pleased to preface this Annual Report for the first time,

having assumed the role of Chair from Ian Watson during the course

of the year under review.

There is a natural tendency for communications such as this to

dwell on the positive aspects of a company's performance and to

understate or plead mitigation on the challenges and the negatives

that impact results. In my view, this approach arguably discredits

the overall content, and strains the credibility of what is, after

all, the most important annual communication to the current and

prospective owners of a company.

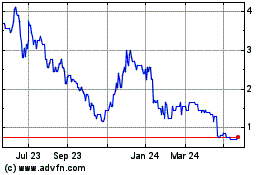

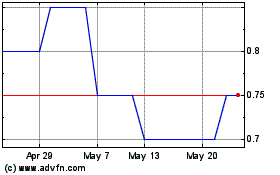

FINANCIAL AND OPERATIONAL PERFORMANCE

The Company remained loss-making, although it was able to report

free cash flow, which was used to pay down debt and partially fund

the Business' other initiatives. The quick ratio approximately

halved, gearing increased, and equity accounts declined. This is

not the outcome we planned for, nor is it sustainable, and this is

reflected in our significantly discounted share price which more

than halved in the year under review. The Board and management

fully recognise this and have evolved plans to restore momentum in

operational stability, revenue generation, cost constraint,

profitability and cash generation.

The results for 2022 were, admittedly, impacted negatively by a

combination of external and internal factors.

Externally, the conflict in Ukraine triggered an energy price

and supply crisis that in turn created an inflationary cycle that

central banks around the world responded to with monetary policy

actions. Additionally, global supply chains were disrupted. Within

South Africa, where the Company primarily operates, electricity

supply was constantly disrupted by loadshedding, the government

logistics infrastructure and services deteriorated, and raised

inflation impacted operating costs.

Internally, the Company faced issues with operational stability,

particularly at its Vanchem plant. Production at the newly

commissioned Kiln-3 was negatively impacted by the unreliable

municipal power supply. The ore supply from Vametco was found to

have a higher silica content than ideal resulting in the need for

system clearing shutdowns. Thus, although Vametco performed well,

Vanchem failed to hit its production target for the year resulting

in guidance misses and higher Group overall sustaining costs.

GOING FORWARD AND FINDING SOLUTIONS

I prefaced my remarks by stating that the challenges Bushveld

has faced, and the consequential disappointing financial results,

mask the abundant opportunity that can be realised as the Company

stabilises, and in the mid-term optimises, its operations and

financial platform. Your Board believes this is eminently

achievable and is underway.

In the face of these challenges, management has and continues to

undertake various initiatives to ensure profitability in the

current year, to improve the Company's capital structure, to secure

a more stable power supply to support increased production, to

contain costs and to crystallise value for the Bushveld Energy

assets. The BELCO electrolyte plant will be commissioned and

commence production during the second half of 2023, making Bushveld

a fully-fledged vanadium electrolyte producer. Additionally, we are

making good progress with the Vametco mini-grid, which is expected

to supply just under 10 percent of Vametco's electrical energy and

also be online during the second half of 2023.

At Vanchem, an arrangement has been concluded with the

municipality to stabilise power supply and this has already had a

positive impact in the first quarter of 2023. Also, an ore supply

contract has been concluded with a third-party operating in the

Bushveld Complex for the supply of low-silica high-grade ore that

will have a positive impact on productivity and costs at the

plant.

As previously announced, plans are well advanced for CellCube,

one of Bushveld Energy's assets, to be carved out into a listed

vehicle on the London Stock Exchange (LSE). Your Company will

retain a significant minority holding in this vehicle and therefore

keep a stake in the evolution of vanadium as an energy storage

resource. This carve-out will help reduce central costs and permit

greater focus on the residual core businesses. The devolved pure

energy storage entity should also be able to attract capital, new

investors, and a valuation aligned to that sector.

We have previously announced that we are negotiating a

restructuring of the financing provided by Orion. The objective of

the proposed arrangements is to extend debt maturities and to

reduce the equity dilution overhang from the convertible loan note.

We are grateful to Orion for their continuing support. The

refinancing will be conditional on a number of factors being worked

on and also upon shareholder approval which we expect will be

sought at this year's General Meeting.

GOVERNANCE

During the year under review the Board of Directors has been

materially reconstituted. Ian Watson, who chaired the Company since

its inception, retired. Ian oversaw the early development of

Bushveld and its transformation into an integrated vanadium

producer. His long service and guiding hand deserve our full

appreciation and we wish him well for the future.

On Ian's retirement I assumed the role of Interim Chair and

subsequently the Board has seen fit to confirm my appointment as

Chairman on an ongoing basis. I thank my fellow Directors for

placing their trust in me and look forward to working with them as

a team to the benefit of all our stakeholders.

Additionally, two of our longest serving Directors, Anthony

Viljoen (a co-founder) and Jeremy Friedlander retired from the

Board. Their wise counsel and engagement in the development of

Bushveld should similarly be recognised.

We have been fortunate to attract a new slate of very capable

Directors to the Board with the appointments over the last 18

months of Kevin Alcock, Mirco Bardella and David Noko. They bring

relevant and valuable experience to the Board and are playing a key

role in guiding Bushveld in its next stage of development.

During the year we also welcomed Jacqueline Musiitwa as a

Non-Executive Director but unfortunately, she was obliged to step

down upon accepting a role within the United States Agency for

International Development (USAID) that precluded her from remaining

in private sector roles. We wish her success in this important

engagement.

Further to this, we have announced that co-founder and Chief

Executive, Fortune Mojapelo, has decided to step down from his role

as of 01 July 2023. He has led the Company for over 11 years and

has, through his vision and dedication to the Company, built

Bushveld Minerals from an exploration business to a multi-asset

vanadium producer, owning and operating two of four global primary

vanadium processing facilities. We sincerely appreciate all that

Fortune has done to make Bushveld what it is today and wish him

every success in his future endeavours.

We are delighted that Craig Coltman is taking up the position as

CEO. Having worked with De Beers Consolidated Mines for over 32

years in various operational and commercial roles, and most

recently as Chief Financial Officer and Executive Director of the

group, Craig is well qualified to take up the leadership mantle and

steer the Company going forward.

We look forward to working with him during a short period of

transition and thereafter.

CONCLUSION

We reinforce to our shareholders that our strategic aims are

robust and achievable. The foundations are laid, the edifice is

progressing but remains work in progress. The focus of the Board

and the Management is to deliver value and returns to our owners

through, and I am being intentionally repetitive, achieving our

operational targets, managing costs, generating free cash flow,

strengthening our balance sheet, and investing capital

prudently.

The Board has been incredibly engaged and supportive as we

tackle our challenges and it remains only for me, on their behalf,

to thank the entire Bushveld team for their efforts, resilience and

dedication during a challenging year and wish them well for fairer

winds ahead.

Michael J. Kirkwood

Chairman

Chief Executive Officer's Review

Progress with more potential in the pipeline

DEAR STAKEHOLDERS,

I am pleased to present the report on Bushveld Minerals'

performance over the past financial year. The year 2022 marks 10

years since the Company's listing on AIM as a junior mineral

exploration company. It also marks five years since we embarked on

our transformative journey from an explorer into a vanadium

producer, first with the acquisition of Vametco, and later Vanchem.

This allowed us to produce a broad range of vanadium products that

enable the production of more environmentally friendly steel and

support the global energy transition to green renewable energy

through the application of long-duration VRFBs.

In that time the Company has invested substantially to establish

a vertically-integrated primary vanadium production platform

comprising (a) two of only four operating primary-processing plants

in the world, supplying more than three percent of the global

vanadium market, with scope to grow this into the future and (b) a

VRFB platform that is positioned to play a meaningful role in the

growing stationary energy storage market.

While 2022 started with optimism on the back of a receding

COVID-19 pandemic, several factors in the geopolitical developments

continued to plague the global economy and specifically the

vanadium market. Consequently, between 2021 and 2022, vanadium

demand in steel making dropped by 0.41 percent which was

fortunately mitigated by a 79 percent increase in vanadium demand

from the energy storage sector, resulting in an overall increase of

0.48 percent in vanadium demand.

This global backdrop was exacerbated by unique local challenges,

most notably the national electricity crisis that saw Vanchem

without a steady flow of electrical supply at a pivotal time when

it was commissioning and optimising Kiln-3 after the refurbishment

programme.

THE YEAR IN REVIEW

If external factors paint a bleak operating environment for the

Company in the past three years, they also cast a spotlight on its

resilience, as it continued to invest in its producing assets to

grow production and lower unit costs (particularly at the recently

refurbished and ramping up Vanchem) as well as continuing to

develop its vanadium energy storage platform.

The Group production increase from 3,592 mtV in 2021 to 3,842

mtV in 2022, was underpinned by Vametco's operational performance.

Having achieved operational stability during the second half of

2021, its consistent production rates enabled it to report

full-year production of 2,705 mtV, exceeding the upper end guidance

of 2,550 - 2,650mtV.

In contrast to stable production at Vametco, Vanchem production

missed guidance for an overall production of 1,137mtV.

Consequently, Group production, at 3,842 mtV, was below the lower

end of the revised guidance of 3,900- 4,100 mtV. Lower recovery

rates from Kiln-1 at Vanchem as it was taken out of service, a

slower-than-anticipated ramp-up of Kiln-3 post commissioning,

higher silica content in the ore supply, and the impact of

loadshedding which affected our ability to optimise output, meant

production levels were considerably lower than anticipated. Details

on the Group's operational performance can be found in the

Operating Assets and Operational Review section of the Annual

Report.

Although we did not achieve our Group production run rate target

of 5,000 - 5,400 mtV by the end of 2022, we remain committed to

meeting this target by attaining similar levels of operational

stability at Vanchem as Vametco - centred around securing supply of

suitable ore, stable power supply and improved post commissioning

operations - all three areas that the Company has made progress in

resolving.

Specifically, in November 2022, an agreement was reached with

the Emalahleni Local Municipality putting Vanchem on a load-

curtailment contract plan. This arrangement has resulted in

reduced/curtailed power supply rather than an outright loss of

power during periods of loadshedding. While this has resulted in a

marked improvement in power security for Vanchem so far in 2023, we

continue to pursue a direct contract with Eskom, in line with

Vametco's power supply arrangements. In addition to this, the

access to low-silica, third-party feedstock will also contribute to

improved production and less downtime at Vanchem.

Group production cash cost of US$27.7/kgV was higher than in

2021 and above our guidance of between US$22.7/kgV and US$23.5/kgV,

driven by significantly higher price inflation across most inputs

and energy prices as well as a higher fixed cost base not matched

by expected higher production at Vanchem. Next to stable production

performance, cost containment is an area receiving intense focus

across several areas of the business. Details on our cost

initiatives can be found in the Finance Director's Review.

BUSHVELD ENERGY

Progress continues in advancing both the development of the

BELCO electrolyte plant in East London and the mini-grid at

Vametco. We have concluded that the full value and potential of

Bushveld Energy as a subsidiary business will be constrained and

for this reason we have been preparing its carve-out into a

stand-alone business.

As previously announced, we have entered into a conditional

agreement to sell our entire interest in CellCube to Mustang, and,

in exchange, we will receive shares in Mustang. The sale is an

important part of the carve-out process, as it effectively gives

Bushveld a significant stake in a London-listed energy storage

business. The transaction provides CellCube with direct access to

capital markets, allowing it to attain a transparent market value

and attract specialist investors looking to participate in this

exciting growth sector.

As we have communicated, it is the right time for this emerging

energy storage story to take on a life of its own, while we retain

an interest in the business through Mustang and, most importantly,

maintain our vertically-integrated business model. Subject to

various regulatory consents and capitalisation, we expect to

complete the carve-out during the second half of 2023.

FINANCIAL PERFORMANCE AND CONVERTIBLE LOAN NOTE

Despite the operational challenges we faced during the year

under review, higher prices and sales meant we generated Revenue of

US$148.4 million, underlying EBITDA of US$22.3 million and a

reduced adjusted EBITDA loss of US$1.7 million. During the year we

repaid the entire Nedbank revolving credit facility of US$5.9

million. We generated free cash flow of US$14.6 million and ended

the year with a cash and cash equivalent balance of US$10.9

million.

A large proportion of our capital investment over the last five

years was funded by debt, which includes a US$35 million

convertible loan note held by Orion. With an advancing maturity

date of November 2023, the convertible loan note was putting

pressure on our balance sheet and creating a potentially dilutive

overhang on the share price. We are in advanced discussions with

Orion for the convertible loan note to be restructured so as to

substantially reduce the pressure on the Company's balance sheet.

Details of the revised structure are provided in Note 37 of the

Financial Statements.

An extensive assessment of the financial position indicates that

the Group requires additional liquidity in order to meet its

obligations and activities over the next 12 months. We are

exercising levers within our control to improve the Group's

liquidity. In addition to these internal mechanisms under our

control we are pursuing various financing alternatives to increase

our liquidity and capital resources. Details on the Group's Going

Concern can be found in the Finance Director's Review and in Note 3

of the Financial Statements.

SUSTAINABILITY AND SAFETY

Long-term sustainability depends on securing and maintaining a

solid social licence to operate by nurturing strong partnerships

with all our stakeholders, especially our communities.

We also acknowledge that sustainability, for all companies, is a

journey. In 2022, we made notable progress in our sustainability

journey, highlighted by the establishment of an Environment Social

and Governance (ESG) Committee to oversee and monitor the

implementation of our ESG strategy. Our longer-term ambitions

remain unchanged, the details of which can be found in the

Sustainability section of this report. The safety and well-being of

our employees and contractors is an absolute priority and we remain

committed to the objective of zero harm in our workplace. We had no

fatalities during the current reporting period, however, the

Group's 2022 Total Injury Frequency Rate (TIFR) of 10.32 was 33

percent higher than 2021. For this reason, in the year under

review, we commissioned an audit of our safety procedures and

performance. We understand what the gaps are and I am heartened to

report that this has started yielding results, as evidenced by the

50 percent improvement in the TIFR in the last quarter of 2022.

CONCLUSION

I extend my heartfelt thanks to every one of Bushveld Minerals'

employees. In spite of the many challenges we face, your visible

commitment to ensuring the success of this Company in 2022 was

greatly appreciated by myself, senior management, and the Board. I

would like to thank our shareholders for their patience,

commitment, and faith in the Company.

I am confident in the opportunities that lie in the future for

the Business and firmly believe that the efforts of the past,

position the Company well to capture these going forward.

Finally, the Company and I announced today that after more than

10 years as the founding CEO of Bushveld Minerals, I will be

stepping down and will not seek re-election to the board of the

Company. Simultaneously announced today is the appointment of Craig

Coltman as CEO of the Company with effect from 01 July 2023.

Co-founding and leading Bushveld Minerals into an integrated

vanadium platform positioned to play an ever increasing role in the

growing vanadium industry has been an immense privilege. While

recognising the challenging circumstances the Company has had to

navigate in recent years, my conviction in the potential and future

success of this Company remains.

To our shareholders and stakeholders, thank you for your trust;

and to the team at Bushveld under the leadership of Craig, I wish

you the success that all your hard work and the trust of our

stakeholders deserves.

Fortune Mojapelo

Chief Executive Officer

Finance Director's Review

Positive Underlying EBITDA as Vametco attains target

production

1. OVERVIEW

Unit FY 2022 FY 2021

Revenue US$m 148.4 106.9

--------- -------- --------

Cost of sales US$m (108.3) (102.8)

--------- -------- --------

Other operating costs and income US$m (40.0) (12.8)

--------- -------- --------

Administrative costs US$m (20.3) (20.5)

--------- -------- --------

Adjusted EBITDA(1) US$m (1.7) (9.9)

--------- -------- --------

Impairment charges US$m (24.0) (2.4)

--------- -------- --------

Underlying EBITDA(2) US$m 22.3 (7.5)

--------- -------- --------

Operating loss US$m (20.1) (29.3)

--------- -------- --------

Average foreign exchange rate US$:ZAR 16.35 14.79

--------- -------- --------

Group production mtV 3,842 3,592

--------- -------- --------

Group sales mtVw 3,584 3,314

--------- -------- --------

All-in sustaining cost US$/kgV 43.7 37.4

--------- -------- --------

Average realised price US$/kgV 41.4 32.2

--------- -------- --------

The 2022 financial results show an improvement on the prior year

in a number of line items although we remained loss making. Our

strategy to prioritise operational stability and increase

investment in maintenance paid off as Vametco achieved consistent

and stable operational performance which was reflected in the

financial numbers.

We recorded an underlying EBITDA of US$22.3 million and adjusted

EBITDA loss of US$1.7 million. While an operating loss of US$20.1

million was incurred, this was a US$9.2 million positive change

from the prior year, as realised prices rose and we continued with

our cost management measures to mitigate any inflationary pressures

and electricity challenges. We realised savings of US$1.5 million

owing to initiatives related to procurement. The operating loss

also included impairment losses of US$24.0 million, U$21.5 million

higher than the prior year. US$17.2 million of the impairment

losses pertain to Vanchem.

Two years of volatile prices, operational challenges and the

impact of the COVID-19 pandemic have restricted our ability to pay

down the rest of the debt on our balance sheet. To this end we

recently announced a proposed refinancing of the Orion US$35

million convertible loan notes and capitalised interest into a

revised capital structure. Details on the proposed refinancing are

included in note 37 in the annual consolidated financial

statements. The refinancing will be conditional on several items,

including due diligence, shareholder approval at a general meeting

and definitive documentation. We have made significant progress

with the legal documentation of the restructuring.

The restructure of the convertible loan notes is expected to

remove the risk of a large cash outflow, which has been putting

pressure on our balance sheet and cash position. The new structure

will enable the Group to repay the debt over a longer time period

and in line with the Group's planned internally generated cash

flows.

2. INCOME STATEMENT

Analysis of results

The income statement summary below is adjusted from the

"statutory" primary statement presentation:

Year ended Year ended

31-Dec-22 31-Dec-21

US$'000 US$'000

Revenue 148,448 106,857

-------------------- --------------------

Cost of sales excluding depreciation (90,268) (83,780)

-------------------- --------------------

Other operating costs and income(3) (39,950) (12,837)

-------------------- --------------------

Administration costs excluding depreciation (19,889) (20,125)

-------------------- --------------------

Adjusted EBITDA (1,659) (9,885)

-------------------- --------------------

Depreciation (18,475) (19,395)

-------------------- --------------------

Operating loss (20,134) (29,280)

-------------------- --------------------

Other losses (818) (1,902)

-------------------- --------------------

Share of loss from joint ventures (5,112) (4,351)

-------------------- --------------------

Fair value gain on derivative liability 2,934 9,010

-------------------- --------------------

Net financing expenses(4) (13,654) (12,373)

-------------------- --------------------

Loss before tax (36,784) (38,896)

-------------------- --------------------

Income tax 1,345 4,671

-------------------- --------------------

Net loss for the year (35,439) (34,225)

-------------------- --------------------

Revenue

Year ended Year ended

31-Dec-22 31-Dec-21

Group sales (mtV) 3,584 3,314

----------- -----------

Average realised price (US$/kgV) 41.4 32.2

----------- -----------

Revenue (US$'000) 148,448 106,857

----------- -----------

Revenue

Revenue of US$148.4 million for the Group was 39 percent higher

than in the previous year, underpinned by the improved average

realised price of US$41.4/kgV (2021: US$32.2/kgV) and increased

Group sales volumes of 3,584 mtV, following record production of

3,842 mtV.

The geographic split of Group sales in 2022 was 44 percent to

the USA, 27 percent to Europe, 9 percent to Asia, 7 percent to

South Africa, and 13 percent to the rest of the world.

During the year, nitro vanadium sales into North America were

prioritised due to the higher vanadium prices realised in this

region and we maximised worldwide sales into the aerospace and

speciality chemical products sectors, which attract price

premiums.

Cost analysis

Year ended Year ended

31-Dec-22 31-Dec-21

Cost of sales excluding depreciation (90, 268) (83,780)

----------- -----------

Other operating costs and income (39,950) (12,837)

----------- -----------

Administrative costs excluding depreciation (19,889) (20,125)

----------- -----------

Total income statement operating cost excluding

depreciation (150,107) (116,742)

----------- -----------

Total units sold (mtV) 3,584 3,314

----------- -----------

Cost per income statement per unit sold

(excluding depreciation) (US$/kgV) 41.9 35.2

----------- -----------

Sustaining capital (6,589) (7,192)

----------- -----------

Total cost including sustaining capital (156,696) (123,934)

----------- -----------

Cost per unit sold including sustaining

capital (US$/kgV) 43.7 37.4

----------- -----------

Cost of sales

The cost of sales, excluding depreciation, for the year was

US$90.3 million, contained to an inflationary 8 percent increase

year-on-year, primarily due to higher costs at both Vametco and

Vanchem. The cost increases included:

-- Higher personnel costs at Vanchem associated with the

commissioning and ramp-up of Kiln-3 in order to seek to achieve the

anticipated production run rate of 2,600 mtVp.a which was not

attained in the financial year due to ore quality and electricity

supply issues;

-- Inflationary increases in raw material prices from suppliers;

-- Higher energy costs due to the increase in oil and diesel

prices as well as an increase in diesel usage during periods of

loadshedding at Vanchem;

-- Higher maintenance costs, mainly at Vanchem, due to the

additional maintenance required on Kiln-1, as well as maintenance

costs to sustain the plants, production volumes and improve

operational stability; and

-- Higher mining costs at Vametco, primarily due to increased

activity associated with mining the Upper Seam.

Other operating costs and income

Other operating costs and income increased to US$40.0 million

due to:

-- A US$2.9 million increase in selling and distribution costs

to US$9.3 million, primarily driven by the higher commissions paid

which are a consequence of the increased revenue as well as

increased shipping and warehouse costs;

-- A US$3.3 million increase in idle plant costs to US$6.7

million, primarily due to the unplanned downtime at Vanchem

associated with Kiln-1 during the first half of the year, unplanned

downtime due to loadshedding and higher than anticipated silica

content in the ore;

-- A US$21.5 million increase in impairment losses to US$24.0

million, due to an impairment loss of US$17.2 million recognised

for Vanchem given the slower than expected ramp up, impairment loss

of US$5.1 million in respect of the Imaloto Coal Project as there

are no further planned expenditures for this project, and an

impairment loss of US$1.6 million recognised for property, plant

and equipment. The Group recognised in 2019 a gain on bargain

purchase of US$60.6 million on the acquisition of Vanchem being the

difference between the fair value of the consideration paid and the

fair value of the acquired assets and liabilities; and

-- Other operating income of US$2.7 million was unchanged relative the prior year.

Cost per unit sold

The Group cost per unit sold for the year (including sustaining

capital expenditure) was US$43.7/kgV. This represents a 17 percent

increase relative to the prior year primarily as a result of the

cost factors noted above, offset by the cost containment measures

we implement; higher sales volumes and a weaker ZAR:US$ exchange

rate.

Administration costs

Administration costs, excluding depreciation charges for the

year were US$19.9 million. Below is a breakdown of the key items

included in administration costs:

Year ended Year ended

31-Dec-22 31-Dec-21

US$'000 US$'000

Staff costs 9,327 10,746

----------- -----------

Professional fees 6,007 5,861

----------- -----------

Share-based payments 315 (375)

----------- -----------

Other (incl. IT and security expenses) 4,240 3,893

----------- -----------

19,889 20,125

----------- -----------

Cost-saving programme

We continued with our cost-reduction measures, as previously

announced, and realised savings of US$1.5 million owing to

procurement initiatives for the 2022 financial year. We

re-estimated the projected savings for 2023, in light of

inflationary pressures, lingering product shortages, wage

escalations, shipping challenges and surging commodity prices, to

US$1.3 million. The total expected savings will be US$2.8 million

over the two-year period, which is still within the US$2.5 million

to US$4.0 million cost-savings target we had previously provided,

despite the negative impact of factors outside of our control such

as inflation. While production volume growth is expected to

contribute the most to reducing unit costs, we will continue to

seek broader cost- saving opportunities to improve the Group's unit

cost performance even further. These efforts are focused on

procurement, payroll, administration costs and maintenance.

Adjusted and underlying EBITDA

Adjusted EBITDA is a factor of volumes, prices and cost of

production. This is a measure of the underlying profitability of

the Group, which is widely used in the mining sector. Underlying

EBITDA removes the effect of impairment charges.

Year ended Year ended

31-Dec-22 31-Dec-21

US$'000 US$'000

Revenue 148,448 106,857

------------------ -----------

Cost of sales (108,304) (102,782)

------------------ -----------

Other operating costs and income (39,950) (12,837)

------------------ -----------

Administration costs (20,328) (20,518)

------------------ -----------

Add: Depreciation and amortisation 18,475 19,395

------------------ -----------

Adjusted EBITDA (1,659) (9,885)

------------------ -----------

Add: Impairment losses 23,965 2,439

------------------ -----------

Underlying EBITDA 22,306 (7,446)

------------------ -----------

US$'000

------------------ -----------

2021 Underlying EBITDA (7,446)

------------------ -----------

Revenue changes 41,591

------------------ -----------

Operating costs changes (20,163)

------------------ -----------

Inventory movement 8,324

------------------ -----------

2022 Underlying EBITDA 22,306

------------------ -----------

The Group delivered an adjusted EBITDA loss of US$1.7 million,

an improvement of US$8.2 million compared to 2021, primarily driven

by the higher average realised price and higher sales volumes, and

partially offset by the increase in cost of sales and other

operating and administration costs. The Group generated an

underlying EBITDA of US$22.3 million, which was an improvement of

US$29.8 million compared to the previous year.

Net financing expenses

Net financing expenses were US$13.7 million, US$1.3 million

higher than in the prior year. The increase was primarily due to

interest on the Orion PFA and Orion convertible loan notes. Below

is a breakdown of net financing expenses:

Year ended Year ended

31-Dec-22 31-Dec-21

US$'000 US$'000

Finance income (494) (935)

----------- -----------

Interest on borrowings 11,189 10,687

----------- -----------

Unwinding of discount 1,726 1,915

----------- -----------

Interest on lease liabilities 974 459

----------- -----------

Other finance costs 259 247

----------- -----------

13,654 12,373

----------- -----------

Interest on borrowings mainly reflected the finance cost on the

Orion convertible loan notes of US$6.4 million (2021: US$5.4

million), interest on the Orion PFA of US$4.4 million (2021: US$4.3

million), and interest on the Nedbank revolving credit facility of

US$0.2 million (2021: US$0.6 million). Refer to note 36 in the

annual consolidated financial statements for details of the change

in the accounting treatment for the Orion convertible loan notes

and its impact on finance costs.

Other non-cash costs

The share of loss from investments in joint ventures of US$5.1

million (2021: US$4.4 million) is the Group's share of the loss

from its investment in VRFB-H.

The fair value gain on the derivative liability on the Orion

convertible loan notes was US$2.9 million, a decrease from the

US$9.0 million in the prior year, as restated. The decrease was

primarily driven by the decrease in the Company's share price

compared to the conversion price on the Orion convertible loan

notes of 17 pence.

3. BALANCE SHEET

Assets

Non-current assets related to intangibles and property, plant

and equipment decreased compared to the previous year due to

impairment losses recognised, depreciation, and exchange rate

differences arising from a weaker ZAR:US$ exchange rate, partially

offset by capital expenditures.

Investment in joint ventures of US$3.2 million represents the

Group's equity investments in VRFB-H and the Vametco mini-grid. The

investment in joint ventures decreased from 2021 owing to the

recognition of the Group's share of the losses amounting to US$5.1

million, partly offset by the US$1.2 million investment into

Vametco's mini-grid.

Inventories of US$55.0 million increased by US$13.4 million

compared to the prior year, primarily due to an increase in work in

progress at Vanchem as a result of continued loadshedding. This

impacted the conversion of work in progress to finished goods.

The decrease in cash and cash equivalents to US$10.9 million was

primarily due to capital expenditures incurred (US$18.2 million),

the repayment of the Nedbank revolving credit facility (US$5.9

million), the payment of finance costs on the Orion PFA (US$2.9

million), partially offset by cash generated from operations

(US$21.2 million), and the proceeds received from funding provided

by the IDC to build the BELCO electrolyte plant (US$3.4

million).

Equity

The increase in the share capital and share premium was

primarily due to the conversion of the convertible loan notes

issued to Primorus Investments Plc and the shares issued to Lind

Global Macro Fund, in accordance with the backstop agreement

between the Mustang convertible loan notes holders (see RNS dated

29 March 2022). These transactions were entered into in the process

of carving out Bushveld Energy.

Liabilities

Total borrowings (excluding lease liabilities) of US$83.1

million increased by US$3.2 million compared to the previous year,

due to capitalised finance costs of US$11.7 million and funding

provided by the IDC of US$3.4 million in respect of Belco,

partially offset by the repayment of the Nedbank revolving credit

facility of US$5.9 million, repayment of finance costs on the Orion

PFA of US$2.9 million and the fair value gain on the derivative

liability of US$2.9 million. Current borrowings increased in 2022

to US$47.9 million, as the Orion convertible loan notes is due by

the end of 2023.

The net debt reconciliation below outlines the Group's total

debt and cash position:

Year ended Year ended

31-Dec-22 31-Dec-21 Change

US$'000 US$'000 US$'000

Nedbank revolving credit facility - (5,821) 5,821

----------- ----------- ---------

Orion Production Financing (PFA)

Arrangement (35,146) (33,512) (1,634)

----------- ----------- ---------

Orion convertible loan notes (39,742) (36,282) (3,460)

----------- ----------- ---------

Industrial Development Corporation

(IDC) loans (5,480) (3,282) (2,198)

----------- ----------- ---------

Other (2,762) (1,000) (1,762)

----------- ----------- ---------

Lease liabilities (7,283) (4,485) (2,798)

----------- ----------- ---------

Total debt (90,413) (84,382) (6,031)

----------- ----------- ---------

Total debt excluding PFA (55,267) (50,870) (4,397)

----------- ----------- ---------

Cash and cash equivalents 10,874 15,433 (4,559)

----------- ----------- ---------

Net debt (79,539) (68,949) (10,590)

----------- ----------- ---------

Net debt excluding PFA (44,393) (35,437) (8,956)

----------- ----------- ---------

Net debt increased by US$10.6 million compared to the prior year

due to capitalised interest of US$3.4 million on the Orion

convertible loan notes, increase in lease liabilities of US$2.8

million due to additional leases and extension of lease terms and

the decrease in the cash and cash equivalents balance of US$4.6

million.

The Group expects to repay the Orion debt obligations from

internally generated cash flows.

4. CASH FLOW STATEMENT

The table below summarises the main components of cash flow

during the year:

Year ended Year ended

31-Dec-22 31-Dec-21

US$'000 US$'000

Operating loss (20,134) (29,280)

------------------ -------------------

Impairment losses 23,965 2,439

------------------ -------------------

Depreciation and amortisation 18,475 19,395

------------------ -------------------

Other non-cash items (6,630) -

------------------ -------------------

Changes in working capital and provisions 6,154 (5,022)

------------------ -------------------

Taxes received/(paid) (648) 394

------------------ -------------------

Cash inflow/(outflow) from operations 21,183 (12,074)

------------------ -------------------

Sustaining capital expenditures (6,589) (7,192)

------------------ -------------------

Free cash flow 14,594 (19,266)

------------------ -------------------

Cash used in other investing activities (13,000) (9,967)

------------------ -------------------

Cash used in financing activities (5,346) (7,049

------------------ -------------------

Cash outflow (3,752) (36,282)

------------------ -------------------

Opening cash and cash equivalents 15,433 50,541

------------------ -------------------

Foreign exchange movement (807) 1,174

------------------ -------------------

Closing cash and cash equivalents 10,874 15,433

------------------ -------------------

Operating activities

The Group generated cash from operating activities of US$21.2

million, an increase of US$33.3 million from the previous year,

primarily driven by the improvement in adjusted EBITDA.

Investing activities

Cash used in investing activities (including sustaining capital

expenditure) of US$19.6 million was primarily driven by capital

expenditure on property, plant and equipment of US$18.2 million and

an equity investment into the Vametco mini-grid of US$1.2

million.

Capital Expenditure

2022 marks the end of a substantive capital investment phase,

during which we undertook extensive refurbishment and optimisation

of Vametco and Vanchem and constructed the BELCO electrolyte plant.

In addition, following the commissioning of Vanchem's Kiln-3, the

Company's capital expenditure rate has halved compared to 2021 as

spend has been limited mainly to sustaining capital, which is

expected to support positive cash generation.

Capital Expenditure (US$' million)

2022 2023

Vametco 6.5 -

- Growth 3.7-3.9

- Sustaining

------ ----------

Vanchem 4.5 -

- Growth 0.1 3.2-3.4

- Sustaining

------ ----------

Bushveld Energy 7.1 2.3-2.4*

- Growth - -

- Sustaining

------ ----------

Total 18.2 9.2-9.7

------ ----------

* Most of the spending will be on BELCO

Financing activities

Cash used in financing activities of US$5.3 million comprised

the repayment of the Nedbank revolving credit facility (including

interest) of US$5.9 million, repayment of finance cost on the Orion

PFA of US$2.9 million and repayment of lease liabilities of US$0.7

million, partially offset by the proceeds received from borrowings

of US$4.2 million, primarily from the IDC (US$3.4 million).

5. FINANCIAL RISK

The primary financial risks faced by the Group relate to the

availability of funds to meet business needs (liquidity risk), the

risk of default by counterparties to financial transactions (credit

risk), fluctuations in interest and foreign exchange rates, and

commodity prices (market risk). These factors are more fully

outlined in the notes to the consolidated financial statements.

They are important aspects to consider when addressing the Group's

going concern status. We proactively manage the risks within our

control.

There are, however, factors outside the control of management.

These are volatility in the ZAR:US$ exchange rate, as well as the

vanadium price, which we do not currently hedge, and which can have

a significant impact on the cash flows of the business. The slower

than planned ramp up in production at Vanchem has hampered our

ability to introduce a hedging policy. However, we remain committed

to considering a hedging policy and assessing the potential to

implement a strategy to address the fluctuations in the ZAR:US$

exchange rate when we attain steady state production at our

operations.

6. GOING CONCERN AND OUTLOOK

We closely monitor and manage liquidity risk by ensuring that

the Group has sufficient funds for all ongoing operations. As part

of the annual budgeting and long-term planning process, the

Directors reviewed the approved Group budget and cashflow forecast

through to 31 December 2024. The current cashflow forecast has been

amended in line with any material changes identified during the

year. Equally, where funding requirements are identified from the

cashflow forecast, appropriate measures are taken to ensure these

requirements can be satisfied.

We entered into a non-binding term sheet with Orion subsequent

to year-end to refinance the convertible loan notes. The closing of

the transaction is still subject to certain conditions, including

South Africa Reserve Bank approval, shareholders' approval at the

general meeting which we urge shareholders to support and the

finalisation of definitive binding documentation. We have made

significant progress with the legal documentation of the

restructuring.

We have performed an assessment of whether the Group would be

able to continue as a going concern for at least twelve months from

the date of the annual consolidated financial statement. We took

into account the financial position, expected future performance of

the operations, the debt facilities and debt service requirements,

including those of the proposed refinancing of the Orion

convertible loan notes, the working capital and capital expenditure

commitments and forecasts.

Current cashflow forecast indicates that the Group requires

additional liquidity to fund its obligations and activities during

the next twelve months. We have identified and are proactively

exercising levers within our control which will improve the Group's

liquidity. Importantly, we are also actively pursuing various

financing alternatives including raising capital to increase

liquidity and capital resources. We believe shareholders will

support the capital raising endeavours to ensure the growth the

Company is positioned for, can be delivered.

The Group's ability to continue as a going concern is dependent

on its ability to complete the refinance of the Orion convertible

loan notes and obtain the necessary additional funding required

through a capital raise or alternative funding sources. These

conditions indicate the existence of material uncertainties that

may cast significant doubt on the Group's ability to continue as a

going concern.

The consolidated financial statements for the year ended 31

December 2022 have been prepared on a going concern basis as, in

the opinion of the Directors, the Group will be in a position to

continue to meet its operating and capital costs requirements and

pay its debts as and when they fall due for at least twelve months

from the date of this report. The going concern note included in

the accounting policies provides further information.

Tanya Chikanza

Finance Director

1. Adjusted EBITDA is EBITDA excluding the Group's share of

losses from joint ventures, fair value gain on derivative liability

and other losses.

2. Underlying EBITDA is Adjusted EBITDA excluding impairment losses.

3. Other operating costs and income include other operating

income, impairment losses, selling and distribution costs, other

mine operating costs and idle plant costs.

4. Finance income less finance costs

5. Other operating costs and income include other operating

income, selling and distribution costs, other mine operating costs

and idle plant costs

6. Finance income less finance costs

Bushveld Minerals Limited (Registration number 54506)

Consolidated Financial Statements for the year ended 31 December

2022

Consolidated Statement of Profit or Loss

------------------------------------------------- ---------------------------------

2022 2021

Restated*

Notes US$ '000 US$ '000

------------------------------------------------- ------- --------- -------------

Revenue 5 148,448 106,857

Cost of sales (108,304) (102,782)

--------- -------------

Gross profit 40,144 4,075

Other operating income 2,733 2,619

Impairment losses 13, 14 (23,965) (2,439)

Selling and distribution costs (9,270) (6,406)

Other mine operating costs (2,723) (3,224)

Idle plant costs (6,725) (3,387)

Administration expenses 7 (20,328) (20,518)

--------- -------------

Operating loss (20,134) (29,280)

Finance income 8 494 935

Finance costs* 9 (14,148) (13,308)

Other losses 10 (818) (1,902)

Fair value gain on derivative liability* 28 2,934 9,010

Share of loss from investments in joint ventures 18 (5,112) (4,351)

--------- -------------

Loss before taxation (36,784) (38,896)

Taxation 11 1,345 4,671

--------- -------------

Loss for the year (35,439) (34,225)

--------- -------------

Loss attributable to:

Owners of the parent (38,968) (32,892)

Non-controlling interest 3,529 (1,333)

--------- -------------

(35,439) (34,225)

--------- -------------

Loss per ordinary share

Basic loss per share (cents) 12 (3.07) (2.74)

Diluted loss per share (cents) 12 (3.07) (2.74)

--------- -------------

The accounting policies and the notes form an integral part of

the consolidated financial statements.

Refer to note 36 for details of restatement

Consolidated Statement of Comprehensive Loss

-------------------------------------------------- --------------------------------------

2022 2021

Restated*

Notes US$ '000 US$ '000

-------------------------------------------------- ------------ --------- -------------

Loss for the year (35,439) (34,225)

Consolidated other comprehensive income / (loss):

Items that will not be reclassified to profit

or loss:

Losses on valuation of investments in equity

instruments - (3,772)

Other fair value movements 140 14

--------- -------------

Total items that will not be reclassified to

profit or loss 140 (3,758)

--------- -------------

Items that may be reclassified to profit or

loss:

Currency translation differences (15,712) (9,713)

--------- -------------

Other comprehensive loss for the year net of

taxation (15,572) (13,471)

--------- -------------

Total comprehensive loss (51,011) (47,696)

--------- -------------

Total comprehensive loss attributable to:

Equity holders (53,323) (48,031)

Non-controlling interest 2,312 335

--------- -------------

(51,011) (47,696)

--------- -------------

The accounting policies and the notes form an integral part of

the consolidated financial statements.

Consolidated Statement of Financial

Position

----------------------------------------- --------------------------------------------------

2022 2021 2020

Restated* Restated*

Notes US$ '000 US$ '000 US$ '000

----------------------------------------- ------- --------- --------------- -------------

Assets

Non-current assets

Intangible assets 13 53,469 59,254 59,004

Property, plant and equipment 14 127,409 153,113 167,580

Investment properties 15 2,412 2,595 2,811

Investments in joint ventures 18 3,151 7,855 -

Restricted investment 21 2,710 - -

--------- --------------- -------------

Total non-current assets 189,151 222,817 229,395

--------- --------------- -------------

Current assets

Inventories 19 54,990 41,646 34,082

Trade and other receivables 20 9,498 17,642 10,425

Restricted investment 21 - 2,869 3,111

Current tax receivable - 275 814

Financial assets 17 3,075 - 22,453

Cash and cash equivalents 22 10,874 15,433 50,541

--------- --------------- -------------

Total current assets 78,437 77,865 121,426

--------- --------------- -------------

Total assets 267,588 300,682 350,821

--------- --------------- -------------

Equity and liabilities

Share capital 23 17,122 16,797 15,858

Share premium 23 127,702 125,551 117,066

(Accumulated loss)/retained income* 23 (39,147) (179) 21,567

Share-based payment reserve 24 515 - 375

Foreign currency translation reserve 23 (35,346) (20,851) (9,470)

Fair value reserve 23 (1,798) (1,938) 12,966

--------- --------------- -------------

Attributable to equity holders 69,048 119,380 158,362

Non-controlling interest 36,583 32,482 32,147

--------- --------------- -------------

Total equity 105,631 151,862 190,509

--------- --------------- -------------

Liabilities

Non-current liabilities

Post retirement medical liability 25 1,675 1,906 2,076

Environmental rehabilitation liabilities 26 16,610 18,031 17,998

Deferred consideration 27 1,527 1,684 1,803

Borrowings* 28 35,272 69,686 79,362

Lease liabilities 29 6,721 3,921 4,377

Deferred tax liabilities 16 1,191 6,014 11,550

--------- --------------- -------------

Total non-current liabilities 62,996 101,242 117,166

--------- --------------- -------------

Current liabilities

Trade and other payables 30 45,896 33,081 22,066

Provisions 31 1,714 3,722 3,297

Borrowings* 28 47,858 10,211 13,337

Lease liabilities 29 561 564 626

Deferred consideration 27 901 - 3,820

Current tax payable 2,031 - -

-------- -------- --------

Total current liabilities 98,961 47,578 43,146

-------- -------- --------

Total liabilities 161,957 148,820 160,312

-------- -------- --------

Total equity and liabilities 267,588 300,682 350,821

-------- -------- --------

The consolidated financial statements and the notes were

approved by the Board of Directors on the 20th of June 2023 and

were signed on its behalf by:

Tanya Chikanza Finance Director

The accounting policies and the notes form an integral part of

the consolidated financial statements.

Refer to note 36 for details of restatement

Bushveld Minerals Limited

(Registration number 54506)

Consolidated Financial Statements for the year ended 31 December

2022

Consolidated Statement of Changes in Equity

Share Share Foreign Share-based Convertible Fair (Accumulated Total Non- Total

capital premium currency payment loan note value loss)/retained attributable controlling equity

translation reserve reserve reserve income to equity interest

reserve holders

of the Group

---------------

US$ '000 US$ '000 US$ '000 US$ '000 US$ '000 US$ '000 US$ '000 US$ '000 US$ '000 US$ '000

--------------- ------------ ----------- ------------ ----------- ------------ ---------- -------------- ------------ ------------ ----------------

Opening balance

as previously

reported 15,858 117,066 (9,470) 375 55 12,966 28,367 165,217 32,147 197,364

Adjustments

Restatement

(note 36) - - - - (55) - (6,800) (6,855) - (6,855)

------------ ----------- ------------ ----------- ------------ ---------- -------------- ------------ ------------ ----------------

Restated

balance at 1

January

2021* 15,858 117,066 (9,470) 375 - 12,966 21,567 158,362 32,147 190,509

------------ ----------- ------------ ----------- ------------ ---------- -------------- ------------ ------------ ----------------

Restated loss

for the year* - - - - - - (32,892) (32,892) (1,333) (34,225)

Other

comprehensive

income,

net of tax:

Currency

translation

differences - - (11,381) - - - - (11,381) 1,668 (9,713)

Other fair

value movements - - - - - (3,758) - (3,758) - (3,758)

------------ ----------- ------------ ----------- ------------ ---------- -------------- ------------ ------------ ----------------

Total

comprehensive

loss

for the year - - (11,381) - - (3,758) (32,892) (48,031) 335 (47,696)

Transaction

with owners:

Issue of shares 939 8,485 - - - - - 9,424 - 9,424

Share-based

payment - - - (375) - - - (375) - (375)

Transfer

between

reserves - - - - - (11,146) 11,146 - - -

------------ ----------- ------------ ----------- ------------ ---------- -------------- ------------ ------------ ----------------

Balance at 1

January 2022 16,797 125,551 (20,851) - - (1,938) (179) 119,380 32,482 151,862

------------ ----------- ------------ ----------- ------------ ---------- -------------- ------------ ------------ ----------------

Loss for the

year - - - - - - (38,968) (38,968) 3,529 (35,439)

Other

comprehensive

income,

net of tax:

Currency

translation

differences - - (14,495) - - - - (14,495) (1,217) (15,712)

Other fair

value movements - - - - - 140 - 140 - 140

------------ ----------- ------------ ----------- ------------ ---------- -------------- ------------ ------------ ----------------

Total

comprehensive

loss

for the year - - (14,495) - - 140 (38,968) (53,323) 2,312 (51,011)

------------ ----------- ------------ ----------- ------------ ---------- -------------- ------------ ------------ ----------------

Transaction

with owners:

Issue of shares 325 2,151 - - - - - 2,476 - 2,476

Share-based

payment - - - 515 - - - 515 - 515

Contribution

from

non-controlling

interest (note - - - - - - - - 1,789 1,789

28)

------------ ----------- ------------ ----------- ------------ ---------- -------------- ------------ ------------ ----------------

Balance at 31

December 2022 17,122 127,702 (35,346) 515 - (1,798) (39,147) 69,048 36,583 105,631

------------ ----------- ------------ ----------- ------------ ---------- -------------- ------------ ------------ ----------------

*Refer to note 36 for details of restatement

Consolidated Statement of Cash Flows

------------------------------------------------ -------------------------------------------

2022 2021

Restated*

Note US$ '000 US$ '000

------------------------------------------------ ------------------ --------- ------------

Cash flows from operating activities

Loss before taxation (36,784) (38,896)

Adjustments for:

Depreciation property, plant and equipment

(including right-of-use assets) 14 18,475 19,395

Share of loss from joint ventures 18 5,112 4,351

Remeasurement of financial liabilities 28 - 1,902

Fair value gain on derivative liability* 28 (2,934) (9,010)

Finance income 8 (494) (935)

Finance costs* 9 14,148 13,308

Impairment losses 13, 14 23,965 2,439

Other non-cash movements 1,138 -

Foreign exchange differences (6,949) -

Changes in working capital 6,154 (5,022)

Income taxes (paid)/received (648) 394

--------- ------------

Net cash generated from / (used in) operating

activities 21,183 (12,074)

--------- ------------

Cash flows from investing activities

Finance income 336 935

Purchase of property, plant and equipment (18,197) (19,450)

Payment of deferred consideration 27 - (3,874)

Purchase of investments 18 (1,211) (9,988)

Purchase of exploration and evaluation assets 13 (517) (929)

Disposal of financial assets held at fair value - 16,147

--------- ------------

Net cash used in investing activities (19,589) (17,159)

--------- ------------

Cash flows from financing activities

Finance costs 28 (3,217) (2,948)

Repayment of borrowings 28 (5,623) (4,732)

Proceeds from borrowings 28 4,222 1,336

Lease payments 29 (728) (705)

--------- ------------

Net cash used in financing activities (5,346) (7,049)

--------- ------------

Total cash and cash equivalents movement for

the year (3,752) (36,282)

Cash and cash equivalents at the beginning

of the year 15,433 50,541

Effect of translation of foreign exchange rates (807) 1,174

--------- ------------

Total cash and cash equivalents at end of

the year 22 10,874 15,433

--------- ------------

The accounting policies and the notes form an integral part of

the consolidated financial statements.

*Refer to note 36 for details of restatement

Notes to the Consolidated Financial Statements

1. General information and principal activities

Bushveld Minerals Limited ("Bushveld" or the "Company") and its

subsidiaries and interest in equity accounted investments (together

the "Group") are an integrated primary vanadium producer and energy

storage solutions provider. The Company was incorporated and

domiciled in Guernsey on 5 January 2012 and admitted to the AIM

market in London on 26 March 2012. The address of the Company's

registered office is Oak House, Hirzel Street, St Peter Port,

Guernsey, GY1 3RH.

As at 31 December 2022, the Bushveld Group comprised of:

Equity holding Country

Company Note and voting of incorporation Nature of activities

rights

---------------------------------- ------ -------------- ------------------ -------------------------

Bushveld Minerals Limited n/a Guernsey Ultimate holding company

Bushveld Resources Limited 1 100% Guernsey Holding company

Ivanti Resources (Pty) Limited 2 100% South Africa Processing company

Pamish Investments No 39 (Pty)

Limited 2 64% South Africa Mining right holder

Bushveld Minerals SA (Pty)

Limited 2 100% South Africa Group support services

Bushveld Vanchem (Pty) Limited 13 100% South Africa Processing company

Vanadium and iron ore

Great 1 Line Invest (Pty) Limited 2 62.5% South Africa exploration

Vanadium and iron ore

Gemsbok Magnetite (Pty) Limited 2 74% South Africa exploration

Caber Trade and Invest 1 (Pty) Vanadium and iron ore

Limited 2 51% South Africa exploration

Bushveld Vanadium 2 (Pty) Limited 2 100% South Africa Holding company

Bushveld Energy Limited 1 84% Mauritius Holding company

Bushveld Energy Company (Pty)

Limited 4 100% South Africa Energy development

Bushveld Vametco Hybrid Mini-Grid

Company (RF) 12 40% South Africa Energy development

(Pty) Limited

Bushveld Electrolyte Company

(Pty) Ltd 12 55% South Africa Energy development

VRFB Holdings Limited 4 50.5% Guernsey Holding company

Vanadium Electrolyte Rental 1&4 40% & 30% UK Energy development

Limited

Enerox Holdings Limited 14 50% Guernsey Holding company

Bushveld Vametco Limited 2 100% Guernsey Sales of vanadium

Strategic Minerals Connecticut

LLC 7 100% United States Holding company

Bushveld Vanadium 1 (Pty) Limited 8 100% South Africa Holding company

Bushveld Vametco Holdings (Pty)

Limited 11 74% South Africa Mining right holder

Bushveld Vametco Alloys (Pty) Mining and manufacturing

Limited 9 100% South Africa company

Bushveld Vametco Properties

(Pty) Limited 10 100% South Africa Property owning company

Lemur Holdings Limited 1 100% Mauritius Holding company

Coal Mining Madagascar SARL 5 99% Madagascar Coal exploration

Imaloto Power Project Limited 3 100% Mauritius Holding company

Imaloto Power Project Company

SARL 6 99% Madagascar Power generation company

Lemur Investments Limited 3 100% Mauritius Holding company

Lemur SA (Pty) Ltd 3 100% South Africa Coal exploration

================================== ====== ============== ================== =========================

1. Held directly by Bushveld Minerals Limited

2. Held by Bushveld Resources Limited

3. Held by Lemur Holdings Limited

4. Held by Bushveld Energy Limited

5. Held by Lemur Investments Limited

6. Held by Imaloto Power Limited

7. Held by Bushveld Vametco Limited

8. Held by Strategic Minerals Connecticut LLC

9. Held by Bushveld Vametco Holdings (Pty) Limited

10. Held by Vametco Alloys (Pty) Limited

11. Held by Bushveld Vanadium 1 (Pty) Limited

12. Held by Bushveld Energy Company (Pty) Limited

13. Held by Bushveld Vanadium 2 (Pty) Limited

14. Held by VRFB Holdings Limited

2. Adoption of new and revised standards Accounting standards and interpretations applied

In the current year, the Group has adopted the following

standards and interpretations that are effective for the current

financial year and that are relevant to its operations:

Amendments to The amendments simplified the application of IFRS 1

IFRS 1 First time by a subsidiary that becomes a first-time adopter after

adoption of International its parent. Subsidiary, associate or joint venture can

Financial Reporting elect to apply exemption in par D16(a) to the cumulative

Standards ("IFRS"): translation difference.

Subsidiary as

a first-time adopter

--------------------------- -----------------------------------------------------------

Amendments to The amendments clarify what is included in the fees

IFRS 9 Financial paid and fees received.

Instruments: Fees

in the '10 per

cent' test for

derecognition

of financial liabilities

--------------------------- -----------------------------------------------------------

Amendments to The amendments address costs a company should include

IAS 37 Provisions, as the cost of fulfilling a contract when assessing

Contingent Liabilities whether a contract is onerous.

and Contingent

Assets: Cost of

fulfilling a contract

--------------------------- -----------------------------------------------------------

Amendments to The amendments prohibit deducting from the cost of an

IAS 16 Property, item of property, plant and equipment any proceeds from

Plant and Equipment: selling items produced while bringing that asset to

Proceeds before the location and condition necessary for it to be capable

intended use of operating in the manner intended by management.

--------------------------- -----------------------------------------------------------

Amendments to The amendments update an outdated reference in IFRS

IFRS 3 Business 3 without significantly changing its requirements

Combinations:

Reference to the

conceptual framework

--------------------------- -----------------------------------------------------------

The adoption of these Standards and Interpretations, which

become effective for annual periods beginning on or after 1 January

2022, had no material impact on the consolidated financial

statements of the Group.

Accounting standards and interpretations not applied

Standards, amendments and interpretations to existing standards

that are not yet effective and have not been early adopted by the

Group:

Amendments to The amendments provide recognition exemption and no

IAS 12 Income longer applies to transactions that, on initial recognition,

Taxes: Deferred give rise to equal taxable and deductible temporary

tax related to differences.

assets and liabilities

arising from a

single transaction

-------------------------- -----------------------------------------------------------------

Amendments to The amendments include the definition of accounting

IAS 8 Accounting estimates to help entities to distinguish between accounting

Policies, Changes policies and accounting estimates.

in Accounting

Estimates and

Errors: Definition

of accounting

estimates

-------------------------- -----------------------------------------------------------------

Amendments to The amendments intend to help preparers in deciding

IAS 1 Presentation which accounting policies to disclose in their financial

of Financial Statements statements.

and IFRS Practice

Statement 2:

-------------------------- -----------------------------------------------------------------

Amendments to

IAS 1 Presentation The amendments may change the classification of certain

of Financial Statements: liabilities as current or non-current, for example convertible

Classification debt. Entities may need to provide new disclosures for

of liabilities liabilities subject to covenants.

as current or

non- current and

non-current liabilities

with covenants

-------------------------- -----------------------------------------------------------------

IFRS 16 Leases: The amendments specify how a seller-lessee should apply

Lease liability the subsequent measurement requirements in IFRS 16 to

in a sale and the lease liability that arises in the sale and leaseback

leaseback transaction.

-------------------------- -----------------------------------------------------------------

The Directors anticipate that the adoption of these Standards

and Interpretations, which become effective for annual periods

beginning on or after 1 January 2023, in future periods will have

no material impact on the consolidated financial statements of the

Group, except for the adoption of Amendments to IAS 1 Presentation

of Financial Statements: Classification of liabilities as current

or non-current and non-current liabilities with covenants.

3. Significant accounting policies

The principal accounting policies applied in the preparation of

the consolidated financial statements are set out below. These

policies have been consistently applied to all the years presented,

unless otherwise stated.

Basis of preparation

The consolidated financial statements of the Company and its

subsidiaries and interest in equity accounted investments as at and

for the year ended 31 December 2022 have been prepared in

accordance with the UK-adopted International Accounting

Standards.

The consolidated financial statements have been prepared under

the historical cost basis, except for certain financial instruments

and investment properties measured at fair value. Historical cost

is generally based on the fair value of the consideration given in

exchange for the assets.

Going concern

The consolidated financial statements have been prepared on the

going concern basis, which contemplates continuity of normal

business activities and the realisation of assets and discharge of

liabilities in the normal course of business.

The Group recorded a net loss after tax of US$35.44 million for

the year ended 31 December 2022 (31 December 2021: US$34.22

million) and as at 31 December 2022 had cash and cash equivalents

of US$10.87 million (31 December 2021: US$15.43 million) as well as

total borrowings of US$83.13 million, of which US$47.85 million is

due within 12 months most of which comprised of the Orion

convertible loan notes (31 December 2021: total borrowing of

US$79.90 million). In recent years, the Group has been loss making

due to a combination of weaker vanadium prices and losses incurred

whilst the refurbishment work at Vanchem was completed. The

refurbished Kiln-3 was commissioned in June 2022, later than