Shares of Paramount Gold and Silver Rally With the Bullion While Newmont Mining Lags

January 31 2012 - 8:20AM

Marketwired

Gold prices have been on the upswing this month as the Fed signaled

it may keep interest rates low through 2014. Even the GDX, which

seeks to replicate as closely as possible, the price and yield

performance of the NYSE Arca Gold Miners Index, has shown signs of

strength in January, surging more than 10 percent. Five Star

Equities examines the outlook for companies in the Gold industry

and provides equity research on Paramount Gold & Silver

Corporation (NYSE Amex: PZG) (TSX: PZG) and Newmont Mining

Corporation (NYSE: NEM). Access to the full company reports can be

found at:

www.fivestarequities.com/PZG www.fivestarequities.com/NEM

Over the past year, the GDX has underperformed the price of gold

by a large margin. While the SPDR Gold Trust ETF -- which attempts

to reflect the performance of the price of gold bullion--- is up

nearly 30 percent year-on-year, the GDX has grown a mere 5 percent

over the same period.

According to a recent article from International Business Times,

gold stocks have lagged the price of gold due to a number of

factors, "including operational disappointments, rising cost

structures, elevated political risk in many locations of their

assets, and macroeconomic headwinds that have weighed on the equity

markets."

Five Star Equities releases regular market updates on the Gold

industry so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.fivestarequities.com and get

exclusive access to our numerous stock reports and industry

newsletters.

Shares of Newmont Mines have lagged fellow gold miners this

month after the company said it expected production costs to

increase to US$625 to US$675 (NZ$778 to NZ$840) an ounce of gold,

from US$560 to US$590 an ounce in 2011. The company blamed higher

labour and power prices and a looming carbon tax for a forecast

rise in costs. Newmont Mining Corporation, together with its

subsidiaries, engages in the acquisition, exploration, and

production of gold and copper properties.

Shares of Paramount Gold and Silver are up more than 17 percent

this month. Paramount Gold and Silver is an exploration stage

mining company with projects in northern Nevada and Chihuahua,

Mexico.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.fivestarequities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Jun 2024 to Jul 2024

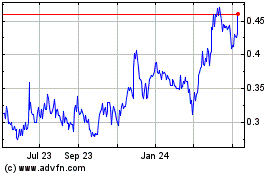

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Jul 2023 to Jul 2024