Beat the Cold Weather with These Hot Sector ETFs - ETF News And Commentary

January 10 2014 - 12:08PM

Zacks

Lowest temperatures in

more than two decades have left most parts of America shivering. In

particular, the Midwest and Northeast, experienced arctic-like

conditions after the polar vortex. Southern U.S. is also seeing

freezing temperatures.

This is restricting the movement of people and goods by road, air

or ship and hurting some food companies. However, some sectors are

likely to reap benefits from this severe weather condition.

Investors might like to cash in on this opportunity in the form of

ETFs that carry lower risk compared to individual stock holdings.

For those investors, we have highlighted some ETFs that could be in

focus and move higher on rising demand in the coming days:

Energy ETFs

Oil and gas price has risen this week in anticipation of rising

demand and falling supply. Harsh weather is curtailing production

and disrupting some refinery operations while boosting demand for

heating fuel. This combination of rising demand and falling supply

will push up oil and gas prices further (read: Will the Clean

Energy ETF Surge Continue in 2014?).

In order to play this surge, investors could either deal directly

in the futures market or concentrate on oil and gas producers. The

two lucrative choices in this space could be SPDR S&P

Oil & Gas Exploration & Production ETF (XOP) and

First Trust ISE-Revere Natural Gas Index Fund

(FCG). While XOP provides equal weight exposure to the

basket of securities in oil and gas, FCG provides the same to the

natural gas space.

XOP has $717.6 million in AUM invested across 81 securities and FCG

holds 30 stocks in its basket having $453.6 million in its asset

base. In terms of annual fees, XOP is cheaper than FCG by 25 bps.

However, FCG is expected to outperform XOP as it has a Zacks ETF

Rank of 2 or ‘Buy’ rating while XOP has Zacks ETF Rank of 3 or

‘Hold’ rating.

For the futures market, investors have United States Oil

Fund (USO) for direct exposure to the spot price of WTI

and United States Natural Gas Fund (UNG) for

natural gas spot price (read: Will Natural Gas ETFs Extend Their

Winning Streak?).

Utility ETFs

Utility companies are poised to benefit from severe cold as more

Americans use electricity for heating, leading to higher bills.

Though there are several ETFs in this space, the two ultra-popular

Utilities Select Sector SPDR (XLU) and

Vanguard Utilities ETF (VPU) might be good options

(see: all the Utilities ETFs here).

With AUM of $4.5 billion, XLU provides exposure to a small basket

of 31 securities with nearly 57.4% concentration on the top 10

firms. Electric utilities take the top spot in terms of sector at

54.33%, closely followed by multi utilities (37.84%). The ETF

charges 0.18% in expense ratio. Though the fund could get a boost

in the near term from a freezing U.S., investors should note that

the long-term outlook on the fund remains bleak with a Zacks ETF

Rank of 4 or ‘Sell’ rating.

On the other hand, VPU has amassed nearly $1.3 billion in asset

base and charges 14 bps in annual fees. The fund is home to 78

securities and the top 10 companies hold about 46.4% of total

assets. Here again, electric utilities take the lion’s share with

51.8%, followed by multi utilities. The ETF has a decent Zacks ETF

Rank of 3 or ‘Hold’ rating.

Retail ETFs

Some retailers could see an uptick in demand. These include space

heaters, shovels, snow blowers, apparels, and other cold-weather

accessories. This would lead to higher stock prices and investors

could well tap this opportunity through SPDR S&P Retail

ETF (XRT) and Market Vectors Retail ETF

(RTH).

XRT provides diversified exposure to the basket of 104 retail

stocks as none of these holds more than 1.13% of assets. In terms

of sector holdings, the fund allocates double-digit exposure to

apparel retail, specialty stores, automotive retail and Internet

retail. The ETF has over $1 billion in AUM and charges 35 bps in

fees and expenses (read: A Comprehensive Guide to Retail ETFs).

Holding 26 securities, RTH is concentrated in the top 10 securities

at 59% of total assets. From a sector look, specialty retail takes

the top spot at 33% while hypermarkets, departmental stores and

healthcare services round off to the next three spots. The fund has

managed assets of $40.5 million and has expense ratio of 0.35%.

Both the products have a Zacks ETF Rank of 2 or ‘Buy’ rating.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

FT-ISE R NAT GA (FCG): ETF Research Reports

MKT VEC-RETAIL (RTH): ETF Research Reports

US-OIL FUND LP (USO): ETF Research Reports

VIPERS-UTIL (VPU): ETF Research Reports

SPDR-SP O&G EXP (XOP): ETF Research Reports

SPDR-SP RET ETF (XRT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

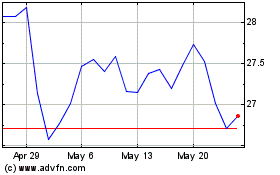

First Trust Natural Gas ... (AMEX:FCG)

Historical Stock Chart

From Apr 2024 to May 2024

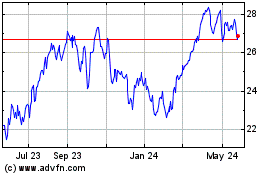

First Trust Natural Gas ... (AMEX:FCG)

Historical Stock Chart

From May 2023 to May 2024