Espey Mfg. & Electronics Corp.'s earnings and backlog at record levels for the fiscal year ended June 30, 2008. Company announce

August 18 2008 - 4:17PM

Business Wire

Espey Mfg. & Electronics Corp. (AMEX:ESP) announces results for

its fiscal year and fourth quarter, both ended June 30, 2008, and

the August 15, 2008 sales order backlog. For the fiscal year ended

June 30, 2008, the Company reported net sales of $25.7 million,

compared with $27.6 million for the prior fiscal year. Net income

increased more than 34% to $3,421,869, $1.63 per diluted share for

the year, compared with net income of $2,544,720, $1.23 per diluted

share, for the fiscal year ended June 30, 2007. At June 30, 2008,

the sales order backlog increased to $44.8 million, compared with

last year�s $36.3 million on June 30, 2007. New sales orders for

the year totaled $34.3 million. For the fourth quarter ended June

30, 2008, net sales decreased by $1,216,649, to $6.2 million,

compared with last year�s fourth quarter net sales of $7.4 million.

Net income for the fourth quarter ended June 30, 2008 was $933,994,

$.45 per diluted share, compared with net income of $807,729, $.39

per diluted share, for the corresponding period last year. Mr.

Howard Pinsley, President & CEO, commented �We are very pleased

with our success for the recently concluded fiscal year, resulting

in strong increases in both net income and sales order backlog. Our

record sales order backlog at August 18, 2008, $47.2 million,

reflects that our Company is well positioned for the future.�

Furthermore, the Espey Board of Directors has declared an increased

cash dividend. The regular first quarter dividend for the fiscal

year ending June 30, 2009 is $.225 per share, an increase of $.025

per share. The dividend will be payable on September 25, 2008, to

all shareholders of record at September 4, 2008. Espey�s primary

business is the development, design, and production of specialized

military and industrial power supplies/transformers. The Company

can be found on the Internet at www.espey.com. This press release

may contain certain statements that are "forward-looking

statements" and are made pursuant to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995. These

forward-looking statements represent the Company's current

expectations or beliefs concerning future events. The matters

covered by these statements are subject to certain risks and

uncertainties that could cause actual results to differ materially

from those set forth in the forward-looking statements. The Company

wishes to caution readers not to place undue reliance on any such

forward-looking statements, which speak only as of the date made.

Espey Mfg. & Electronics Corp. comparative unaudited

three-month and audited twelve-month figures for the periods ended

June 30, 2008 and 2007. � Three Months � Twelve Months � 2008 �

2007 � 2008 � 2007 Sales: $6,188,789 � $7,405,438 $25,701,739 �

$27,656,359 Net Income: 933,994 807,729 3,421,869 2,544,720 Income

per share: Basic .45 .39 1.65 1.24 Diluted .45 .39 1.63 1.23 �

Weighted average number of Shares outstanding: � Basic 2,094,817

2,060,028 2,079,734 2,048,626 Diluted 2,111,863 2,101,553 2,103,836

2,077,664

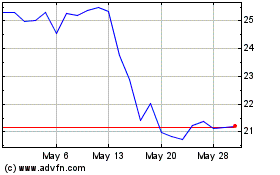

Espey Manufacturing and ... (AMEX:ESP)

Historical Stock Chart

From Jul 2024 to Aug 2024

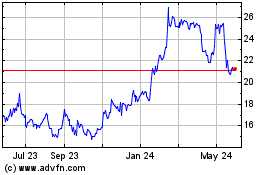

Espey Manufacturing and ... (AMEX:ESP)

Historical Stock Chart

From Aug 2023 to Aug 2024