Current Report Filing (8-k)

November 27 2019 - 2:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

November 22, 2019

|

CORE MOLDING TECHNOLOGIES, INC.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-12505

|

31-1481870

|

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

800 Manor Park Drive, Columbus, Ohio

|

|

43228-0183

|

|

________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

614-870-5000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On November 22, 2019, Core Molding Technologies, Inc. (the "Company"), Horizon Plastics International, the Company’s wholly owned subsidiary ("Horizon", together with the Company, referred to collectively herein as the "Borrowers"), as well as the Company’s domestic guarantor subsidiaries (collectively the Guarantors”), entered into a Forbearance Agreement (the “Forbearance Agreement”) with KevBank National Association as administrative agent (the “Administrative Agent”) and certain of the lender parties (collectively, the “Lenders”) who are also parties to that certain Amended and Restated Credit Agreement, dated as of January 16, 2018 and as amended March 14, 2019 (as amended, the “Credit Agreement”). Pursuant to the Forbearance Agreement, the Borrowers and the Lenders acknowledged and confirmed that an event of default occurred under the Credit Agreement resulting from the Borrowers failure to maintain the required Fixed Charge Coverage Ratio (as defined in the Credit Agreement”) for the fiscal quarter ended September 30, 2019. The Forbearance Agreement provides that the Administrative Agent and Lenders shall forbear from the exercise of rights and remedies pursuant to the Loan Documents described in the Credit Agreement through March 13, 2020, as long as the Company satisfies the conditions set forth in the Forbearance Agreement, including, (i) the Borrowers shall remain current on all loan payments during the forbearance period, (ii) on or before December 6, 2019, the Administrative Agent and Lenders shall each receive a copy of a report of Huron Consulting Group containing findings and observations in respect of the businesses and operations of the Company and the Borrowers shall deliver a strategic alternative assessment in respect of the Borrowers’ operations and financing, (iii) on or before December 15, 2019, the Administrative Agent and Lenders shall each receive a copy of appraisals of machinery and equipment and inventory appraisals, and the Borrowers shall have determined and proposed a new capital structure to the Administrative Agent and Lenders, (iv) on or before February 14, 2020, the Borrowers shall have obtained a definitive, written commitment from involved parties and/or lenders providing the basis for implementation of a new capital structure, and (v) on or before March 13, 2020, the Borrowers shall have closed on a new capital structure, acceptable to the Administrative Agents and Lenders. The Forbearance Agreement also implemented a new availability block with respect to the U.S. Revolving Loans portion of the Credit Agreement, reducing availability from $32,500,000 to $28,000,000 and increasing the applicable margin for existing term and revolving loans, as well as increasing the commitment fees on any unused U.S. Revolving Loans

The foregoing description is qualified in its entirety by reference to the Forbearance Agreement, a copy of which is attached to this Form 8-K as exhibit 10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

99.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORE MOLDING TECHNOLOGIES, INC.

|

|

November 27, 2019

|

|

By:

|

|

/s/ John P. Zimmer

|

|

|

|

|

|

|

|

|

|

|

|

Name: John P. Zimmer

|

|

|

|

|

|

Title: Vice President, Treasurer, Secretary and Chief Financial Officer

|

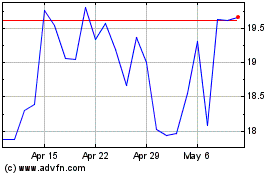

Core Molding Technologies (AMEX:CMT)

Historical Stock Chart

From Aug 2024 to Sep 2024

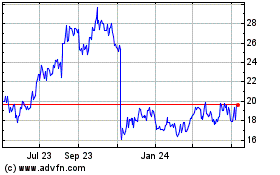

Core Molding Technologies (AMEX:CMT)

Historical Stock Chart

From Sep 2023 to Sep 2024