Current Report Filing (8-k)

March 19 2021 - 5:16PM

Edgar (US Regulatory)

0001136174FALSE00011361742021-03-182021-03-180001136174us-gaap:CommonStockMember2021-03-182021-03-180001136174us-gaap:SeriesAPreferredStockMember2021-03-182021-03-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 18, 2021

Ontrak, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-31932

|

|

88-0464853

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

2120 Colorado Ave., Suite 230, Santa Monica, CA 90404

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (310) 444-4300

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

OTRK

|

The NASDAQ Global Market

|

|

9.50% Series A Cumulative Perpetual Preferred Stock, $0.0001 par value

|

OTRKP

|

The NASDAQ Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

Previously, on March 1, 2021, Ontrak, Inc. (the “Company”) reported the notification of termination from its largest customer with an effective date of June 26, 2021. As a result of this termination notice, the Company’s management assessed various options and deemed it prudent to initiate a workforce reduction plan to effectively align its resources, manage its operating costs and position it to achieve its previously stated growth target for 2021.

Under the workforce reduction plan and in order to address the change in staffing needs in the short term resulting from the impending termination of the customer contract, the Company intends to reduce approximately 35% of positions, predominately within departments directly supporting the contract. The Company estimates one-time costs of approximately $1.5 million of termination benefits to the impacted employees, including severance payments and benefits. The Company expects to complete the reduction in workforce plan by the end of the second quarter in 2021 and expects to bring back capacity to scale appropriately as new or expanded customer relationships are onboarded from its pipeline.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ontrak, Inc.

|

|

|

|

|

|

|

Date: March 19, 2021

|

|

By:

|

/s/ Brandon H. LaVerne

|

|

|

|

|

Brandon H. LaVerne

|

|

|

|

|

Chief Financial Officer

|

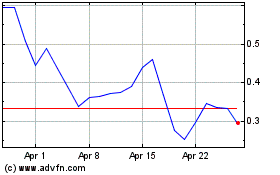

Ontrak (NASDAQ:OTRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

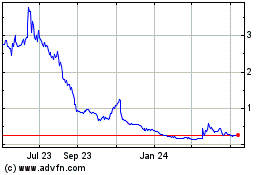

Ontrak (NASDAQ:OTRK)

Historical Stock Chart

From Apr 2023 to Apr 2024