Nvidia Has to Play This Game Perfectly -- Heard on the Street

September 03 2020 - 7:29AM

Dow Jones News

By Dan Gallagher

The phrase "this time is different" can be a dangerous one in

business. Fortunately for Nvidia Corp., it also appears to be

accurate.

The chipmaker's last major product cycle for its graphics

processors designed for videogaming was a letdown. The performance

upgrade for the company's Turing family was considered

disappointing relative to the previous cycle's boost -- especially

at the higher prices Nvidia was demanding. And relatively few games

at the time were using the ray-tracing technology that was the key

feature of the Turing line.

To make matters worse, that upgrade came right around the

popping of the cryptocurrency bubble in which "miners" were

snapping up Nvidia's chips to handle the complex equations that are

used to generate new units of currencies such as etherium. That

inflated sales in the few quarters before the first Turing chips

hit the market in late 2018, then hurt sales when miners later

dumped those chips on the secondary market.

The experience proved costly in a couple ways. Nvidia's gaming

revenue fell for four straight quarters following the launch, and

its highflying stock shed more than half its value during the last

three months of the year.

The road looks clearer for the company's newest gaming chips

announced earlier this week.

The new family, known as Ampere, offers twice the computing

performance of the previous generation, and many more games in the

ecosystem have adopted ray-tracing -- including the blockbuster

"Fortnite." Nvidia also kept the pricing down on the newest

generation. Deutsche Bank analyst Ross Seymore notes that the

midrange $500 version of the newest Ampere line offers the same

performance as the $1,000 version of the Turing lineup. And this

time, there is no crypto-bubble to thwart the supply chain and skew

comparisons.

That has led Nvidia to project record videogame-related revenue

for its fiscal third quarter ending in October. The forecast calls

for a 25% jump from the second quarter, which would amount to a

little over $2 billion in revenue for that segment. Analysts expect

Nvidia's gaming revenue to surge 28% for the full fiscal year

ending in January. Some of that will come from the growing sales of

the popular Nintendo Switch console, which uses a central processor

from Nvidia. But the Ampere chips are expected to be the main

driver, with Stacy Rasgon of Bernstein predicting a "monster gaming

cycle" for Nvidia.

Nvidia can afford nothing less. The company's data-center

business has grown quickly and made the company a darling on Wall

Street, but videogaming remains the company's largest segment,

accounting for 47% of its total revenue for the trailing 12-month

period ended July. The stock had already surged 127% for the year

before its gaming announcement early Tuesday and has picked up

another 7% since. That has made Nvidia the second-largest company

on the PHLX Semiconductor Index by market value, giving the

never-cheap stock a multiple of 58 times forward earnings -- 55%

above its valuation ahead of the last gaming cycle.

At this level, another gaming reset would be painful.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

September 03, 2020 07:14 ET (11:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

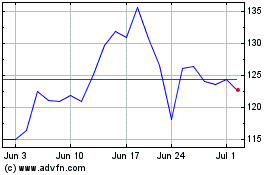

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024