As filed with the Securities and Exchange

Commission on June 8, 2020

Registration

File No.: 333-

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

AYTU BIOSCIENCE, INC.

(Exact name of registrant as specified in

charter)

|

Delaware

|

|

47-0883144

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

373 Inverness Parkway, Suite 206

Englewood, Colorado 80112

(720) 437-6580

(Address, including zip code and telephone

number, including area code, of registrant’s principal executive offices)

Joshua R. Disbrow

Chief Executive Officer

373 Inverness Parkway, Suite 206

Englewood, Colorado 80112

Telephone: (720) 437-6580

(Name, address, including zip code and telephone

number, including area code, of agent for service of process)

Copy to:

Nolan S. Taylor

Anthony W. Epps

Kymra Archibald

Dorsey & Whitney LLP

111 S. Main Street, Suite 2100

Salt Lake City, Utah 84111

(801) 933-7360

Approximate Date

of Commencement of Proposed Sale to Public: From time to time after the effective date of this Registration Statement.

If the securities being

registered on this form are being offered in connection with the formation of a holding company and there is compliance with General

Instruction G, check the following box: ☐

If this form is filed

to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer ☐

|

Smaller reporting company ☒

|

|

Accelerated Filer ☐

|

Emerging growth company ☐

|

|

Non-accelerated filer ☒

|

|

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place

an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i)

(Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d)

(Cross-Border Third-Party Tender Offer) ☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount to be

Registered(1)

|

|

|

Proposed

Maximum

Offering Price

per Unit(1)(2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price(1)(2)

|

|

|

Amount of

Registration Fee

|

|

|

Common Stock, par value $0.0001 per share

|

|

|

24,539,877.30

|

|

|

$

|

1.63

|

|

|

$

|

40,000,000

|

|

|

$

|

5,192.00

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”),

the shares being registered hereunder include such indeterminate number of shares of common stock as may be issuable with respect

to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions.

|

|

|

(2)

|

Estimated in accordance with Rule 457(c) solely for purposes of calculating the registration fee. The maximum price per Security

and the maximum aggregate offering price are based on the average of the $1.70 (high) and $1.55 (low) sale price of the Registrant's

Common Stock, par value $0.0001 per share as reported on the Nasdaq Capital Market on 06/01/2020, which date is within five

business days prior to filing this Registration Statement.

|

The Registrant

hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant

shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as

the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information

in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where such offer or sale is not permitted.

SUBJECT TO

COMPLETION, DATED JUNE 8, 2020

PROSPECTUS

$40,000,000

Common Stock

This prospectus relates

to the offering of common stock, par value $0.0001 per share, of Aytu BioScience, Inc., a Delaware corporation, (“Aytu”

or the “Company”), having a maximum aggregate offering price of $40,000,000, which may be issued from time to time

by the Company in connection with acquisitions by the Company of assets, businesses, or securities. We expect that the terms of

acquisitions involving the issuance of any such shares will be determined by direct negotiations with the owners or controlling

persons of the assets, businesses or securities to be acquired, and that the shares of common stock issued will be valued at prices

reasonably related to the market price of the common stock either at the time an agreement is entered into concerning the terms

of the acquisition or at or about the time the shares are delivered.

We do not expect to receive

any cash proceeds when we issue shares of common stock offered by this prospectus.

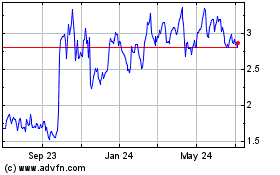

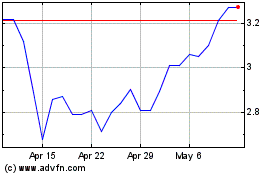

Our

common stock is listed on The NASDAQ Capital Market under the symbol “AYTU.” On June 1, 2020, the last reported sale

price for our common stock was $1.58 per share

Investing in our

securities involves risks. Please refer to the “Risk Factors” section on page 5 contained in any applicable

prospectus supplement and in the documents we incorporate by reference for a description of the risks you should consider when

evaluating this investment.

THESE SECURITIES

HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE

SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is

2020

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is

part of an “acquisition shelf” registration statement on Form S-4 that we filed with the Securities and Exchange Commission,

or the Commission, under the Securities Act of 1933, as amended, or the Securities Act, using an “acquisition shelf”

registration process. This prospectus relates to the offering of common stock, par value $0.0001 per share, of Aytu BioScience,

Inc., a Delaware corporation, having a maximum aggregate offering price of $40,000,000, which may be issued from time to time by

the Company in connection with acquisitions by the Company of assets, businesses, or securities. We expect that the terms of acquisitions

involving the issuance of any such shares will be determined by direct negotiations with the owners or controlling persons of the

assets, businesses or securities to be acquired, and that the shares of common stock issued will be valued at prices reasonably

related to the market price of the common stock either at the time an agreement is entered into concerning the terms of the acquisition

or at or about the time the shares are delivered. A prospectus supplement or post-effective amendment to this registration statement

will contain more specific information about an acquisition target or any of the terms of a definitive acquisition agreement. Any

statement that we make in this prospectus will be modified or superseded by any inconsistent statement made by us in a prospectus

supplement or post-effective amendment. Before deciding to receive any of our securities as part of an acquisition transaction,

you should read both this prospectus and any accompanying post-effective amendment together with the additional information described

under the headings “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

You should rely only

on the information contained in this prospectus, any applicable prospectus supplement or any post-effective amendment and those

documents incorporated by reference in this prospectus or any post-effective amendment. We have not authorized anyone to provide

you with information different from that contained in this prospectus, any applicable prospectus supplement or any post-effective

amendment. If anyone provides you with different or additional information you should not rely on it. This prospectus may only

be used where it is legal to sell these securities. This prospectus is not an offer to sell, or a solicitation of an offer to buy,

in any state where the offer or sale is prohibited. The information in this prospectus, any applicable prospectus supplement any

post-effective amendment or any document incorporated herein or therein by reference is accurate as of the date contained on the

cover of such documents. Neither the delivery of this prospectus, any applicable prospectus supplement or any post-effective amendment,

nor any sale made under this prospectus or any post-effective amendment will, under any circumstances, imply that the information

in this prospectus, any applicable prospectus supplement or any post-effective amendment is correct as of any date after the date

of this prospectus or any such post-effective amendment.

References in this

prospectus to the “Company,” “Aytu,” “we,” “our,” and “us,” refer to

Aytu BioScience, Inc.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, and

the documents incorporated by reference herein, contain certain “forward-looking statements” within the meaning of

Section 27A of the Securities Act, Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995, and

are based on management’s current expectations. These forward-looking statements can be identified by the use of forward-looking

terminology, including, but not limited to, “believes,” “may,” “will,” “would,”

“should,” “expect,” “anticipate,” “seek,” “see,” “confidence,”

“trends,” “intend,” “estimate,” “on track,” “are positioned to,” “on

course,” “opportunity,” “continue,” “project,” “guidance,” “target,”

“forecast,” “anticipated,” “plan,” “potential” and the negative of these terms

or comparable terms.

Various factors could

adversely affect our operations, business or financial results in the future and cause our actual results to differ materially

from those contained in the forward looking statements, including those factors discussed under “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” or otherwise discussed

in our Annual Report on Form 10-K for the fiscal year ended June 30, 2019, our Quarterly Reports on Form 10-Q for the quarterly

periods ended September 30, 2019, December 31, 2019 and March 31, 2020, and in our other filings made from time to time with the

SEC after the date of this prospectus.

For additional information

about factors that could cause actual results to differ materially from those described in the forward-looking statements, please

see the documents that we have filed with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current

Reports on Form 8-K and other documents and reports filed from time to time with the SEC.

All subsequent forward-looking

statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to in this section. We are not under any obligation to, and expressly disclaim any obligation to, update

or alter any forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise.

PROSPECTUS SUMMARY

This document serves

as a prospectus of Aytu BioScience to register shares of our common stock, par value $0.0001 per share, having a maximum aggregate

offering price of $40,000,000, which we plan to use in acquisition transactions from time to time in connection with the acquisition

of assets, stock or businesses, whether by purchase, merger or any other form of business combination. It is expected that the

terms of these acquisitions will be determined by direct negotiations with the owners or controlling persons of the assets, businesses

or securities to be acquired, and that the shares of common stock issued will be valued at prices reasonably related to the market

price of our common stock either at the time an agreement is entered into concerning the terms of the acquisition or at or about

the time the shares are delivered. In addition to shares of our common stock, consideration for these acquisitions may consist

of any consideration permitted by applicable law, including, without limitation, the payment of cash, the issuance of a note or

other form of indebtedness, the assumption of liabilities or any combination of these items.

The common stock we

issue pursuant to this prospectus and applicable prospectus supplement or post-effective amendment in these transactions may be

reoffered pursuant to this prospectus by the stockholders thereof from time to time in transactions on the Nasdaq Capital Market

(or any other exchange on which our common stock may be listed or traded from time to time), in negotiated transactions, in block

trades, through the writing of options on securities, or any combination of these methods of sale, at fixed prices that may be

changed, at market prices prevailing at the time of sale, at prices relating to the prevailing prices or at negotiated prices.

These selling stockholders may sell their shares of common stock to or through broker-dealers, and the broker-dealers may receive

compensation in the form of discounts, concessions or commissions from the selling stockholders or the purchasers of shares for

whom the broker-dealer may act as agent or to whom they may sell as principal or both.

In addition, we may

issue our common stock pursuant to this prospectus and applicable prospectus supplement amendment or post-effective amendment to

acquire the assets, stock or business of debtors in cases under the United States Bankruptcy Code, which may constitute all or

a portion of the debtor’s assets, stock or business. The common stock we issue in these transactions may be sold by the debtor

or its stockholders for cash from time to time in market transactions or it may be transferred by the debtor in satisfaction of

claims by creditors under a plan of reorganization approved by the applicable U.S. Bankruptcy Court or otherwise transferred in

accordance with the Bankruptcy Code.

We will bear all expenses

in connection with the registration of the common stock being resold by selling stockholders, other than selling discounts and

commissions and fees and expenses of the selling stockholders. The terms for the issuance of common stock may include provisions

for the indemnification of the selling stockholders for specified civil liabilities, including liabilities under the Securities

Act of 1933, as amended, or the Securities Act. The selling stockholders and any brokers, dealers or agents that participate in

the distribution of the common stock may be deemed to be underwriters, and any profit on the sale of stock by them and any discounts,

concessions or commissions received by any of these underwriters, brokers, dealers or agents may constitute underwriting discounts

and commissions under the Securities Act.

THE COMPANY

We are a commercial-stage

specialty pharmaceutical company focused on commercializing novel products that address significant healthcare needs in both prescription

and consumer health categories. Through the Company’s heritage prescription business, we currently market a portfolio of

prescription products addressing large primary care and pediatric markets. The primary care portfolio includes (i) Natesto®,

the only FDA-approved nasal formulation of testosterone for men with hypogonadism (low testosterone, or “Low T”), (ii)

ZolpiMist™, the only FDA-approved oral spray prescription sleep aid, and (iii) Tuzistra® XR, the only FDA-approved 12-hour

codeine-based antitussive syrup.

The Company’s

recently acquired prescription pediatric portfolio includes (i) AcipHex® Sprinkle™, a granule formulation of rabeprazole

sodium, a commonly prescribed proton pump inhibitor; (ii) Cefaclor, a second-generation cephalosporin antibiotic suspension; (iii)

Karbinal® ER, an extended-release carbinoxamine (antihistamine) suspension indicated to treat numerous allergic conditions;

and (iv) Poly-Vi-Flor® and Tri-Vi-Flor®, two complementary prescription fluoride-based supplement product lines containing

combinations of fluoride and vitamins in various formulations for infants and children with fluoride deficiency. We use our pediatric

portfolio in our commercialization efforts in order to leverage our internal commercial infrastructure and national sales force.

In February 2020, we

acquired Innovus Pharmaceuticals (“Innovus”), a specialty pharmaceutical company commercializing, licensing and developing

safe and effective consumer healthcare products designed to improve men’s and women’s health and vitality. Innovus commercializes

over thirty-five consumer health products competing in large healthcare categories including diabetes, men’s health, sexual wellness

and respiratory health. The Innovus product portfolio is commercialized through direct-to-consumer marketing channels utilizing

the Company’s proprietary Beyond Human® marketing and sales platform.

On March 10, 2020,

we announced the licensing of a COVID-19 IgG/IgM Rapid Test from L.B. Resources, Ltd. The test is intended for professional use

and delivers clinical results between 2 and 10 minutes at the point-of-care. This exclusive agreement grants Aytu the exclusive

right to distribute the product in the United States for a period of three years, with additional three-year autorenewals thereafter.

The COVID-19 IgG/IgM Rapid Test is a solid phase immunochromatographic assay used in the rapid, qualitative and differential detection

of IgG and IgM antibodies to the 2019 Novel Coronavirus in human whole blood, serum or plasma. We have made an additional investment

to further our interest in fighting the COVID-19 pandemic by signing an exclusive licensing agreement with Cedars-Sinai Medical

Center for a medical device platform technology called Healight™. This technology, which has been studied in the laboratory

setting, is being investigated as a potential treatment for COVID-19 in hospitalized patients. In collaboration with researchers

from the Medically Associated Science and Technology Program (MAST), we expect to advance the development of Healight in the near

term.

Aytu’s strategy is to continue building

its portfolio of revenue-generating products, leveraging its focused commercial team and expertise to build leading brands within

large therapeutic markets. Key Product Highlights

Key

Product Highlights

Primary Care Rx Portfolio

Prior to November 1,

2019, we were focused on the commercial development of the following three primary care focused products:

|

|

●

|

Natesto® – In 2016, we acquired exclusive U.S. rights to Natesto® (testosterone)

nasal gel, a novel formulation of testosterone delivered via a discreet, easy-to-use nasal gel, including a license to four Orange

Book-listed patents. The recorded chain of title from the inventor to the assignee of these four patents is incomplete, but the

licensor Acerus is obligated to complete it. Natesto is approved by the U.S. Food and Drug Administration, or FDA, for the treatment

of hypogonadism (low testosterone) in men and is the only testosterone replacement therapy, or TRT, delivered via a nasal gel.

Natesto offers multiple advantages over currently available TRTs and competes in a $1.7 billion market accounting for nearly 7

million prescriptions annually. Importantly, as Natesto is delivered via the nasal mucosa and not the skin, there is no risk of

testosterone transference to others, a known potential side effect and black box warning associated with all other topically applied

TRTs, including the market leader AndroGel®.

|

|

|

●

|

ZolpiMist® – In June 2018, we acquired an exclusive U.S. license to ZolpiMist®.

ZolpiMist is an FDA-approved prescription product that is indicated for the short-term treatment of insomnia, and is the only oral

spray formulation of zolpidem tartrate - the most widely prescribed prescription sleep aid in the U.S. ZolpiMist®

is not covered by any U.S. patents. ZolpiMist® is commercially available and competes in the non-benzodiazepine

prescription sleep aid category, a $1.8 billion prescription drug category with over 43 million prescriptions written annually.

Thirty million prescriptions of zolpidem tartrate (Ambien®, Ambien® CR, Intermezzo®, Edluar®, ZolpiMist®,

and generic forms of immediate-release, controlled release, and orally dissolving tablet formulations) are written each year in

the U.S., representing almost 70% of the non-benzodiazepine sleep aid category. Approximately 2.5 million prescriptions are written

for novel formulations of zolpidem tartrate products (controlled release and sublingual tablets). We intend to integrate ZolpiMist®

into our sales force’s promotional efforts as an adjunct product to Natesto as there is substantial overlap of physician

prescribers of both testosterone and prescription sleep aids.

|

|

|

●

|

Tuzistra® XR – In November 2018 we acquired U.S. rights to be supplied and to market

Tuzistra XR from Tris Pharma, Inc., the only FDA-approved 12-hour codeine-based antitussive. Tuzistra XR is a prescription antitussive

consisting of codeine polistirex and chlorpheniramine polistirex in an extended-release oral suspension. Tuzistra XR is a patented

combination of codeine, an opiate agonist antitussive, and chlorpheniramine, a histamine-1 receptor antagonist, indicated for relief

of cough and symptoms associated with upper respiratory allergies or a common cold in adults aged 18 years and older. Tuzistra

XR is protected by two Orange Book-listed patents extending to 2027 and 2029 owned by Tris Pharma, subject to a security interest

to Deerfield Management, and multiple pending patents. Aytu benefits from the patent portfolio through its supply and marketing

relationship with Tris Pharma and not by license or ownership of the patents. According to MediMedia, the US cough cold prescription

market is worth in excess of $3 billion at current brand pricing, with 30-35 million annual prescriptions. This market is dominated

by short-acting treatments, which require dosing 4-6 times a day. Tuzistra XR was developed using Tris Pharma’s liquid sustained

release technology, LiquiXR®, which allows for extended drug delivery throughout a 12-hour dosing period.

|

The

Pediatric Rx Portfolio

In November 2019 we

acquired a portfolio of pediatric primary care products (the “Commercial Portfolio”) from Cerecor, Inc. in order to

expand our portfolio of commercial-stage products and further leverage our commercial infrastructure and sales force. Through this

acquisition the Company now commercializes nine prescription products and sells directly to pediatric and primary care physicians

throughout the U.S.

The Commercial Portfolio

contains established prescription products competing in markets exceeding $8 billion in annual U.S. sales. Each product has distinct

clinical features and patient-friendly benefits and are indicated to treat common pediatric and primary care conditions.

|

|

●

|

AcipHex® Sprinkle™ (rabeprazole sodium) – AcipHex Sprinkle is a granule formulation

of rabeprazole sodium, a commonly prescribed proton pump inhibitor. AcipHex Sprinkle is indicated for the treatment of gastroesophageal

reflux disease (GERD) in pediatric patients 1 to 11 years of age for up to 12 weeks. Aytu does not own or license any patents covering

this product.

|

|

|

●

|

Cefaclor (cefaclor oral suspension) – Cefaclor for oral suspension is a second-generation

cephalosporin antibiotic suspension and is indicated for the treatment of numerous common infections caused by Streptococcus

pneumoniae, Haemophilus influenzae, staphylococci, and Streptococcus pyogenes, and others. Aytu does not own

or license any patents covering this product.

|

|

|

●

|

Flexichamber® – Flexichamber is an anti-static, valved collapsible holding chamber

intended to be used by patients to administer aerosolized medication from most pressurized metered dose inhalers (MDIs) such as

commonly used asthma medications. Aytu does not own or license any patents covering this product.

|

|

|

●

|

Karbinal® ER (carbinoxamine maleate extended-release oral suspension) – Karbinal

ER is an H1 receptor antagonist (antihistamine) indicated to treat various allergic conditions including seasonal and perennial

allergic rhinitis, vasomotor rhinitis, and other common allergic conditions. Aytu does not own or license any patents covering

this product.

|

|

|

●

|

Poly-Vi-Flor® and Tri-Vi-Flor® – Poly-Vi-Flor and

Tri-Vi-Flor are two complementary prescription fluoride-based supplement product lines containing combinations of vitamins and

fluoride in various oral formulations. These prescription supplements are prescribed for infants and children to treat or prevent

fluoride deficiency due to poor diet or low levels of fluoride in drinking water and other sources. While Aytu does not own or

license any patents covering these products, we have an exclusive supply relationship for the use of Metafolin®

in pediatric products and which is a patented ingredient in Poly-Vi-Flor and Tri-Vi-Flor.

|

Aytu

Consumer Health Portfolio

Our consumer health

subsidiary markets over 35 products in the U.S. and more than 10 in multiple countries around the world through 5 international

commercial partners. The following represents the core products:

In addition, we currently

expect to launch in the U.S. the following products in 2020, subject to the applicable regulatory approvals, if required:

|

|

●

|

Musclin® is a proprietary supplement made of two FDA Generally Recognized As Safe (GRAS) approved

ingredients designed to increase muscle mass, endurance and activity (first half of 2020). The main ingredient in Musclin®

is a natural activator of the transient receptor potential cation channel, subfamily V, member 3 (TRPV3) channels on muscle fibers

responsible to increase fibers width resulting in larger muscles;

|

|

|

●

|

Regenerum™* is a proprietary product containing two natural molecules: the first is an activator

of the TRPV3 channels resulting in the increase of muscle fiber width, and the second targets a different unknown receptor to build

the muscle’s capacity for energy production and increases physical endurance, allowing longer and more intense exercise.

Regenerum™ is being developed for patients suffering from muscle wasting. We currently expect to launch this product in 2020

pending successful clinical trials in patients with muscle wasting or cachexia;

|

|

|

●

|

Octiq™* is an expected FDA ophthalmic OTC monograph compliant product for the treatment of eye

redness and eye lubrication (early 2020); and

|

|

|

●

|

Regoxidine™* is an ANDA approved 5% Minoxidil foam for men and women for hair growth on the

top of the scalp (first half 2020).

|

|

|

*

|

Aytu does not own or license any patents covering these

products.

|

The COVID-19 IgG/IgM

Rapid Tests

The Company has signed

distribution agreements to distribute two similar COVID-19 IgG/IgM rapid tests. Both tests are serology-based rapid tests detecting

IgG and IgM antibodies specific to the COVID-19 virus. We initially licensed a rapid test from L.B. Resources, Limited (a Hong

Kong Corporation). We added a second rapid test by signing a distribution agreement with Singapore-based Biolidics, Limited. Aytu

does not own or license any patents covering the COVID-19 IgG/IgM rapid tests.

These tests are intended

for professional use and deliver clinical results between 2 and 10 minutes at the point-of-care.

The COVID-19 IgG/IgM

rapid test are solid phase immunochromatographic assays used in the rapid, qualitative and differential detection of IgG and IgM

antibodies to the COVID-19 in human whole blood, serum or plasma. Both tests have been clinically validated and can be distributed

in the United States following the Company’s notification of our intent to distribute the tests.

Features of the COVID-19

IgG/IgM Rapid Tests:

|

|

●

|

Results reported rapidly

|

|

|

●

|

Facilitates patient treatment decisions quickly

|

|

|

●

|

Simple, time-saving procedure

|

|

|

●

|

Small specimens, only 5 µL of serum/plasma or 10 µL of whole blood specimens required

|

|

|

●

|

All necessary reagents provided & no equipment needed

|

|

|

●

|

High sensitivity and specificity

|

We have extensive experience

across a wide range of business development activities and have in-licensed or acquired products from large, mid-sized, and small

enterprises in the United States and abroad. Through an assertive product and business development approach, we expect that we

will continue to build a substantial portfolio of complementary products.

Our

Strategy

In the near-term, we

expect to create value for shareholders by implementing a focused strategy of increasing sales of our prescription therapeutics

while leveraging our commercial infrastructure. Further, we expect to increase sales of our newly acquired consumer healthcare

product portfolio following the closing of our acquisition of Innovus Pharmaceuticals. Additionally, we expect to expand both our

Rx and consumer health product portfolios through continuous business and product development. Finally, we expect to identify operational

efficiencies identified through our recent transactions and implement expense reductions accordingly.

Corporate

Information

Our principal executive

offices are located at 373 Inverness Parkway, Suite 206, Englewood, Colorado 80112, and our phone number is (720) 437-6580. Our

corporate website address is http://www.aytubio.com. The information contained on, connected to or that can be accessed via our

website is not part of this prospectus. We have included our website address in this prospectus as an inactive textual reference

only and not as an active hyperlink.

RISK FACTORS

Investing in our securities

involves a risk of loss. Before investing in our securities, you should carefully consider the risk factors described under “Risk

Factors” in our Annual Report on Form 10-K filed with the SEC for the most recent year, in any applicable prospectus supplement

and in our filings with the SEC, including our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, together with all

of the other information included in this prospectus and any prospectus supplement and the other information incorporated by reference

herein and therein. These risks are not the only ones facing us. Additional risks not currently known to us or that we currently

deem immaterial also may impair or harm our business and financial results. Statements in or portions of a future document incorporated

by reference in this prospectus, including, without limitation, those relating to risk factors, may update and supersede statements

in and portions of this prospectus or such incorporated documents. Please also refer to the section entitled “Special Note

Regarding Forward-Looking Statements.”

Risks Related to COVID-19

We are relying

on FDA policies and guidance provisions that have changed very recently, and may continue to change, and relate directly to the

COVID-19 health crisis. If we misinterpret this guidance or the guidance changes unexpectedly and/or materially, potential sales

of the COVID-19 tests would be impacted.

The U.S. Food and Drug

Administration (FDA) issued non-binding guidance for manufacturers relating to the pathway to enable FDA approval for devices related

to testing for COVID-19 under an Emergency Use Authorization (EUA). Following the issuance of the initial published guidance, on

March 16, 2020, revised guidance specific to COVID-19 “antibody tests” was issued. Newer guidance was published on

May 4, 2020 further describing the requirements for serology tests to continue to be marketed under an Emergency Use Authorization.

If our interpretation of the newly revised guidance is incorrect or specifics around the guidance change, the sales of the COVID-19

test could be materially impacted.

If our recently

licensed COVID-19 IgG/IgM rapid tests do not perform as expected or the reliability of the technology is questioned, we could experience

delayed or reduced market acceptance of the tests, increased costs and damage to our reputation.

Our success depends

on the market’s confidence that we can provide reliable, high-quality COVID-19 diagnostic tests. We believe that customers

in our target markets are likely to be particularly sensitive to product defects and errors. Our reputation and the public image

of our licensed COVID-19 diagnostic tests may be impaired if they fail to perform as expected or are perceived as difficult to

use. Despite quality control testing, defects or errors could occur with the tests.

In the future, if our

licensed COVID-19 diagnostic tests experience a material defect or error, this could result in loss or delay of revenues, delayed

market acceptance, damaged reputation, diversion of development resources, legal claims, increased insurance costs or increased

service and warranty costs, any of which could harm our business. Such defects or errors could also prompt us to amend certain

warning labels or narrow the scope of the use of our diagnostic tests, either of which could hinder our success in the market.

Even after any underlying concerns or problems are resolved, any widespread concerns regarding our technology or any manufacturing

defects or performance errors in the test could result in lost revenue, delayed market acceptance, damaged reputation, increased

service and warranty costs and claims against us.

If we become

subject to claims relating to improper handling, storage or disposal of hazardous materials, we could incur significant cost and

time to comply.

Our research and development

processes involve the controlled storage, use and disposal of hazardous materials, including biological hazardous materials. We

are subject to foreign, federal, state and local regulations governing the use, manufacture, storage, handling and disposal of

materials and waste products. We may incur significant costs complying with both existing and future environmental laws and regulations.

In particular, we are subject to regulation by the Occupational Safety and Health Administration, (OSHA), and the Environmental

Protection Agency (EPA), and to regulation under the Toxic Substances Control Act and the Resource Conservation and Recovery Act

in the United States. OSHA or the EPA may adopt additional regulations in the future that may affect our research and development

programs. The risk of accidental contamination or injury from hazardous materials cannot be eliminated completely. In the event

of an accident, we could be held liable for any damages that result, and any liability could exceed the limits or fall outside

the coverage of our workers’ compensation insurance. We may not be able to maintain insurance on acceptable terms, if at

all.

Our licensed

COVID-19 tests have not been manufactured on a high-volume scale and could be subject to unforeseen scale-up risks.

While the manufacturers

of the COVID-19 IgG/IgM rapid rests have experience manufacturing diagnostic tests, there can be no assurance that they can manufacture

the COVID-19 diagnostic tests at a scale that is adequate for our current and future commercial needs. We may face significant

or unforeseen difficulties in securing adequate supply of the COVID-19 diagnostic tests, relating to the manufacturing of the tests.

These risks include but are not limited to:

|

|

●

|

Technical issues relating to manufacturing components of the COVID-19 diagnostic tests on a high-volume

commercial scale at reasonable cost, and in a reasonable time frame;

|

|

|

●

|

difficulty meeting demand or timing requirements for orders due to excessive costs or lack of capacity

for part or all of an operation or process;

|

|

|

●

|

changes in government regulations or in quality or other requirements that lead to additional manufacturing

costs or an inability to supply product in a timely manner, if at all; and

|

|

|

●

|

increases in raw material or component supply cost or an inability to obtain supplies of certain critical

supplies needed to complete our manufacturing processes.

|

These and other difficulties

may only become apparent when scaling up to the manufacturing process of the COVID-19 diagnostic tests to a more substantive commercial

scale. In the event the tests cannot be manufactured in sufficient commercial quantities or manufacturing is delayed, our future

prospects could be significantly impacted and our financial prospects could be materially harmed.

Our suppliers

may experience development or manufacturing problems or delays that could limit the growth of our revenue or increase our losses.

We may encounter unforeseen

situations in the manufacturing of the COVID-19 diagnostic tests that could result in delays or shortfalls in our production. Suppliers

may also face similar delays or shortfalls. In addition, suppliers’ production processes may have to change to accommodate

any significant future expansion of manufacturing capacity, which may increase suppliers’ manufacturing costs, delay production

of diagnostic tests, reduce our product gross margin and adversely impact our business. If we are unable to keep up with demand

for the COVID-19 diagnostic test by successfully securing supply and shipping our diagnostic tests in a timely manner, our revenue

could be impaired, market acceptance for the test could be adversely affected and our customers might instead purchase our competitors’

diagnostic tests.

We have relied

and expect to continue to rely on third parties to conduct studies of the COVID-19 diagnostic tests that will be required by the

FDA or other regulatory authorities and those third parties may not perform satisfactorily.

Although we intend

to sell the COVID-19 IgG/IgM rapid tests by virtue of recent FDA guidance allowing for reduced product clinical and analytical

studies, we have relied on third parties, such as independent testing laboratories and hospitals, to conduct such studies. Our

reliance on these third parties will reduce our control over these activities. These third-party contractors may not complete activities

on schedule or conduct studies in accordance with regulatory requirements or our study design. We cannot control whether they devote

sufficient time, skill and resources to our studies. Our reliance on third parties that we do not control will not relieve us of

any applicable requirement to prepare, and ensure compliance with, various procedures required under good clinical practices. If

these third parties do not successfully carry out their contractual duties or regulatory obligations or meet expected deadlines,

if the third parties need to be replaced or if the quality or accuracy of the data they obtain is compromised due to their failure

to adhere to our clinical protocols or regulatory requirements or for other reasons, our studies may be extended, delayed, suspended

or terminated, and we may not be able to obtain regulatory approval for additional diagnostic tests.

If the manufacturers’

delivery of the COVID-19 tests and the required clinical data is delayed, then our ability to obtain necessary regulatory approvals

and/or authorizations to distribute the COVID-19 tests will be impaired, which will adversely affect our business plans.

While the FDA has provided

a path forward to begin selling the COVID-19 tests on an expedited basis, we are still required to provide the FDA with data concerning

the validation of the tests and to satisfy certain labeling conditions. If the manufacturers are delayed in delivering to us the

COVID-19 tests and related validation data, we will, in turn, be delayed in obtaining FDA authorization or approval required before

we can begin selling the COVID-19 tests. Any such delays will adversely affect our business plans.

We rely on

third parties to manufacture the COVID-19 tests for us and if such third party refuses or is unable to supply us with the COVID-19

test, our business will be materially harmed.

We rely on third parties

to manufacture the COVID-19 diagnostic tests, which manufacturers licenses their rights from the owners of the intellectual property

underlying the COVID-19 tests. If any issues arise with respect to the manufacturers’ ability to manufacture and deliver

to us the COVID-19 tests, our business could be materially harmed.

While we have obtained

an exclusive distribution agreement for the right to commercialize one of the COVID-19 test in the United States, Canada and Mexico,

the manufacturer has no obligation to supply us with a minimum amount of, or any, COVID-19 tests. The manufacturer may choose not

to supply us with a sufficient quantity of such tests in order to supply such tests to other distributors, or for any reason. In

addition, the manufacturer may be unable to provide us with an adequate supply of COVID-19 tests for various reasons, including,

among others, if it becomes insolvent, if a United States regulatory authority or other governments block the import or sale of

the COVID-19 tests, if it fails to maintain its rights to manufacture the COVID-19 test, or if the owner of the underlying intellectual

property fails to adequately maintain such intellectual property.

If there is

little or no demand for the COVID-19 tests our business could be materially harmed.

While we have received

a number of inquiries regarding the COVID-19 tests and expect to receive orders upon our receipt of a supply of COVID-19 tests,

there is no guarantee that such inquiries will result in customer orders. If no orders for COVID-19 tests are made, our business

will be materially harmed.

Our business

may be adversely affected by the effects of the COVID-19 pandemic.

In December 2019, a

novel strain of coronavirus, SARS-CoV-2, causing a disease referred to as COVID-19, was reported to have surfaced in Wuhan, China.

It has since spread to multiple other countries; and, in March 2020, the World Health Organization declared the COVID-19 outbreak

a pandemic. This pandemic has adversely affected or has the potential to adversely affect, among other things, the economic and

financial markets and labor resources of the countries in which we operate, our manufacturing and supply chain operations, research

and development efforts, commercial operations and sales force, administrative personnel, third-party service providers, business

partners and customers, and the demand for some of our marketed products.

The COVID-19 pandemic

has resulted in travel and other restrictions to reduce the spread of the disease, including governmental orders across the globe,

which, among other things, direct individuals to shelter at their places of residence, direct businesses and governmental agencies

to cease non-essential operations at physical locations, prohibit certain non-essential gatherings, maintain social distancing,

and order cessation of non-essential travel. As a result of these recent developments, we have implemented work-from-home policies

for a significant part of our employees. The effects of shelter-in-place and social distancing orders, government-imposed quarantines,

and work-from-home policies may negatively impact productivity, disrupt our business, and delay our business timelines, the magnitude

of which will depend, in part, on the length and severity of the restrictions and other limitations on our ability to conduct our

business in the ordinary course. Such restrictions and limitations may also negatively impact our access to regulatory authorities

(which may be affected, among other things, by travel restrictions and may be delayed in responding to inquiries, reviewing filings,

and conducting inspections). The COVID-19 pandemic may also result in the loss of some of our key personnel, either temporarily

or permanently. In addition, our sales and marketing efforts may be impacted by postponement of face-to-face meetings and restrictions

on access by non-essential personnel to hospitals or clinics, all of which could slow adoption and implementation of our marketed

products, resulting in lower net product sales. For example, while the impact of shelter-in-place and social distancing orders,

physicians’ office closures, and delays in the treatment of patients following the COVID-19 pandemic on our net product sales of

our products for the three months ended March 31, 2020 was limited, overall demand was lower in April 2020 compared to the same

period of 2019. In addition to other potential impacts of the COVID-19 pandemic on net product sales, we expect to see continued

adverse impact on new patient starts for all products while these measures remain in place. See Part I, Item 2. “Management’s

Discussion and Analysis of Financial Condition and Results of Operations - Results of Operations” for a discussion of our

net product sales. Demand for some or all of our marketed products may continue to be reduced while the shelter-in-place or social

distancing orders are in effect and, as a result, some of our inventory may become obsolete and may need to be written off, impacting

our operating results. These and similar, and perhaps more severe, disruptions in our operations may materially adversely impact

our business, operating results, and financial condition.

Quarantines, shelter-in-place,

social distancing, and similar government orders (or the perception that such orders, shutdowns, or other restrictions on the conduct

of business operations could occur) related to COVID-19 or other infectious diseases are impacting personnel at our research and

manufacturing facilities, our suppliers, and other third parties on which we rely, and may impact the availability or cost of materials

produced by or purchased from such parties, which could result in a disruption in our supply chain.

In addition, infections

and deaths related to COVID-19 may disrupt the United States’ healthcare and healthcare regulatory systems. Such disruptions could

divert healthcare resources away from, or materially delay, FDA review and potential approval of our marketed products. It is unknown

how long these disruptions could continue. Further, while we are focused on therapies to address the COVID-19 pandemic, our other

product candidates may need to be de-prioritized. Any elongation or de-prioritization of our other products could materially affect

our business.

While

the potential economic impact brought by, and the duration of, the COVID-19 pandemic may be difficult to assess or predict, it

is currently resulting in significant disruption of global financial markets. This disruption, if sustained or recurrent, could

make it more difficult for us to access capital if needed. In addition, a recession or market correction resulting from the spread

of COVID-19 could materially affect our business and the value of our common stock. The global COVID-19 pandemic continues to rapidly

evolve. The ultimate impact of this pandemic is highly uncertain and subject to change. We do not yet know the full extent of potential

delays or impacts on our business, healthcare systems, or the global economy as a whole. These effects could have a material impact

on our operations. To the extent the COVID-19 pandemic adversely affects our business, prospects, operating results, or financial

condition, it may also materially affect our business.

Risks Related to the Healight Technology

We must rely on a

third party to develop and commercialize the Healight Technology.

We must rely on Cedars-Sinai

Medical Center to conduct testing and clinical trials of the Healight Technology (“Healight”). As a result,

we are expected to remain dependent on a third party to conduct ongoing trials and the timing and completion of these trials will

be partially controlled by such third party and may result in delays to the Healight development program. Nevertheless, we are

responsible for ensuring that each of the trials is conducted in accordance with the applicable protocol and legal, regulatory,

and scientific standards and our reliance on a third party does not relieve us of our regulatory responsibilities. If we or Cedars-Sinai

Medical Center fail to comply with applicable requirements, the FDA may require to perform additional clinical tests.

There is no guarantee

that Cedars-Sinai Medical Center will devote adequate time and resources to the Healight development activities or perform as contractually

required. Furthermore, Cedars-Sinai Medical Center may also have relationships with other entities, some of which may be our competitors.

If Cedars-Sinai Medical Center fails to meet expected deadlines, adhere to our clinical protocols, meet regulatory requirements,

or otherwise performs in a substandard manner, or terminates its engagement with us, the timelines for the Healight technology

development may be extend, delayed, suspended, or terminated.

The development of

Healight faces uncertainties related to testing.

The development of Healight

is based on scientific hypotheses and experimental approaches that may not lead to desired results. It is possible that the timeframe

for obtaining proof of principle and other results may be considerably longer than originally anticipated, or may not be possible

given time, resource, financial, strategic, and collaborator constraints. Success in one stage of testing is not necessarily an

indication that the Healight program will succeed in later stages of testing and development. The discovery of unexpected side

effects, inability to increase scale of manufacture, market attractiveness, regulatory hurdles, competition, as well as other factors

may make the Healight technology unattractive of unsuitable for human use.

Risks Related to our Bylaws

Our Amended

and Restated Bylaws provides that the Court of Chancery of the State of Delaware is the exclusive forum for certain litigation

that may be initiated by our stockholders, including claims under the Securities Act, which could limit our stockholders’

ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees.

Our Amended and Restated

Bylaws provides that the Court of Chancery of the State of Delaware shall, to the fullest extent permitted by law, be the sole

and exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim for breach

of a fiduciary duty owed by any of our directors, officers, employees or agents to us or our stockholders, (iii) any action asserting

a claim arising pursuant to any provision of the Delaware General Corporation Law, our certificate of incorporation or our bylaws

or (iv) any action asserting a claim governed by the internal affairs doctrine. The choice of forum provision may limit a stockholder’s

ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers, employees

or agents, which may discourage such lawsuits against us and our directors, officers, employees and agents. Stockholders who do

bring a claim in the Court of Chancery could face additional litigation costs in pursuing any such claim, particularly if they

do not reside in or near the State of Delaware. The Court of Chancery may also reach different judgments or results than would

other courts, including courts where a stockholder considering an action may be located or would otherwise choose to bring the

action, and such judgments or results may be more favorable to us than to our stockholders. Alternatively, if a court were to find

the choice of forum provision contained in our certificate of incorporation to be inapplicable or unenforceable in an action, we

may incur additional costs associated with resolving such action in other jurisdictions, which could adversely affect our business

and financial condition. Notwithstanding the foregoing, the exclusive provision shall not preclude or contract the scope of exclusive

federal or concurrent jurisdiction for actions brought under the Exchange Act, or the Securities Act of 1933, as amended, or the

Securities Act, or the respective rules and regulations promulgated thereunder.

USE OF PROCEEDS

We will receive no

proceeds from the offering of the shares other than the value of the assets, businesses, or securities acquired by us in acquisitions

for which shares are offered under this prospectus.

DESCRIPTION OF COMMON STOCK

General

This prospectus describes

the general terms of our capital stock. For a more detailed description of our capital stock, you should read the applicable provisions

of the Delaware General Corporation Law, or DGCL, and our charter and bylaws.

Our certificate of

incorporation provides that we may issue up to 200,000,000 shares of common stock, par value $0.0001 per share, and up to 50,000,000

shares of preferred stock, par value $0.0001 per share, and permits our board of directors, without stockholder approval, to amend

the charter to increase or decrease the aggregate number of shares of stock or the number of shares of stock of any class or series

that we have authority to issue. As of June 1, 2020, there were 120,614,876 shares of our common stock outstanding and no shares

of our preferred stock outstanding. Under Delaware law, stockholders generally are not personally liable for our debts or obligations

solely as a result of their status as stockholders.

Common Stock

Holders of our common

stock generally have no preference, conversion, exchange, sinking fund, redemption or appraisal rights and have no preemptive rights

to subscribe for any of our securities. Holders of our common stock are entitled to receive dividends when authorized by our board

of directors out of assets legally available for the payment of dividends. They are also entitled to share ratably in our assets

legally available for distribution to our stockholders in the event of our liquidation, dissolution or winding up, after payment

of or adequate provision for all of our known debts and liabilities. These rights are subject to the preferential rights of any

other class or series of our stock. The outstanding shares of common stock are, and any shares offered by this prospectus will

be when issued and paid for, fully paid and nonassessable.

Each outstanding share

of common stock entitles the holder to one vote on all matters submitted to a vote of stockholders, including the election of directors.

Except as provided with respect to any other class or series of stock, the holders of our common stock will possess the exclusive

voting power. In uncontested elections, directors are elected by a majority of all of the votes cast in the election of directors,

and in contested elections, directors are elected by a plurality of all of the votes cast in the election of directors.

Transfer Agent and Registrar

The transfer agent

of our common stock is Issuer Direct Corporation. Their address is 500 Perimeter Park Drive, Suite D, Morrisville, NC 27560.

ANTI-TAKEOVER EFFECTS OF CERTAIN PROVISIONS

OF DELAWARE LAW AND OUR CERTIFICATE OF INCORPORATION AND BYLAWS

Certain provisions

of the Certificate of Incorporation and Bylaws could have an anti-takeover effect. These provisions are intended to enhance the

likelihood of continuity and stability in the composition of the Board and in the policies formulated by the Board and to discourage

an unsolicited takeover of us if the Board determines that such takeover is not in the best interests of us and our stockholders.

However, these provisions could have the effect of discouraging certain attempts to acquire us or remove incumbent management even

if some or a majority of stockholders deemed such an attempt to be in their best interests.

The provisions in the

Certificate of Incorporation and the Bylaws include: (a) a procedure which requires stockholders to nominate directors in advance

of a meeting to elect such directors; (b) the authority to issue additional shares of preferred stock without stockholder approval;

(c) the number of directors on our Board will be fixed exclusively by the Board; (d) any newly created directorship or any vacancy

in our Board resulting from any increase in the authorized number of directors or the death, disability, resignation, retirement,

disqualification, removal from office or other cause will be filled solely by the affirmative vote of a majority of the directors

then in office, even if less than a quorum; and (e) our Bylaws may be amended by our Board.

The Delaware General

Corporation Law (the “DGCL”) contains statutory “anti-takeover” provisions, including Section 203 of the

DGCL which applies automatically to a Delaware corporation unless that corporation elects to opt-out as provided in Section 203.

We, as a Delaware corporation, have not elected to opt-out of Section 203 of the DGCL. Under Section 203 of the DGCL, a stockholder

acquiring more than 15% of the outstanding voting shares of a corporation (an “Interested Stockholder”) but less than

85% of such shares may not engage in certain business combinations with the corporation for a period of three years subsequent

to the date on which the stockholder became an Interested Stockholder unless prior to such date, the board of directors of the

corporation approves either the business combination or the transaction which resulted in the stockholder becoming an Interested

Stockholder, or the business combination is approved by the board of directors and by the affirmative vote of at least 662/3% of

the outstanding voting stock that is not owned by the Interested Stockholder.

Limitation of Liability and Indemnification

of Officers and Directors

Pursuant to provisions

of the DGCL, we have adopted provisions in our Certificate of Incorporation that provide that our directors shall not be personally

liable for monetary damages to us or our stockholders for a breach of fiduciary duty as a director to the full extent that the

DGCL permits the limitation or elimination of the liability of directors.

We have in effect a

directors and officers liability insurance policy indemnifying our directors and officers and the directors and officers of our

subsidiaries within a specific limit for certain liabilities incurred by them, including liabilities under the Securities Act.

We pay the entire premium of this policy. Our Certificate of Incorporation also contains a provision for the indemnification by

us of all of our directors and officers, to the fullest extent permitted by the DGCL.

Exclusive Forum

Our Bylaws provide

that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall,

to the fullest extent permitted by law, be the sole and exclusive forum for (a) any derivative action or proceeding brought on

behalf of the Company, (b) any action asserting a claim of breach of a fiduciary duty owed by any director, officer, other employee

or stockholder of the Company to the Company or the Company’s stockholders, (c) any action asserting a claim arising pursuant

to any provision of the DGCL or as to which the DGCL confers jurisdiction on the Court of Chancery of the State of Delaware, or

(d) any action asserting a claim governed by the internal affairs doctrine. Any person or entity purchasing or otherwise acquiring

any interest in shares of our stock shall be deemed to have notice of and consented to the foregoing forum selection provisions.

PLAN OF DISTRIBUTION

This prospectus is

a part of an “acquisition shelf” registration statement on Form S-4 that we have filed with the SEC. Under the shelf

registration process, we may from time to time offer and sell shares of our common stock, par value $0.0001 per share, having a

maximum aggregate offering price of $40,000,000, in connection with the acquisition of assets, stock or businesses, whether by

purchase, merger or any other form of business combination. We are actively looking for high-quality, durable, cash flow-producing

assets potentially unrelated to our current portfolio of products in order to diversify our business and potentially monetize our

substantial net operating losses as part of our asset redeployment and diversification strategy. We intend to focus our search

primarily in the United States, although we will also evaluate international investment opportunities should we find such opportunities

attractive.

It is expected that

the terms of these acquisitions will be determined by direct negotiations with the owners or controlling persons of the assets,

businesses or securities to be acquired, and that the shares of common stock issued will be valued at prices reasonably related

to the market price of our common stock at the time an agreement is entered into concerning the terms of the acquisition, at or

about the time the shares are delivered or during some other negotiated period. Factors taken into account in acquisitions may

include, among other factors, the quality and reputation of the business to be acquired and its management, the strategic market

position of the business to be acquired and its proprietary assets, earning power, cash flow and growth potential. In addition

to shares of our common stock, consideration for these acquisitions may consist of any consideration permitted by applicable law,

including, without limitation, the payment of cash, the issuance of preferred stock, the issuance of a note or other form of indebtedness,

the assumption of liabilities or any combination of these items. All expenses of this registration, other than the expenses of

the selling stockholders, if any, will be paid by us. We do not expect to pay underwriting discounts or commissions, although we

may pay finders’ fees from time to time in connection with certain acquisitions. Any person receiving finders’ fees

may be deemed to be an “underwriter” within the meaning of the Securities Act, and any profit on the resale of securities

purchased by them may be considered underwriting commissions or discounts under the Securities Act.

In addition, we may

issue our common stock pursuant to this prospectus and applicable prospectus supplement, or post-effective amendment, to acquire

the assets, stock or business of debtors in cases under the United States Bankruptcy Code, which may constitute all or a portion

of the debtor’s assets, stock or business. The common stock we issue in these transactions may be sold by the debtor or its

stockholders for cash from time to time in market transactions or it may be transferred by the debtor in satisfaction of claims

by creditors under a plan of reorganization approved by the applicable United States Bankruptcy Court or otherwise transferred

in accordance with the Bankruptcy Code.

In an effort to maintain

an orderly market in our securities or for other reasons, we may negotiate agreements with persons receiving common stock covered

by this prospectus that will limit the number of shares that they may sell at specified intervals. These agreements may be more

or less restrictive than restrictions on sales made under exemptions from the registration requirements of the Securities Act,

including the requirements under Rule 144 or Rule 145(d), and the persons party to these agreements may not otherwise be subject

to the Securities Act requirements. We anticipate that, in general, negotiated agreements will be of limited duration and will

permit the recipients of securities issued in connection with acquisitions to sell up to a specified number of shares during a

specified period of time. We may also determine to waive any such agreements without public notice.

This prospectus may

be supplemented to furnish the information necessary for a particular negotiated transaction, and the registration statement of

which this prospectus is a part will be amended or supplemented, as required, to supply information concerning an acquisition.

We may permit individuals

or entities who will receive shares of our common stock in connection with the acquisitions described above, or their transferees

or successors-in-interest, to use this prospectus to cover the resale of such shares. See “Selling Stockholders,” as

it may be amended or supplemented from time to time, for a list of those individuals or entities that are authorized to use this

prospectus to sell their shares of our common stock.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly

and current reports, proxy statements and other information with the SEC. You may obtain such SEC filings from the SEC’s

website at http://www.sec.gov. Copies of our periodic and current reports and proxy statements, may be obtained, free of charge,

on our website at https://irdirect.net/AYTU/sec_filings. This reference to our Internet address is for informational purposes only

and the information contained on or accessible through such Internet address is not and shall not be deemed to be incorporated

by reference into this prospectus.

As permitted by SEC

rules, this prospectus does not contain all of the information we have included in the registration statement and the accompanying

exhibits and schedules we file with the SEC. You may refer to the registration statement, exhibits and schedules for more information

about us and the securities. The registration statement, exhibits and schedules are available through the SEC’s website or

at its public reference room.

INCORPORATION OF CERTAIN DOCUMENTS

BY REFERENCE

In this prospectus,

we “incorporate by reference” certain information that we file with the SEC, which means that we can disclose important

information to you by referring you to that information. The information we incorporate by reference is an important part of this

prospectus, and later information that we file with the SEC will automatically update and supersede this information. The following

documents or information have been filed by us with the SEC and are incorporated by reference into this prospectus (other than,

in each case, documents or information that are or are deemed to have been furnished rather than filed in accordance with SEC rules,

including disclosure furnished under Items 2.02 or 7.01 of Form 8-K):

|

|

●

|

our Definitive Proxy Statement on Schedule

14A filed with the SEC on March 4, 2020;

|

|

|

●

|

our Annual Report on Form

10-K for the fiscal year ended June 30, 2019 filed with the SEC on September 26, 2019;

|

|

|

●

|

our Current Reports on Form 8-K filed with the SEC on August

2, 2019, September 18, 2019, October

15, 2019, October 15, 2019 (as

amended on January 10,

2020), November 4, 2019 (as amended

on November 4, 2019, as further amended

on November 7, 2019), November

12, 2019, November 26, 2019, December

2, 2019, December 11, 2019, January

15, 2020, January 24, 2020, February

13, 2020, February

14, 2020 (as amended on February

26, 2020), February

21, 2020, March, 12, 2020, March

13, 2020, March 13, 2020,

March 19, 2020, March

20, 2020, March 23, 2020, March

25, 2020, April 1, 2020, April

3, 2020, April 15, 2020, April

16, 2020, April 24, 2020 and June 1 2020; and

|

|

|

●

|

the description of our Common Stock contained in our Registration Statement on Form 8-A, as filed

with the SEC on October 17, 2017,

including any amendment or report filed for the purpose of updating such description.

|

All documents and reports

that we file with the SEC (other than, in each case, documents or information that are or are deemed to have been furnished rather

than filed in accordance with SEC rules) under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended,

which we refer to in this prospectus as the “Exchange Act,” from the date of this prospectus until the completion of

the offering under this prospectus shall be deemed to be incorporated by reference into this prospectus. Unless specifically stated

to the contrary, none of the information we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K that we may from

time to time furnish to the SEC will be incorporated by reference into, or otherwise included in, this prospectus. The information

contained on or accessible through any websites, including https://irdirect.net/AYTU/sec_filings, is not and shall not be deemed

to be incorporated by reference into this prospectus.

You may request a copy

of these filings, other than an exhibit to these filings unless we have specifically included or incorporated that exhibit by reference

into the filing, at no cost, by writing or telephoning us at the following address:

Aytu BioScience, Inc.

373 Inverness Parkway, Suite 206

Englewood, Colorado 80112

(720) 437-6580

Any statement contained

in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained in this prospectus, any prospectus supplement, or any

other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the

statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part

of this prospectus.

EXPERTS

The consolidated financial

statements of Aytu BioScience, Inc. at June 30, 2019 and 2018, and for each of the two years in the period ended June 30, 2019

have been audited by Plante & Moran, PLLC (successor to EKS&H LLLP), independent registered public accounting firm. Such

financial statements have been incorporated herein by reference in reliance on the report of such firm given upon their authority

as experts in accounting and auditing.

The abbreviated financial

statements of the Pediatrics Product Portfolio of Cerecor Inc. at September 30, 2019 and December 31, 2018, and for the nine-month

period ended September 30, 2019 and for the year ended December 31, 2018, incorporated by reference in Aytu BioScience, Inc.’s

Current Report on Form 8-K/A dated January 10, 2020 have been audited by Ernst & Young LLP, independent auditors, as set forth

in their report thereon incorporated by reference therein, and incorporated herein by reference. Such abbreviated financial statements

are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting

and auditing.

The

consolidated financial statements as of December 31, 2018 and 2017 and each of the two years in the period ended December 31,

2018 of Innovus Pharmaceuticals, Inc. incorporated by reference, have been audited by Hall & Company, an independent registered

public accounting firm, as stated in their reports. Such financial statements have been included in reliance upon the reports

of such firm given upon their authority as experts in accounting and auditing.

LEGAL MATTERS

Certain legal matters

in connection with the offered securities will be passed upon for us by Dorsey & Whitney LLP, Salt Lake City, Utah. Any underwriters

or agents will be represented by their own legal counsel

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 20. Indemnification of Directors

and Officers

We are incorporated

under the laws of the State of Delaware. Section 145 of the Delaware General Corporation Law provides that a Delaware corporation

may indemnify any persons who are, or are threatened to be made, parties to any threatened, pending or completed action, suit or

proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation),

by reason of the fact that such person was an officer, director, employee or agent of such corporation, or is or was serving at

the request of such person as an officer, director, employee or agent of another corporation or enterprise. The indemnity may include

expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by

such person in connection with such action, suit or proceeding, provided that such person acted in good faith and in a manner he

reasonably believed to be in or not opposed to the corporation’s best interests and, with respect to any criminal action

or proceeding, had no reasonable cause to believe that his conduct was illegal. A Delaware corporation may indemnify any persons

who are, or are threatened to be made, a party to any threatened, pending or completed action or suit by or in the right of the

corporation by reason of the fact that such person was a director, officer, employee or agent of such corporation, or is or was