UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

INFORMATION STATEMENT PURSUANT TO SECTION 14C OF THE

SECURITIES EXCHANGE ACT OF 1934

|

x Filed by the Registrant

|

¨ Filed by a Party other than the Registrant

|

Check the appropriate box:

|

x

|

Preliminary Information Statement

|

|

|

Definitive Information Statement Only

|

|

¨

|

Confidential, for Use of the Commission (as permitted by Rule 14c)

|

|

IGEN NETWORKS CORPORATION

|

|

(Name of Registrant as Specified In Its Charter)

|

______________________________________________________

Name of Person(s) Filing Information Statement, if other than Registrant:

Payment of Filing Fee (Check the appropriate box):

|

¨

|

Fee computed on table below per Exchange Act Rules 14C-5(g) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount of which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party: ____________________________

|

|

|

(4)

|

Date Filed: ____________________________

|

IGEN NETWORKS CORP.

29970 Technology Drive, Suite 204

Murrieta, CA 92563

844-332-5699

Copies of correspondence to:

James B. Parsons

Parsons/Burnett/Bjordahl/Hume, LLP

2155 112th Ave NE

Bellevue, WA 98004

(425) 451-8036

NOTICE OF ACTION TAKEN WITHOUT A STOCKHOLDER MEETING

Date of Mailing: April __, 2020

TO THE STOCKHOLDERS OF IGEN NETWORKS CORP.:

The attached Information Statement is furnished by the Board of Directors (the “Board”) of IGen Networks Corp. (the “Company,” “we” or “us”). The Company, a Nevada corporation, is a public company registered with the Securities and Exchange Commission.

On April 2, 2020, a stockholders holding 1,000,000 shares of $0.001 par value Series B Super Voting Preferred Stock (“Series B Preferred Stock”), consented to amend the Articles of Incorporation. Each share of Series B Preferred Stock has voting rights equal to 500 shares of common stock. The shares voted equal approximately 72%, of our common stock voting power, consented in writing to amend the Company’s Articles of Incorporation (the “Articles of Amendment”). This consent was sufficient to approve the Articles of Amendment under Nevada law and our Articles of Incorporation. The attached Information Statement describes the Articles of Amendment that the common stockholders of the Company have approved, which will increase the Company’s authorized shares of common stock to 1,500,000,000 shares from 750,000,000 shares, of which 1,490,000,000 will be common stock, and 10,000,000 will be preferred stock, with rights and preferences set by the Board of Directors. The Articles of Amendment will become effective upon filing with the Nevada Secretary of State, which can occur no earlier than twenty (20) calendar days after the filing and dissemination of the Definitive Information Statement.

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

There are no stockholder dissenters’ or appraisal rights in connection with any of the matters discussed in this Information Statement.

Please read this Notice and Information Statement carefully and in its entirety. It describes the terms of the actions taken by the stockholders.

Although you will not have an opportunity to vote on the approval of the Articles of Amendment, this Information Statement contains important information about the Articles of Amendment.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

Neil Chan, CEO

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF INFORMATION STATEMENT MATERIALS IN CONNECTION WITH THIS NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT:

IGEN NETWORKS CORP.

29970 Technology Drive, Suite 204

Murrieta, CA 92563

844-532-5699

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being furnished to the stockholders of IGen Networks Corp., a Nevada corporation (the “Company,” “we” or “us”), to advise them of the corporate actions that have been authorized by written consent of a majority of the Company’s stockholders, who own Series B Preferred Stock with approximately 72% of the Company’s common stock voting power as of the record date of April 7, 2020 (the “Record Date”). These actions are being taken without notice, meetings or votes in accordance with Article 78 of the Nevada Revised Statutes (NRS), the Company’s Articles of Incorporation and its Bylaws. This Information Statement is being mailed to the stockholders of the Company, as of the Record Date, on April __, 2020.

On April 1, 2020, the Board of Directors approved, and recommended to the stockholders for approval, an amendment to the Company’s Articles of Incorporation (the “Articles of Amendment”) that will increase the Company’s authorized shares of common stock to 1,500,000,000 shares from 750,000,000 shares, of which 1,490,000,000 will be common stock and 10,000,000 will be preferred stock, with right and preference set by the Board of Directors. The full text of the Articles of Amendment is attached to this Information Statement as Appendix A.

On April 2, 2020, a majority of the stockholders holding 1,000,000 shares of Series B Preferred Stock, each share having the right to vote 500 shares of common stock, or approximately 72% of our common stock voting power, consented in writing to the Articles of Amendment. This consent was sufficient to approve the Articles of Amendment under Nevada law.

NO VOTE REQUIRED

We are not soliciting consents to approve the Articles of Amendment. Nevada law and our Articles of Incorporation permit the Company to take any action which may be taken at an annual or special meeting of its stockholders by written consent, if the holders of a majority of the shares of its Series B Preferred Stock sign and deliver a written consent to the action to the Company.

NO APPRAISAL RIGHTS

Under Nevada corporate law, stockholders have no appraisal or dissenters’ rights in connection with the Articles of Amendment.

INTERESTS OF CERTAIN PARTIES IN THE MATTERS TO BE ACTED UPON

None of the directors or executive officers of the Company has any substantial interest resulting from the Articles of Amendment that is not shared by all other stockholders pro rata, and in accordance with their respective interests.

COST OF THIS INFORMATION STATEMENT

The entire cost of furnishing this Information Statement will be borne by us. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our Common Stock held of record by them.

HOUSEHOLDING OF STOCKHOLDER MATERIALS

In some instances, we may deliver only one copy of this Information Statement to multiple stockholders sharing a common address. If requested by phone or in writing, we will promptly provide a separate copy to a stockholder sharing an address with another stockholder. Requests should be directed to our Chief Executive Officer, Neil Chan, 29970 Technology Drive, Suite 204, Murrieta, CA 92563, 844-532-5699. Stockholders sharing an address who currently receive multiple copies and wish to receive only a single copy should contact their broker or send a signed, written request to us at the above address.

AMENDMENT TO THE ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK.

General

Our Articles of Incorporation currently authorizes 750,000,000 shares of stock, 740,000,000 shares of which are Common stock and 10,000,000 shares of which are Preferred stock.

On April 1, 2020 ,the Board of Directors, and on April 2, 2020 the consenting stockholders, approved the filing of an amendment to our Articles of Incorporation to increase the authorized shares of capital stock to 1,500,000,000 shares from 750,000,000 shares (the “Amendment”), of which 1,500,000,000 will be Common stock and 10,000,000 will Preferred stock with rights and preferences set by the Board of Directors.

Reasons for the Increase in Authorized Shares of Common Stock

Our Articles of Incorporation presently authorize 740,000,000 shares of common stock. As of April 7, 2020, there were 388,050,873 shares of common stock and 1,000,000 shares of Series B Preferred Stock outstanding. In order to provide funding for the Company’s operations, development and growth, it will be necessary to issue additional shares of Common stock, or Preferred shares that may be convertible into Common stock. The increase in the Company’s authorized shares to 1,500,000,000 shares from 750,000,000 shares is intended to provide adequate authorized shares to cover the Company’s potential financing and/or acquisition needs for at least the next 12 months.

Principal Effects of the Increase in Authorized Shares of Preferred Stock

The Board of Directors will have the power to issue the shares of Preferred Stock in one or more classes or series with such preferences and voting rights as the Board of Directors may fix in the resolution providing for the issuance of such shares. The issuance of shares of Preferred Stock could affect the relative rights of the Company’s shares of Common Stock. Depending upon the exact terms, limitations and relative rights and preferences, if any of the shares of Preferred Stock as determined by the Board of Directors at the time of issuance, the holders of shares of Preferred Stock may be entitled to a higher dividend rate than that paid on the Common Stock, a prior claim on funds available for the payment of dividends, a fixed preferential payment in the event of liquidation and dissolution of the Company, redemption rights, rights to convert their shares of Preferred Stock into shares of Common Stock, and voting rights which would tend to dilute the voting control of the Company by the holders of shares of Common Stock. Depending on the particular terms of any series of the Preferred Stock, holders thereof may have significant voting rights and the right to representation on the Company’s Board of Directors. In addition, the approval of the holders of shares of Preferred Stock, voting as a class or as a series, may be required for the taking of certain corporate actions, such as mergers.

Possible Anti-Takeover Effects of Authorization of Blank Check Preferred Stock

The Amendment was not proposed in response to, or for the purpose of deterring, any effort to obtain control of the Company or as an anti-takeover measure. It should be noted that any action taken by the Company to discourage an attempt to acquire control of the Company might result in shareholders not being able to participate in any possible premiums which might be obtained in the absence of anti-takeover provisions. Any transaction which may be so discouraged or avoided could be a transaction that the Company’s shareholders might consider to be in their best interests. However, the Board of Directors has a fiduciary duty to act in the best interests of the Company’s shareholders at all times.

Effective Date

Under Rule 14c-2, promulgated pursuant to the Securities Exchange Act of 1934, as amended, the Amendment shall be effective twenty (20) days after this Information Statement is mailed to stockholders of the Company. We anticipate the effective date to be on or about April 29, 2020.

(a) SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of April 7, 2020, with respect to the holdings of (1) each person who is the beneficial owner of more than 5% of our common stock, (2) each of our directors, (3) each executive officer, and (4) all of our current directors and executive officers as a group.

Beneficial ownership of the common and preferred stock is determined in accordance with the rules of the Securities and Exchange Commission and includes any shares of Common stock over which a person exercises sole or shared voting or investment power, or of which a person has a right to acquire ownership at any time within 60 days of December 31, 2019. Except as otherwise indicated, we believe that the persons named in this table have sole voting and investment power with respect to all shares of common stock held by them. Applicable percentage ownership in the following table is based on 388,050,873 shares of Common stock outstanding as April 7, 2020 plus, for each individual, any securities that individual has the right to acquire within 60 days of April 7, 2020.

Security Ownership of Certain Beneficial Owners and Management

The table below sets forth information regarding the ownership of our common stock, as of April 7, 2020 unless otherwise indicated in the footnotes to the table, by (i) all persons known by us to beneficially own more than 5% of our common stock, (ii) each of our current directors and director nominees, (iii) our principal executive officer and our other executive officers who were serving as such at the end of Fiscal 2019 (each, a “named executive officer”), and (iv) all of our directors, director nominees and executive officers as a group. We know of no agreements among our stockholders that relate to voting or investment power over our common stock or any arrangement the operation of which may at a subsequent date result in a change of control of us.

Beneficial ownership is determined in accordance with applicable SEC rules and generally reflects sole or shared voting or investment power over securities. Under these rules, a person is deemed to be the beneficial owner of securities that the person has the right to acquire as of or within 60 days after December 31, 2019, upon the exercise of outstanding stock options or warrants, the conversion of outstanding convertible notes, or the exercise or conversion of any other derivative securities affording the person the right to acquire shares of our common stock. As a result, each person’s percentage ownership set forth in the table below is determined by assuming that all outstanding stock options, warrants or other derivative securities held by such person that are exercisable or convertible as of or within 60 days after December 31, 2019 have been exercised or converted. Except in cases where community property laws apply or as indicated in the footnotes to the table, we believe that each person identified in the table below possesses sole voting and investment power over all shares of common stock shown as beneficially owned by such person. All ownership percentages in the table are based on 388,050,873 shares of our common stock outstanding as of April 7, 2020

|

|

|

Shares Beneficially

|

|

|

|

|

Owned

|

|

|

Name and Address of Beneficial Owner:

|

|

Number

|

|

|

Percent

|

|

|

5% Stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors and Executive Officers:

|

|

|

|

|

|

|

|

Robert Friedman (1)

|

|

|

32,645,833

|

|

|

|

8.4

|

%

|

|

Neil Chan(2)

|

|

|

8,966,255

|

|

|

|

2.3

|

%

|

|

Abel Sierra(3)

|

|

|

300,000

|

|

|

|

*

|

|

|

Robert Nealon(4)

|

|

|

2,916,667

|

|

|

|

*

|

|

|

Mark Wells (5)

|

|

|

960,785

|

|

|

|

*

|

|

|

All executive officers and directors as a group (5 persons)

|

|

|

45,789,540

|

|

|

|

11.8

|

%

|

_____________

|

*

|

Represents beneficial ownership of less than 1%.

|

|

|

|

|

(1)

|

Includes 250,000 shares of Series B Preferred Stock.

|

|

|

|

|

(2)

|

Represents 1,500,000 shares of common stock issuable upon the exercise of stock options that are or will be vested and exercisable within 60 days after December 31, 2019, and 7,216,255 outstanding shares of common stock. Includes 250,000 shares of Series B Preferred Stock.

|

|

(3)

|

Represents 150,000 shares of common stock issuable upon the exercise of stock options that are or will be vested and exercisable within 60 days after December 31, 2019, and 150,000 outstanding shares of common stock. Includes 250,000 shares of Series B Preferred Stock.

|

|

|

|

|

(4)

|

Represents 400,000 shares of common stock issuable upon the exercise of stock options that are or will be vested and exercisable within 60 days after December 31, 2019, and 2,266,267 outstanding shares of common stock. Includes 250,000 shares of Series B Preferred Stock.

|

|

|

|

|

(5)

|

Includes 250,000 shares of Series B Preferred Stock.

|

Securities Authorized for Issuance under Equity Compensation Plans

None

(b) Changes in Control

We know of no arrangements which may at a subsequent date result in a change in control of the Company.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This Information Statement may contain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking statements” for purposes of these provisions, including any projections of earnings, revenues or other financial items, any statement of the plans and objectives of management for future operations, and any statement of assumptions underlying any of the foregoing. These statements may contain words such as “expects,” “anticipates,” “plans,” “believes,” “projects,” and words of similar meaning. These statements relate to our future business and financial performance.

Actual outcomes may differ materially from these statements. The risks listed in this Information Statement as well as any cautionary language in this Information Statement, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from any expectations we describe in our forward-looking statements. There may be other risks that we have not described that may adversely affect our business and financial condition. We disclaim any obligation to update or revise any of the forward-looking statements contained in this Information Statement. We caution you not to rely upon any forward-looking statement as representing our views as of any date after the date of this Information Statement. You should carefully review the information and risk factors set forth in other reports and documents that we file from time to time with the SEC.

ADDITIONAL INFORMATION

This Information Statement should be read in conjunction with certain reports that we previously filed with the SEC, including our:

* Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and

* Quarterly Reports on Form 10-Q for the periods ended June 30, 2019 and September 30, 2019.

The reports we file with the SEC and the accompanying exhibits may be inspected without charge at the Public Reference Section of the Commission at 100 F Street, N.E., Washington, DC 20549. Copies of such materials may also be obtained from the SEC at prescribed rates. The SEC also maintains a Web site that contains reports, proxy and information statements and other information regarding public companies that file reports with the SEC. Copies of the Reports may be obtained from the SEC’s EDGAR archives at http://www.sec.gov. We will also mail copies of our prior reports to any stockholder upon written request.

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

|

|

Neil Chan, CEO

|

|

|

|

|

Murrieta, CA

|

|

|

|

|

April __, 2020

|

|

APPENDIX A

Capital Stock.

The aggregate number of shares that the Corporation will have authority to issue is One Billion Five Hundred Million (1,500,000,000) of which One Billion Four Hundred Ninety Million (1,490,000,000) shares will be Common stock, with a par value of $.001 per share, and Ten Million (10,000,000) shares will be Preferred stock, with a par value of $.001 per share.

The Preferred stock may be divided into and issued in series. The Board of Directors of the Corporation is authorized to divide the authorized shares of Preferred stock into one or more series, each of which shall be so designated as to distinguish the shares thereof from the shares of all other Series Bnd classes. The Board of Directors of the Corporation is authorized, within any limitations prescribed by law and this Article, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of Preferred stock including but not limited to the following:

|

|

a.

|

The rate of dividend, the time of payment of dividends, whether dividends are cumulative, and the date from which any dividends shall accrue;

|

|

|

b.

|

Whether shares may be redeemed, and, if so, the redemption price and the terms and conditions of redemption;

|

|

|

c.

|

The amount payable upon shares in the event of voluntary or involuntary liquidation;

|

|

|

d.

|

Sinking fund or other provisions, if any, for the redemption or purchase of shares;

|

|

|

e.

|

The terms and conditions on which shares may be converted, if the shares of any Series Bre issued with the privilege of conversion;

|

|

|

f.

|

Voting powers, if any, provided that if any of the Preferred Stock or series thereof shall have voting rights, such Preferred Stock or series shall vote only on a share for share basis with the Common Stock on any matter, including but not limited to the election of directors, for which such Preferred Stock or series has such rights; and,

|

|

|

g.

|

Subject to the foregoing, such other terms, qualifications, privileges, limitations, options, restrictions, and special or relative rights and preferences, if any, of shares or such Series Bs the Board of Directors of the Corporation may, at the time so acting, lawfully fix and determine under the laws of the State of Nevada.

|

The Corporation shall not declare, pay or set apart for payment any dividend or other distribution (unless payable solely in shares of Common stock or other class of stock junior to the Preferred stock as to dividends or upon liquidation) in respect of Common stock, or other class of stock junior to the Preferred stock, nor shall it redeem, purchase or otherwise acquire for consideration shares of any of the foregoing, unless dividends, if any, payable to holders of Preferred stock for the current period (and in the case of cumulative dividends, if any, for all past periods) have been paid, are being paid or have been set aside for payment, in accordance with the terms of the Preferred stock, as fixed by the Board of Directors.

In the event of the liquidation of the Corporation, holders of Preferred stock shall be entitled to receive, before any payment or distribution on the Common stock or any other class of stock junior to the Preferred stock upon liquidation, a distribution per share in the amount of the liquidation preference, if any, fixed or determined in accordance with the terms of such Preferred stock plus, if so provided in such terms, an amount per share equal to accumulated and unpaid dividends in respect of such Preferred stock (whether or not earned or declared) to the date of such distribution. Neither the sale, lease or exchange of all or substantially all of the property and assets of the Corporation, nor any consolidation or merger of the Corporation, shall be deemed to be a liquidation for the purposes of this Article.

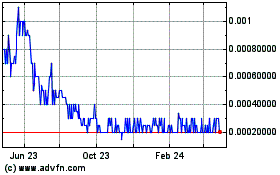

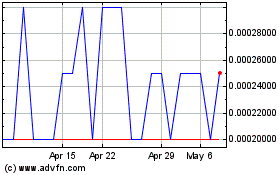

iGen Networks (CE) (USOTC:IGEN)

Historical Stock Chart

From Aug 2024 to Sep 2024

iGen Networks (CE) (USOTC:IGEN)

Historical Stock Chart

From Sep 2023 to Sep 2024