Safran Sees 737 MAX Drag This Year; 2019 Profit Rose -- Update

February 27 2020 - 4:34AM

Dow Jones News

- Safran expects flat-to-lower adjusted revenue in 2020 due to

Boeing's 737 MAX crisis

- The French company has implemented a cost-cutting plan to

mitigate the effect of the situation

- Safran has no supply-chain issues related to the coronavirus

epidemic, CEO Philippe Petitcolin said

By Olivia Bugault

Safran SA said Thursday that its adjusted revenue will be flat

or lower in 2020 on the back of Boeing Co.'s 737 MAX crisis, and

posted rising revenue and profit for 2019.

For 2020, Safran expects its adjusted revenue to decrease by 0%

to 5%, while adjusted recurring operating income should grow by

roughly 5%.

Safran based its outlook on the assumption that the 737 MAX jet

will return to service in mid-2020. The company said it should

produce an average of 1,400 LEAP engines a year, including 10

LEAP-1B engines a week. Previously, Safran estimated its LEAP

annual average production at 2,000 for 2020.

The MAX jet is powered exclusively by the LEAP engines made by a

joint venture of Safran and General Electric Co.

Boeing halted the production of the grounded jet in January

following two fatal crashes in which 346 people died.

The French aircraft-engine manufacturer said it has implemented

an "adaptation plan" that includes savings on direct costs,

overheads, and a hiring freeze to adjust to the situation. The plan

represents roughly 300 million euros ($326.3 million) of spending

adjustment, Chief Executive Philippe Petitcolin said during a

conference call Thursday.

The coronavirus could also hurt 2020 figures. Safran's civil

aftermarket should grow in the high single digits this year if air

traffic returns to normal after the first quarter, the company

said.

All plants have reopened in China and between 74% and 95% of

employees are working on the sites, Mr. Petitcolin said during the

call. He said the company has no supply chain issues related to the

coronavirus epidemic.

Safran will also update its mid-term ambitions in order to

"reflect the impact of the 737 MAX grounding," it said. "Mid-term

ambitions will be updated after the 737MAX return to service and

new ramp-up are clarified," Safran said.

The plan disclosed in November 2018 included organic revenue

growth in a mid-single digit range on average over the 2019-22

period.

In 2019, adjusted net profit stood at EUR2.67 billion compared

with EUR1.98 billion a year earlier.

Adjusted revenue rose to EUR24.64 billion from EUR21.05 billion

a year earlier, and civil aftermarket--a key performance

metric--grew 10% in dollar terms, partly driven by spare-parts

sales.

Free cash flow came in at EUR1.98 billion, after taking an

expected EUR700 million hit due to the 737 MAX issue. In 2020, free

cash flow should be higher, Safran said.

The company declared a dividend of EUR2.38 a share for 2019.

Write to Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

February 27, 2020 04:19 ET (09:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

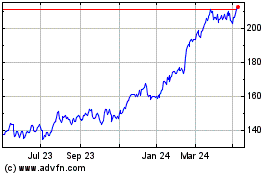

Safran (EU:SAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

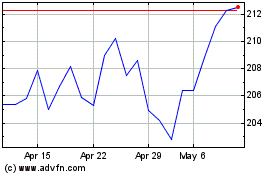

Safran (EU:SAF)

Historical Stock Chart

From Apr 2023 to Apr 2024