Telefonica Shares Tumble After Swing to 4Q Net Loss

February 20 2020 - 5:21AM

Dow Jones News

By Mauro Orru

Telefonica SA's shares plunged Thursday after the company

reported a net loss and a decline in revenue for the fourth quarter

of 2019 following its pullout from some Latin American markets, the

sale of 10 data centers and the depreciation of the Argentine peso

against the euro.

The Spanish telecommunications company reported a net loss for

the quarter of 202 million euros ($218.1 million) compared with a

profit of EUR610 million the previous fourth quarter, while revenue

for the period fell to EUR12.4 billion from EUR12.92 billion.

At 0940 GMT, Telefonica shares were down 3.9% at EUR6.28.

Carl Murdock-Smith, analyst at German bank Berenberg, said

broadband and converged customer losses in Spain would raise

concerns, combined with misses in the U.K., where revenue came in

0.6% below consensus at EUR1.93 billion.

"Given share-price strength running into the results, we might

expect some share price weakness today," Mr. Murdock-Smith

said.

Analysts at U.S. bank Jefferies said Telefonica's group revenue

at EUR12.4 billion is 0.7% ahead of consensus, although revenue for

Spain, which came in at EUR3.27 billion, is 0.4% below

consensus.

Telefonica said operating income before depreciation and

amortization rose to EUR3.67 billion from EUR3.54 billion the

previous fourth quarter--10% below consensus estimates, Mr.

Murdock-Smith said--while operating profit fell to EUR914 million

from EUR1.07 billion for the same period.

The company said it would pay a dividend of EUR0.40 a share,

effectively leaving it unchanged.

Write to Mauro Orru at mauro.orru@wsj.com

(END) Dow Jones Newswires

February 20, 2020 05:06 ET (10:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

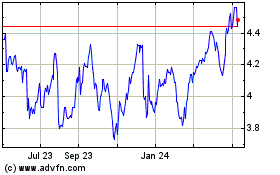

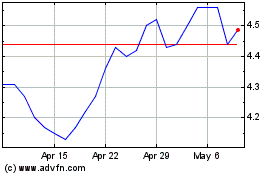

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024