Additional Proxy Soliciting Materials (definitive) (defa14a)

January 27 2020 - 5:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☒

|

|

Soliciting Material Pursuant to §240.14a-12

|

Key Energy Services, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

The following email was sent by Marshall Dodson, Interim CEO, to employees of Key Energy Services, Inc.

on January 27, 2020.

Dear Fellow Employees:

Today, we are announcing that we have signed a Restructuring Support Agreement (RSA) with certain of our term loan lenders that will reduce our long-term debt

by almost 80% and also increase our cash. We expect the transaction outlined in the RSA to close in February and it will take place out-of-court, so there will not

be a bankruptcy filing.

I am pleased we have reached this agreement. This transaction should eliminate the uncertainty you and some of our customers may

have felt about Key’s future. It is also an important step to put parts of the past behind us while improving our financial stability as we work together to build a new Key.

Under the RSA, Key will convert approximately $242 million of our existing term loans to equity and $20 million of new term loans. This

$20 million of new term loans will be part of a new, $51 million term loan. The new $51 million term loan will be cash funded for $30 million of new money, with that cash going to pay the costs of this transaction and improve our

liquidity.

At the completion of this transaction, the converting term loan lenders will own approximately 97% of Key’s common stock, which will be

subject to dilution from new warrants issued to current shareholders and stock set aside for a new management incentive plan. We will be filing a Form 8-K with the SEC, available on our website, that

contains the details.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed amendments to Key’s Certificate of Incorporation. In connection

with such amendments, Key intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with

the SEC, Key will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting of stockholders relating to the amendment. STOCKHOLDERS ARE URGED TO CAREFULLY READ THESE MATERIALS IN THEIR ENTIRETY

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT KEY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE AMENDMENT. The proxy statement and other relevant

materials (when available), and any and all documents filed by Key with the SEC, may also be obtained for free at the SEC’s website at www.sec.gov [sec.gov]. In addition, stockholders may obtain free copies of the documents filed with

the SEC by Key via the Investor Relations section of its website at www.keyenergy.com [keyenergy.com], by calling Key at (713) 651-4300 or by emailing Key at investorrelations@keyenergy.com.

Participants in Solicitation

Key and its directors and officers may be deemed to be participants in the solicitation of proxies in respect of the proposed amendments to Key’s

Certificate of Incorporation. Information regarding Key’s directors and executive officers is contained in Key’s proxy statement dated March 15, 2019, previously filed with the SEC. To the extent holdings of securities by such

directors or executive officers have changed since the amounts printed in Key’s 2019 proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information

regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement to be filed by Key in connection with the proposed amendments to Key’s

Certificate of Incorporation.

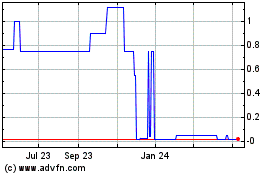

Common Stock (CE) (USOTC:KEGX)

Historical Stock Chart

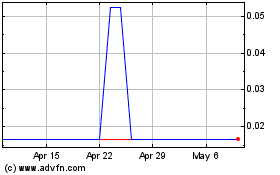

From Mar 2024 to Apr 2024

Common Stock (CE) (USOTC:KEGX)

Historical Stock Chart

From Apr 2023 to Apr 2024