Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

November 22 2019 - 4:12PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

N-Q

QUARTERLY

SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT

INVESTMENT

COMPANY

Investment

Company Act file number 811-06445

The

Herzfeld Caribbean Basin Fund, Inc.

(Exact

name of registrant as specified in charter)

119

Washington Avenue, Suite 504, Miami Beach FL 33139

(Address

of principal executive offices) (Zip code)

ERIK

M. HERZFELD

119

Washington Avenue, Suite 504, Miami Beach FL 33139

(Name

and address of agent for service)

Registrant's

telephone number, including area code: 305-777-1660

Date

of fiscal year end: 06/30/20

Date

of reporting period: 09/30/19

ITEM

1. SCHEDULE OF INVESTMENTS

SCHEDULE

OF INVESTMENTS AS OF September 30, 2019 (unaudited)

|

Shares or

|

|

|

|

|

|

|

|

Principal

Amount

|

|

|

Description

|

|

Fair

Value

|

|

|

|

|

|

|

Common stocks –

99.65% of net assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agricultural Products – 0.63%

|

|

|

|

|

|

|

55,921

|

|

|

Margo Caribe, Inc.*

|

|

$

|

293,585

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Airlines – 7.49%

|

|

|

|

|

|

|

300,029

|

|

|

Avianca

Holdings, S.A. ADR

|

|

|

1,092,106

|

|

|

|

24,273

|

|

|

Copa Holdings, S.A.

|

|

|

2,396,959

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banks – 14.21%

|

|

|

|

|

|

|

18,280

|

|

|

Bancolombia, S.A.

|

|

|

903,946

|

|

|

|

264,477

|

|

|

First Bancorp (Puerto

Rico)

|

|

|

2,639,480

|

|

|

|

1,270

|

|

|

Grupo Elektra, S.A.B. de C.V. Series CPO

|

|

|

89,924

|

|

|

|

55,230

|

|

|

Popular, Inc.

|

|

|

2,986,838

|

|

|

|

|

|

|

Beverages – 5.58%

|

|

|

|

|

|

|

740,000

|

|

|

Becle, S.A.B. de C.V.

|

|

|

1,087,287

|

|

|

|

14,610

|

|

|

Fomento Economico Mexicano, S.A.B. de C.V. ADR

|

|

|

1,337,984

|

|

|

|

18,900

|

|

|

Fomento Economico Mexicano, S.A.B. de C.V. Series UBD

|

|

|

173,110

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Building Products – 2.23%

|

|

|

|

|

|

|

60,170

|

|

|

PGT Innovations, Inc.*

|

|

|

1,039,136

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chemicals – 0.01%

|

|

|

|

|

|

|

25,000

|

|

|

Geltech Solutions Inc.*

|

|

|

4,898

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction & Engineering – 15.65%

|

|

|

|

|

|

|

112,297

|

|

|

MasTec, Inc.*

|

|

|

7,291,444

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction Materials – 5.67%

|

|

|

|

|

|

|

270,645

|

|

|

Cemex S.A.B. de C.V. ADR

|

|

|

1,060,928

|

|

|

|

3,000

|

|

|

Martin Marietta Materials

|

|

|

822,300

|

|

|

|

5,000

|

|

|

Vulcan Materials

|

|

|

756,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diversified Financial Services – 2.70%

|

|

|

|

|

|

|

250,000

|

|

|

Admiralty Holding Company*1

|

|

|

--

|

|

|

|

63,166

|

|

|

Banco Latinoamericano de Exportaciones, S.A.

|

|

|

1,259,530

|

|

|

|

3,844

|

|

|

W Holding Company, Inc.*1

|

|

|

--

|

|

|

|

70,000

|

|

|

Waterloo Investment Holdings Ltd.*1

|

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diversified Telecommunication Services – 0.02%

|

|

|

|

|

|

|

14,017

|

|

|

Telesites S.A.B Series B-1*

|

|

|

9,265

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electric Utilities – 3.40%

|

|

|

|

|

|

|

12,000

|

|

|

Caribbean Utilities Ltd. Class A

|

|

|

187,200

|

|

|

|

700

|

|

|

Cuban Electric Company*1

|

|

|

--

|

|

|

|

6,000

|

|

|

Nextera Energy, Inc.

|

|

|

1,397,940

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Equipment & Services – 0.30%

|

|

|

|

|

|

|

13,474

|

|

|

ERA Group Inc.*

|

|

|

142,285

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entertainment – 0.26%

|

|

|

|

|

|

|

479,175

|

|

|

Fuego Enterprises, Inc.*

|

|

|

119,794

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food & Staples Retailing – 1.34%

|

|

|

|

|

|

|

210,222

|

|

|

Wal-Mart de Mexico, S.A.B. de C.V. Series V

|

|

|

622,766

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food Products – 5.02%

|

|

|

|

|

|

|

42,341

|

|

|

Fresh Del Monte Produce Inc.

|

|

|

1,444,252

|

|

|

|

204

|

|

|

Seaboard Corporation

|

|

|

892,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure – 19.80%

|

|

|

|

|

|

|

26,518

|

|

|

Carnival Corporation

|

|

|

1,159,102

|

|

|

|

16,745

|

|

|

Marriott Vacations Worldwide Corporation

|

|

|

1,734,950

|

|

|

|

56,944

|

|

|

Norwegian Cruise Line Holdings Ltd.*

|

|

|

2,947,991

|

|

|

|

31,229

|

|

|

Royal Caribbean Cruises Ltd.

|

|

|

3,383,038

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Household Durables – 4.85%

|

|

|

|

|

|

|

20

|

|

|

Ceramica Carabobo Class A ADR*1

|

|

|

--

|

|

|

|

40,500

|

|

|

Lennar Corporation

|

|

|

2,261,925

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IT Services – 1.14%

|

|

|

|

|

|

|

16,956

|

|

|

Evertec, Inc.

|

|

|

529,366

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Media – 0.75%

|

|

|

|

|

|

|

208,234

|

|

|

Grupo Radio Centro, S.A.B. de C.V. Series A*

|

|

|

63,280

|

|

|

|

28,400

|

|

|

Grupo Televisa, S.A.B. ADR

|

|

|

277,752

|

|

|

|

32,272

|

|

|

Spanish Broadcasting System, Inc.*

|

|

|

8,358

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metals & Mining – 0.02%

|

|

|

|

|

|

|

3,872

|

|

|

Grupo Mexico, S.A.B. de C.V. Series B

|

|

|

9,074

|

|

|

|

79

|

|

|

Siderurgica Venezolana Sivensa, S.A. Series B*1

|

|

|

--

|

|

|

|

|

|

|

Trading Companies & Distributors – 2.18%

|

|

|

|

|

|

|

6,000

|

|

|

Watsco, Inc.

|

|

|

1,015,080

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transportation Infrastructure - 2.16%

|

|

|

|

|

|

|

6,600

|

|

|

Grupo Aeroportuario del Sureste, S.A.B. de C.V. ADR

|

|

|

1,006,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Water Utilities – 2.48%

|

|

|

|

|

|

|

70,025

|

|

|

Consolidated Water Company Ltd.

|

|

|

1,154,712

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Telecommunication Services – 1.76%

|

|

|

|

|

|

|

44,690

|

|

|

America Movil, S.A.B. de C.V. ADR

|

|

|

664,093

|

|

|

|

209,144

|

|

|

America Movil, S.A.B. de C.V. Series L

|

|

|

155,290

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total common stocks – 99.65%(cost $37,270,513)

|

|

|

46,422,168

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bonds – 0.00% of net assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

165,000

|

|

|

Republic of Cuba - 4.5%, 1977 - in default*1

|

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total bonds – 0.00% (cost $63,038)

|

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments – 99.65% (cost $37,333,551)

|

|

|

46,422,168

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets less liabilities – 0.35% of net assets

|

|

|

163,304

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

assets - 100% (applicable to 6,133,659 shares; equivalent to $7.60 per share)

|

|

$

|

46,585,472

|

|

|

1

|

Securities

have been fair valued in good faith using fair value methodology approved by the Board of Directors. Fair Valued securities comprised

0.00% of net assets.

|

Security

Valuation

In

accordance with accounting principles generally accepted in the United States of America (“GAAP”), fair value is defined

as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an

orderly transaction between market participants at the measurement date.

In

determining fair value, the Fund uses various valuation approaches. In accordance with GAAP, a fair value hierarchy for inputs

is used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring

that observable inputs be used when available.

Observable

inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources

independent of the Fund. Unobservable inputs reflect the Fund’s assumptions about the inputs market participants would use

in pricing the asset or liability developed based on the best information available in the circumstances. The fair value hierarchy

is categorized into three levels based on the inputs as follows:

|

Level

1:

|

Unadjusted

quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

|

|

Level

2:

|

Observable

inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly.

These inputs may include quoted prices for the identical instrument on an active market, prices for similar instruments, interest

rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

|

|

Level

3:

|

Unobservable

inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s

own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would

be based on the best information available.

|

The

availability of valuation techniques and observable inputs can vary from security to security and is affected by a wide variety

of factors including, the type of security, whether the security is new and not yet established in the marketplace, and other

characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable

or unobservable in the market, the determination of fair value requires more judgment. Those estimated values do not necessarily

represent the amounts that may be ultimately realized due to the occurrence of future circumstances that cannot be reasonably

determined. Because of the inherent uncertainty of valuation, those estimated values may be materially higher or lower than the

values that would have been used had a ready market for the securities existed. Accordingly, the degree of judgment exercised

by the Fund in determining fair value is greatest for securities categorized in Level 3. In certain cases, the inputs used to

measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level

in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level

input that is significant to the fair value measurement.

Fair

value is a market-based measure considered from the perspective of a market participant rather than an entity-specific measure.

Therefore, even when market assumptions are not readily available, the Fund’s own assumptions are set to reflect those that

market participants would use in pricing the asset or liability at the measurement date. The Fund uses prices and inputs that

are current as of the measurement date, including periods of market dislocation. In periods of market dislocation, the observability

of prices and inputs may be reduced for many securities. This condition could cause a security to be reclassified to a lower level

within the fair value hierarchy.

Investments

in securities traded on a national securities exchange (or reported on the NASDAQ National Market or Capital Market) are stated

at the last reported sales price on the day of valuation (or at the NASDAQ official closing price); other securities traded in

the over-the-counter market and listed securities for which no sale was reported on that date are stated at the last quoted bid

price. Restricted securities and other securities for which quotations are not readily available are valued at fair value as determined,

in good faith, by the Board of Directors.

The

following table summarizes the classification of the Fund’s investments by the above fair value hierarchy levels as of September

30, 2019:

|

|

|

Level

1

|

|

|

Level

2

|

|

|

Level

3

|

|

|

Total

|

|

|

Assets (at fair value)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Stocks

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USA

|

|

$

|

27,085,285

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

27,085,285

|

|

|

Puerto

Rico

|

|

|

6,449,271

|

|

|

|

0

|

|

|

|

0

|

|

|

|

6,449,271

|

|

|

Mexico

|

|

|

5,893,160

|

|

|

|

0

|

|

|

|

0

|

|

|

|

5,893,160

|

|

|

Panama

|

|

|

4,748,594

|

|

|

|

0

|

|

|

|

0

|

|

|

|

4,748,594

|

|

|

Cayman

|

|

|

1,341,912

|

|

|

|

0

|

|

|

|

0

|

|

|

|

1,341,912

|

|

|

Colombia

|

|

|

903,946

|

|

|

|

0

|

|

|

|

0

|

|

|

|

903,946

|

|

|

Other

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Bonds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cuba

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Total Investments in

securities

|

|

$

|

46,422,168

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

46,422,168

|

|

The

fair valued securities (Level 3) held in the Fund consisted of Cuban Electric Company, Ceramica Carabobo Class A ADR, Siderurgica

Venezolana Sivensa S.A. Series B, Admiralty Holding Company, Waterloo Investment Holdings Ltd., W Holding Company, Inc. and Republic

of Cuba 4.5%, 1997 bond. There was no change in value since June 30, 2019, therefore no Level 3 reconciliation table is required.

For

more information with regards to significant accounting policies, see the most recent semi-annual or annual report filed with

the Securities and Exchange Commission.

Unrealized

Appreciation/(Depreciation)

As

of September 30, 2019, the cost basis for federal income tax purposes, gross unrealized appreciation, gross unrealized depreciation

and net unrealized appreciation/(depreciation) were as follows:

|

Tax

Cost of Securities

|

Tax

Unrealized Appreciation

|

Tax

Unrealized (Depreciation)

|

Net

Tax Unrealized

Appreciation/(Depreciation)

|

|

$37,515,021

|

$13,505,604

|

($4,598,457)

|

$8,907,147

|

ITEM

2. CONTROLS AND PROCEDURES

|

|

(a)

|

The

registrant's principal executive and principal financial Officers, or persons performing

similar functions, have concluded that the registrant's disclosure controls and procedures

(as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the

"1940 Act") (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days

of the filing date of this Form N-Q that includes the disclosure required by this paragraph

based on their evaluation of the controls and procedures required by Rule 30a-3(b) under

the 1940 Act (17 CFR 270.30a-3(b))and Rules 13a-15(b) or 15d-15(b) under the Securities

Exchange Act of 1934 (17 CFR 240.13a-15(b) or 240.15d-15(b)).

|

|

|

(b)

|

There

were no changes in the registrant's internal control over financial reporting (as defined

in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the registrant's

last fiscal quarter that has materially affected, or is reasonably likely to materially

affect, the registrant's internal control over financial reporting.

|

ITEM

3. EXHIBITS

The

certifications required by Rule 30a-2(a) under the Investment Company Act of 1940, as amended, and Section 302 of the Sarbanes-Oxley

Act of 2002 are attached as an exhibit to this filing.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused

this report to be signed on its behalf by the undersigned, thereunto duly authorized.

The

Herzfeld Caribbean Basin Fund, Inc.

|

By

|

/s/

Erik M. Herzfeld

|

|

|

|

Erik

M. Herzfeld

|

|

|

|

President

|

|

|

|

|

|

|

Date:

|

November

22, 2019

|

|

Pursuant

to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed

below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

By

|

/s/

Erik M. Herzfeld

|

|

|

|

Erik

M. Herzfeld

|

|

|

|

President

|

|

|

|

|

|

|

Date:

|

November

22, 2019

|

|

|

By

|

/s/

Erik M. Herzfeld

|

|

|

|

Erik

M. Herzfeld

|

|

|

|

Treasurer

|

|

|

|

|

|

|

Date:

|

November

22, 2019

|

|

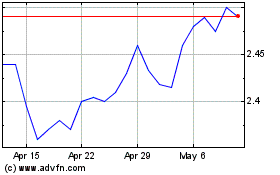

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

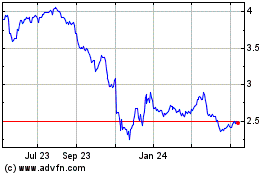

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Apr 2023 to Apr 2024