Current Report Filing (8-k)

May 14 2019 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 8, 2019

PERFORMANT FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

(State or Other Jurisdiction of Incorporation)

|

001-35628

(Commission File Number)

|

20-0484934

(I.R.S. Employer

Identification No.)

|

333 North Canyons Parkway

Livermore, California 94551

(Address of principal executive offices) (Zip Code)

(925) 960-4800

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, par value $.0001 per share

|

PFMT

|

The Nasdaq Stock Market LLC

|

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(b) On May 8, 2019, Brian P. Golson notified the Board of Directors (the “Board”) of Performant Financial Corporation (the “Company”), of his decision to resign from the Board. Mr. Golson, a representative of Parthenon Capital Partners, has served as a director of the Company since 2008.

(d) In addition, on May 8, 2019, the Board unanimously appointed Jeffrey S. Stein to serve as a member of the Board to fill the vacancy created by the resignation of Mr. Golson. Mr. Stein, an Executive in Residence with Parthenon Capital Partners, will serve as a Class II director with a term expiring at the Company’s 2020 Annual Meeting of Stockholders or until his successor is duly elected and qualified. While the Board may consider appointing Mr. Stein to one or more committees of the Board, no such appointments have been made at this time. Mr. Stein was elected pursuant to a Director Nomination Agreement with Parthenon Capital Partners that provides Parthenon Capital Partners the right to designate nominees for election to our board of directors for so long as Parthenon Capital Partners owns 10% or more of the total number of shares to common stock outstanding. Mr. Stein has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Mr. Stein served as a member of the Board from January 2004 to February 2014. Since September 2002, Mr. Stein has served as the Executive in Residence at Parthenon Capital Partners. Prior to joining Parthenon, Mr. Stein was a Partner at Watermill Ventures, a Boston-based private buyout firm acquiring middle market companies in transition. Mr. Stein received a Bachelor's degree in Accounting from Boston College Carroll School of Management. Mr. Stein's financial and accounting expertise provides valuable insight for the members of the Board.

Consistent with the compensation currently provided to the members of the Board, Mr. Stein will receive an annual retainer of $30,000, prorated for partial service this year, that he has directed to be paid to Parthenon Capital Partners. He will also receive a $75,000 annual cash payment that he has directed to be paid to Parthenon Capital Partners. Mr. Stein will also enter into an indemnification agreement with the Company pursuant to which the Company will agree to indemnify him from certain liabilities that may arise by reason of his status as a director. The form of indemnification agreement was filed as an exhibit to Amendment No. 2 to the Company’s Form S-1 Registration Statement, filed with the SEC on July 20, 2012, and the terms of the indemnification agreement are incorporated herein by reference. The benefits provided under Mr. Stein’s indemnification agreement are in addition to indemnification benefits provided under the Company’s bylaws.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 14, 2019

|

|

|

|

|

|

|

PERFORMANT FINANCIAL CORPORATION

|

|

|

|

|

By:

|

/s/ Lisa Im

|

|

|

Lisa Im

|

|

|

Chief Executive Officer

|

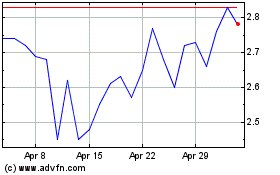

Performant Financial (NASDAQ:PFMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

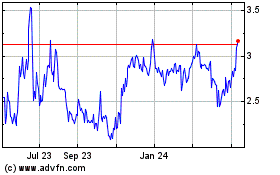

Performant Financial (NASDAQ:PFMT)

Historical Stock Chart

From Apr 2023 to Apr 2024