Vodafone Sells New Zealand Arm for $2.2 Billion to Infratil, Brookfield Consortium

May 13 2019 - 1:06PM

Dow Jones News

By Adam Clark

Vodafone Group PLC (VOD.LN) said Monday that it has agreed to

sell its New Zealand business to a consortium of Infratil Ltd.

(IFT.NZ) and Brookfield Asset Management Inc. (BAM).

The buyers will pay a cash price equivalent to an enterprise

value of 3.4 billion New Zealand dollars ($2.2 billion), Vodafone

said.

Vodafone New Zealand generated adjusted earnings before

interest, tax, depreciation and amortization of NZ$463 million on

revenue of NZ$1.99 billion in fiscal 2019.

The deal is expected to be completed during Vodafone's fiscal

2020, subject to regulatory approval. On completion, the parties

will enter a "partner-market agreement" including use of the

Vodafone brand, preferential roaming arrangements and access to

Vodafone's procurement functions.

"An important aspect of our strategy is the active management of

our portfolio and deleveraging, which this transaction further

demonstrates. We have always been proud of our Vodafone New Zealand

business, which has a great team, and we look forward to a

continued close relationship through our partner-market agreement,"

Vodafone Chief Executive Nick Read said.

Write to Adam Clark at adam.clark@dowjones.com

(END) Dow Jones Newswires

May 13, 2019 12:51 ET (16:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

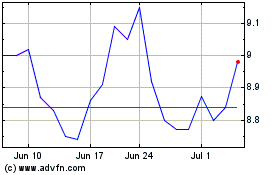

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

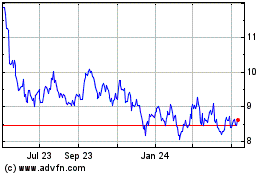

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024