UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant

☒

Filed by a Party other than the Registrant

☐

Check the appropriate box:

|

|

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

Mattel, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee

is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

Mattel, Inc. Supplemental Proxy Materials

For the Annual Meeting of Stockholders to be Held on May 16, 2019

Our Annual Meeting of Stockholders will be held on May 16, 2019. Attached is a presentation that is intended to supplement our Proxy

Statement that was filed on April 4, 2019.

Mattel, Inc. Business, Governance &

Compensation Update Spring 2019 ©2019 Mattel, Inc. All Rights Reserved.

This presentation contains a number of

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. The use of words such as

“anticipates,” “expects,” “intends,” “plans,” “confident that” and “believes,” among others, generally identify forward-looking statements. These forward-looking statements are

based on currently available operating, financial, economic and other information, and are subject to a number of significant risks and uncertainties. A variety of factors, many of which are beyond our control, could cause actual future results to

differ materially from those projected in the forward-looking statements. Specific factors that might cause such a difference include, but are not limited to: (i) Mattel’s ability to design, develop, produce, manufacture, source and ship

products on a timely and cost-effective basis, as well as interest in and purchase of those products by retail customers and consumers in quantities and at prices that will be sufficient to profitably recover Mattel’s costs; (ii) downturns in

economic conditions affecting Mattel’s markets which can negatively impact retail customers and consumers, and which can result in lower employment levels, lower consumer disposable income and spending, including lower spending on purchases of

Mattel’s products; (iii) other factors which can lower discretionary consumer spending, such as higher costs for fuel and food, drops in the value of homes or other consumer assets, and high levels of consumer debt; (iv) potential difficulties

or delays Mattel may experience in implementing cost savings and efficiency enhancing initiatives; (v) other economic and public health conditions or regulatory changes in the markets in which Mattel and its customers and suppliers operate, which

could create delays or increase Mattel’s costs, such as higher commodity prices, labor costs or transportation costs, or outbreaks of disease; (vi) currency fluctuations, including movements in foreign exchange rates, which can lower

Mattel’s net revenues and earnings, and significantly impact Mattel’s costs; (vii) the concentration of Mattel’s customers, potentially increasing the negative impact to Mattel of difficulties experienced by any of Mattel’s

customers, including the bankruptcy and liquidation of Toys “R” Us, Inc., or changes in their purchasing or selling patterns; (viii) the future willingness of licensors of entertainment properties for which Mattel currently has licenses

or would seek to have licenses in the future to license those products to Mattel; (ix) the inventory policies of Mattel’s retail customers, including retailers’ potential decisions to lower their inventories, even if it results in lost

sales, as well as the concentration of Mattel’s revenues in the second half of the year, which coupled with reliance by retailers on quick response inventory management techniques increases the risk of underproduction of popular items,

overproduction of less popular items and failure to achieve compressed shipping schedules; (x) the increased costs of developing more sophisticated digital and smart technology products, and the corresponding supply chain and design challenges

associated with such products; (xi) work disruptions, which may impact Mattel’s ability to manufacture or deliver product in a timely and cost-effective manner; (xii) the bankruptcy and liquidation of Toys “R” Us, Inc. or other of

Mattel’s significant retailers, or the general lack of success of one of Mattel’s significant retailers which could negatively impact Mattel’s revenues or bad debt exposure; (xiii) the impact of competition on revenues, margins and

other aspects of Mattel’s business, including the ability to offer products which consumers choose to buy instead of competitive products, the ability to secure, maintain and renew popular licenses and the ability to attract and retain

talented employees; (xiv) the risk of product recalls or product liability suits and costs associated with product safety regulations; (xv) changes in laws or regulations in the United States and/or in other major markets, such as China, in which

Mattel operates, including, without limitation, with respect to taxes, tariffs, trade policies, or product safety, which may increase Mattel’s product costs and other costs of doing business, and reduce Mattel’s earnings, (xvi) failure

to realize the planned benefits from any investments or acquisitions made by Mattel, (xvii) the impact of other market conditions, third party actions or approvals and competition which could reduce demand for Mattel’s products or delay or

increase the cost of implementation of Mattel’s programs or alter Mattel’s actions and reduce actual results; (xviii) changes in financing markets or the inability of Mattel to obtain financing on attractive terms (xix) the impact of

litigation or arbitration decisions or settlement actions; and (xx) other risks and uncertainties as may be described in Mattel’s periodic filings with the Securities and Exchange Commission, including the “Risk Factors” section of

Mattel’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as well as in Mattel’s other public statements. Mattel does not update forward-looking statements and expressly disclaims any obligation to do so, except as

required by law. To supplement the financial results presented in accordance with generally accepted accounting principles in the United States (“GAAP”), Mattel presents certain non-GAAP financial measures within the meaning of

Regulation G promulgated by the Securities and Exchange Commission. The non-GAAP financial measures used herein include: Gross Sales, Adjusted Gross Profit and Adjusted Gross Margin, Adjusted Other Selling and Administrative Expenses, Adjusted

Operating Income (Loss), Adjusted Earnings (Loss) Per Share, EBITDA, adjusted EBITDA, and constant currency. Mattel uses these metrics to analyze its continuing operations and to monitor, assess and identify meaningful trends in its operating and

financial performance, and each is discussed in detail on the following page. These measures are not, and should not be viewed as, substitutes for GAAP financial measures. A glossary of non-GAAP financial measures is located in the Appendix and

reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the attached Appendix and in our 2018 Q4/YE and 2019 Q1 earnings releases, which are available in the “Investors”

section of our corporate website, http://corporate.mattel.com/, under the subheading “Financial Information – Earnings Releases.” Forward-Looking Statements / Regulation G

Transforming Mattel Into an IP-driven,

High-Performing Toy Company Source: Mattel 2019 Proxy Statement ©2019 Mattel, Inc. All Rights Reserved. We remain focused on advancing our strategy in the short-to-mid term and are laying the groundwork to capture the full value of our

intellectual property in the mid-to-long term Our mission is to create innovative products and experiences that inspire, entertain and develop children through play $521 million of run-rate cost savings exiting 2018, ahead of plan Gross margin of

46.6% in the fourth quarter and 39.8% for the full year (+250 bps YOY) 22% reduction of our global non-manufacturing workforce Barbie and Hot Wheels continued their momentum, finishing the year ahead of expectations Barbie gross sales increased 14%

in 2018 versus the prior year Hot Wheels gross sales increased 7% in 2018 versus the prior year Created Mattel Films, Mattel Television, and our Global Franchise Management team Will develop our franchises across film and television, digital gaming,

live events, music, consumer products, and merchandise Focused on attracting and retaining the best talent at all levels

Q1 2019 marked the third consecutive

quarter of year-over-year improvement in Gross Margin, Operating Profit / Loss, EBITDA and EPS Encouraged by company performance coming out of FY 2018 ©2019 Mattel, Inc. All Rights Reserved. Transformation Showing Tangible Results Q4 and FY

2018 Highlights Our leadership team is demonstrating significant progress toward restoring profitability, coupled with strong retail execution, in particular with Barbie and Hot Wheels Full year Net Sales of $4.51 billion; fourth quarter Net Sales

of $1.52 billion Mattel was the #1 global toy company in 2018, per NPD Barbie Gross Sales in the quarter increased 12% as reported and 15% in constant currency, versus prior year, marking the fifth consecutive quarter of growth; reached the

brand’s highest full year Gross Sales in the last five years Hot Wheels Gross Sales for the quarter increased 9% as reported and 12% in constant currency, versus prior year, and reached the brand’s highest full year Gross Sales in its

history Reported Operating Income of $107 million in the fourth quarter, an improvement of $358 million, versus prior year; the largest year-over-year fourth quarter improvement since 2009 Achieved $521 million of run-rate cost savings exiting 2018

and expect to exceed cumulative $650 million run-rate cost savings target exiting 2019 Delivered gross margin of 46.6% in Q4 and 39.8% for the full year; the first gross margin improvement for each since 2013 Reported Q4 Earnings Per Share of $0.04

versus Loss Per Share of ($0.82) in the prior year Sources: Mattel 2019 Proxy Statement; Full Year and Fourth Quarter 2018 Earnings Release (February 7, 2019); First Quarter 2019 Earnings Release (April 25, 2019)

Sources: Mattel 2019 Proxy Statement;

October 3, 2017, April 19, 2018, and October 10, 2018 Press Releases Amy Thompson Chief People Officer Previously served as Chief People Officer at TOMS Shoes and held several global HR leadership roles at Starbucks Coffee Company At TOMS,

successfully developed and implemented plans that increased employee engagement and improved accountability Soren Laursen Executive Director Over 25 years of toy industry experience including most recently as CEO of TOP-TOY and formerly as President

of Lego Systems at LEGO Brings global business and industry experience to accelerate key aspects of Mattel's growth strategy in Europe Sven Gerjets Chief Technology Officer 25+ years of experience leading technology organizations and improving

business results across a range of industries Previously served as Chief Product Officer of n.io Innovation and Chief Information Officer at Time Warner Cable EVP, CLO & Secretary of Mattel since 2011 and SVP, General Counsel and Secretary from

1999 to 2011, total of 25+ years of experience in legal roles at Mattel Strong institutional knowledge of our Company and industry, with previous experience as a lawyer at Latham & Watkins LLP and Sullivan & Cromwell LLP Robert Normile Chief

Legal Officer & Secretary 17 years of experience at Mattel, working as SVP and Managing Director, Latin America and VP and General Manager, Mexico among other positions Prior to joining Mattel in 2002, served as Head of Commercial for

Traditional Trade at Procter & Gamble Mexico Roberto Isaias Chief Supply Chain Officer Ynon Kreiz Chairman and Chief Executive Officer As the former Chairman and CEO of Maker Studios, Endemol Group, and Fox Kids Europe N.V., Ynon brings an

outstanding track record of innovation and success in children's entertainment Named CEO April 2018 Richard has been a significant contributor to the transformation of Mattel’s Power Brands, with significant operating experience and in-depth

knowledge of Mattel Richard Dickson President and Chief Operating Officer Transformed Leadership to Drive Growth Mattel Leadership ©2019 Mattel, Inc. All Rights Reserved. Sept 2017 Oct 2018 July 2017 Feb 2019 With more than four decades of

financial leadership experience in the technology, telecom, and cable industries, Joe positions us to improve long-term growth and profitability Joe Euteneuer Chief Financial Officer Named CFO September 2017 Rejoined MAT 2014/2015 July 1992 Our

leadership team brings deep industry expertise and is well-positioned to drive progress on our transformation

50% Female / Ethnically-Diverse Directors

©2019 Mattel, Inc. All Rights Reserved. DIVERSE, FRESH PERSPECTIVES 6 Directors 3 Directors 1 Director Large Corporation Leadership Consumer Products Restructuring International Business Marketing & Advertising Digital Media &

Entertainment Financial Management & Operations Technology Corporate Governance WELL-BALANCED TENURES OF NOMINEES COMPLEMENTARY SKILLS & EXPERIENCE Ynon Kreiz Chairman & CEO Former Chairman & CEO, Maker Studios Former Chairman &

CEO, Endemol Group Former Chairman & CEO, Fox Kids Europe N.V. Michael Dolan Lead Independent Director Former CEO, Bacardi Ltd. Former Chairman & CEO, IMG Worldwide Former EVP, CFO, Viacom Joined Jun 2017 Joined Feb 2004 Soren Laursen

Executive Director Former CEO, TOP-TOY Former President, LEGO Systems Advisor, The Toy Association Todd Bradley Independent Director Former CEO, Mozido Former President, TIBCO Software Former EVP, Strategic Growth, HP, Inc. Joined May 2018 Joined

May 2018 Adriana Cisneros Independent Director CEO, Cisneros Former VP, Director of Strategy, Cisneros Ann Lewnes Independent Director EVP, CMO, Adobe Systems Former SVP, CMO, Adobe Systems Former VP, Sales & Marketing, Intel Joined Aug 2018

Joined Feb 2015 Roger Lynch Independent Director CEO, Conde Nast Former President & CEO, Pandora Former Founding CEO, Sling TV Dominic Ng Independent Director Chairman & CEO, East West Bancorp since 1992 Former President, Seyen Investment

Joined Aug 2018 Joined Mar 2006 Dr. Judy Olian Independent Director President of Quinnipiac University Former Dean of the UCLA Anderson School of Management Vasant Prabhu Independent Director CFO, Visa Former CFO, NBC Universal Former Vice Chairman

& CFO, Starwood Hotels Joined Sep 2018 Joined Sept 2007 Refreshed Board Reflects Needs of Our Business 80% Independent Directors 4.5 Average Director Tenure Our directors bring a diverse range of valuable perspectives and experiences that

support Mattel in executing its transformation strategy 50% Female / Ethnically-Diverse Directors 80% Independent Directors 5 Directors Added in Past Year (4 Independent) 4.5 Average Director Tenure Source: Mattel 2019 Proxy Statement

Compensation Program Design Driven By

Shareholder Feedback Feedback We Heard How We Responded CEO compensation structure should have greater alignment with company performance and stockholder value creation Incentive metrics should closely align with transformation and strategic goals

Preference for higher percentage of performance-based incentives Our CEO’s compensation structure establishes immediate alignment with our transformation goals 69% of target annual compensation is in the form of equity 88% of target annual

compensation is based on Mattel and stock price performance New hire equity grant only earned if Mattel’s relative TSR is ≥ 65th percentile of the S&P 500 at the end of three years to establish immediate alignment with our

stockholders Re-aligned metrics to emphasize profitability and cash flow, core components of our transformation strategy MIP metrics replace Operating Profit measure with EBITDA and decreased from 70% to 50% weighting, given the closer linkage to

cash flow generation Increased long-term incentive grant value of performance-based units from 33% of LTIP to 50% Size of companies in our executive compensation peer group should be reconsidered We realigned our peer group in 2018 by: Targeting

median position and utilizing a lower revenue cap of 3x from the previous 4x revenue cap Increasing focus on branded content/home entertainment companies A three-year financial performance measurement should be employed in the equity Long Term

Incentive Plan Metrics against which LTIP performance units are earned was re-aligned to replace EPS with cumulative three year Free Cash Flow to better incentivize long-term cash flow generation Following a broad review of our compensation programs

and discussion of stockholder feedback, we implemented several changes in 2018 to enhance alignment with our transformation goals Source: Mattel 2019 Proxy Statement ©2019 Mattel, Inc. All Rights Reserved.

©2019 Mattel, Inc. All Rights

Reserved. Sources: Mattel 2019 Proxy Statement and Form 8-Ks filed April 20, 2018 and June 11, 2018 Executive Compensation Program Aligns with Transformation Goals Mattel emphasizes performance-based compensation, placing the majority of

executives’ pay at risk and tying CEO compensation to rigorous goals and stockholder return Under our Choice Program, we allow eligible employees (excluding our CEO, CFO, and COO) to allocate the stock option and RSU component of the LTI to a

selected mix of each in 25% increments 2018 ELEMENT Equity Long-Term Incentives 2018 OBJECTIVE Base Salary Fixed cash compensation representative of individual role, performance and skill set, market data, and internal pay equity Performance Units

(50% of LTI) Incentivize and motivate executives to achieve key long-term strategic financial objectives and stock price appreciation 100% Three-Year Cumulative Free Cash Flow Three-Year Relative TSR to S&P 500 Multiplier (+/- 33% of Payout)

Annual Cash Incentive (MIP) Incentivize and motivate executives to achieve our short-term strategic and financial objectives that we believe will drive long-term value creation 75% Financial Performance Goals 50% adjusted EBITDA 20% Net Sales 25%

Individualized Strategic Priorities 15% Gross Margin 15% Working Capital and Tooling Stock Options (25% of LTI) Align executives’ interests with stockholders’ interests and foster long-term focus on increasing stockholder value

Restricted Stock (25% of LTI) Encourage executive stock ownership and stockholder-aligned retention Vest in approx. equal annual installments over three years 88% of CEO target total direct compensation is performance-based 2017 LTI Mix 2018 LTI Mix

2018 LTI Changes

Sources: Mattel 2019 Proxy Statement and

Form 8-K filed April 20, 2018 ©2019 Mattel, Inc. All Rights Reserved. CEO Compensation is Highly Performance-Based Target Total Direct Compensation is Long-term Focused $1.5MM Base Salary $2.25MM Target Annual Cash Incentive No guaranteed bonus

$8.25MM Equity Long-Term Incentives Comprised of: 50% Performance Units 25% Stock Options 25% RSUs To promote long-term value creation, Performance Units use 3-year Free Cash Flow as the financial measure and a 3-year relative TSR modifier 88%

Performance Based New Hire Performance Award Provided new CEO with one-time new hire grant of performance-based stock options valued at $5MM Options cliff vest after three years Award creates immediate alignment with stockholder interests, further

intensifying focus on driving long-term, sustainable growth Grant will only vest if Mattel’s relative TSR performance versus the S&P 500 is at or above the 65th percentile for the three-year period Significant percentage of CEO pay is

linked to long-term performance to help drive sustainable, profitable growth and strong execution during a critical period in our transformation Compensation structure for our CEO, Ynon Kreiz, who began serving as CEO in April 2018, incorporates

rigorous, long-term targets and tightly aligns with stockholder value creation

(1) The $521 million run-rate cost

savings exiting 2018 resulting from our Structural Simplification program ©2019 Mattel, Inc. All Rights Reserved. Source: Mattel 2019 Proxy Statement 2018 Payouts Reflect Meaningful Progress in Advancing Our Transformation Strategy Pay Element

2018 NEO Results Base Salary No salary increases, except to adjust corporate secretary to market level of peer group Mattel Incentive Plan Paid out above target, driven primarily by our improved EBITDA and stronger than expected adjusted net sales

Long-Term Incentive Plan No payout under LTIP reflecting TSR and EPS performance below rigorous threshold 2018 New-Hire Award No payout to date, on track to not vest as rigorous performance criteria requires TSR at or above 65th percentile of

S&P 500 to vest 2018 pay outcomes reflect the rigor of our pay-for-performance program MIP: Above-target MIP payouts driven by improved EBTIDA and stronger than expected adjusted net sales Exceeded anticipated progress against cost savings,

benefitting EBITDA (1) Full-year sales above plan due to strong holiday season and fourth quarter The 2018 Net sales target was the one metric set below 2017 actual performance LTIP: No payout under 2016-2018 LTIP reflects rigor of performance goals

Tracking below target for 2017-2019 reflecting our commitment to our pay-for-performance philosophy The 2018 EPS target was the one metric set below 2017 actual performance 2018 net sales target was set below 2017 actual performance to reflect

industry headwinds from the Toys “R” Us liquidation

©2019 Mattel, Inc. All Rights

Reserved. Source: Mattel 2019 Proxy Statement Historical Payouts Reflect Rigorous Performance Targets Cost savings from early realization under our Structural Simplification plan and revenue improvement drove better than expected 2018 MIP payout The

Compensation Committee remains fully committed to its pay-for-performance philosophy and rigorous target setting process LTIP MIP No Payout No Payout No Payout No Payout No Payout No Payout Payout Below Target - Below Target - Below Target - 2013

2014 2015 2016 2017 2011-2013 2012-2014 2013-2015 2014-2016 2015-2017 Payout 2018 2016-2018 No Payout 2018 MIP Payout Calculation Measure Weight Target Actual Adjusted EBITDA 50% $127 $245 Adjusted Net Sales 20% $4,503 $4,623 Adjusted Gross Margin

15% 41.8% 40.4% Working Capital 10% $1,558 $1,564 Tooling 5% $110 $75

©2019 Mattel, Inc. All Rights

Reserved. Stockholder Proposal – Amendment to Proxy Access Provisions The Board has already provided stockholders with a meaningful and carefully considered proxy access right The views of different stockholders and other stakeholders were

carefully considered by the Board when adopting proxy access The Board strongly believes that a re-nomination threshold prevents a candidate who has not demonstrated the ability to garner significant stockholder support from continuing to impose the

expense and disruption of invoking the proxy access process The Company’s current corporate governance structure reflects the Board’s ongoing commitment to strong and effective governance practices and responsiveness to stockholders The

change requested by the proposal has limited acceptance Of the approximately 340 companies in the S&P 500 that had adopted proxy access as of the end of 2018, the vast majority (approximately two-thirds) included a limitation on the resubmission

of nominees who had not achieved a minimum level of support Of the S&P 500 companies that include such a limitation, over three-quarters take the same approach as Mattel, prohibiting re-nomination for two years if 25% support is not achieved The

Board recommends that stockholders vote AGAINST this stockholder proposal The proposal requests Mattel amend its proxy access bylaw provisions Currently, the Company’s Bylaws prohibit re-nomination of a candidate who did not receive support of

at least 25% of the shares voted in the prior election AND was nominated using the proxy access provision at either of the preceding two annual meetings Amendment would remove the need to obtain a threshold of support to qualify for re-nomination as

a shareholder proxy access candidate in the two subsequent Annual Meetings Source: Mattel 2019 Proxy Statement

©2019 Mattel, Inc. All Rights

Reserved. We Request Your Support at Our 2019 Annual Meeting The Board asks that you vote: For all management proposals Against stockholder proposal ü ü ü ü û FOR election of all ten director nominees FOR ratification of

PricewaterhouseCoopers as MAT’s independent registered public accounting firm FOR advisory vote on executive compensation FOR restated 2010 equity and long-term compensation plan AGAINST stockholder proposal on proxy access provisions Source:

Mattel 2019 Proxy Statement

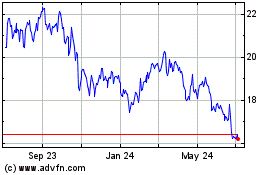

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

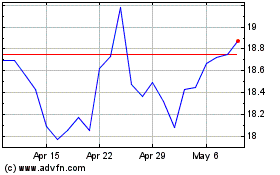

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Apr 2023 to Apr 2024