U.S. Stocks Extend Slump as Pressure Intensifies on Tech

November 20 2018 - 10:04AM

Dow Jones News

By David Hodari

U.S. stocks opened lower Tuesday, extending the latest wave of

selling as pressure intensified on the global technology

sector.

The Dow Jones Industrial Average fell 440 points, or 1.7%, to

24582 shortly after the opening bell. The S&P 500 dropped 1.1%

and the Nasdaq Composite declined 2.2%. The Nasdaq slumped 3%

Monday, closing near a seven-month low, with tech-giant Alphabet

slipping into bear-market territory.

In Europe, the pan-continental Stoxx Europe 600 index fell 0.8%

in early afternoon trading, with the index's tech sector leading

the way down, descending 2.5% to its lowest level in 18 months.

Selling in the European auto sector echoed similar losses in

Asia. Renault shares dropped 2.6% after Mitsubishi Motors and

Nissan slipped 6.9% and 5.5% respectively, following the arrest of

Nissan Chairman Carlos Ghosn. Nissan, which has a strategic

partnership with both Mitsubishi and Renault, said Monday that it

intended to oust Mr. Ghosn after an internal probe concluded he had

under reported his pay. On Tuesday, France said it was asking

Renault to look for interim leadership while Mr. Ghosn is under

arrest.

Falling automotive stocks combined with the pressure on

Asia-Pacific technology equities to send share prices across the

region tumbling.

Japan's Nikkei index was down 1.1%, while the Shanghai Composite

Index and Hong Kong's Hang Seng both fell around 2%. The tech-heavy

Shenzhen A-Share dropped 2.7%.

Lower-than-expected demand for Apple's new iPhones and the

company's expansion of its product offerings have put a strain on

its supply chain, making it harder for the company to forecast the

number of necessary components.

Shares in screen manufacturer Japan Display -- one of the Apple

suppliers to have recently cut its quarterly profit estimates --

were down 10.3% Tuesday.

Adding to the downbeat mood in the tech sector, Chinese

officials said they had found widespread evidence of

anticompetitive behavior. Beijing investigators cited a

price-fixing probe into South Korean firms Samsung Electronics,

down 2%, and SK Hynix, down 3.3%. U.S.-based Micron Technology was

also implicated in the reports, and its shares fell 5.5% in

premarket trade.

Despite those developments, computer hardware firms have still

outperformed the broader tech sector so far this year. The S&P

500 technology hardware and equipment basket has climbed 8.7% in

2018, versus 3.8% for the index's broader tech sector.

A combination of soft earnings forecasts from sector giants like

Apple and Facebook, anxieties that corporate earnings may have

peaked and frosty trading relations between the U.S. and China have

left tech stocks vulnerable to selling, surprising investors.

"The tech sector, especially in the U.S. is more exposed to

political and regulatory risk than a lot of investors were prepared

for," said Jared Woodard, global investment strategist at Bank of

America Merrill Lynch.

With the November BAML Fund Managers survey revealing the

largest drop in allocation to tech in October since the financial

crisis, investors were eyeing the prospective meeting between

President Trump and China's President Xi, expected at the Group of

20 summit in Buenos Aires later in November, for any signs that a

trade deal might be negotiated.

"The trade conflict is a tech arms race and something not likely

to be resolved in any major way in the near term. We suggest more

pain for financial markets is likely possible for consumers before

either party makes concessions," Mr. Woodard said.

The course of global economic growth and political risk during

the first months of 2019 could also determine whether Chinese

giants like Baidu, Alibaba Group and Tencent Holdings take an even

bigger hit next year, say strategists.

"Big Chinese tech companies haven't been generating the amount

of revenue they were previously. They've been loading up on debt

instead and that plays into other areas of credit concern for

China," said Frances Hudson, a global strategist at Aberdeen

Standard Investments. "It could come back to bite them depending on

how the world moves next year."

Aside from ongoing trade tensions between the world's two

largest economies, market participants were also watching Brexit

negotiations between U.K. and European Union lawmakers. U.K. Prime

Minister Theresa May continued to fight to save the deal she

negotiated with the EU while also defending her grip on power

against a potential confidence vote by fellow members of

Parliament.

In commodities, the price of Brent crude oil fell 0.8% to $66.26

a barrel -- extending its month losses to more than 17% -- while

gold was up 0.1% at $1,226.70 a troy ounce.

In cryptocurrency markets, bitcoin plunged 16% to $4,395.46

according to CoinDesk, its lowest price since October 2017.

Write to David Hodari at David.Hodari@dowjones.com

(END) Dow Jones Newswires

November 20, 2018 09:49 ET (14:49 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

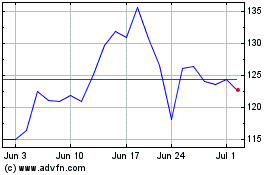

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024