British pay-TV group Sky PLC has become the target of a bidding

war involving some of the world's largest media companies.

NBCUniversal Inc.'s owner, Comcast Corp., raised its offer to buy

all of Sky to GBP25.9 billion on July 11. The move came just hours

after Rupert Murdoch's 21st Century Fox Inc., which already owns

39% of Sky, increased its original bid to consolidate ownership of

the U.K. company. The intensified bidding made the fight for

control of Sky a central battlefield in the broader clash between

Comcast and Walt Disney Co. to acquire most of Fox's entertainment

assets, until Comcast dropped its pursuit of the Fox assets.

WHO'S WHO?

Sky is Europe's largest pay-TV operator, with operations in

seven countries. It had more than 23 million customers as of June

30, 2018. In the fiscal year to the end of June, Sky had revenue of

GBP13.59 billion and a pretax profit of GBP864 million.

Fox is an American TV and entertainment group controlled by the

Murdoch Family Trust, which also controls Dow Jones's parent, News

Corp, as well as several U.K. newspapers among other properties. On

June 20, Fox agreed to sell most of its assets to Disney--including

the Sky interest. A previous deal reached in December, was

challenged by Comcast, which dropped its pursuit of the assets on

July 19.

Comcast is an American cable juggernaut that owns NBCUniversal

as well as the Xfinity cable and telecommunications service. It

attempted to buy Fox's entertainment assets, making an unsolicited

bid for them on June 13, but walked away weeks later. It continues

to seek the acquisition of Sky.

The Walt Disney conglomerate houses the namesake Disney brand,

Star Wars franchise owner Lucasfilm, U.S. sports channel ESPN, and

Marvel in its portfolio. Disney said on June 20 that it would

assume full ownership of Sky if Fox buys the stake it doesn't own

prior to completion of the deal between the two American

companies.

WHY SKY?

With a market value of around GBP27.18 billion as of Sept. 20,

Sky has a more modest scale than its American suitors. But it is in

many ways a smaller version of what American media companies are

trying to become: an integrated distribution platform that produces

its own content.

HOW IS THE DEAL STRUCTURED?

Comcast has lifted its offer price for Sky to GBP14.75 a share,

valuing the company at $34 billion. That represents a 5% premium to

Fox's latest offer and an 18% increase to Comcast's previous

GBP12.50-a-share bid . Comcast said its latest offer was

recommended by Sky's independent directors, who withdrew their

earlier support of the Fox bid.

Fox had raised its original bid by 30% to GBP14.00 a share for

the 61% of Sky it doesn't already own. Fox launched its bid to

consolidate ownership of the U.K. satellite-TV company in December

2016. However, the deal came under the scrutiny of British

regulators, who after a lengthy review formally cleared it on July

12.

Fox agreed to sell Sky's news operations to Disney with a

promise to fund the news service with at least GBP100 million a

year for 15 years, to ease government's concerns that a Sky

takeover would give the Murdoch family too much influence over U.K.

media.

Fox said on Aug. 7 that the deal is dependent on approval from

shareholders representing 75% of Sky shares that it doesn't

currently hold. However, Fox said it reserves the right to reduce

the acceptance condition to a level not less than a simple majority

of all Sky shares.

WHAT TOOK SO LONG?

Fox launched its bid to consolidate ownership of Sky in December

2016, but the deal was held up by British regulators. In December

2017, Fox agreed to sell most of its assets--including its current

39% stake in Sky--to Disney. From then on, the fate of the Sky

takeover was linked to that of the much larger fight for the Fox

assets.

Comcast, which had tried to strike a deal with Fox for its

entertainment assets, emerged as a suitor for Sky in February,

confirming a takeover proposal in April. In June, Comcast made a

separate, unsolicited offer for the Fox assets as a whole. The

Comcast move triggered a higher offer from Disney for those assets,

which was accepted by Fox. Disney said then that it would take full

ownership of Sky upon completion of the Fox deal, if Fox ended up

buying the 61% of the U.K. company it doesn't own. Fox, backed by

Disney, increased its offer on July 11, but Comcast quickly

responded with a higher offer, which received the support of the

Sky independent directors.

Days later, Comcast dropped its pursuit of the Fox assets and

said it would focus on buying the British pay-TV group.

Shareholders of Disney and Fox approved the $71 billion deal

between the two companies on July 27.

The U.K. Takeover Panel has ruled that Disney would be required

to offer GBP14.00 a share for 61% of Sky if it succeeds in

acquiring Fox's entertainment assets, setting a floor-price in the

bidding war for the British media group. The regulatory body

confirmed its decision on Aug. 3, after a hearing requested by

various interested parties, but on Aug. 8 the panel said it would

consider appeals lodged by several interested parties against the

ruling. It has scheduled a hearing to consider the appeals for Aug.

15.

After officially posting the offer documents, both Comcast and

Fox extended the period for Sky shareholders to accept their bids,

havingas they received fewlittle acceptances by their initial

deadlines.

Investors have long expected higher bids; Sky's shares were

trading at GBP15.80 on Sept. 20. Mr. Murdoch's first attempt to

take over Sky at the beginning of the decade failed amid a public

and political backlash over his now-defunct U.K. tabloid newspaper

News of the World's phone-hacking scandal.

WHAT'S NEXT?

Comcast and Fox have until 1600 GMT on Sept. 21 to revise their

offers for Sky and declare them final. If they fail to do so, the

U.K. Takeover Panel will step in to settle the takeover battle via

a sealed-bids auction.

The auction will consist of a maximum of three bidding rounds,

starting at 1600 GMT on Sept. 21 and ending Sept. 22, the Takeover

Panel said. The winning offer will be announced on Sept. 22

evening, the British regulator added.

Under the auction rules, Fox, as the lowest bidder so far, can

make the only bid in the first round. In the second round, Comcast

can make a counterbid. If that doesn't determine a winner, then

both parties can submit offers in the third and final round. The

bids won't be made public until after the auction's completion on

Sept. 22.

Stu Woo and Ben Dummett contributed to this article.

(END) Dow Jones Newswires

September 20, 2018 10:17 ET (14:17 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

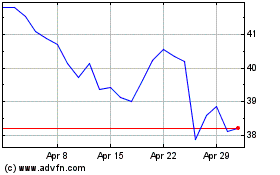

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024