Current Report Filing (8-k)

August 22 2018 - 3:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported):

August 17, 2018

NATURALSHRIMP INCORPORATED

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-54030

|

|

74-3262176

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification No.)

|

5080 Spectrum Drive, Suite 1000

Addison, Texas 75001

(Address

of principal executive offices)

Registrant’s

telephone number, including area code:

(888) 791-9474

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written

communication pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

☐

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. [ ]

Item 3.03. Material Modification to Rights of Security

Holders.

On

August 17, 2018, the Company, pursuant to approval by the

Company’s board of directors, filed a certificate of

designation (the “Certificate of Designation”) with the

state of Nevada in order to designate a class of preferred stock.

The class of preferred stock that was designated is referred to as

Series A Convertible Preferred Stock (the “Series A

Stock”), consists of 5,000,000 shares, and was designated

from the 200,000,000 authorized preferred shares of the Company.

The Series A Stock is not entitled to dividends, but carries

liquidation rights upon the dissolution, liquidation or winding up

of the Company, whether voluntary or involuntary, at which time the

holders of the Series A Stock shall receive the sum of $0.001 per

share before any payment or distribution shall be made on the

Company’s common stock, or any class ranking junior to the

Series A Stock. The shares of Series A Stock shall vote together as

a single class with the holders of the Company’s common stock

for all matters submitted to the holders of common stock, including

the election of directors, and shall carry voting rights of 60

common shares for every share of Series A Stock. Any time after the

two-year anniversary of the initial issuance date of the Series A

Stock, the Series A Stock shall be convertible at the written

consent of a majority of the outstanding shares of Series A Stock,

in an amount of shares of common stock equal to 100% of the then

outstanding shares of common stock at the time of such

conversion.

On

August 21, 2018, the Company entered into a Stock Exchange

Agreement (the “Exchange Agreement”) with NaturalShrimp

Holdings, Inc. (“NaturalShrimp”), the Company’s

majority shareholder, which is controlled by the Company’s

CEO and President. Pursuant to the Exchange Agreement, the Company

and NaturalShrimp exchanged 75,000,000 shares of common stock for

5,000,000 shares of Series A Stock. The 75,000,000 shares of common

stock will be cancelled and returned to the authorized but unissued

shares of common stock of the Company.

The

foregoing description of the above referenced Certificate of

Designation and Exchange Agreement do not purport to be complete.

For an understanding of their terms and provisions, reference

should be made to Exhibits 3.1 and 3.2 to this Current Report on

Form 8-K.

Item 9.01 Financial Statement and Exhibits

Exhibits

In reviewing the agreements included or incorporated by reference

as exhibits to this Current Report on Form 8-K, please remember

that they are included to provide you with information regarding

their terms and are not intended to provide any other factual or

disclosure about the Company or the other parties to the

agreements. The agreements may contain representations and

warranties by each of the parties to the applicable agreement.

These representations and warranties have been made solely for the

benefit of the parties to the applicable agreement and accordingly,

these representations and warranties may not describe the actual

state of affairs as of the date they were made or at any other

time. Additional information about the Company may be found

elsewhere in this Current Report on Form 8-K and in our other

public filings, which are available without charge through the

SEC’s website at http://www.sec.gov.

|

Exhibit

No.

|

|

Description

|

|

|

|

Certificate

of Designation for Series A Convertible Preferred

Stock

|

|

|

|

Stock

Exchange Agreement dated August 21, 2018

|

* Furnished herewith.

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Dated:

August 22, 2018

|

|

NATURALSHRIMP INCORPORATED

|

|

|

|

|

|

|

|

|

By:

|

/s/

Bill Williams

|

|

|

|

Name:

Bill G. Williams

|

|

|

|

Title:

Chief Executive Officer

|

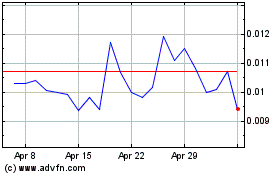

NaturalShrimp (QB) (USOTC:SHMP)

Historical Stock Chart

From Aug 2024 to Sep 2024

NaturalShrimp (QB) (USOTC:SHMP)

Historical Stock Chart

From Sep 2023 to Sep 2024