Verdict In Weed Killer Case Hits Bayer -- WSJ

August 14 2018 - 3:02AM

Dow Jones News

Roundup maker Monsanto was acquired by the German firm in

June

By Anthony Shevlin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 14, 2018).

Shares in Bayer AG fell sharply on Monday after Monsanto Co. --

which the German chemical company recently acquired -- was ordered

to pay $289.2 million in a landmark lawsuit over whether exposure

to two of its weed killers caused cancer.

The ruling by a California state jury on Friday found that

Monsanto's Roundup and Ranger Pro products presented a "substantial

danger" to consumers, and that the St. Louis-based company knew --

or should have known -- the potential risks they posed.

The case is the first of many that could go to trial and

represents a nagging issue for Bayer, which closed its $60

billion-plus acquisition of Monsanto in June after two years of

wrangling.

Monsanto said that as of February it had a recorded liability of

$254 million relating to various product claims and that it is

aware of 5,200 plaintiffs who claim to have been injured by

exposure to glyphospate-based products. The company has previously

said it couldn't estimate losses from the litigation.

Controversy has dogged the Roundup weed killer for years as

studies have produced mixed results about the potential

carcinogenic hazard of glyphosate, its active ingredient. However,

Friday's ruling was a surprise to some because of existing U.S.

regulations that allow the ingredient's use.

Bayer said Monday that the jury's verdict was "at odds with the

weight of scientific evidence, decades of real world experience and

the conclusions of regulators around the world." It also noted that

the verdict remains subject to post-trial motions and an

appeal.

A spokesman added that Bayer's involvement in the case and its

ability to comment further are currently restricted by U.S.

antitrust arrangements. The company declined to comment on any

potential liabilities.

Bayer shares on Monday closed at a nearly 5-year low, falling

10% to EUR83.73 ($95.45).

Analysts at Barclays said the result was "likely to create a

litigious headache for Bayer" and that the number of similar

pending cases could multiply. However, they said it was unlikely

they would all result in a similar financial award and that U.S.

regulators could maintain their benign stance on the product, which

first went on sale in 1974.

The next trial involving Roundup, also a state case, is

scheduled to begin in October in St. Louis. Dates for lawsuits in

federal courts have yet to be set.

The suit in California was brought by Dewayne "Lee" Johnson, who

had worked as a groundskeeper for the Benicia Unified School

District in the San Francisco Bay area and has been diagnosed with

non-Hodgkin lymphoma.

Mr. Johnson's lawyers had argued Monsanto knew that testing of

glysophate was insufficient, and that employees "ghostwrote"

favorable scientific articles and paid outside scientists to

publish the articles under their names.

Sales of Roundup make up the bulk of Monsanto's agricultural

productivity division, which generated $3.7 billion in sales for

the company's 2017 fiscal year -- about one-quarter of Monsanto's

total. Glyphosate, the product's main chemical ingredient, has been

off-patent for years, but Roundup underlies Monsanto's

multibillion-dollar franchise in genetically engineered crops,

including corn, soybean, cotton and canola varieties designed to

survive the spray.

--Donato Paolo Mancini, Nathan Allen and Jacob Bunge contributed

to this article.

(END) Dow Jones Newswires

August 14, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

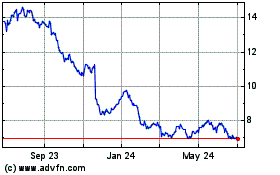

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

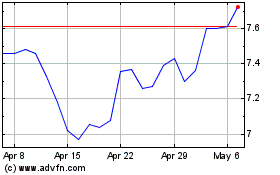

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024