AIG Helps Launch the Alliance for Lifetime Income to Empower & Educate Consumers & Financial Advisors on the Importance of Ha...

June 14 2018 - 9:01AM

Business Wire

Alliance for Lifetime Income Represents

Unprecedented Collaboration Among 24 Industry Leaders

AIG (NYSE:AIG) today announced it is a founding member of the

Board of Directors for the Alliance for Lifetime Income (Alliance),

a new industry coalition of 24 leading financial services

organizations whose goal is to educate Americans about the

importance of protected lifetime income solutions and empower them

to take action. This initiative aligns with AIG’s longstanding

commitment to help people protect the future they envision by

further raising awareness of the critical role that protected

lifetime income from annuities can play within an individual’s

overall retirement portfolio.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20180614005549/en/

“As a nation, we have vastly expanded 401(k)s and other

retirement accumulation vehicles, but have not tackled the looming

issue of securing retirement income,” said Jana Greer, President

and CEO, Retirement.

“With a long history in the retirement industry, AIG is proud to

join this powerful coalition, helping to address what is one of the

most critical financial planning issues of our time—helping

Americans fund today’s longer retirements with protected income

that cannot be outlived,” Greer added. “Today’s longer lifespans

are a game-changer—they make running out of money in retirement a

serious concern for millions of Americans. That’s why raising

national awareness and changing the conversation from saving to

retirement income has never been more important.”

AIG and the other Alliance members are combining their energy

and resources to educate more Americans and help make protected

lifetime income solutions, such as annuities, an important part of

the retirement planning dialogue.

“The mission of the Alliance goes beyond that of traditional

trade organizations,” Greer said. “It is campaign-oriented and has

significant resources that will allow for broad consumer and

financial advisor messaging in a unified, educational approach that

has not been done before.”

Today the Alliance launches a first of its kind, multi-year

campaign centered on the theme “Protect Your Income. Retire Your

Risk,” which boldly underscores the importance of protected

lifetime income for at least a portion of one’s portfolio to help

mitigate the risk of running out of money in retirement.

As the campaign moves forward, the Alliance will offer new

thought leadership, research, third-party expert views and tools,

including a new educational website for consumers and financial

advisors, www.RetireYourRisk.org.

About AIG

American International Group, Inc. (AIG) is a leading global

insurance organization. Founded in 1919, today AIG member companies

provide a wide range of property casualty insurance, life

insurance, retirement products, and other financial services to

customers in more than 80 countries and jurisdictions. These

diverse offerings include products and services that help

businesses and individuals protect their assets, manage risks and

provide for retirement security. AIG common stock is listed on the

New York Stock Exchange and the Tokyo Stock Exchange.

Additional information about AIG can be found at www.aig.com |

YouTube: www.youtube.com/aig | Twitter: @AIGinsurance

www.twitter.com/AIGinsurance | LinkedIn:

www.linkedin.com/company/aig. These references with additional

information about AIG have been provided as a convenience, and the

information contained on such websites is not incorporated by

reference into this press release.

AIG is the marketing name for the worldwide property-casualty,

life and retirement, and general insurance operations of American

International Group, Inc. For additional information, please visit

our website at www.aig.com. All products and services are written

or provided by subsidiaries or affiliates of American International

Group, Inc. Products or services may not be available in all

countries, and coverage is subject to actual policy language.

Non-insurance products and services may be provided by independent

third parties. Certain property-casualty coverages may be provided

by a surplus lines insurer. Surplus lines insurers do not generally

participate in state guaranty funds, and insureds are therefore not

protected by such funds.

About the Alliance for Lifetime Income

The Alliance for Lifetime Income, based in Washington, D.C., is

a nonprofit 501(c)(6) organization formed and supported by some of

the nation’s leading financial services organizations, to create

awareness and educate Americans about the importance of protected

lifetime income. The Alliance is focused on helping to educate

Americans on the risk of outliving their savings so they can enjoy

their retirement lives. The Alliance provides consumers and

financial advisors with the educational resources, tools and

insights they can use to build plans for protected retirement

income. For more information about the Alliance, visit

www.AllianceForLifetimeIncome.org.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180614005549/en/

American International Group, Inc.Kenny Juarez (Media),

212-458-8352; kenny.juarez@aig.comLinda Malamut (Media),

310-772-6533; linda.malamut@aig.comKnox Witcher (Media),

703-994-4943; witcher@pinkstongroup.com

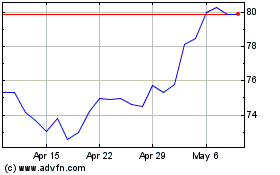

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

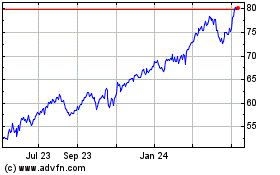

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024