Comcast Confirms It Is Preparing Bid for 21st Century Fox, Threatening Disney Deal

May 23 2018 - 8:55AM

Dow Jones News

By Austen Hufford

Cable giant Comcast Corp. said it is "in advanced stages of

preparing" a higher, all-cash offer for the entertainment assets

that 21st Century Fox has agreed to sell to Walt Disney Co. for

$52.4 billion in stock.

Earlier this month, reports surfaced, including in The Wall

Street Journal, that Comcast was considering making a play to break

up that deal and had lined up around $60 billion in financing for

an all-cash offer.

Comcast said Wednesday that while no final decision has been

made, the work to finance the all-cash offer "is well

advanced."

21st Century Fox and Wall Street Journal-parent News Corp share

common ownership.

The assets Comcast and Disney are seeking to purchase include

the Twentieth Century Fox TV and film studio, cable networks and

international properties.

Shares of Comcast fell 1.6% in pre-market trading as shares of

Disney declined 0.6%. Shares of 21st Century Fox were up 0.5%.

(END) Dow Jones Newswires

May 23, 2018 08:40 ET (12:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

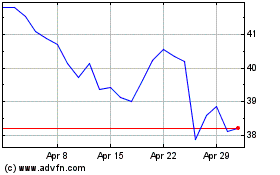

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024