Barclays CEO's Penalties Over Whistleblower Saga Top $1.5 Million -- 3rd Update

May 11 2018 - 11:06AM

Dow Jones News

By Max Colchester

LONDON -- Barclays PLC Chief Executive Jes Staley has been hit

with penalties equal to roughly a quarter of his 2016 pay over his

efforts to unmask a whistleblower.

After a yearlong probe, U.K. regulators Friday fined the

American executive GBP642,430 ($868,501) for a "serious error of

judgment" in trying to identify the author of a letter that made

criticisms of a hire Barclays made, but ultimately said Mr. Staley

could keep his job.

The British bank's board also Friday docked pay worth GBP500,000

from Mr. Staley's 2016 bonus. In total that year, he earned GBP4.23

million.

"I have consistently acknowledged that my personal involvement

in this matter was inappropriate, and I have apologized for

mistakes which I made," Mr. Staley said in a statement. The New

York State Department of Financial Services is still probing the

matter.

The episode, which has proved an embarrassing distraction for

Mr. Staley, is the first test of new British rules aimed at holding

bank executives to account for their actions. In the end U.K.

regulators had to balance the risk of destabilizing Barclays by

forcing a CEO change with the need to show they take protecting the

identity of whistleblowers seriously.

Complicating matters was the fact that Mr. Staley's actions

occurred just before new U.K. rules came into force to protect not

just whistleblowers within a company but anyone who privately flags

concerns of bad behavior.

The debacle traces back to summer 2016 when Mr. Staley sought to

defend his former JP Morgan Chase & Co. colleague Tim Main from

an anonymous critic, according to people familiar with the matter.

Mr. Main had recently been brought in the as head of the financial

institutions group at Barclays.

According to the account filed by the Financial Conduct

Authority, in June 2016 a member of the Barclays board received a

letter from a person identifying themselves as "John Q. Public," a

long-term shareholder in Barclays. The letter made personal

allegations about Mr. Main. It also questioned the process for

hiring him at Barclays, the FCA said.

Mr. Staley told regulators he took issue with the allegations

and considered the letter's sender didn't count as a whistleblower

because, among other things, the person was from outside Barclays.

Mr. Staley thought the letter came from someone who had worked with

him and Mr. Main at JP Morgan.

Later that month, Barclays's office in New York received a

second letter expressing similar concerns. The letter was anonymous

but was purported to have been drafted by Barclays employees,

according to the FCA.

"This raised in Mr. Staley's mind the need to find a way to stop

this campaign by finding out who was sending the Letters, proving

that they weren't whistleblows and that their contents were false,"

the regulator said.

The FCA said Mr. Staley failed to recognize that both the

letters -- which were similar in content - could have been written

by insiders at Barclays and so whistleblowing rules needed to apply

to both incidents.

In late June, Mr. Staley asked security to identify the author

of the first letter. A day later, Mr. Staley met with Barclays's

general counsel and head of compliance and was told not to as the

senders could be considered whistleblowers. The executive called

off the search .

A month later, Mr. Staley asked his office for an update on the

matter and was again told the letters were being treated as

whistleblows. Mr. Staley and his office said they didn't recall

whether he was told this.

The day after, Mr. Staley spoke to compliance and again was told

the author of the letter couldn't be identified. Mr. Staley said he

couldn't remember the contents of the call and mistakenly

understood that compliance told him that the letter was no longer

being treated as a whistleblow. Without informing compliance, the

board or executive committee members, Mr. Staley told the security

team that he had been given clearance to find the author of the

first letter.

Mr. Staley later sent a text message to the security team asking

for an update on the attempt to identify the author of the letter.

He received a response saying the security team wanted to get video

footage of the purchase of the postage for the letter from U.S.

contacts. This proved impossible and Mr. Staley then asked if he

could contact the author of the letter another way. He was told

no.

In early 2017, Barclays's board was told of Mr. Staley's attempt

to identify the author of the letter. The board began its own probe

and told regulators.

"Given his conflict Mr. Staley should have maintained an

appropriate distance; he should not have taken steps to identify

the author," the regulators wrote in a joint statement. Barclays

now must report annually to the regulators detailing how the bank

handles whistleblowing matters.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

May 11, 2018 10:51 ET (14:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

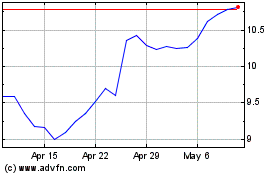

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2024 to May 2024

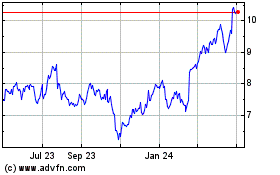

Barclays (NYSE:BCS)

Historical Stock Chart

From May 2023 to May 2024