Ampco-Pittsburgh Corporation (NYSE: AP) reported consolidated

sales of $115.1 million for the three months ended March 31, 2018,

compared to $103.5 million for the three months ended March 31,

2017. Higher sales of forged engineered products to the oil and gas

industry was the primary driver, while sales of forged and cast

rolls also increased.

Net income for the three months ended March 31, 2018, was $0.9

million, or $0.08 earnings per common share, compared to net loss

of $4.8 million, or $0.39 loss per common share for the three

months ended March 31, 2017.

Loss from operations for the three months ended March 31, 2018,

was $1.1 million, compared to loss from operations of $2.6 million

for the three months ended March 31, 2017, as the impact of higher

overall shipment volumes and pricing more than offset the effect of

higher raw material and operating costs and lower cost absorption

related to a partial plant idling.

Other income (expense) – net for the three months ended March

31, 2018, improved by $4.1 million compared to the three months

ended March 31, 2017, including a one-time current period benefit

of $2.4 million related to a contractual settlement with a third

party, higher pension income of $1.1 million, and the non-recurring

prior year cost of $0.4 million related to extinguishing the

outstanding debt of ASW Steel, Inc., acquired in November 2016.

Sales for the Forged and Cast Engineered Products segment for

the three months ended March 31, 2018, increased approximately 15%

compared to prior year. Despite the loss of a key customer to a

plant closure, higher shipment volumes of forged engineered

products to the oil and gas industry led the increase. Sales of

forged and cast mill rolls also increased. The segment recorded an

operating income, compared to an operating loss in the prior year,

due to the higher shipment volumes and improved pricing, partly

mitigated by higher raw material and operating costs and

unfavorable cost absorption related to the idling of a cast roll

foundry which was in full operation in the prior year period.

Sales for the Air and Liquid Processing segment for the three

months ended March 31, 2018, declined approximately 3%, as lower

sales of centrifugal pumps to U.S. Navy shipbuilders was partly

offset by higher sales demand for custom air handlers. Segment

operating income declined for the quarter compared to prior year,

in line with the lower sales volumes.

Remarking on the quarter’s results, John Stanik,

Ampco-Pittsburgh’s Chief Executive Officer said, “Although pleased

with our continued improvement, we remain focused on further

operational advances, equipment reliability and commercial terms to

be able to sustain and expand on this progress as our order book

grows.”

Teleconference Access

Ampco-Pittsburgh Corporation (NYSE: AP) will hold a conference

call on Thursday, May 10, 2018, at 10:30 a.m. Eastern Time (ET) to

discuss its financial results for the first quarter ended March 31,

2018.

We encourage participants to pre-register for the conference

call at http://dpregister.com/10119580. Callers who pre-register

will be given a conference passcode and unique PIN to gain

immediate access to the call and bypass the live operator.

Participants may pre-register at any time, including up to and

after the call start time. Those without internet access or unable

to pre-register may dial in by calling:

• Participant Dial-in (Toll Free): 1-844-308-3408 •

Participant International Dial-in: 1-412-317-5408

For those unable to listen to the live broadcast, a replay will

be available one hour after the event concludes on our website

under the Investors menu at www.ampcopgh.com.

The Private Securities Litigation Reform Act of 1995 (the “Act”)

provides a safe harbor for forward-looking statements made by or on

our behalf. This news release may contain forward-looking

statements that reflect our current views with respect to future

events and financial performance. All statements in this document

other than statements of historical fact are statements that are,

or could be, deemed forward-looking statements within the meaning

of the Act. In this document, statements regarding future financial

position, sales, costs, earnings, cash flows, other measures of

results of operations, capital expenditures or debt levels and

plans, objectives, outlook, targets, guidance or goals are

forward-looking statements. Words such as “may,” “intend,”

“believe,” “expect,” “anticipate,” “estimate,” “project,”

“forecast” and other terms of similar meaning that indicate future

events and trends are also generally intended to identify

forward-looking statements. Forward-looking statements speak only

as of the date on which such statements are made, are not

guarantees of future performance or expectations, and involve risks

and uncertainties. For Ampco-Pittsburgh, these risks and

uncertainties include, but are not limited to, those described

under Item 1A, Risk Factors, of Ampco-Pittsburgh’s Annual Report on

Form 10-K. In addition, there may be events in the future that we

are not able to predict accurately or control which may cause

actual results to differ materially from expectations expressed or

implied by forward-looking statements. Except as required by

applicable law, we assume no obligation, and disclaim any

obligation, to update forward-looking statements whether as a

result of new information, events or otherwise.

AMPCO-PITTSBURGH

CORPORATION

FINANCIAL

SUMMARY

(Dollars in thousands except per share amounts; shares

outstanding in thousands) Three Months Ended March 31,

2018 2017 Sales

$

115,077 $ 103,516

Cost of products sold (excl. depreciation and

amortization) 94,757 84,781 Selling and administrative 15,473

15,377 Depreciation and amortization 5,905 5,922 Loss on

disposition of assets

45

0 Total operating expenses

116,180 106,080

Loss from operations (1,103 ) (2,564 ) Other income

(expense) – net

2,051

(2,013 ) Income (loss) before

income taxes 948 (4,577 ) Income tax benefit (provision) 441 (135 )

Equity gains in joint venture

0

50 Net income (loss) before

noncontrolling interest 1,389 (4,662 ) Net income attributable to

noncontrolling interest

448

121 Net income (loss) attributable to

Ampco-Pittsburgh

$ 941

$ (4,783 )

Net income (loss) per common share

attributable to Ampco-Pittsburgh:

Basic

$ 0.08 $

(0.39 )

Diluted

$ 0.08 $

(0.39 )

Weighted-average number of common shares

outstanding:

Basic

12,362 12,271

Diluted

12,379

12,271

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180510005670/en/

Ampco-Pittsburgh CorporationMichael G. McAuley,

412-429-2472Senior Vice President, Chief Financial Officer and

Treasurermmcauley@ampcopgh.com

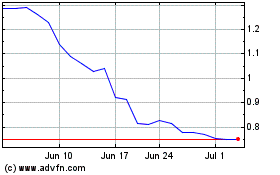

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

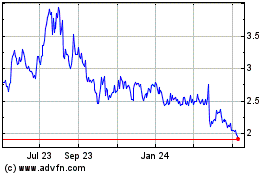

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024