Horizon Bancorp (“Horizon” or the “Company”) (NASDAQ:HBNC) today

announced its unaudited financial results for the three-month

period ended March 31, 2018.

SUMMARY:

- Net income for the quarter ended March 31, 2018 was $12.8

million, or $0.50 diluted earnings per share, compared to $8.2

million, or $0.37 diluted earnings per share, for the quarter ended

March 31, 2017. This represents the highest quarterly net income

and diluted earnings per share in the Company’s 145-year

history.

- Return on average assets was 1.32% for the first quarter of

2018 compared to 1.07% for the first quarter of 2017.

- Return on average equity was 11.29% for the first quarter of

2018 compared to 9.66% for the first quarter of 2017.

- Total loans increased by an annualized rate of 3.4%, or $23.7

million, during the first quarter of 2018.

- Consumer loans increased by an annualized rate of 17.6%, or

$20.0 million, during the first quarter of 2018.

- Residential mortgage loans increased by an annualized rate of

7.6%, or $11.4 million, during the first quarter of 2018.

- Net interest income increased $7.8 million, or 30.7%, to $33.4

million for the three months ended March 31, 2018 compared to $25.6

million for the three months ended March 31, 2017.

- Net interest margin was 3.81% for the three months ended March

31, 2018 compared to 3.80% for the three months ended March 31,

2017.

- Horizon’s tangible book value per share increased to $12.86

compared to $12.72 and $11.79 at December 31, 2017 and March 31,

2017, respectively. This represents the highest tangible book value

per share in the Company’s 145-year history.

Craig Dwight, Chairman and CEO, commented: “We

are pleased to announce record 2018 first quarter earnings of $0.50

diluted earnings per share. Horizon’s net income of $12.8 million

was an increase of $4.6 million, or 55.7%, when compared to the

prior year. Diluted earnings per share increased $0.13 per share,

or 35.1%, to $0.50, for the first quarter of 2018 when compared to

the prior year.”

Dwight continued, “Horizon’s total loans

increased at an annualized rate of 3.4% for the first quarter led

by consumer and mortgage loan annualized growth of 17.6% and 7.6%,

respectively. Our organic loan growth was somewhat tempered during

the first quarter of 2018 due to approximately $64.7 million of

commercial loan payoffs, the majority of which were expected or

requested by Horizon Bank. The Bank originated approximately $116.0

million in commercial loans during the first quarter of 2018;

however, only $41.2 million of these loan originations had been

funded as of March 31, 2018. Horizon’s growth markets of Fort

Wayne, Grand Rapids, Indianapolis and Kalamazoo, grew loans by

$14.8 million, for an annualized rate of 11.8%, during the first

quarter of 2018.”

Mr. Dwight concluded, “As expected, Horizon

started to fully realize the cost savings from our 2017

acquisitions of Lafayette Community Bancorp and Wolverine Bancorp,

Inc. during the first quarter of 2018. Increases in net interest

income and non-interest income of $7.6 million and $759,000,

respectively, more than offset an increase in non-interest expense

of $4.3 million when compared to the prior year helping to improve

our efficiency ratio to 61.92% for the first quarter of 2018

compared to 64.97% for the same period in the prior year. Given

that the first quarter is typically Horizon’s seasonally slow

period, we expect continued growth and further improvement in our

efficiency during the year.”

Income Statement Highlights

Net income for the first quarter of 2018 was

$12.8 million, or $0.50 diluted earnings per share, compared to

$7.6 million, or $0.30 diluted earnings per share, for the fourth

quarter of 2017 and $8.2 million, or $0.37 diluted earnings per

share, for the first quarter of 2017. Excluding acquisition-related

expenses, gain on sale of investment securities, gain on the

accounting for Horizon’s equity interest in Lafayette Community

Bancorp, tax reform bill impact and purchase accounting adjustments

(“core net income”), net income for the first quarter of 2018 was

$11.2 million, or $0.44 diluted earnings per share, compared to

$10.1 million, or $0.40 diluted earnings per share, for the fourth

quarter of 2017 and $7.5 million, or $0.34 diluted earnings per

share, for the first quarter of 2017.

The increase in net income and diluted earnings

per share from the fourth quarter of 2017 to the first quarter of

2018 reflects an increase in net interest income of $2.0 million

and decreases in income tax expense of $3.2 million, provision for

loan losses of $533,000 and non-interest expense of $454,000,

partially offset by a decrease in non-interest income of $1.0

million.

The decrease in non-interest income from the

fourth quarter of 2017 to the first quarter of 2018 was due to

lower fiduciary fees as ESOP fees were lower during the first

quarter of 2018, lower gain on sale of mortgage loans and lower

other income as the previous quarter included $530,000 gain on the

accounting for Horizon’s equity interest in Lafayette Community

Bancorp prior to the 2017 merger.

The increase in net income and diluted earnings

per share from the first quarter of 2017 to the same 2018 period

reflects an increase in net interest income of $7.8 million, an

increase in non-interest income of $759,000 and a decrease in

income tax expense of $531,000, partially offset by increases in

non-interest expense of $4.3 million and provision for loan losses

of $237,000. The increase in diluted earnings per share was due to

an increase in net income of $4.6 million when compared to the

prior year, offset by an increase in average diluted shares

outstanding as a result of issuing shares as part of the

consideration for the acquisitions of Lafayette Community Bancorp

and Wolverine Bancorp, Inc.

| |

| Non-GAAP Reconciliation of Net Income and

Diluted Earnings per Share |

| (Dollars in Thousands, Except per Share Data,

Unaudited) |

| |

Three Months Ended |

| |

March 31 |

|

December 31 |

|

March 31 |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2017 |

|

| Non-GAAP

Reconciliation of Net Income |

|

|

|

|

|

| Net income as

reported |

$ |

12,804 |

|

|

$ |

7,650 |

|

|

$ |

8,224 |

|

| Merger expenses |

|

- |

|

|

|

1,444 |

|

|

|

- |

|

| Tax effect |

|

- |

|

|

|

(418 |

) |

|

|

- |

|

| Net

income excluding merger expenses |

|

12,804 |

|

|

|

8,676 |

|

|

|

8,224 |

|

| |

|

|

|

|

|

| Gain on sale of

investment securities |

|

(11 |

) |

|

|

- |

|

|

|

(35 |

) |

| Tax effect |

|

2 |

|

|

|

- |

|

|

|

12 |

|

| Net

income excluding gain on sale of investment securities |

|

12,795 |

|

|

|

8,676 |

|

|

|

8,201 |

|

| |

|

|

|

|

|

| Gain on remeasurement

of equity interest in Lafayette |

|

- |

|

|

|

(530 |

) |

|

|

- |

|

| Tax effect |

|

- |

|

|

|

78 |

|

|

|

- |

|

| Net

income excluding gain on remeasurement of equity interest in

Lafayette |

|

12,795 |

|

|

|

8,224 |

|

|

|

8,201 |

|

| |

|

|

|

|

|

| Tax reform bill

impact |

|

- |

|

|

|

2,426 |

|

|

|

- |

|

| Net

income excluding tax reform bill impact |

|

12,795 |

|

|

|

10,650 |

|

|

|

8,201 |

|

| |

|

|

|

|

|

| Acquisition-related

purchase accounting adjustments ("PAUs") |

|

(2,037 |

) |

|

|

(868 |

) |

|

|

(1,016 |

) |

| Tax effect |

|

428 |

|

|

|

304 |

|

|

|

356 |

|

| Core Net

Income |

$ |

11,186 |

|

|

$ |

10,086 |

|

|

$ |

7,541 |

|

| |

|

|

|

|

|

| Non-GAAP

Reconciliation of Diluted Earnings per Share |

|

|

|

|

|

| Diluted earnings per

share ("EPS") as reported |

$ |

0.50 |

|

|

$ |

0.30 |

|

|

$ |

0.37 |

|

| Merger expenses |

|

- |

|

|

|

0.06 |

|

|

|

- |

|

| Tax effect |

|

- |

|

|

|

(0.02 |

) |

|

|

- |

|

| Diluted

EPS excluding merger expenses |

|

0.50 |

|

|

|

0.34 |

|

|

|

0.37 |

|

| |

|

|

|

|

|

| Gain on sale of

investment securities |

|

- |

|

|

|

- |

|

|

|

- |

|

| Tax effect |

|

- |

|

|

|

- |

|

|

|

- |

|

| Diluted

EPS excluding gain on sale of investment securities |

|

0.50 |

|

|

|

0.34 |

|

|

|

0.37 |

|

| |

|

|

|

|

|

| Gain on remeasurement

of equity interest in Lafayette |

|

- |

|

|

|

(0.02 |

) |

|

|

- |

|

| Tax effect |

|

- |

|

|

|

- |

|

|

|

- |

|

| Diluted EPS excluding

gain on remeasurement of equity interest in Lafayette |

|

0.50 |

|

|

|

0.32 |

|

|

|

0.37 |

|

| |

|

|

|

|

|

| Tax reform bill

impact |

|

- |

|

|

|

0.10 |

|

|

|

- |

|

| Diluted

EPS excluding tax reform bill impact |

|

0.50 |

|

|

|

0.42 |

|

|

|

0.37 |

|

| |

|

|

|

|

|

| Acquisition-related

PAUs |

|

(0.08 |

) |

|

|

(0.03 |

) |

|

|

(0.05 |

) |

| Tax effect |

|

0.02 |

|

|

|

0.01 |

|

|

|

0.02 |

|

| Core

Diluted EPS |

$ |

0.44 |

|

|

$ |

0.40 |

|

|

$ |

0.34 |

|

| |

|

|

|

|

|

Horizon’s net interest margin increased to 3.81% for the first

quarter of 2018 when compared to 3.71% for the fourth quarter of

2017 and 3.80% for the first quarter of 2017. The increase in net

interest margin from the fourth quarter of 2017 reflects an

increase in the yield of interest-earning assets of 18 basis

points, offset by an increase in the cost of interest-bearing

liabilities of nine basis points. The increase in the yield of

interest-earning assets was due to an increase in the yield on

loans receivable and non-taxable investment securities of 22 and 18

basis points, respectively. The increase in the cost of

interest-bearing liabilities was due to an increase in the cost of

interest-bearing deposits and borrowings of six and nine basis

points, respectively.

The increase in net interest margin from the

first quarter of 2017 reflects an increase in the yield of

interest-earning assets of 22 basis points, offset by an increase

in the cost of interest-bearing liabilities of 26 basis points. The

increase in yield of interest-earning assets was due to an increase

in the yield on loans receivable of 25 basis points. The increase

in cost of interest-bearing liabilities was due to increases in the

cost of interest-bearing deposits and borrowings of 15 and 46 basis

points, respectively.

Excluding acquisition-related purchase

accounting adjustments (“core net interest margin”), the margin was

3.55% for the first quarter of 2018 compared to 3.61% for the prior

quarter and 3.66% for the first quarter of 2017. The decrease in

core net interest margin was due to an increased cost of funding

when comparing the periods. Interest income from

acquisition-related purchase accounting adjustments was $2.0

million, $868,000 and $1.0 million for the three months ended March

31, 2018, December 31, 2017 and March 31, 2017, respectively.

|

|

| Non-GAAP Reconciliation of Net Interest

Margin |

|

| (Dollars in Thousands, Unaudited) |

|

| |

Three Months Ended |

|

| |

March 31 |

|

December 31 |

|

March 31 |

|

| |

|

2018 |

|

|

|

2017 |

|

|

|

2017 |

|

|

| Non-GAAP

Reconciliation of Net Interest Margin |

|

|

|

|

|

|

| Net interest income as

reported |

$ |

33,411 |

|

|

$ |

31,455 |

|

|

$ |

25,568 |

|

|

| |

|

|

|

|

|

|

| Average

interest-earning assets |

|

3,580,143 |

|

|

|

3,471,169 |

|

|

|

2,797,429 |

|

|

| |

|

|

|

|

|

|

| Net interest income as

a percentage of average interest-earning assets ("Net

Interest Margin") |

|

3.81 |

% |

|

|

3.71 |

% |

|

|

3.80 |

% |

|

| |

|

|

|

| Acquisition-related

purchase accounting adjustments ("PAUs") |

|

(2,037 |

) |

|

|

(868 |

) |

|

|

(1,016 |

) |

|

| |

|

|

|

|

|

|

| Core net

interest income |

|

31,374 |

|

|

|

30,587 |

|

|

|

24,552 |

|

|

| |

|

|

|

|

|

|

| Core net

interest margin |

|

3.55 |

% |

|

|

3.61 |

% |

|

|

3.66 |

% |

|

| |

|

|

|

Lending Activity

Total loans increased $23.7 million from $2.835

billion as of December 31, 2017 to $2.859 billion as of March 31,

2018 as consumer loans increased by $20.0 million, residential

mortgage loans increased by $11.4 million and mortgage warehouse

loans increased by $6.8 million. These increases were offset by a

decrease in commercial loans of $13.4 million from December 31,

2017. During the first quarter of 2018, $64.7 million in commercial

loan payoffs occurred, the majority of which were either expected

or requested by the Bank. The Bank originated approximately $116.0

million in commercial loans during the first quarter of 2018;

however, only $41.2 million of these loans funded as of March 31,

2018.

| |

| Loan Growth by Type, Excluding Acquired

Loans |

| (Dollars in Thousands, Unaudited) |

|

|

|

| |

March 31 |

|

December 31 |

|

Amount |

|

Percent |

| |

|

2018 |

|

|

2017 |

|

Change |

|

Change |

| Commercial |

$ |

1,656,374 |

|

$ |

1,669,728 |

|

$ |

(13,354 |

) |

|

-0.8 |

% |

| Residential

mortgage |

|

618,131 |

|

|

606,760 |

|

|

11,371 |

|

|

1.9 |

% |

| Consumer |

|

480,989 |

|

|

460,999 |

|

|

19,990 |

|

|

4.3 |

% |

|

Subtotal |

|

2,755,494 |

|

|

2,737,487 |

|

|

18,007 |

|

|

0.7 |

% |

| Held for sale

loans |

|

1,973 |

|

|

3,094 |

|

|

(1,121 |

) |

|

-36.2 |

% |

| Mortgage warehouse

loans |

|

101,299 |

|

|

94,508 |

|

|

6,791 |

|

|

7.2 |

% |

| Total

loans |

$ |

2,858,766 |

|

$ |

2,835,089 |

|

$ |

23,677 |

|

|

0.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential mortgage lending activity for the three months ended

March 31, 2018 generated $1.4 million in income from the gain on

sale of mortgage loans, a decrease of $565,000 from the fourth

quarter of 2017 and a decrease of $491,000 from the first quarter

of 2017. Total origination volume for the first quarter of 2018,

including loans placed into portfolio, totaled $72.3 million,

representing a decrease of 19.8% from the fourth quarter of 2017

and an increase of 9.7% from the first quarter of 2017. Revenue

derived from Horizon’s residential mortgage lending activities was

only 5.4% of Horizon’s total revenue for the first quarter of

2018.

Purchase money mortgage originations during the

first quarter of 2018 represented 76.6% of total originations

compared to 73.7% of total originations during the fourth quarter

of 2017 and 69.8% during the first quarter of 2017.

The provision for loan losses totaled $567,000

for the first quarter of 2018 compared to $1.1 million for the

fourth quarter of 2017 and $330,000 for the first quarter of 2017.

The decrease in the provision for loan losses from the fourth

quarter of 2017 to the first quarter of 2018 was due to the

reduction in total commercial loans and good credit quality. The

increase in the provision for loan losses from the first quarter of

2017 to the first quarter of 2018 was due to additional general and

non-specific allocations for loan growth in new markets and an

increase in allocation for other economic factors during 2018.

The ratio of the allowance for loan losses to

total loans remained at 0.58% as of March 31, 2018 when compared to

December 31, 2017 and decreased from 0.70% as of March 31, 2017 due

to an increase in gross loans. The ratio of the allowance for loan

losses to total loans, excluding loans with credit-related purchase

accounting adjustments, was 0.77% as of March 31, 2018 compared to

0.81% as of December 31, 2017. Loan loss reserves and

credit-related loan discounts on acquired loans as a percentage of

total loans was 1.15% as of March 31, 2018 compared to 1.23% as of

December 31, 2017.

| |

|

| Non-GAAP Allowance for Loan and Lease Loss

Detail |

|

| As of March 31, 2018 |

|

| (Dollars in Thousands, Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Pre-discount Loan

Balance |

|

Allowance for Loan

Losses (ALLL) |

|

Loan Discount |

|

ALLL +

Loan Discount |

|

Loans, net |

|

ALLL/ Pre-discount

Loan Balance |

|

Loan Discount/

Pre-discount Loan Balance |

|

ALLL + Loan Discount/

Pre-discount Loan Balance |

|

| Horizon Legacy |

$ |

2,152,002 |

|

$ |

16,474 |

|

N/A |

|

$ |

16,474 |

|

$ |

2,135,528 |

|

0.77 |

% |

|

0.00 |

% |

|

0.77 |

% |

|

| Heartland |

|

10,848 |

|

|

- |

|

|

742 |

|

|

742 |

|

|

10,106 |

|

0.00 |

% |

|

6.84 |

% |

|

6.84 |

% |

|

| Summit |

|

35,397 |

|

|

- |

|

|

2,147 |

|

|

2,147 |

|

|

33,250 |

|

0.00 |

% |

|

6.07 |

% |

|

6.07 |

% |

|

| Peoples |

|

105,363 |

|

|

- |

|

|

2,609 |

|

|

2,609 |

|

|

102,754 |

|

0.00 |

% |

|

2.48 |

% |

|

2.48 |

% |

|

| Kosciusko |

|

52,298 |

|

|

- |

|

|

664 |

|

|

664 |

|

|

51,634 |

|

0.00 |

% |

|

1.27 |

% |

|

1.27 |

% |

|

| LaPorte |

|

121,265 |

|

|

- |

|

|

3,445 |

|

|

3,445 |

|

|

117,820 |

|

0.00 |

% |

|

2.84 |

% |

|

2.84 |

% |

|

| CNB |

|

5,561 |

|

|

- |

|

|

152 |

|

|

152 |

|

|

5,409 |

|

0.00 |

% |

|

2.73 |

% |

|

2.73 |

% |

|

| Lafayette |

|

118,829 |

|

|

- |

|

|

2,170 |

|

|

2,170 |

|

|

116,659 |

|

0.00 |

% |

|

1.83 |

% |

|

1.83 |

% |

|

| Wolverine |

|

257,203 |

|

|

- |

|

|

4,346 |

|

|

4,346 |

|

|

252,857 |

|

0.00 |

% |

|

1.69 |

% |

|

1.69 |

% |

|

| Total |

$ |

2,858,766 |

|

$ |

16,474 |

|

$ |

16,275 |

|

$ |

32,749 |

|

$ |

2,826,017 |

|

0.58 |

% |

|

0.57 |

% |

|

1.15 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2018, non-performing loans totaled $15.1

million, which reflects a five basis point decrease in

non-performing loans to total loans, or a $1.3 million decline from

$16.4 million in non-performing loans as of December 31, 2017.

Compared to December 31, 2017, non-performing commercial loans

decreased by $576,000, non-performing real estate loans decreased

by $440,000 and non-performing consumer loans decreased by

$317,000.

Expense Management

Total non-interest expense was $454,000 lower in

the first quarter of 2018 when compared to the fourth quarter of

2017; however, excluding merger-related expenses of $1.4 million

for the three months ended December 31, 2017, total non-interest

expense increased $990,000, or 4.0%. The increase in non-interest

expense, after excluding merger-related expenses, was due to

increases in salaries and employee benefits, net occupancy, data

processing and other expense.

Salaries and employee benefits expense was

$284,000 higher during the first quarter of 2018 when compared to

the fourth quarter of 2017, when adjusted for merger-related

expenses, due to higher employment and unemployment taxes, health

insurance, 401K and supplemental employee retirement plan match

expenses. Employment and unemployment taxes and health insurance

expense is typically higher during the first quarter of the year

due to the nature of these expenses. Expenses related to the

Company’s match on 401K and supplemental employee retirement plans

were higher during the first quarter as a result of the 2017

bonuses paid in March 2018. Net occupancy expense, adjusted for

merger-related expenses, was $499,000 higher during the first

quarter of 2018 when compared to the fourth quarter of 2017 due to

an increase in snow removal costs and market expansions. Data

processing and other expense increased $124,000 and $177,000,

respectively, when adjusted for merger-related expenses, due to

market expansions and recent acquisitions. These increases were

offset by a decrease in loan expense of $141,000 due to a decrease

in collection-related expenses when comparing the first quarter of

2018 to the fourth quarter of 2017.

Total non-interest expense was $4.3 million

higher in the first quarter of 2018 compared to the same period of

2017. The increase was primarily due to an increase in salaries and

employee benefits of $2.7 million, other expenses of $526,000, net

occupancy expenses of $514,000, data processing expenses of

$389,000 and loan expense of $150,000. The increase in salaries and

employee benefits reflects overall company growth and recent

acquisitions. Other expense and data processing increased as a

result of market expansions and acquisitions. Net occupancy expense

increased due to increased snow removal costs incurred in 2018,

along with market expansions and acquisitions. Loan expense

increased due to a higher level of loan originations in the first

quarter of 2018 when compared to the same period of 2017.

Income tax expense totaled $2.5 million for the first quarter of

2018, a decrease of $3.2 million and $531,000 when compared to the

fourth quarter and first quarter of 2017, respectively. The

decrease was primarily due to the impact of the new corporate tax

rate which was signed into law at the end of 2017. An adjustment to

Horizon’s net deferred tax asset of $2.4 million ($1.7 million of

net deferred tax assets and $766,000 of net deferred tax assets

related to accumulated other comprehensive income) was recorded to

income tax expense during the fourth quarter of 2017 to reflect the

new corporate tax rate.

Use of Non-GAAP Financial Measures

Certain information set forth in this press

release refers to financial measures determined by methods other

than in accordance with GAAP. Specifically, we have included

non-GAAP financial measures relating to net income, diluted

earnings per share, net interest margin, total loans and loan

growth, the allowance for loan and lease losses, tangible

stockholders’ equity, tangible book value per share, the return on

average assets and the return on average equity. In each case, we

have identified special circumstances that we consider to be

non-recurring and have excluded them, to show the impact of such

events as acquisition-related purchase accounting adjustments,

prepayment penalties on borrowings and the tax reform bill, among

others we have identified in our reconciliations. Horizon believes

that these non-GAAP financial measures are helpful to investors and

provide a greater understanding of our business without giving

effect to the purchase accounting impacts and one-time costs of

acquisitions and non-core items. These measures are not necessarily

comparable to similar measures that may be presented by other

companies and should not be considered in isolation or as a

substitute for the related GAAP measure. See the tables and

other information below and contained elsewhere in this press

release for reconciliations of the non-GAAP figures identified

herein and their most comparable GAAP measures.

| |

|

|

|

|

|

|

|

|

|

| Non-GAAP Reconciliation of Tangible

Stockholders' Equity and Tangible Book Value per

Share |

| (Dollars in Thousands Except per Share Data,

Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

March 31 |

| |

|

2018 |

|

|

2017 |

|

|

2017 |

|

|

2017 |

|

|

2017 |

| Total stockholders'

equity |

$ |

460,416 |

|

$ |

457,078 |

|

$ |

392,055 |

|

$ |

357,259 |

|

$ |

348,575 |

| Less: Intangible

assets |

|

131,724 |

|

|

132,282 |

|

|

103,244 |

|

|

86,726 |

|

|

87,094 |

| Total tangible

stockholders' equity |

$ |

328,692 |

|

$ |

324,796 |

|

$ |

288,811 |

|

$ |

270,533 |

|

$ |

261,481 |

| |

|

|

|

|

|

|

|

|

|

| Common shares

outstanding |

|

25,555,235 |

|

|

25,529,819 |

|

|

23,325,459 |

|

|

22,176,465 |

|

|

22,176,465 |

| |

|

|

|

|

|

|

|

|

|

| Tangible book value per

common share |

$ |

12.86 |

|

$ |

12.72 |

|

$ |

12.38 |

|

$ |

12.20 |

|

$ |

11.79 |

|

|

| Non-GAAP Reconciliation of Return on Average

Assets and Return on Average Common Equity |

| (Dollars in Thousands, Unaudited) |

| |

Three Months Ended |

| |

March 31 |

|

December 31 |

|

March 31 |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2017 |

|

| Non-GAAP

Reconciliation of Return on Average Assets |

|

|

|

|

|

| Average Assets |

$ |

3,942,837 |

|

|

$ |

3,841,551 |

|

|

$ |

3,103,468 |

|

| |

|

|

|

|

|

| Return on average

assets ("ROAA") as reported |

|

1.32 |

% |

|

|

0.79 |

% |

|

|

1.07 |

% |

| Merger expenses |

|

0.00 |

% |

|

|

0.15 |

% |

|

|

0.00 |

% |

| Tax effect |

|

0.00 |

% |

|

|

-0.04 |

% |

|

|

0.00 |

% |

| ROAA

excluding merger expenses |

|

1.32 |

% |

|

|

0.90 |

% |

|

|

1.07 |

% |

| |

|

|

|

|

|

| Gain on sale of

investment securities |

|

0.00 |

% |

|

|

0.00 |

% |

|

|

0.00 |

% |

| Tax effect |

|

0.00 |

% |

|

|

0.00 |

% |

|

|

0.00 |

% |

| ROAA

excluding gain on sale of investment securities |

|

1.32 |

% |

|

|

0.90 |

% |

|

|

1.07 |

% |

| |

|

|

|

|

|

| Gain on remeasurement

of equity interest in Lafayette |

|

0.00 |

% |

|

|

-0.05 |

% |

|

|

0.00 |

% |

| Tax effect |

|

0.00 |

% |

|

|

0.01 |

% |

|

|

0.00 |

% |

| ROAA

excluding gain on remeasurement of equity interest in

Lafayette |

|

1.32 |

% |

|

|

0.86 |

% |

|

|

1.07 |

% |

| |

|

|

|

|

|

| Tax reform bill

impact |

|

0.00 |

% |

|

|

0.25 |

% |

|

|

0.00 |

% |

| ROAA

excluding tax reform bill impact |

|

1.32 |

% |

|

|

1.11 |

% |

|

|

1.07 |

% |

| |

|

|

|

|

|

| Acquisition-related

purchase accounting adjustments (PAUs) |

|

-0.21 |

% |

|

|

-0.09 |

% |

|

|

-0.13 |

% |

| Tax effect |

|

0.04 |

% |

|

|

0.03 |

% |

|

|

0.05 |

% |

| Core

ROAA |

|

1.15 |

% |

|

|

1.05 |

% |

|

|

0.99 |

% |

| |

|

|

|

|

|

| Non-GAAP

Reconciliation of Return on Average Common Equity |

|

|

|

|

|

| Average Common

Equity |

$ |

460,076 |

|

|

$ |

449,318 |

|

|

$ |

345,092 |

|

| |

|

|

|

|

|

| Return on average

common equity ("ROACE") as reported |

|

11.29 |

% |

|

|

6.75 |

% |

|

|

9.66 |

% |

| Merger expenses |

|

0.00 |

% |

|

|

1.28 |

% |

|

|

0.00 |

% |

| Tax effect |

|

0.00 |

% |

|

|

-0.37 |

% |

|

|

0.00 |

% |

| ROACE

excluding merger expenses |

|

11.29 |

% |

|

|

7.66 |

% |

|

|

9.66 |

% |

| |

|

|

|

|

|

| Gain on sale of

investment securities |

|

-0.01 |

% |

|

|

0.00 |

% |

|

|

-0.04 |

% |

| Tax effect |

|

0.00 |

% |

|

|

0.00 |

% |

|

|

0.01 |

% |

| ROACE

excluding gain on sale of investment securities |

|

11.28 |

% |

|

|

7.66 |

% |

|

|

9.63 |

% |

| |

|

|

|

|

|

| Gain on remeasurement

of equity interest in Lafayette |

|

0.00 |

% |

|

|

-0.47 |

% |

|

|

0.00 |

% |

| Tax effect |

|

0.00 |

% |

|

|

0.07 |

% |

|

|

0.00 |

% |

| ROACE

excluding gain on remeasurement of equity interest in

Lafayette |

|

11.28 |

% |

|

|

7.26 |

% |

|

|

9.63 |

% |

| |

|

|

|

|

|

| Tax reform bill

impact |

|

0.00 |

% |

|

|

2.14 |

% |

|

|

0.00 |

% |

| ROACE

excluding tax reform bill impact |

|

11.28 |

% |

|

|

9.40 |

% |

|

|

9.63 |

% |

| |

|

|

|

|

|

| Acquisition-related

purchase accounting adjustments ("PAUs") |

|

-1.80 |

% |

|

|

-0.77 |

% |

|

|

-1.19 |

% |

| Tax effect |

|

0.38 |

% |

|

|

0.27 |

% |

|

|

0.42 |

% |

| Core

ROACE |

|

9.86 |

% |

|

|

8.90 |

% |

|

|

8.86 |

% |

| |

|

|

|

|

|

About Horizon

Horizon Bancorp is an independent, commercial

bank holding company serving northern and central Indiana, and

southern, central and the Great Lakes Bay regions of Michigan

through its commercial banking subsidiary Horizon Bank. Horizon

also offers mortgage-banking services throughout the Midwest.

Horizon Bancorp may be reached online at www.horizonbank.com.

Its common stock is traded on the NASDAQ Global Select Market under

the symbol HBNC.

Forward Looking Statements

This press release may contain forward-looking

statements regarding the financial performance, business prospects,

growth and operating strategies of Horizon. For these

statements, Horizon claims the protections of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. Statements in this press

release should be considered in conjunction with the other

information available about Horizon, including the information in

the filings we make with the Securities and Exchange Commission.

Forward-looking statements provide current expectations or

forecasts of future events and are not guarantees of future

performance. The forward-looking statements are based on

management’s expectations and are subject to a number of risks and

uncertainties. We have tried, wherever possible, to identify

such statements by using words such as “anticipate,” “estimate,”

“project,” “intend,” “plan,” “believe,” “will” and similar

expressions in connection with any discussion of future operating

or financial performance.

Although management believes that the

expectations reflected in such forward-looking statements are

reasonable, actual results may differ materially from those

expressed or implied in such statements. Risks and

uncertainties that could cause actual results to differ materially

include risk factors relating to the banking industry and the other

factors detailed from time to time in Horizon’s reports filed with

the Securities and Exchange Commission, including those described

in its Form 10-K. Undue reliance should not be placed on the

forward-looking statements, which speak only as of the date hereof.

Horizon does not undertake, and specifically disclaims any

obligation, to publicly release the result of any revisions that

may be made to update any forward-looking statement to reflect the

events or circumstances after the date on which the forward-looking

statement is made, or reflect the occurrence of unanticipated

events, except to the extent required by law.

Contact: Horizon BancorpMark E.

SecorChief Financial Officer(219)

873-2611

Fax: (219) 874-9280

|

|

| HORIZON BANCORP |

| Financial Highlights |

| (Dollars in thousands except share and per

share data and ratios, Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

March 31 |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2017 |

|

|

|

2017 |

|

|

|

2017 |

|

| Balance

sheet: |

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

3,969,750 |

|

|

$ |

3,964,303 |

|

|

$ |

3,519,501 |

|

|

$ |

3,321,178 |

|

|

$ |

3,169,643 |

|

| Investment

securities |

|

714,425 |

|

|

|

710,113 |

|

|

|

708,449 |

|

|

|

704,525 |

|

|

|

673,090 |

|

| Commercial loans |

|

1,656,374 |

|

|

|

1,669,728 |

|

|

|

1,322,953 |

|

|

|

1,190,502 |

|

|

|

1,148,277 |

|

| Mortgage warehouse

loans |

|

101,299 |

|

|

|

94,508 |

|

|

|

95,483 |

|

|

|

123,757 |

|

|

|

89,360 |

|

| Residential mortgage

loans |

|

618,131 |

|

|

|

606,760 |

|

|

|

571,062 |

|

|

|

549,997 |

|

|

|

533,646 |

|

| Consumer loans |

|

480,989 |

|

|

|

460,999 |

|

|

|

436,327 |

|

|

|

403,468 |

|

|

|

375,670 |

|

| Earnings assets |

|

3,591,296 |

|

|

|

3,563,307 |

|

|

|

3,153,230 |

|

|

|

2,990,924 |

|

|

|

2,845,922 |

|

| Non-interest bearing

deposit accounts |

|

602,175 |

|

|

|

601,805 |

|

|

|

563,536 |

|

|

|

508,305 |

|

|

|

502,400 |

|

| Interest bearing

transaction accounts |

|

1,619,859 |

|

|

|

1,712,246 |

|

|

|

1,536,169 |

|

|

|

1,401,407 |

|

|

|

1,432,228 |

|

| Time deposits |

|

711,642 |

|

|

|

566,952 |

|

|

|

508,570 |

|

|

|

452,208 |

|

|

|

509,071 |

|

| Borrowings |

|

520,300 |

|

|

|

564,157 |

|

|

|

458,152 |

|

|

|

485,304 |

|

|

|

319,993 |

|

| Subordinated

debentures |

|

37,699 |

|

|

|

37,653 |

|

|

|

37,607 |

|

|

|

37,562 |

|

|

|

37,516 |

|

| Total stockholders'

equity |

|

460,416 |

|

|

|

457,078 |

|

|

|

392,055 |

|

|

|

357,259 |

|

|

|

348,575 |

|

| |

|

|

|

|

|

|

|

|

| |

Three months ended |

| Income

statement: |

|

| Net interest

income |

$ |

33,411 |

|

|

$ |

31,455 |

|

|

$ |

27,879 |

|

|

$ |

27,198 |

|

|

$ |

25,568 |

|

| Provision for loan

losses |

|

567 |

|

|

|

1,100 |

|

|

|

710 |

|

|

|

330 |

|

|

|

330 |

|

| Non-interest

income |

|

8,318 |

|

|

|

9,344 |

|

|

|

8,021 |

|

|

|

8,212 |

|

|

|

7,559 |

|

| Non-interest

expenses |

|

25,837 |

|

|

|

26,291 |

|

|

|

24,513 |

|

|

|

22,488 |

|

|

|

21,521 |

|

| Income tax expense |

|

2,521 |

|

|

|

5,758 |

|

|

|

2,506 |

|

|

|

3,520 |

|

|

|

3,052 |

|

| Net income |

$ |

12,804 |

|

|

$ |

7,650 |

|

|

$ |

8,171 |

|

|

$ |

9,072 |

|

|

$ |

8,224 |

|

| |

|

|

|

|

|

|

|

|

| Per share

data: |

|

|

|

|

|

|

|

|

|

| Basic earnings per

share |

$ |

0.50 |

|

|

$ |

0.30 |

|

|

$ |

0.36 |

|

|

$ |

0.41 |

|

|

$ |

0.37 |

|

| Diluted earnings per

share |

|

0.50 |

|

|

|

0.30 |

|

|

|

0.36 |

|

|

|

0.41 |

|

|

|

0.37 |

|

| Cash dividends declared

per common share |

|

0.15 |

|

|

|

0.13 |

|

|

|

0.13 |

|

|

|

0.13 |

|

|

|

0.11 |

|

| Book value per common

share |

|

18.02 |

|

|

|

17.90 |

|

|

|

16.81 |

|

|

|

16.11 |

|

|

|

15.72 |

|

| Tangible book value per

common share |

|

12.86 |

|

|

|

12.72 |

|

|

|

12.38 |

|

|

|

12.20 |

|

|

|

11.79 |

|

| Market value -

high |

|

30.88 |

|

|

|

29.21 |

|

|

|

29.17 |

|

|

|

27.50 |

|

|

|

28.09 |

|

| Market value - low |

$ |

26.80 |

|

|

$ |

25.99 |

|

|

$ |

25.30 |

|

|

$ |

24.73 |

|

|

$ |

24.91 |

|

| Weighted average shares

outstanding - Basic |

|

25,537,597 |

|

|

|

25,140,800 |

|

|

|

22,580,160 |

|

|

|

22,176,465 |

|

|

|

22,175,526 |

|

| Weighted average shares

outstanding - Diluted |

|

25,645,874 |

|

|

|

25,264,675 |

|

|

|

22,715,273 |

|

|

|

22,322,390 |

|

|

|

22,326,071 |

|

| |

|

|

|

|

|

|

|

|

| Key

ratios: |

|

|

|

|

|

|

|

|

|

| Return on average

assets |

|

1.32 |

% |

|

|

0.79 |

% |

|

|

0.96 |

% |

|

|

1.12 |

% |

|

|

1.07 |

% |

| Return on average

common stockholders' equity |

|

11.29 |

|

|

|

6.75 |

|

|

|

8.92 |

|

|

|

10.24 |

|

|

|

9.66 |

|

| Net interest

margin |

|

3.81 |

|

|

|

3.71 |

|

|

|

3.71 |

|

|

|

3.84 |

|

|

|

3.80 |

|

| Loan loss reserve to

total loans |

|

0.58 |

|

|

|

0.58 |

|

|

|

0.64 |

|

|

|

0.66 |

|

|

|

0.70 |

|

| Average equity to

average assets |

|

11.67 |

|

|

|

11.70 |

|

|

|

10.74 |

|

|

|

10.94 |

|

|

|

11.12 |

|

| Bank only capital

ratios: |

|

|

|

|

|

|

|

|

|

| Tier 1

capital to average assets |

|

9.66 |

|

|

|

9.89 |

|

|

|

9.90 |

|

|

|

9.77 |

|

|

|

10.13 |

|

| Tier 1

capital to risk weighted assets |

|

12.32 |

|

|

|

12.29 |

|

|

|

12.33 |

|

|

|

12.69 |

|

|

|

13.22 |

|

| Total

capital to risk weighted assets |

|

12.87 |

|

|

|

12.85 |

|

|

|

12.93 |

|

|

|

13.31 |

|

|

|

13.87 |

|

| |

|

|

|

|

|

|

|

|

| Loan

data: |

|

|

|

|

|

|

|

|

|

| Substandard loans |

$ |

43,035 |

|

|

$ |

46,162 |

|

|

$ |

36,883 |

|

|

$ |

34,870 |

|

|

$ |

30,865 |

|

| 30 to 89 days

delinquent |

|

8,932 |

|

|

|

9,329 |

|

|

|

6,284 |

|

|

|

4,555 |

|

|

|

5,476 |

|

| |

|

|

|

|

|

|

|

|

|

| 90 days and greater

delinquent - accruing interest |

$ |

30 |

|

|

$ |

167 |

|

|

$ |

162 |

|

|

$ |

160 |

|

|

$ |

245 |

|

| Trouble debt

restructures - accruing interest |

|

1,899 |

|

|

|

1,958 |

|

|

|

2,015 |

|

|

|

1,924 |

|

|

|

1,647 |

|

| Trouble debt

restructures - non-accrual |

|

1,090 |

|

|

|

1,013 |

|

|

|

1,192 |

|

|

|

668 |

|

|

|

998 |

|

| Non-accrual loans |

|

12,062 |

|

|

|

13,276 |

|

|

|

9,065 |

|

|

|

8,811 |

|

|

|

6,944 |

|

| Total non-performing

loans |

$ |

15,081 |

|

|

$ |

16,414 |

|

|

$ |

12,434 |

|

|

$ |

11,563 |

|

|

$ |

9,834 |

|

| Non-performing loans to

total loans |

|

0.53 |

% |

|

|

0.58 |

% |

|

|

0.51 |

% |

|

|

0.51 |

% |

|

|

0.46 |

% |

| |

| HORIZON BANCORP |

| |

| Allocation of the Allowance for Loan and Lease

Losses |

| (Dollars in Thousands, Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

March 31 |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2017 |

|

|

|

2017 |

|

|

|

2017 |

|

| Commercial |

$ |

7,840 |

|

|

$ |

9,093 |

|

|

$ |

8,335 |

|

|

$ |

8,312 |

|

|

$ |

8,071 |

|

| Real estate |

|

1,930 |

|

|

|

2,188 |

|

|

|

2,129 |

|

|

|

2,129 |

|

|

|

1,697 |

|

| Mortgage

warehousing |

|

1,030 |

|

|

|

1,030 |

|

|

|

1,048 |

|

|

|

1,048 |

|

|

|

1,042 |

|

| Consumer |

|

5,674 |

|

|

|

4,083 |

|

|

|

4,074 |

|

|

|

4,097 |

|

|

|

4,244 |

|

|

Total |

$ |

16,474 |

|

|

$ |

16,394 |

|

|

$ |

15,586 |

|

|

$ |

15,586 |

|

|

$ |

15,054 |

|

| |

|

|

|

|

|

|

|

|

| |

| Net Charge-Offs (Recoveries) |

| (Dollars in Thousands, Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

March 31 |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2017 |

|

|

|

2017 |

|

|

|

2017 |

|

| Commercial |

$ |

(38 |

) |

|

$ |

84 |

|

|

$ |

158 |

|

|

$ |

219 |

|

|

$ |

(130 |

) |

| Real estate |

|

6 |

|

|

|

(9 |

) |

|

|

24 |

|

|

|

(8 |

) |

|

|

38 |

|

| Mortgage

warehousing |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Consumer |

|

519 |

|

|

|

217 |

|

|

|

(31 |

) |

|

|

146 |

|

|

|

205 |

|

|

Total |

$ |

487 |

|

|

$ |

292 |

|

|

$ |

151 |

|

|

$ |

357 |

|

|

$ |

113 |

|

| Percent of net

charge-offs to average loans outstanding for the period |

|

0.02 |

% |

|

|

0.01 |

% |

|

|

0.01 |

% |

|

|

0.02 |

% |

|

|

0.01 |

% |

| |

|

|

|

|

|

|

|

|

| |

| Total Non-performing Loans |

| (Dollars in Thousands, Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

March 31 |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2017 |

|

|

|

2017 |

|

|

|

2017 |

|

| Commercial |

$ |

6,778 |

|

|

$ |

7,354 |

|

|

$ |

3,582 |

|

|

$ |

3,033 |

|

|

$ |

1,783 |

|

| Real estate |

|

5,276 |

|

|

|

5,716 |

|

|

|

5,545 |

|

|

|

5,285 |

|

|

|

5,057 |

|

| Mortgage

warehousing |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Consumer |

|

3,027 |

|

|

|

3,344 |

|

|

|

3,307 |

|

|

|

3,245 |

|

|

|

2,994 |

|

|

Total |

$ |

15,081 |

|

|

$ |

16,414 |

|

|

$ |

12,434 |

|

|

$ |

11,563 |

|

|

$ |

9,834 |

|

| Non-performing loans to

total loans |

|

0.53 |

% |

|

|

0.58 |

% |

|

|

0.51 |

% |

|

|

0.51 |

% |

|

|

0.46 |

% |

| |

|

|

|

|

|

|

|

|

| |

| Other Real Estate Owned and Repossessed

Assets |

| (Dollars in Thousands, Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

March 31 |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2017 |

|

|

|

2017 |

|

|

|

2017 |

|

| Commercial |

$ |

547 |

|

|

$ |

578 |

|

|

$ |

324 |

|

|

$ |

409 |

|

|

$ |

542 |

|

| Real estate |

|

281 |

|

|

|

200 |

|

|

|

1,443 |

|

|

|

1,805 |

|

|

|

2,413 |

|

| Mortgage

warehousing |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Consumer |

|

42 |

|

|

|

60 |

|

|

|

26 |

|

|

|

21 |

|

|

|

20 |

|

|

Total |

$ |

870 |

|

|

$ |

838 |

|

|

$ |

1,793 |

|

|

$ |

2,235 |

|

|

$ |

2,975 |

|

| |

|

|

|

|

|

|

|

|

|

|

| HORIZON BANCORP AND SUBSIDIARIES |

| Average Balance Sheets |

| (Dollar Amounts in Thousands, Unaudited) |

|

|

| |

Three Months Ended |

|

Three Months Ended |

| |

March 31, 2018 |

|

March 31, 2017 |

| |

Average Balance |

|

Interest |

|

Average Rate |

|

Average Balance |

|

Interest |

|

Average Rate |

| |

Assets |

|

| |

Interest-earning

assets |

|

| |

Federal

funds sold |

$ |

3,714 |

|

|

$ |

14 |

|

1.53 |

% |

|

$ |

3,034 |

|

|

$ |

5 |

|

0.67 |

% |

| |

Interest-earning deposits |

|

22,962 |

|

|

|

90 |

|

1.59 |

% |

|

|

24,748 |

|

|

|

69 |

|

1.13 |

% |

| |

Investment securities - taxable |

|

421,068 |

|

|

|

2,326 |

|

2.24 |

% |

|

|

398,871 |

|

|

|

2,332 |

|

2.37 |

% |

| |

Investment securities - non-taxable(1) |

|

307,921 |

|

|

|

1,865 |

|

2.88 |

% |

|

|

270,522 |

|

|

|

1,637 |

|

3.41 |

% |

| |

Loans

receivable(2)(3) |

|

2,824,478 |

|

|

|

35,131 |

|

5.04 |

% |

|

|

2,100,254 |

|

|

|

24,791 |

|

4.79 |

% |

| |

Total

interest-earning assets(1) |

|

3,580,143 |

|

|

|

39,426 |

|

4.50 |

% |

|

|

2,797,429 |

|

|

|

28,834 |

|

4.28 |

% |

|

|

| |

Non-interest-earning

assets |

|

| |

Cash and

due from banks |

|

43,809 |

|

|

|

40,994 |

|

|

| |

Allowance

for loan losses |

|

(16,342 |

) |

|

|

(14,937 |

) |

|

| |

Other

assets |

|

335,227 |

|

|

|

279,982 |

|

|

|

|

| |

Total

average assets |

$ |

3,942,837 |

|

|

$ |

3,103,468 |

|

|

|

|

| |

Liabilities and

Stockholders' Equity |

|

| |

Interest-bearing

liabilities |

|

| |

Interest-bearing deposits |

$ |

2,304,829 |

|

|

$ |

2,871 |

|

0.51 |

% |

|

$ |

1,960,337 |

|

|

$ |

1,753 |

|

0.36 |

% |

| |

Borrowings |

|

528,066 |

|

|

|

2,572 |

|

1.98 |

% |

|

|

249,923 |

|

|

|

937 |

|

1.52 |

% |

| |

Subordinated debentures |

|

36,477 |

|

|

|

572 |

|

6.36 |

% |

|

|

36,290 |

|

|

|

576 |

|

6.44 |

% |

| |

Total

interest-bearing liabilities |

|

2,869,372 |

|

|

|

6,015 |

|

0.85 |

% |

|

|

2,246,550 |

|

|

|

3,266 |

|

0.59 |

% |

|

|

| |

Non-interest-bearing liabilities |

|

| |

Demand

deposits |

|

595,644 |

|

|

|

491,154 |

|

|

| |

Accrued

interest payable and other liabilities |

|

17,745 |

|

|

|

20,672 |

|

|

| |

Stockholders'

equity |

|

460,076 |

|

|

|

345,092 |

|

|

|

|

| |

Total average

liabilities and stockholders' equity |

$ |

3,942,837 |

|

|

$ |

3,103,468 |

|

|

|

|

| |

Net interest

income/spread |

|

$ |

33,411 |

|

3.65 |

% |

|

$ |

25,568 |

|

3.69 |

% |

| |

Net interest income as

a percentage of average interest-earning assets(1) |

|

3.81 |

% |

|

3.80 |

% |

|

|

|

(1) |

|

Securities balances represent daily average balances for the

fair value of securities. The average rate is calculated based on

the daily average balance for the amortized cost of

securities. The average rate is presented on a tax equivalent

basis. |

|

(2) |

|

Includes fees on loans. The inclusion of loan fees does not

have a material effect on the average interest rate. |

|

(3) |

|

Non-accruing loans for the purpose of the computations above

are included in the daily average loan amounts outstanding. Loan

totals are shown net of unearned income and deferred loan fees. The

average rate is presented on a tax equivalent basis. |

| |

| HORIZON BANCORP AND SUBSIDIARIES |

| Condensed Consolidated Balance

Sheets |

| (Dollar Amounts in Thousands) |

| |

| |

March 31 |

|

December 31 |

| |

|

2018 |

|

|

|

2017 |

|

| |

(Unaudited) |

|

|

|

Assets |

|

|

|

| Cash and

due from banks |

$ |

63,591 |

|

|

$ |

76,441 |

|

|

Investment securities, available for sale |

|

507,736 |

|

|

|

509,665 |

|

|

Investment securities, held to maturity (fair value of $203,896 and

$201,085) |

|

206,689 |

|

|

|

200,448 |

|

| Loans

held for sale |

|

1,973 |

|

|

|

3,094 |

|

| Loans,

net of allowance for loan losses of $16,474 and $16,394 |

|

2,840,319 |

|

|

|

2,815,601 |

|

| Premises

and equipment, net |

|

75,408 |

|

|

|

75,529 |

|

| Federal

Home Loan Bank stock |

|

18,105 |

|

|

|

18,105 |

|

|

Goodwill |

|

119,880 |

|

|

|

119,880 |

|

| Other

intangible assets |

|

11,844 |

|

|

|

12,402 |

|

| Interest

receivable |

|

12,044 |

|

|

|

16,244 |

|

| Cash

value of life insurance |

|

76,366 |

|

|

|

75,931 |

|

| Other

assets |

|

35,795 |

|

|

|

40,963 |

|

| Total

assets |

$ |

3,969,750 |

|

|

$ |

3,964,303 |

|

|

Liabilities |

|

|

|

|

Deposits |

|

|

|

|

Non-interest bearing |

$ |

602,175 |

|

|

$ |

601,805 |

|

| Interest

bearing |

|

2,331,501 |

|

|

|

2,279,198 |

|

| Total

deposits |

|

2,933,676 |

|

|

|

2,881,003 |

|

|

Borrowings |

|

520,300 |

|

|

|

564,157 |

|

|

Subordinated debentures |

|

37,699 |

|

|

|

37,653 |

|

| Interest

payable |

|

1,216 |

|

|

|

886 |

|

| Other

liabilities |

|

16,443 |

|

|

|

23,526 |

|

| Total

liabilities |

|

3,509,334 |

|

|

|

3,507,225 |

|

| Commitments and

contingent liabilities |

|

|

|

| Stockholders’

Equity |

|

|

|

| Preferred

stock, Authorized, 1,000,000 shares, Issued 0 shares |

|

- |

|

|

|

- |

|

| Common

stock, no par value, Authorized 66,000,000 shares |

|

|

|

| Issued,

25,580,304 and 25,549,069 shares, Outstanding 25,555,235 and

25,529,819 shares |

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

275,302 |

|

|

|

275,059 |

|

| Retained

earnings |

|

195,292 |

|

|

|

185,570 |

|

|

Accumulated other comprehensive loss |

|

(10,178 |

) |

|

|

(3,551 |

) |

| Total

stockholders’ equity |

|

460,416 |

|

|

|

457,078 |

|

| Total

liabilities and stockholders’ equity |

$ |

3,969,750 |

|

|

$ |

3,964,303 |

|

| |

|

|

|

| |

| HORIZON BANCORP AND SUBSIDIARIES |

| Condensed Consolidated Statements of

Income |

| (Dollar Amounts in Thousands, Except Per Share Data,

Unaudited) |

| |

| |

Three Months Ended |

| |

March 31 |

| |

|

2018 |

|

|

2017 |

|

Interest Income |

|

|

|

| Loans

receivable |

$ |

35,131 |

|

$ |

24,791 |

|

Investment securities |

|

|

|

|

Taxable |

|

2,430 |

|

|

2,406 |

| Tax

exempt |

|

1,865 |

|

|

1,637 |

| Total

interest income |

|

39,426 |

|

|

28,834 |

|

Interest Expense |

|

|

|

|

Deposits |

|

2,871 |

|

|

1,753 |

| Borrowed

funds |

|

2,572 |

|

|

937 |

|

Subordinated debentures |

|

572 |

|

|

576 |

| Total

interest expense |

|

6,015 |

|

|

3,266 |

|

Net Interest Income |

|

33,411 |

|

|

25,568 |

| Provision

for loan losses |

|

567 |

|

|

330 |

|

Net Interest Income after Provision for Loan

Losses |

|

32,844 |

|

|

25,238 |

|

Non-interest Income |

|

|

|

| Service

charges on deposit accounts |

|

1,888 |

|

|

1,400 |

| Wire

transfer fees |

|

150 |

|

|

150 |

|

Interchange fees |

|

1,328 |

|

|

1,176 |

| Fiduciary

activities |

|

1,925 |

|

|

1,922 |

| Gains

(losses) on sale of investment securities (includes |

|

|

|

| $11 and

$35 for the three months ended March 31, 2018 and 2017,

respectively, related to accumulated other comprehensive earnings

reclassifications) |

|

11 |

|

|

35 |

| Gain on

sale of mortgage loans |

|

1,423 |

|

|

1,914 |

| Mortgage

servicing income net of impairment |

|

349 |

|

|

447 |

| Increase

in cash value of bank owned life insurance |

|

435 |

|

|

464 |

| Other

income |

|

809 |

|

|

51 |

| Total

non-interest income |

|

8,318 |

|

|

7,559 |

|

Non-interest Expense |

|

|

|

| Salaries

and employee benefits |

|

14,373 |

|

|

11,709 |

| Net

occupancy expenses |

|

2,966 |

|

|

2,452 |

| Data

processing |

|

1,696 |

|

|

1,307 |

|

Professional fees |

|

501 |

|

|

613 |

| Outside

services and consultants |

|

1,264 |

|

|

1,222 |

| Loan

expense |

|

1,257 |

|

|

1,107 |

| FDIC

insurance expense |

|

310 |

|

|

263 |

| Other

losses |

|

146 |

|

|

50 |

| Other

expense |

|

3,324 |

|

|

2,798 |

| Total

non-interest expense |

|

25,837 |

|

|

21,521 |

|

Income Before Income

Tax |

|

15,325 |

|

|

11,276 |

| Income

tax expense (includes $2 and $12 for the three months ended |

|

|

|

| March 31,

2018 and 2017, respectively, related to income tax expense from

reclassification items) |

|

2,521 |

|

|

3,052 |

|

Net Income |

$ |

12,804 |

|

$ |

8,224 |

|

Basic Earnings Per Share |

$ |

0.50 |

|

$ |

0.37 |

|

Diluted Earnings Per Share |

|

0.50 |

|

|

0.37 |

| |

|

|

|

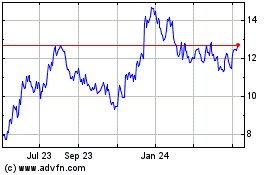

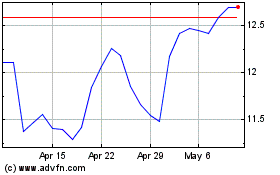

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024