By Steven Russolillo and Alexandra Wexler

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 23, 2018).

One of the oldest and largest investors in Tencent Holdings Ltd.

is selling close to $10 billion of shares in the Chinese internet

giant, reducing one of the world's most lucrative tech bets at a

time of turbulence for the sector.

Naspers Ltd., a South African media and internet firm, said

Thursday it will sell 190 million shares of Tencent, cutting its

stake in the company to 31.2% from 33.2%. The stock was priced at

405 Hong Kong dollars (US$52) a share on Friday morning in Hong

Kong, a 7.8% discount to Tencent's closing price the previous

day.

The sale represents a windfall for Naspers, which paid just $34

million for its Tencent stake in 2001 -- before it went public -- a

position that is now valued at roughly $175 billion. It hadn't sold

any of its Tencent stock before and said it won't sell any more of

its shares for at least three years.

Tencent, best known in China for its WeChat messaging app and

being the world's largest videogame publisher by revenue, has

surged to become one of the world's most valuable technology

companies. Its shares have nearly doubled over the past year,

catapulting the company's market capitalization to about $532

billion, putting it ahead of Facebook Inc. and Berkshire Hathaway

Inc.

Tencent's shares fell 5% on Thursday in Hong Kong after the

company's quarterly results, reported a day earlier, showed slowing

revenue growth from mobile and PC games, one of its main profit

drivers.

A Tencent representative said the company was aware of Naspers's

intention to sell a stake and said the company's company's

commitment to not sell any more shares for several years "indicates

confidence in our long-term growth and management."

Naspers, which has become Africa's most valuable company in

large part because of its Tencent stake, said it would use the

proceeds from the share sale to invest in its classifieds, online

food delivery and financial-technology businesses, as well as to

pursue other growth opportunities. Naspers shares dropped about 8%

in response to the news and another 4.6% on Thursday in South

Africa trading.

The sale comes at a sensitive time for global technology stocks,

which have been on a tear for much of the past year.

Facebook shares have tumbled this week, with the company losing

about $46 billion of its market value after criticism over its

handling of user information. The controversy has prompted renewed

calls for governments around the world to better regulate giant

technology companies that have amassed large volumes of user data.

The tech-heavy Nasdaq Composite has fallen in six of the past eight

trading days, and is down 5.6% from its record earlier this

month.

The sale of Tencent shares could add more pressure to global

tech stocks. Tencent, along with search giant Baidu.com Inc. and

e-commerce titan Alibaba Group Holding Ltd., make up the three

so-called BAT stocks that, because of their size, clout and market

dominance in Asia, are routinely compared with the U.S.'s closely

watched FAANG stocks -- Facebook, Amazon.com Inc., Apple Inc.,

Netflix Inc. and Alphabet Inc.-owned Google.

A survey this week by Bank of America Merrill Lynch found that

the "long FAANG+BAT" trade -- meaning investors who have piled into

these technology giants -- was the most crowded trade on Wall

Street.

Nevertheless, Naspers will still be a major shareholder in

Tencent and several other tech companies. The company, founded in

1915 as a newspaper publisher, also holds stakes in a host of other

tech firms, including Mail.ru Group, a Russian internet company

that runs two of the country's three biggest social networks;

Delivery Hero, a food-delivery company based in Germany; and

Flipkart, India's biggest e-commerce site.

Naspers trades at a discount to the market value of its Tencent

stake in part because of a dividend-withholding tax that would kick

in should it ever sell out. The tax doesn't apply to Thursday's

share sale because the company isn't returning proceeds to

shareholders. The company's market value was recently about $115

billion, according to FactSet, accounted for Thursday's sharp

fall.

In November, Naspers, led by Chief Executive Bob van Dijk,

reported a 98% rise in half-year net profit to $1.1 billion,

largely driven by its Tencent holding and its digital classified

businesses, which turned a profit for the first time.

Some analysts said they were surprised by the sale but cautioned

against reading too much into the move.

"To keep it in context, Tencent is a great business that Naspers

is sitting on huge profits from," said Richard Kramer, founder of

Arete Research. "Whether they own 20% or 30%, it's still a

phenomenal asset and puts them in a privileged position."

--Alyssa Abkowitz and Adria Calatayud contributed to this

article.

Write to Steven Russolillo at steven.russolillo@wsj.com and

Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

March 23, 2018 02:48 ET (06:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

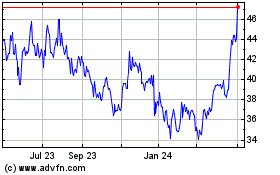

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Aug 2024 to Sep 2024

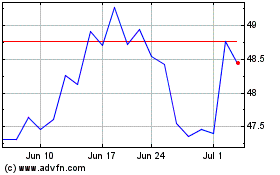

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Sep 2023 to Sep 2024