Report of Foreign Issuer (6-k)

February 28 2018 - 5:51PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2018

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

N/A

GAFISA S.A.

CNPJ/MF n

°

01.545.826/0001-07

NIRE 35.300.147.952

Publicly-held Company

NOTICE TO SHAREHOLDERS

GAFISA S.A. (B3: GFSA3) (“

Company

”), complementing the information released on the notices to shareholders on December 20, 2017, January 24, 2018 and February 8, 2018, and due the closure on February 21, 2018 of term for subscription of unsubscribed shares during the second period to subscribe to unsubscribed shares (“

Second Period to Subscribe to Unsubscribed Shares

”), within the scope of the capital increase approved at the Extraordinary Shareholders’ Meeting held on December 20, 2017 (“

Capital Increase

”), informs the following.

During the Second Period to Subscribe to Unsubscribed Shares, 468,381 non-par, registered common shares were subscribed, at the issue price of R$15.00 per share, totaling R$7,025,715.00.

Among the preemptive rights exercised, the rights corresponding to 100,364 non-par, registered common shares were cancelled, of which: (i) the preemptive rights corresponding to 90,715 shares were cancelled since their exercise was conditioned to the subscription of 100% Capital Increase; and (ii) the preemptive rights corresponding to 9,649 shares were cancelled since its shareholders requested, in the respective subscription lists, to receive a number of shares issued by the Company corresponding the ratio between the number of shares effectively issued and the maximum number of shares of the Capital Increase.

Thus, considering (i) the term to exercise the preemptive right, (ii) two periods to subscribe to unsubscribed shares and (iii) the cancellations of preemptive rights mentioned above, in total 16,717,752 non-par registered common shares were subscribed, at the issue price of R$15.00 per share, of which R$0.01 allocated to the capital stock and R$14.99 to the capital reserve, pursuant to Article 182, Paragraph 1, “a” of Law No. 6.404/76.

Therefore, the Company’s Board of Directors, at a meeting held on this date, partially ratified the Capital Increase, in the amount of R$167,177.52, so that the Company’s capital stock will total R$2,521,318,365.26, divided into 44,757,914 non-par, book-entry, registered common shares, and total subscription, including the amount allocated to the capital reserve, reaching the amount of R$250,766,280.00.

As a result of the cancellation of preemptive rights exercised informed above, on March 5, 2018, the Company will refund the amounts already paid, without interest or monetary

restatement, by means of the custody agents of those shareholders who (i) conditioned their participation in the Capital Increase to the subscription of the maximum number of shares of the Capital Increase; or (ii) requested, in respective subscription lists, to receive an amount of Shares corresponding to the ratio between the number of shares to be effectively issued and the maximum number of shares of the Capital Increase.

The shares issued will be credited on March 5 and can be viewed in the shareholders’ statements as of March 6.

São Paulo, February 28, 2018.

GAFISA S.A.

Carlos Calheiros

Chief Financial and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 28, 2018

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Sandro Gamba

Title: Chief Executive Officer

|

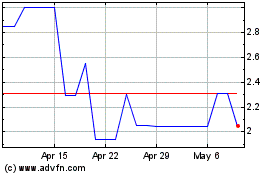

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

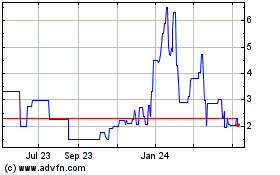

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024