FOURTH QUARTER 2017 HIGHLIGHTS

- Revenues increased 4.4% to $185.9

million in Q4 2017 compared to $178.1 million in Q4 2016.

- Net loss from continuing operations,

which includes a non-cash pre-tax goodwill impairment charge of

$45.0 million related to the company's Business Advisory segment,

was $29.3 million in Q4 2017 compared to net income from continuing

operations of $4.2 million in Q4 2016.

- Adjusted EBITDA(6), a non-GAAP measure,

was $31.5 million in Q4 2017 compared to $23.9 million in Q4

2016.

- Diluted loss per share from continuing

operations was $1.36 in Q4 2017 compared to diluted earnings per

share from continuing operations of $0.19 in Q4 2016.

- Adjusted diluted earnings per share

from continuing operations(6), a non-GAAP measure, was $0.68 in Q4

2017 compared to $0.58 in Q4 2016.

FULL YEAR 2017 HIGHLIGHTS AND 2018 GUIDANCE

- Revenues for full year 2017 increased

0.9% to $732.6 million compared to $726.3 million for full year

2016.

- Net loss from continuing operations for

full year 2017, which includes non-cash pretax goodwill impairment

charges of $253.1 million related to the company's Healthcare and

Business Advisory segments, was $170.5 million, compared to net

income from continuing operations of $39.5 million for full year

2016.

- Adjusted EBITDA(6) for full year 2017

was $104.6 million compared to $129.7 million for full year

2016.

- Diluted loss per share from continuing

operations was $7.95 for full year 2017 compared to diluted

earnings per share from continuing operations of $1.84 for full

year 2016.

- Adjusted diluted earnings per share

from continuing operations(6) was $2.15 for full year 2017 compared

to $3.21 for full year 2016.

- Huron provides full year 2018 earnings

guidance, including revenue expectations in a range of $720.0

million to $760.0 million.

Global professional services firm Huron (NASDAQ: HURN) today

announced financial results from continuing operations for the

fourth quarter and full year ended Dec. 31, 2017.

“Our fourth quarter results were slightly below our

expectations, with mixed results across segments. We have made

significant progress in the operational turnaround of our

Healthcare business, growing segment revenues 20% sequentially in

the fourth quarter,” said James H.

Roth, chief executive officer and president of Huron. “The Education segment performed well

throughout the year and finished the fourth quarter consistent with

our expectations. The Business Advisory segment had a softer fourth

quarter, but we believe they are positioned for growth in

2018.”

“While we are encouraged by the strengthening in demand in the

healthcare market in the fourth quarter, we remain cautious about

predicting our performance in 2018. Nevertheless, I am confident in

our strategic direction and believe we have repositioned our

company to return to sustainable organic growth in the years

ahead,” added Roth.

FOURTH QUARTER 2017 RESULTS FROM CONTINUING

OPERATIONS

Revenues increased 4.4% to $185.9 million for the fourth quarter

of 2017 compared to $178.1 million for the fourth quarter of 2016.

Fourth quarter 2017 revenues included $9.8 million from Huron's

2017 acquisitions of Innosight Holdings, LLC (Innosight) and Pope

Woodhead and Associates Limited (Pope Woodhead). Fourth quarter

2017 revenues also included revenues from Huron's 2017 acquisition

of the international assets of ADI Strategies, which has since been

fully integrated into the Business Advisory segment.

Net loss from continuing operations was $29.3 million for the

fourth quarter of 2017 compared to net income from continuing

operations of $4.2 million for the same period last year. Fourth

quarter 2017 results reflect a non-cash pretax charge of $45.0

million to reduce the carrying value of goodwill in the company's

Business Advisory segment. The impairment charge is non-cash in

nature and does not affect the company's liquidity or debt

covenants. Diluted loss per share from continuing operations was

$1.36 for the fourth quarter of 2017, compared to diluted earnings

per share from continuing operations of $0.19 for the fourth

quarter of 2016.

Fourth quarter 2017 loss before interest, taxes, depreciation

and amortization ("EBITDA")(6) was $14.6 million, compared to

earnings before interest, taxes, depreciation and amortization of

$20.7 million in the same period last year.

In addition to using EBITDA to evaluate the company’s financial

performance, management uses other non-GAAP financial measures,

which exclude the effect of the following items (in thousands):

Three Months Ended December 31,

2017 2016 Amortization of intangible

assets $ 8,595 $ 8,739 Restructuring charges $ 951 $ 5,463 Other

losses (gains), net $ 1,333 $ (2,484 ) Goodwill impairment charges

$ 43,493 $ — Non-cash interest on convertible notes $ 1,998 $ 1,906

Other non-operating expense $ 235 $ — Foreign currency transaction

losses $ 15 $ 259 Tax effect $

(21,195

) $ (5,354 ) Tax expense related to the enactment of Tax Cuts and

Jobs Act of 2017 $

8,762

$ — Tax benefit related to "check-the-box" election $ 20 $ —

The company has excluded the impact of the Tax Cuts and Jobs Act

of 2017, which was enacted in the fourth quarter of 2017, to permit

comparability with prior periods.

Adjusted EBITDA(6) was $31.5 million, or 16.9% of revenues, in

the fourth quarter of 2017, compared to $23.9 million, or 13.4% of

revenues, in the same quarter last year. Adjusted net income from

continuing operations(6) was $14.9 million, or $0.68 per diluted

share, for the fourth quarter of 2017, compared to $12.5 million,

or $0.58 per diluted share, for the same period in 2016.

The average number of full-time billable consultants(2)

increased 7.1% to 2,140 in the fourth quarter of 2017 compared to

1,998 in the same quarter last year. Full-time billable consultant

utilization rate(3) was 74.2% during the fourth quarter of 2017

compared to 72.2% during the same period last year. Average billing

rate per hour for full-time billable consultants(4) was $205 for

the fourth quarter of 2017 compared to $209 for the fourth quarter

of 2016. The average number of full-time equivalent

professionals(5) was 256 in the fourth quarter of 2017 compared to

277 for the same period in 2016.

FULL YEAR 2017 RESULTS FROM CONTINUING OPERATIONS

Revenues increased 0.9% to $732.6 million for full year 2017

compared to $726.3 million for full year 2016. 2017 revenues

included $43.9 million from Huron's 2017 acquisitions of Innosight

and Pope Woodhead, and $13.9 million of incremental revenues due to

the full period impact of the acquisitions of MyRounding Solutions,

LLC, and HSM Consulting, which were completed in Feb. 2016 and Aug.

2016, respectively. Revenues for full year 2017 also included a

full period impact of Huron's acquisition of the U.S. assets of ADI

Strategies and revenues from the acquisition of the international

assets of ADI Strategies. These acquisitions were completed in May

2016 and Apr. 2017, respectively, and have been fully integrated

into the Business Advisory segment.

Net loss from continuing operations was $170.5 million for full

year 2017 compared to net income from continuing operations of

$39.5 million for full year 2016. Results for full year 2017

reflect non-cash pretax goodwill impairment charges of $253.1

million related to the company's Healthcare and Business Advisory

segments. The impairment charges are non-cash in nature and do not

affect the company's liquidity or debt covenants. Diluted loss per

share from continuing operations was $7.95 for the full year 2017,

compared to diluted earnings per share from continuing operations

of $1.84 for full year 2016.

Loss before interest, taxes, depreciation, and amortization(6)

for the full year 2017 was $154.7 million, compared to EBITDA of

$122.1 million for full year 2016.

In addition to using EBITDA to evaluate the company’s financial

performance, management uses other non-GAAP financial measures,

which exclude the effect of the following items (in thousands):

Twelve Months Ended December 31,

2017 2016 Amortization of intangible

assets $ 35,027 $ 33,108 Restructuring charges $ 6,246 $ 9,592

Other losses (gains), net $ 1,111 $ (1,990 ) Goodwill impairment

charges $ 253,093 $ — Non-cash interest on convertible notes $

7,851 $ 7,488 Other non-operating expense (income) $ (696 ) $ —

Foreign currency transaction gains, net $ (434 ) $ (11 ) Tax effect

$

(91,557

) $ (18,942 ) Tax expense related to the enactment of Tax Cuts and

Jobs Act of 2017 $

8,762

$ — Tax benefit related to "check-the-box" election $ (2,728 ) $ —

The company has excluded the effect of a $2.7 million tax

benefit, recorded in the third quarter of 2017, from recognizing a

previously unrecognized tax benefit from a "check-the-box" election

made in 2014 to treat one of the company's wholly-owned foreign

subsidiaries as a disregarded entity for U.S. federal income tax

purposes.

The company has also excluded the impact of the Tax Cuts and

Jobs Act of 2017, which was enacted in the fourth quarter of 2017,

to permit comparability with prior periods.

Adjusted EBITDA(6) was $104.6 million, or 14.3% of revenues, for

the full year of 2017, compared to $129.7 million, or 17.9% of

revenues, for the full year 2016. Adjusted net income from

continuing operations(6) was $46.6 million, or $2.15 per diluted

share, for the full year 2017, compared to $68.7 million, or $3.21

per diluted share, for the full year 2016.

The average number of full-time billable consultants(2)

increased 6.5% to 2,045 for the full year 2017 compared to 1,921 in

the same period last year. Full-time billable consultant

utilization rate(3) was 74.5% for the full year 2017 compared to

74.6% during the same period last year. Average billing rate per

hour for full-time billable consultants(4) was $203 for the full

year 2017 compared to $212 for the full year 2016. The average

number of full-time equivalent professionals(5) was 268 for full

year 2017 compared to 261 for the full year 2016.

OPERATING SEGMENTS

Huron’s results reflect a portfolio of service offerings focused

on helping clients address complex business challenges.

The company’s full year 2017 revenues by operating segment as a

percentage of total company revenues are as follows: Healthcare (49%); Education (23%); and Business Advisory (28%). Financial results by

segment are included in the attached schedules and in Huron's

forthcoming Annual Report on Form 10-K filing for the year ended

Dec. 31, 2017.

OUTLOOK FOR 2018(8)

Based on currently available information, the company provided

guidance for full year 2018 of revenues before reimbursable

expenses in a range of $720.0 million to $760.0 million. The

company anticipates net income in a range of $23.0 million to $29.5

million, and both EBITDA and adjusted EBITDA in a range of $86.5

million to $98.5 million. GAAP diluted earnings per share is

expected in a range of $1.05 to $1.35, and non-GAAP adjusted

diluted earnings per share is expected in a range of $2.10 to

$2.40.

Management will provide a more detailed discussion of its

outlook during the company’s earnings conference call webcast.

FOURTH QUARTER 2017 WEBCAST

The company will host a webcast to discuss its financial results

today, Feb. 27, 2018, at 5:00 p.m. Eastern Time (4:00 p.m. Central

Time). The conference call is being webcast by NASDAQ and can be

accessed at Huron's website at http://ir.huronconsultinggroup.com. A replay will

be available approximately two hours after the conclusion of the

webcast and for 90 days thereafter.

USE OF NON-GAAP FINANCIAL MEASURES(6)

In evaluating the company’s financial performance and outlook,

management uses EBITDA, adjusted EBITDA, adjusted EBITDA as a

percentage of revenues, adjusted net income (loss) from continuing

operations, and adjusted diluted earnings (loss) per share from

continuing operations, which are non-GAAP measures. Management uses

these non-GAAP financial measures to gain an understanding of the

company's comparative operating performance (when comparing such

results with previous periods or forecasts). These non-GAAP

financial measures are used by management in their financial and

operating decision making because management believes they reflect

the company's ongoing business in a manner that allows for

meaningful period-to-period comparisons. Management also uses these

non-GAAP financial measures when publicly providing their business

outlook, for internal management purposes, and as a basis for

evaluating potential acquisitions and dispositions. Management

believes that these non-GAAP financial measures provide useful

information to investors and others in understanding and evaluating

Huron’s current operating performance and future prospects in the

same manner as management does, if they so choose, and in comparing

in a consistent manner Huron’s current financial results with

Huron’s past financial results. Investors should recognize that

these non-GAAP measures might not be comparable to similarly titled

measures of other companies. These measures should be considered in

addition to, and not as a substitute for or superior to, any

measure of performance, cash flows or liquidity prepared in

accordance with accounting principles generally accepted in the

United States.

ABOUT HURON

Huron is a global professional services firm committed to

achieving sustainable results in partnership with its clients. The

company brings depth of expertise in strategy, technology,

operations, advisory services and analytics to drive lasting and

measurable results in the healthcare, higher education, life

sciences and commercial sectors. Through focus, passion and

collaboration, Huron provides guidance to support organizations as

they contend with the change transforming their industries and

businesses. Learn more at www.huronconsultinggroup.com.

Statements in this press release that are not historical in

nature, including those concerning the company’s current

expectations about its future requirements and needs, are

“forward-looking” statements as defined in Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are identified by words such as “may,” “should,”

“expects,” “provides,” “anticipates,” “assumes,” “can,” “will,”

“meets,” “could,” “likely,” “intends,” “might,” “predicts,”

“seeks,” “would,” “believes,” “estimates,” “plans,” “continues,” or

“outlook” or similar expressions. These forward-looking statements

reflect the company's current expectations about future

requirements and needs, results, levels of activity, performance,

or achievements. Some of the factors that could cause actual

results to differ materially from the forward-looking statements

contained herein include, without limitation: failure to achieve

expected utilization rates, billing rates and the number of

revenue-generating professionals; inability to expand or adjust our

service offerings in response to market demands; our dependence on

renewal of client-based services; dependence on new business and

retention of current clients and qualified personnel; failure to

maintain third-party provider relationships and strategic

alliances; inability to license technology to and from third

parties; the impairment of goodwill; various factors related to

income and other taxes; difficulties in successfully integrating

the businesses we acquire and achieving expected benefits from such

acquisitions; risks relating to privacy, information security, and

related laws and standards; and a general downturn in market

conditions. These forward-looking statements involve known and

unknown risks, uncertainties, and other factors, including, among

others, those described under “Item 1A. Risk Factors” in Huron's

forthcoming Annual Report on Form 10-K for the year ended December

31, 2017, that may cause actual results, levels of activity,

performance or achievements to be materially different from any

anticipated results, levels of activity, performance, or

achievements expressed or implied by these forward-looking

statements. The company disclaims any obligation to update or

revise any forward-looking statements as a result of new

information or future events, or for any other reason.

HURON CONSULTING GROUP INC. CONSOLIDATED

STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE INCOME (LOSS)

(In thousands, except per share amounts) (Unaudited)

Three Months Ended Twelve

Months Ended December 31, December 31,

2017 2016 2017 2016

Revenues and reimbursable expenses: Revenues $ 185,927 $

178,124 $ 732,570 $ 726,272 Reimbursable expenses 19,313

17,076 75,175 71,712 Total revenues and

reimbursable expenses 205,240 195,200 807,745 797,984

Direct

costs and reimbursable expenses (exclusive of depreciation and

amortization shown in operating expenses): Direct costs 111,621

114,246 454,806 437,556 Amortization of intangible assets and

software development costs 2,544 3,862 10,932 15,140 Reimbursable

expenses 19,535 17,002 75,436 71,749

Total direct costs and reimbursable expenses 133,700 135,110

541,174 524,445

Operating expenses and

other losses (gains), net: Selling, general and administrative

expenses 43,227 40,267 175,364 160,204 Restructuring charges 951

5,463 6,246 9,592 Other losses (gains), net 1,333 (2,484 ) 1,111

(1,990 ) Depreciation and amortization 9,664 8,435 38,213 31,499

Goodwill impairment charges 43,493 — 253,093 —

Total operating expenses and other losses (gains), net

98,668 51,681 474,027 199,305 Operating

income (loss) (27,128 ) 8,409 (207,456 ) 74,234

Other income

(expense), net: Interest expense, net of interest income (4,802

) (4,004 ) (18,613 ) (16,274 ) Other income, net 361 (39 )

3,565 1,197 Total other expense, net (4,441 ) (4,043

) (15,048 ) (15,077 ) Income (loss) from continuing operations

before taxes (31,569 ) 4,366 (222,504 ) 59,157 Income tax expense

(benefit) (2,259 ) 179 (51,999 ) 19,677 Net income

(loss) from continuing operations (29,310 ) 4,187 (170,505 ) 39,480

Income (loss) from discontinued operations, net of tax (302 ) (33 )

388 (1,863 ) Net income (loss) $ (29,612 ) $ 4,154 $

(170,117 ) $ 37,617 Net earnings (loss) per basic share: Net

income (loss) from continuing operations $ (1.36 ) $ 0.20 $ (7.95 )

$ 1.87 Income (loss) from discontinued operations, net of tax (0.02

) — 0.02 (0.09 ) Net income (loss) $ (1.38 ) $ 0.20

$ (7.93 ) $ 1.78 Net earnings (loss) per diluted

share: Net income (loss) from continuing operations $ (1.36 ) $

0.19 $ (7.95 ) $ 1.84 Income (loss) from discontinued operations,

net of tax (0.02 ) — 0.02 (0.08 ) Net income (loss) $

(1.38 ) $ 0.19 $ (7.93 ) $ 1.76 Weighted average

shares used in calculating earnings per share: Basic 21,515 21,083

21,439 21,084 Diluted 21,515 21,473 21,439 21,424

Comprehensive

income (loss): Net income (loss) $ (29,612 ) $ 4,154 $ (170,117

) $ 37,617 Foreign currency translation adjustments, net of tax

(233 ) 12 1,602 64 Unrealized (gain) loss on investment, net of tax

6,393 1,066 4,724 (97 ) Unrealized gain on cash flow hedging

instruments, net of tax 433 90 429 63

Other comprehensive income 6,593 1,168 6,755

30 Comprehensive income (loss) $ (23,019 ) $ 5,322 $

(163,362 ) $ 37,647

HURON CONSULTING GROUP

INC. CONSOLIDATED BALANCE SHEETS (In thousands,

except share and per share amounts) (Unaudited)

December 31, December 31,

2017 2016 Assets Current assets: Cash and cash

equivalents $ 16,909 $ 17,027 Receivables from clients, net 101,778

94,246 Unbilled services, net 57,618 51,290 Income tax receivable

4,039 4,211 Prepaid expenses and other current assets 10,951

13,308 Total current assets 191,295 180,082 Property and

equipment, net 45,541 32,434 Deferred income taxes, net 16,752 —

Long-term investment 39,904 34,675 Other non-current assets 25,375

24,814 Intangible assets, net 72,311 81,348 Goodwill 645,750

799,862 Total assets $ 1,036,928 $ 1,153,215

Liabilities and stockholders’ equity Current liabilities:

Accounts payable $ 9,194 $ 7,273 Accrued expenses and other current

liabilities 20,144 19,788 Accrued payroll and related benefits

73,698 82,669 Accrued contingent consideration for business

acquisitions 8,515 1,985 Deferred revenues 27,916 24,053

Total current liabilities 139,467 135,768 Non-current

liabilities: Deferred compensation and other liabilities 20,895

24,171 Accrued contingent consideration for business acquisitions,

net of current portion 14,313 6,842 Long-term debt, net of current

portion 342,507 292,065 Deferred lease incentives 15,333 10,703

Deferred income taxes, net 1,097 35,633 Total

non-current liabilities 394,145 369,414

Commitments and

contingencies Stockholders’ equity Common stock; $0.01

par value; 500,000,000 shares authorized; 24,560,468 and 24,126,118

shares issued at December 31, 2017 and December 31, 2016,

respectively 241 235 Treasury stock, at cost, 2,443,577 and

2,408,343 shares at December 31, 2017 and December 31, 2016,

respectively (121,994 ) (113,195 ) Additional paid-in capital

434,256 405,895 Retained earnings 180,443 351,483 Accumulated other

comprehensive income 10,370 3,615 Total stockholders’

equity 503,316 648,033 Total liabilities and

stockholders’ equity $ 1,036,928 $ 1,153,215

HURON CONSULTING GROUP INC. CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands)

(Unaudited) Twelve Months Ended December

31, 2017 2016 Cash flows from

operating activities: Net income (loss) $ (170,117 ) $ 37,617

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: Depreciation and amortization 50,089 46,816

Share-based compensation 14,838 16,577 Amortization of debt

discount and issuance costs 10,203 9,609 Goodwill impairment charge

253,093 — Allowances for doubtful accounts and unbilled services

3,217 4,250 Deferred income taxes (53,753 ) 1,189 Gain on sale of

business (931 ) — Change in fair value of contingent consideration

liabilities 1,111 (1,990 ) Changes in operating assets and

liabilities, net of acquisitions: (Increase) decrease in

receivables from clients 1,650 1,440 (Increase) decrease in

unbilled services (4,332 ) 2,443 (Increase) decrease in current

income tax receivable / payable, net 210 (4,410 ) (Increase)

decrease in other assets (366 ) 11,904 Increase (decrease) in

accounts payable and accrued liabilities 3,732 (3,144 ) Increase

(decrease) in accrued payroll and related benefits (10,966 ) 3,044

Increase (decrease) in deferred revenues 2,117 3,898

Net cash provided by operating activities 99,795 129,243

Cash flows from investing activities: Purchases of

property and equipment, net (24,402 ) (13,936 ) Investment in life

insurance policies (1,826 ) (2,035 ) Distributions from life

insurance policies 2,889 — Purchases of businesses, net of cash

acquired (106,915 ) (69,133 ) Capitalization of internally

developed software costs (1,370 ) (1,086 ) Proceeds from note

receivable 1,177 — Proceeds from sale of business 1,499 (446

) Net cash used in investing activities (128,948 ) (86,636 )

Cash flows from financing activities: Proceeds from exercise

of stock options — 123 Shares redeemed for employee tax

withholdings (4,846 ) (4,953 ) Share repurchases — (55,265 )

Proceeds from borrowings under credit facility 277,500 200,000

Repayments of debt (240,745 ) (224,000 ) Payments for debt issuance

costs (408 ) — Payment of contingent consideration liabilities

(2,680 ) — Net cash provided by (used in) financing

activities 28,821 (84,095 ) Effect of exchange rate changes

on cash 214 78 Net decrease in cash and cash equivalents (118 )

(41,410 ) Cash and cash equivalents at beginning of the period

17,027 58,437 Cash and cash equivalents at end of the

period $ 16,909 $ 17,027

HURON CONSULTING GROUP INC. SEGMENT OPERATING

RESULTS AND OTHER OPERATING DATA (Unaudited)

Three Months EndedDecember 31, Percent

Increase

(Decrease)

Segment and Consolidated Operating Results (in thousands):

2017 2016 Healthcare: Revenues $

95,648 $ 101,381 (5.7 )% Operating income $ 35,181 $ 28,674 22.7 %

Segment operating income as a percentage of segment revenues 36.8 %

28.3 %

Education: Revenues $ 40,279 $ 38,001 6.0 % Operating

income $ 8,546 $ 6,836 25.0 % Segment operating income as a

percentage of segment revenues 21.2 % 18.0 %

Business

Advisory: Revenues $ 50,000 $ 38,742 29.1 % Operating income $

11,710 $ 6,107 91.7 % Segment operating income as a percentage of

segment revenues 23.4 % 15.8 %

Total Company: Revenues $

185,927 $ 178,124 4.4 % Reimbursable expenses 19,313 17,076

13.1 %

Total revenues and reimbursable expenses $

205,240 $ 195,200 5.1 %

Statements of Operations

reconciliation: Segment operating income $ 55,437 $ 41,617 33.2

% Items not allocated at the segment level: Other operating

expenses 28,075 27,257 3.0 % Other losses (gains), net 1,333 (2,484

) (153.7 )% Depreciation and amortization 9,664 8,435 14.6 %

Goodwill impairment charge (1) 43,493 — N/M Total

operating income (loss) (27,128 ) 8,409 N/M Other expense, net

4,441 4,043 9.8 %

Income (loss) from continuing

operations before taxes $ (31,569 ) $ 4,366 N/M

Other

Operating Data: Number of full-time billable consultants (at

period end) (2): Healthcare 778 888 (12.4 )%

Education 549 468 17.3 % Business Advisory 809 547

47.9 % Total 2,136 1,903 12.2 %

Average number of full-time

billable consultants (for the period) (2):

Healthcare 769 976 Education 543 470 Business Advisory 828

552 Total 2,140 1,998

HURON

CONSULTING GROUP INC. SEGMENT OPERATING RESULTS AND OTHER

OPERATING DATA (CONTINUED) (Unaudited) Three

Months Ended December 31, Other Operating Data

(continued): 2017 2016 Full-time

billable consultant utilization rate (3):

Healthcare 84.5 % 72.4 % Education 70.6 % 68.7 % Business Advisory

67.2 % 74.9 % Total 74.2 % 72.2 %

Full-time billable consultant

average billing rate per hour (4): Healthcare $

222 $ 215 Education $ 207 $ 225 Business Advisory $ 185 $ 188 Total

$ 205 $ 209

Revenue per full-time billable consultant (in

thousands): Healthcare $ 84 $ 69 Education $ 65 $ 69 Business

Advisory $ 58 $ 65 Total $ 69 $ 68

Average number of full-time

equivalents (for the period) (5): Healthcare 207

212 Education 32 41 Business Advisory 17 24 Total 256

277

Revenue per full-time equivalent (in thousands):

Healthcare $ 149 $ 158 Education $ 146 $ 137 Business Advisory $

125 $ 116 Total $ 147 $ 151

HURON CONSULTING GROUP INC. SEGMENT OPERATING RESULTS AND

OTHER OPERATING DATA (CONTINUED) (Unaudited)

Twelve Months EndedDecember 31, Percent

Increase

(Decrease)

Segment and Consolidated Operating Results (in thousands):

2017 2016 Healthcare: Revenues $

356,909 $ 424,912 (16.0 )% Operating income $ 118,761 $ 147,903

(19.7 )% Segment operating income as a percentage of segment

revenues 33.3 % 34.8 %

Education: Revenues $ 167,908 $

149,817 12.1 % Operating income $ 40,318 $ 38,310 5.2 % Segment

operating income as a percentage of segment revenues 24.0 % 25.6 %

Business Advisory: Revenues $ 207,753 $ 151,543 37.1 %

Operating income $ 46,600 $ 29,382 58.6 % Segment operating income

as a percentage of segment revenues 22.4 % 19.4 %

Total

Company: Revenues $ 732,570 $ 726,272 0.9 % Reimbursable

expenses 75,175 71,712 4.8 %

Total revenues and

reimbursable expenses $ 807,745 $ 797,984 1.2 %

Statements of Operations reconciliation: Segment operating

income $ 205,679 $ 215,595 (4.6 )% Items not allocated at the

segment level: Other operating expenses 120,718 111,852 7.9 % Other

losses (gains), net 1,111 (1,990 ) N/M Depreciation and

amortization expense 38,213 31,499 21.3 % Goodwill impairment

charge (1) 253,093 — N/M Total operating income

(loss) (207,456 ) 74,234 N/M Other expense, net 15,048

15,077 (0.2 )%

Income (loss) from continuing operations

before taxes $ (222,504 ) $ 59,157 N/M

Other

Operating Data: Number of full-time billable consultants (at

period end) (2): Healthcare 778 888 (12.4 )%

Education 549 468 17.3 % Business Advisory 809 547

47.9 % Total 2,136 1,903 12.2 %

Average number of full-time

billable consultants (for the period) (2):

Healthcare 796 998 Education 509 437 Business Advisory 740

486 Total 2,045 1,921

HURON

CONSULTING GROUP INC. SEGMENT OPERATING RESULTS AND OTHER

OPERATING DATA (CONTINUED) (Unaudited) Twelve

Months Ended December 31, Other Operating Data

(continued): 2017 2016 Full-time

billable consultant utilization rate (3):

Healthcare 78.4 % 77.1 % Education 72.8 % 70.6 % Business Advisory

71.7 % 73.1 % Total 74.5 % 74.6 %

Full-time billable consultant

average billing rate per hour (4): Healthcare $

206 $ 210 Education $ 213 $ 219 Business Advisory $ 193 $ 208 Total

$ 203 $ 212

Revenue per full-time billable consultant (in

thousands): Healthcare $ 295 $ 300 Education $ 291 $ 293

Business Advisory $ 268 $ 293 Total $ 284 $ 297

Average number

of full-time equivalents (for the period) (5):

Healthcare 213 203 Education 35 38 Business Advisory 20 20

Total 268 261

Revenue per full-time equivalent (in

thousands): Healthcare $ 576 $ 614 Education $ 564 $ 572

Business Advisory $ 464 $ 453 Total $ 566 $ 596

______________________

(1) The non-cash goodwill impairment charges are not

allocated at the segment level because the underlying goodwill

asset is reflective of our corporate investment in the segments. We

do not include the impact of goodwill impairment charges in our

evaluation of segment performance. (2) Consists of full-time

professionals who provide consulting services and generate revenues

based on the number of hours worked. (3) Utilization rate

for full-time billable consultants is calculated by dividing the

number of hours all full-time billable consultants worked on client

assignments during a period by the total available working hours

for all of these consultants during the same period, assuming a

forty-hour work week, less paid holidays and vacation days.

(4) Average billing rate per hour for full-time billable

consultants is calculated by dividing revenues for a period by the

number of hours worked on client assignments during the same

period. (5) Consists of cultural transformation consultants

within the Studer Group solution, which include coaches and their

support staff, consultants who work variable schedules as needed by

clients, and full-time employees who provide software support and

maintenance services to clients. N/M- Not Meaningful

HURON CONSULTING GROUP INC.

RECONCILIATION OF NET INCOME (LOSS) FROM CONTINUING

OPERATIONS

TO ADJUSTED EARNINGS BEFORE INTEREST,

TAXES, DEPRECIATION AND AMORTIZATION (6)

(In thousands) (Unaudited) Three Months

Ended Twelve Months Ended December 31,

December 31, 2017 2016 2017

2016 Revenues $ 185,927 $ 178,124

$ 732,570 $ 726,272 Net income (loss) from

continuing operations $ (29,310 ) $ 4,187 $ (170,505 ) $ 39,480 Add

back: Income tax expense (benefit) (2,259 ) 179 (51,999 ) 19,677

Interest expense, net of interest income 4,802 4,004 18,613 16,274

Depreciation and amortization 12,208 12,297 49,145

46,639

Earnings (loss) before interest, taxes,

depreciation and amortization (EBITDA) (6) (14,559 )

20,667 (154,746 ) 122,070 Add back: Restructuring charges 951 5,463

6,246 9,592 Other losses (gains), net 1,333 (2,484 ) 1,111 (1,990 )

Goodwill impairment charges 43,493 — 253,093 — Other non-operating

expense (income) 235 — (696 ) — Foreign currency transaction losses

(gains), net 15 259 (434 ) (11 )

Adjusted

EBITDA (6) $ 31,468 $ 23,905 $ 104,574

$ 129,661

Adjusted EBITDA as a percentage of

revenues (6) 16.9 % 13.4 % 14.3 % 17.9 %

HURON CONSULTING GROUP INC.

RECONCILIATION OF NET INCOME (LOSS) FROM CONTINUING

OPERATIONS

TO ADJUSTED NET INCOME (LOSS) FROM

CONTINUING OPERATIONS (6)

(In thousands, except per share amounts) (Unaudited)

Three Months Ended Twelve Months Ended

December 31, December 31, 2017

2016 2017 2016 Net income (loss)

from continuing operations $ (29,310 ) $ 4,187 $

(170,505 ) $ 39,480

Weighted average shares – diluted

21,515 21,473 21,439 21,424

Diluted earnings (loss) per share

from continuing operations $ (1.36 ) $ 0.19 $ (7.95 ) $

1.84 Add back: Amortization of intangible assets 8,595 8,739

35,027 33,108 Restructuring charges 951 5,463 6,246 9,592 Other

losses (gains), net 1,333 (2,484 ) 1,111 (1,990 ) Goodwill

impairment charges 43,493 — 253,093 — Non-cash interest on

convertible notes 1,998 1,906 7,851 7,488 Other non-operating

expense (income) 235 — (696 ) — Tax effect

(21,195

) (5,354 )

(91,557

) (18,942 ) Tax expense related to the enactment of Tax Cuts and

Jobs Act of 2017

8,762

—

8,762

— Tax benefit related to "check-the-box" election 20 —

(2,728 ) — Total adjustments, net of tax

44,192

8,270

217,109

29,256

Adjusted net income from continuing

operations (6) $

14,882

$ 12,457 $

46,604

$ 68,736

Adjusted weighted average shares -

diluted (7) 21,738 21,473 21,627 21,424

Adjusted

diluted earnings per share from continuing operations

(6) $

0.68

$ 0.58 $

2.15

$ 3.21

______________________

(6) In evaluating the company’s financial performance

and outlook, management uses earnings (loss) before interest,

taxes, depreciation and amortization (“EBITDA”), adjusted EBITDA,

adjusted EBITDA as a percentage of revenues, adjusted net income

(loss) from continuing operations, and adjusted diluted earnings

(loss) per share from continuing operations, which are non-GAAP

measures. Management uses these non-GAAP financial measures to gain

an understanding of the company's comparative operating performance

(when comparing such results with previous periods or forecasts).

These non-GAAP financial measures are used by management in their

financial and operating decision making because management believes

they reflect the company's ongoing business in a manner that allows

for meaningful period-to-period comparisons. Management also uses

these non-GAAP financial measures when publicly providing the

company's business outlook, for internal management purposes, and

as a basis for evaluating potential acquisitions and dispositions.

Management believes that these non-GAAP financial measures provide

useful information to investors and others in understanding and

evaluating Huron’s current operating performance and future

prospects in the same manner as management does, if they so choose,

and in comparing in a consistent manner Huron’s current financial

results with Huron’s past financial results. Investors should

recognize that these non-GAAP measures might not be comparable to

similarly titled measures of other companies. These measures should

be considered in addition to, and not as a substitute for or

superior to, any measure of performance, cash flows or liquidity

prepared in accordance with accounting principles generally

accepted in the United States.

(7)

As the company reported a net loss for the three and twelve months

ended December 31, 2017, GAAP diluted weighted average shares

outstanding equals the basic weighted average shares outstanding

for that period. The non-GAAP adjustments described above resulted

in adjusted net income from continuing operations for those

periods. Therefore, dilutive common stock equivalents have been

included in the calculation of adjusted diluted weighted average

shares outstanding.

HURON CONSULTING GROUP

INC. RECONCILIATION OF NON-GAAP MEASURES FOR FULL YEAR 2018

OUTLOOK RECONCILIATION OF NET INCOME

TO ADJUSTED EARNINGS BEFORE INTEREST,

TAXES, DEPRECIATION AND AMORTIZATION (8)

(In millions) (Unaudited) Year Ending

December 31, 2018 Guidance Range Low

High Projected revenues - GAAP $ 720.0

$ 760.0

Projected net income - GAAP $ 23.0 $ 29.5 Add

back: Income tax expense 9.0 13.5 Interest expense, net of interest

income 18.5 19.0 Depreciation and amortization 36.0 36.5

Projected earnings before interest, taxes, depreciation

and amortization (EBITDA) (8) 86.5 98.5

Projected adjusted EBITDA (8) $ 86.5 $ 98.5

Projected adjusted EBITDA as a percentage of projected

revenues (8) 12.0 % 13.0 %

RECONCILIATION OF NET INCOME TO ADJUSTED NET INCOME

((8)) (In millions, except per share amounts)

(Unaudited) Year Ending December 31,

2018 Guidance Range Low High

Projected net income - GAAP $ 23.0 $ 29.5

Projected diluted earnings per share - GAAP $ 1.05 $

1.35 Add back: Amortization of intangible assets 24.0 24.0

Non-cash interest on convertible notes 8.0 8.0 Tax effect (8.0 )

(8.0 ) Total adjustments, net of tax 24.0 24.0

Projected adjusted net income (8) $ 47.0 $

53.5

Projected adjusted diluted earnings per share

(8) $ 2.10 $ 2.40

______________________

(8) In evaluating the company’s outlook, management

uses projected EBITDA, projected adjusted EBITDA, projected

adjusted EBITDA as a percentage of revenues, projected adjusted net

income, and projected adjusted diluted earnings per share, which

are non-GAAP measures. Management believes that the use of such

measures, as supplements to projected net loss and projected

diluted loss per share, and other GAAP measures, are useful

indicators for investors. These useful indicators can help readers

gain a meaningful understanding of the company’s core operating

results and future prospects without the effect of non-cash or

other one-time items. Investors should recognize that these

non-GAAP measures might not be comparable to similarly titled

measures of other companies. These measures should be considered in

addition to, and not as a substitute for or superior to, any

measure of performance, cash flows or liquidity prepared in

accordance with accounting principles generally accepted in the

United States.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180227006621/en/

HuronMEDIA CONTACTSarah McHugh,

312-880-2624smchugh@huronconsultinggroup.comorINVESTOR

CONTACTJohn D. Kelly,

312-583-8722investor@huronconsultinggroup.com

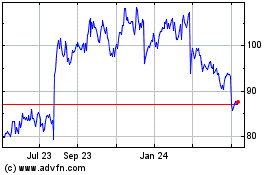

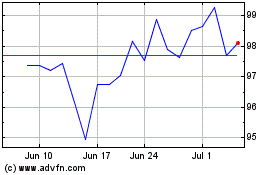

Huron Consulting (NASDAQ:HURN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Huron Consulting (NASDAQ:HURN)

Historical Stock Chart

From Apr 2023 to Apr 2024