Community Health Systems, Inc. (NYSE: CYH) (the “Company”) today

announced financial and operating results for the three months and

year ended December 31, 2017.

The following highlights the financial and operating results for

the three months ended December 31, 2017. Certain items have been

adjusted for items that management considers not reflective of

ongoing operations as discussed further on pages 4 and 5 of this

press release:

- Net operating revenues totaled

$3.059 billion and were adversely impacted by a $591 million

increase in contractual allowances and provision for bad debts from

the change in estimate further discussed below.

- Net loss attributable to Community

Health Systems, Inc. common stockholders was $(2.013) billion, or

$(17.98) per share (diluted), compared with net loss of $(220)

million, or $(1.99) per share (diluted) for the same period in

2016. Excluding the adjusting items as presented in the table in

footnote (h) on page 17, net loss attributable to Community Health

Systems, Inc. common stockholders was $(0.28) per share

(diluted).

- Adjusted EBITDA was $409

million.

- Loss from continuing operations

attributable to Community Health Systems, Inc. common stockholders

was $(17.95) per share (diluted). Excluding the adjusting items as

presented in the table in footnote (h) on page 17, loss from

continuing operations attributable to Community Health Systems,

Inc. common stockholders was $(0.25) per share (diluted).

- Cash flow from operations was $156

million, compared with $327 million for the same period in

2016.

- On a same-store basis, admissions

decreased 1.7 percent and adjusted admissions decreased 0.9

percent, compared with the same period in 2016.

Net operating revenues for the three months ended December 31,

2017, totaled $3.059 billion, a 31.6 percent decrease, compared

with $4.469 billion for the same period in 2016. As further

discussed below, the financial results include a change in estimate

recorded by the Company during the three months ended December 31,

2017 to increase contractual allowances and the provision for bad

debts by a total of approximately $591 million as a result of

information obtained from new accounting processes and

methodologies implemented in preparation for the adoption of the

new revenue recognition accounting guidance.

Loss from continuing operations attributable to Community Health

Systems, Inc. common stockholders was $(2.010) billion, or $(17.95)

per share (diluted), for the three months ended December 31, 2017,

compared with $(211) million, or $(1.91) per share (diluted), for

the same period in 2016. Excluding the adjusting items as presented

in the table in footnote (h) on page 17, loss from continuing

operations was $(0.25) per share (diluted).

Net loss attributable to Community Health Systems, Inc. common

stockholders was $(2.013) billion, or $(17.98) per share (diluted),

for the three months ended December 31, 2017, compared with $(220)

million, or $(1.99) per share (diluted), for the same period in

2016. Excluding the adjusting items as presented in the table in

footnote (h) on page 17, net loss attributable to Community Health

Systems, Inc. common stockholders was $(0.28) per share (diluted),

for the three months ended December 31, 2017. For the three months

ended December 31, 2017, loss from discontinued operations, net of

tax, was approximately $(3) million, or $(0.03) per share

(diluted). Weighted-average shares outstanding (diluted) were 112

million for the three months ended December 31, 2017, and 111

million for the three months ended December 31, 2016.

Adjusted EBITDA for the three months ended December 31, 2017,

was $409 million compared with $564 million for the same period in

2016, representing a 27.5 percent decrease. Adjusted EBITDA for the

three months ended December 31, 2017, includes an adjustment for

the $591 million adverse impact of the change in estimate recorded

during the three-month period to increase contractual allowances

and the provision for bad debts as noted above.

The consolidated operating results for the three months ended

December 31, 2017, reflect a 19.2 percent decrease in total

admissions, and a 19.3 percent decrease in total adjusted

admissions, compared with the same period in 2016. On a same-store

basis, admissions decreased 1.7 percent and adjusted admissions

decreased 0.9 percent during the three months ended December 31,

2017, compared with the same period in 2016. On a same-store basis

(as further defined in footnote (a) on page 14), net operating

revenues increased 1.8 percent during the three months ended

December 31, 2017, compared with the same period in 2016.

Net operating revenues for the year ended December 31, 2017,

totaled $15.353 billion, a 16.7 percent decrease, compared with

$18.438 billion for the same period in 2016.

Loss from continuing operations attributable to Community Health

Systems, Inc. common stockholders was $(2.447) billion, or $(21.89)

per share (diluted), for the year ended December 31, 2017, compared

with $(1.706) billion, or $(15.41) per share (diluted), for the

same period in 2016. Excluding the adjusting items as presented in

the table in footnote (h) on page 17, loss from continuing

operations was $(1.20) per share (diluted).

Net loss attributable to Community Health Systems, Inc. common

stockholders was $(2.459) billion, or $(22.00) per share (diluted),

for the year ended December 31, 2017, compared with $(1.721)

billion, or $(15.54) per share (diluted), for the same period in

2016. Excluding the adjusting items as presented in the table in

footnote (h) on page 17, net loss attributable to Community Health

Systems, Inc. common stockholders was $(1.26) per share (diluted),

for the year ended December 31, 2017. Loss from discontinued

operations, net of tax, for the year ended December 31, 2017, was

approximately $(12) million, or $(0.11) per share (diluted).

Weighted-average shares outstanding (diluted) were 112 million for

the year ended December 31, 2017, and 111 million for the year

ended December 31, 2016.

Adjusted EBITDA for the year ended December 31, 2017, was $1.703

billion compared with $2.225 billion for the same period in 2016,

representing a 23.5 percent decrease. Adjusted EBITDA for the year

ended December 31, 2017, includes an adjustment for the $591

million adverse impact of the change in estimate recorded during

the three months ended December 31, 2017 to increase contractual

allowances and the provision for bad debts as noted above.

The consolidated operating results for the year ended December

31, 2017, reflect a 13.9 percent decrease in total admissions, and

a 14.5 percent decrease in total adjusted admissions, compared with

the same period in 2016. On a same-store basis, admissions

decreased 1.9 percent and adjusted admissions decreased 1.7 percent

during the year ended December 31, 2017, compared with the same

period in 2016. On a same-store basis (as further defined in

footnote (a) on page 14), net operating revenues increased 0.2

percent during the year ended December 31, 2017, compared with the

same period in 2016.

Commenting on the results, Wayne T. Smith, chairman and chief

executive officer of Community Health Systems, Inc., said, “We are

pleased with our progress in the fourth quarter and expect to carry

that momentum through 2018, as we execute strategies that we

believe will strengthen our core business and drive improved

results. During the fourth quarter, we completed our 2017 announced

divestiture plan and we intend to continue to optimize our

portfolio in 2018 to help pay down debt and refine our portfolio to

stronger markets. In 2018, we remain committed to growth

initiatives to advance our competitive position, including

expanding our transfer and access program across our networks,

launching Accountable Care Organizations, and strategically

expanding outpatient services. We are also committed to driving

operational efficiencies, and, as always, are dedicated to patient

safety and clinical advancements that improve healthcare for the

patients and communities we serve.”

On February 26, 2018, the Company amended its Credit Facility,

with requisite revolving lender approval, to remove the EBITDA to

interest expense ratio financial covenant, to replace the senior

secured net debt to EBITDA ratio financial covenant with a first

lien net debt to EBITDA ratio financial covenant, and to reduce the

extended revolving credit commitments to $650 million (for a total

of $840 million in revolving credit commitments when combined with

the non-extended portion of the revolving credit facility). In

addition, the Company agreed pursuant to the amendment to modify

its ability to retain asset sale proceeds, and instead apply them

to prepayments of term loans based on pro forma first lien

leverage.

Impact of Hurricanes Harvey and Irma on Operating

Results

During August and September 2017, the Company’s facilities in

Victoria, Texas, experienced an interruption in business and

incurred additional costs as a direct result of the landfall of

Hurricane Harvey. Also during September 2017, due to the broad

regional impact of Hurricane Irma, many of the Company’s hospital

operations in the state of Florida and at one of its hospitals in

the state of Georgia experienced disruptions, with the most

significant impact on hospital operations in Key West and Punta

Gorda, Florida. The Company estimates that these hurricanes

resulted in a loss of net operating revenues together with

incremental expenses directly related to hurricane response efforts

of approximately $40 million in the aggregate during the year ended

December 31, 2017 and the three months ended September 30, 2017.

The impact on net operating revenues was the direct result of the

evacuations and population disruption prior to the hurricanes, as

well as during the aftermath and recovery efforts in the

communities affected by the hurricanes. This estimated impact is

prior to any insurance recoveries which the Company may

receive.

Completion of 2017 Divestiture Plan and Expansion of

Divestiture Plan in 2018

The Company completed its divestiture of six hospitals on

October 1, 2017, and two hospitals on November 1, 2017, bringing

its total completed divestitures during 2017 to the previously

announced 30 hospitals that had been subject to definitive

agreements. In addition to the previously announced divestiture of

these 30 hospitals, the Company continues to receive interest from

acquirers for certain of its hospitals. The Company is pursuing

these interests for sale transactions involving hospitals with a

combined total of approximately $2.0 billion in annual net

operating revenues and combined mid-single digit Adjusted EBITDA

margins.

To understand the impact of the recent divestiture activity,

financial and statistical data for 2017 and 2016 presented in this

press release include the following in operating results through

the effective date of each respective transaction:

- On April 29, 2016, the Company

completed the spin-off of Quorum Health Corporation (“QHC”),

comprised of 38 affiliated hospitals and related outpatient

services in 16 states, together with Quorum Health Resources, LLC,

a subsidiary providing management advisory and consulting services

to non-affiliated hospitals. Same-store operating results and

statistical data exclude information for the hospitals divested in

the spin-off of QHC in the comparable period in 2016.

- On April 29, 2016, the Company sold its

unconsolidated minority equity interests in Valley Health System,

LLC and Summerlin Hospital Medical Center, LLC, both joint ventures

with Universal Health Systems, Inc. comprising a total of five

hospitals in Las Vegas, Nevada.

- On December 31, 2016, the Company sold

an 80 percent majority ownership interest in its home care division

to a subsidiary of Almost Family, Inc. Same-store operating results

exclude the home care division in the comparable period in

2016.

- As part of its ongoing portfolio

rationalization efforts, the Company sold 30 hospitals during 2017.

Same-store operating results exclude the results of these hospitals

divested in 2017 and the comparable period in 2016.

Information About Non-GAAP Financial Measures

Adjusted EBITDA, a non-GAAP financial measure, is EBITDA

adjusted to add back net income attributable to noncontrolling

interests and to exclude the effect of discontinued operations,

loss from early extinguishment of debt, impairment and (gain) loss

on sale of businesses, gain on sale of investments in

unconsolidated affiliates, expense incurred related to the spin-off

of QHC, expense incurred related to the sale of a majority

ownership interest in the Company’s home care division, expense

(income) related to government and other legal settlements and

related costs, expense related to employee termination benefits and

other restructuring charges, (income) expense from fair value

adjustments on the CVR agreement liability accounted for at fair

value related to the HMA legal proceedings, and related legal

expenses, and the overall impact of the change in estimate related

to net patient revenue recorded in the fourth quarter of 2017

resulting from the increase in contractual allowances and the

provision for bad debts.

Certain significant adjustments impacting reported amounts for

the three months and year ended December 31, 2017, which were used

in the calculation of Adjusted EBITDA, non-GAAP adjusted loss from

continuing operations attributable to Community Health Systems,

Inc. common stockholders per share (diluted) and non-GAAP adjusted

net loss attributable to Community Health Systems, Inc. common

stockholders per share (diluted) are further discussed below:

(i) Impairment of Goodwill and Other

Long-Lived Assets

During the three months ended December 31, 2017, the Company

recorded non-cash impairment expense totaling $1.760 billion,

resulting from an impairment charge of $1.419 billion on the value

of goodwill for the Company’s hospital reporting unit and

impairment charges of approximately $341 million to reduce the

value of long-lived assets at hospitals that the Company has sold

or identified for sale and at certain under-performing hospitals.

The impairment charge recorded for goodwill resulted from a

determination that the carrying value of the Company’s hospital

operations reporting unit exceeded its fair value, primarily as the

result of the decline in the Company’s market capitalization and

fair value of long-term debt during the three months ended December

31, 2017, as well as a decrease in the estimated future earnings of

the Company compared to previous estimates.

During the year ended December 31, 2017, the Company recorded

non-cash impairment expense totaling $2.123 billion, resulting from

the fourth quarter impairment charge of $1.419 billion on the value

of goodwill for the Company’s hospital reporting unit noted above

and impairment charges of approximately $704 million to reduce the

value of long-lived assets at hospitals that the Company has sold

or identified for sale and at certain under-performing

hospitals.

The impairment charges do not have an impact on the calculation

of the Company’s financial covenants under the Company’s Credit

Facility.

(ii) Change in Estimate for Patient

Revenues and Patient Accounts Receivable

As required by generally accepted accounting principles, the

Company adopted the new revenue recognition accounting standard on

January 1, 2018. In connection with this adoption, during the

fourth quarter of 2017, the Company completed an extensive analysis

of its patient revenues and patient accounts receivable and

developed new accounting processes and methodologies. This analysis

also included an evaluation of patient accounts receivable retained

after the 2017 divestitures of 30 hospitals, and certain other

revenues. Based on the information obtained related to the

aforementioned adoption, the financial results discussed below

include a change in estimate recorded by the Company during the

three months and year ended December 31, 2017 to increase

contractual allowances and the provision for bad debts by

approximately $591 million.

These changes in estimate are not expected to have a material

impact on the recognition of revenue on a prospective basis and do

not have an impact on the calculation of the Company’s financial

covenants under the Company’s Credit Facility. Additionally, the

calculation of Adjusted EBITDA, as defined, excludes this change in

estimate in the amounts presented below.

(iii) Impact of Tax Reform

Changes

The financial results for the three months and year ended

December 31, 2017 include the estimated impact of the Tax Cuts and

Jobs Act of 2017 (the “Tax Act”), which resulted in a recorded loss

of $(0.29) per share (diluted) due to the net effect of changes to

the corporate tax rate, changes in the deductibility of certain

items, and the impact on the Company’s valuation allowances on

existing deferred tax assets resulting from the enactment of the

Tax Act in December 2017. The Company has accounted for the effects

of the Tax Act using reasonable estimates based on currently

available information and the Company’s interpretations thereof,

and this estimated impact may be revised as a result of, among

other things, changes in interpretations the Company has made and

the issuance of new tax or accounting guidance.

For information regarding why the Company believes Adjusted

EBITDA presents useful information to investors, and for a

reconciliation of Adjusted EBITDA to net income attributable to

Community Health Systems, Inc. stockholders, see footnote (e) to

the Financial Highlights, Financial Statements and Selected

Operating Data below.

Additionally, the Company has presented adjusted loss from

continuing operations attributable to Community Health Systems,

Inc. common stockholders per share (diluted) and adjusted net loss

attributable to Community Health Systems, Inc. common stockholders

per share (diluted) to reflect the impact on earnings per share

from the selected items used in the calculation of Adjusted EBITDA.

For a reconciliation of these measures, see footnote (h) to the

Financial Highlights, Financial Statements and Selected Operating

Data below.

Included on pages 19, 20, 21 and 22 of this press release are

tables setting forth the Company’s 2018 annual earnings guidance.

The 2018 guidance is based on the Company’s historical operating

performance, current trends and other assumptions that the Company

believes are reasonable at this time, and reflects the impact of

planned divestitures in 2018.

Community Health Systems, Inc. is one of the largest publicly

traded hospital companies in the United States and a leading

operator of general acute care hospitals in communities across the

country. The Company, through its subsidiaries, owns, leases or

operates 127 affiliated hospitals in 20 states with an aggregate of

approximately 21,000 licensed beds.

The Company’s headquarters are located in Franklin, Tennessee, a

suburb south of Nashville. Shares in Community Health Systems, Inc.

are traded on the New York Stock Exchange under the symbol “CYH.”

More information about the Company can be found on its website at

www.chs.net.

Community Health Systems, Inc. will hold a conference call on

Wednesday, February 28, 2018, at 10:00 a.m. Central, 11:00 a.m.

Eastern, to review financial and operating results for the fourth

quarter and year ended December 31, 2017. Investors will have the

opportunity to listen to a live Internet broadcast of the

conference call by clicking on the Investor Relations link of the

Company’s website at www.chs.net. To listen to the live call,

please go to the website at least fifteen minutes early to

register, download and install any necessary audio software. For

those who cannot listen to the live broadcast, a replay will be

available shortly after the call and will continue to be available

through March 28, 2018. Copies of this press release and conference

call slide show, as well as the Company’s Current Report on Form

8-K (including this press release), will be available on the

Company’s website at www.chs.net.

COMMUNITY HEALTH SYSTEMS,

INC. AND SUBSIDIARIES Financial Highlights (a)(b)(c)(d)

(In millions, except per share amounts) (Unaudited)

Three Months Ended Year Ended December 31,

December 31, 2017 2016 2017 2016

Net operating revenues $ 3,059 $ 4,469 $ 15,353 $ 18,438

Loss from continuing operations (f), (i), (j), (k) (2,004 ) (189 )

(2,384 ) (1,611 )

Net loss attributable to Community Health

Systems, Inc. stockholders

(2,013 ) (220 ) (2,459 ) (1,721 ) Adjusted EBITDA (e) 409 564 1,703

2,225 Net cash provided by operating activities 156 327 773 1,137

Basic loss per share attributable to

Community Health Systems, Inc. common stockholders (l):

Continuing operations (f), (i), (j), (k) $ (17.95 ) $ (1.91 ) $

(21.89 ) $ (15.41 ) Discontinued operations (0.03 )

(0.09 ) (0.11 ) (0.13 ) Net loss $ (17.98 ) $ (1.99 )

$ (22.00 ) $ (15.54 )

Diluted loss per share attributable to

Community Health Systems, Inc. common stockholders (l):

Continuing operations (f), (h), (i), (j), (k) $ (17.95 ) $ (1.91 )

$ (21.89 ) $ (15.41 ) Discontinued operations (0.03 )

(0.09 ) (0.11 ) (0.13 ) Net loss (h) $ (17.98 ) $

(1.99 ) $ (22.00 ) $ (15.54 )

Weighted-average number of shares outstanding (g): Basic 112 111

112 111 Diluted 112 111 112 111

____

For footnotes, see pages 14, 15, 16, 17

and 18.

COMMUNITY HEALTH SYSTEMS,

INC. AND SUBSIDIARIES Condensed Consolidated Statements of

Loss (a)(b)(c)(d) (In millions, except per share amounts)

(Unaudited)

Three Months Ended December 31,

2017 2016 Amount

% of

NetOperatingRevenues

Amount

% of

NetOperatingRevenues

Operating revenues (net of contractual allowances and discounts) $

4,076 $ 5,147 Provision for bad debts 1,017

678 Net operating revenues

3,059 100.0 % 4,469 100.0

% Operating costs and expenses: Salaries and benefits 1,671

54.6 % 2,087 46.7 % Supplies 616 20.1 % 730 16.3 % Other operating

expenses 881 28.9 % 992 22.2 % Government and other legal

settlements and related costs (j) 1 - % 5 0.1 % Electronic health

records incentive reimbursement (3 ) (0.1 ) % (15 ) (0.3 ) % Rent

88 2.9 % 110 2.5 % Depreciation and amortization 196 6.4 % 261 5.8

% Impairment and (gain) loss on sale of businesses, net (i)

1,760 57.5 % 224 5.0 % Total

operating costs and expenses 5,210 170.3 %

4,394 98.3 % (Loss) income from

operations (f), (i), (j) (2,151 ) (70.3 ) % 75 1.7 % Interest

expense, net 225 7.4 % 232 5.2 % Loss from early extinguishment of

debt 5 0.2 % - - % Equity in earnings of unconsolidated affiliates

(2 ) (0.1 ) % (5 ) (0.1 ) % Loss from

continuing operations before income taxes (2,379 ) (77.8 ) % (152 )

(3.4 ) % (Benefit from) provision for income taxes (375 )

(12.3 ) % 37 0.8 % Loss from continuing

operations (f), (i), (j) (2,004 ) (65.5 ) % (189 )

(4.2 ) % Discontinued operations, net of taxes: Loss from

operations of entities sold or held for sale (3 ) (0.1 ) % (3 )

(0.1 ) % Impairment of hospitals sold or held for sale -

- % (6 ) (0.1 ) % Loss from discontinued

operations, net of taxes (3 ) (0.1 ) % (9 ) (0.2 ) %

Net loss (2,007 ) (65.6 ) % (198 ) (4.4 ) % Less: Net income

attributable to noncontrolling interests 6 0.2

% 22 0.5 % Net loss attributable to Community

Health Systems, Inc. stockholders $ (2,013 ) (65.8 ) % $ (220 )

(4.9 ) %

Basic loss per share attributable to

Community Health Systems, Inc. common stockholders (l):

Continuing operations (f), (i), (j) $ (17.95 ) $ (1.91 )

Discontinued operations (0.03 ) (0.09 ) Net loss $

(17.98 ) $ (1.99 )

Diluted loss per share attributable to

Community Health Systems, Inc. common stockholders (l):

Continuing operations (f), (h), (i), (j) $ (17.95 ) $ (1.91 )

Discontinued operations (0.03 ) (0.09 ) Net loss (h)

$ (17.98 ) $ (1.99 ) Weighted-average number of shares

outstanding (g): Basic 112 111 Diluted

112 111

____

For footnotes, see pages 14, 15, 16, 17

and 18.

COMMUNITY HEALTH SYSTEMS,

INC. AND SUBSIDIARIES Condensed Consolidated Statements of

Loss (a)(b)(c)(d) (In millions, except per share amounts)

(Unaudited)

Year Ended December 31, 2017

2016 Amount

% of

NetOperatingRevenues

Amount

% of

NetOperatingRevenues

Operating revenues (net of contractual allowances and discounts) $

18,398 $ 21,275 Provision for bad debts 3,045

2,837 Net operating revenues

15,353 100.0 % 18,438 100.0

% Operating costs and expenses: Salaries and benefits

7,376 48.0 % 8,624 46.8 % Supplies 2,672 17.4 % 3,011 16.3 % Other

operating expenses 3,864 25.2 % 4,248 23.1 % Government and other

legal settlements and related costs (j) (31 ) (0.2 ) % 16 0.1 %

Electronic health records incentive reimbursement (28 ) (0.2 ) %

(70 ) (0.4 ) % Rent 394 2.6 % 450 2.4 % Depreciation and

amortization 861 5.6 % 1,100 6.0 % Impairment and (gain) loss on

sale of businesses, net (i) 2,123 13.8 %

1,919 10.4 % Total operating costs and

expenses 17,231 112.2 % 19,298

104.7 % Loss from operations (f), (i), (j) (1,878 )

(12.2 ) % (860 ) (4.7 ) % Interest expense, net 931 6.1 % 962 5.2 %

Loss from early extinguishment of debt 40 0.3 % 30 0.2 % Gain on

sale of investments in unconsolidated affiliates (k) - - % (94 )

(0.5 ) % Equity in earnings of unconsolidated affiliates (16

) (0.1 ) % (43 ) (0.3 ) % Loss from continuing

operations before income taxes (2,833 ) (18.5 ) % (1,715 ) (9.3 ) %

Benefit from income taxes (449 ) (3.0 ) % (104 ) (0.6

) % Loss from continuing operations (f), (i), (j), (k)

(2,384 ) (15.5 ) % (1,611 ) (8.7 ) % Discontinued

operations, net of taxes: Loss from operations of entities sold or

held for sale (6 ) (0.1 ) % (7 ) - % Impairment of hospitals sold

or held for sale (6 ) - % (8 ) (0.1 ) % Loss

from discontinued operations, net of taxes (12 ) (0.1 ) %

(15 ) (0.1 ) % Net loss (2,396 ) (15.6 ) % (1,626 ) (8.8 ) %

Less: Net income attributable to noncontrolling interests 63

0.4 % 95 0.5 % Net loss

attributable to Community Health Systems, Inc. stockholders $

(2,459 ) (16.0 ) % $ (1,721 ) (9.3 ) %

Basic loss per share attributable to

Community Health Systems, Inc. common stockholders:

Continuing operations (f), (i), (j), (k) $ (21.89 ) $ (15.41 )

Discontinued operations (0.11 ) (0.13 ) Net loss $

(22.00 ) $ (15.54 )

Diluted loss per share attributable to

Community Health Systems, Inc. common stockholders:

Continuing operations (f), (h), (i), (j), (k) $ (21.89 ) $ (15.41 )

Discontinued operations (0.11 ) (0.13 ) Net loss (h)

$ (22.00 ) $ (15.54 ) Weighted-average number of shares

outstanding (g): Basic 112 111 Diluted

112 111

____

For footnotes, see pages 14, 15, 16, 17

and 18.

COMMUNITY HEALTH

SYSTEMS, INC. AND SUBSIDIARIES Condensed Consolidated

Statements of Comprehensive Loss (In millions) (Unaudited)

Three Months Ended Year Ended December

31, December 31, 2017 2016 2017

2016 Net loss $ (2,007 ) $ (198 ) $ (2,396 ) $ (1,626

) Other comprehensive income, net of income taxes: Net change in

fair value of interest rate swaps, net of tax 11 28 19 17 Net

change in fair value of available-for-sale securities, net of tax 1

(3 ) 8 (11 )

Amortization and recognition of

unrecognized pension cost components, net of tax

12 (1 ) 14 3 Other

comprehensive income 24 24 41

9 Comprehensive loss (1,983 ) (174 ) (2,355 )

(1,617 ) Less: Comprehensive income attributable to noncontrolling

interests 6 22 63

95

Comprehensive loss attributable to

Community Health Systems, Inc. stockholders

$ (1,989 ) $ (196 ) $ (2,418 ) $ (1,712 )

____

For footnotes, see pages 14, 15, 16, 17

and 18.

COMMUNITY

HEALTH SYSTEMS, INC. AND SUBSIDIARIES Selected Operating

Data (a)(c) (Dollars in millions) (Unaudited)

Three

Months Ended December 31, Consolidated Same-Store

2017 2016 % Change 2017 2016

% Change Number of hospitals (at end of period) 125 155 125

125 Licensed beds (at end of period) 20,850 26,222 20,850 20,979

Beds in service (at end of period) 18,457 23,229 18,457 18,662

Admissions 164,365 203,496 -19.2 % 163,859 166,688 -1.7 % Adjusted

admissions 355,418 440,160 -19.3 % 354,134 357,170 -0.9 % Patient

days 726,882 910,209 724,920 738,864 Average length of stay (days)

4.4 4.5 4.4 4.4 Occupancy rate (average beds in service) 42.8 %

42.6 % 42.7 % 43.0 % Net operating revenues $ 3,059 $ 4,469 -31.6 %

$ 3,640 $ 3,576 1.8 %

Net inpatient revenues as a % of net

patient revenues before provision for bad debts (1)

43.4 % 43.6 % 43.4 % 44.5 %

Net outpatient revenues as a % of net

patient revenues before provision for bad debts (1)

56.6 % 56.4 % 56.6 % 55.5 % (Loss) income from operations (f), (i),

(j) $ (2,151 ) $ 75 -2968.0 %

(Loss) income from operations as a % of

net operating revenues

-70.3 % 1.7 % Depreciation and amortization $ 196 $ 261 Equity in

earnings of unconsolidated affiliates $ (2 ) $ (5 )

Net loss attributable to Community Health

Systems, Inc. stockholders

$ (2,013 ) $ (220 ) -815.0 %

Net loss attributable to Community Health

Systems, Inc. stockholders as a % of net operating revenues

-65.8 % -4.9 % Adjusted EBITDA (e) $ 409 $ 564 -27.5 %

Adjusted EBITDA as a % of net operating

revenues

13.4 % 12.6 % Net cash provided by operating activities $ 156 $ 327

-52.3 %

____

For footnotes, see pages 14, 15, 16, 17

and 18.

(1) This calculation excludes the

change in estimate related to net patient revenue to increase

contractual allowances recorded during the three months ended

December 31, 2017.

COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES Selected

Operating Data (a)(c) (Dollars in millions) (Unaudited)

Year Ended December 31, Consolidated

Same-Store 2017 2016 % Change

2017 2016 % Change Number of hospitals (at end

of period) 125 155 125 125 Licensed beds (at end of period) 20,850

26,222 20,850 20,979 Beds in service (at end of period) 18,457

23,229 18,457 18,662 Admissions 738,036 857,412 -13.9 % 659,681

672,375 -1.9 % Adjusted admissions 1,596,739 1,867,348 -14.5 %

1,421,816 1,446,502 -1.7 % Patient days 3,296,469 3,832,104

2,937,290 2,990,760 Average length of stay (days) 4.5 4.5 4.5 4.4

Occupancy rate (average beds in service) 43.3 % 43.1 % 43.4 % 43.8

% Net operating revenues $ 15,353 $ 18,438 -16.7 % $ 14,142 $

14,110 0.2 %

Net inpatient revenues as a % of net

patient revenues before provision for bad debts (1)

43.4 % 43.2 % 43.9 % 44.1 %

Net outpatient revenues as a % of net

patient revenues before provision for bad debts (1)

56.6 % 56.8 % 56.1 % 55.9 % Loss from operations (f), (i), (j) $

(1,878 ) $ (860 ) -118.4 %

Loss from operations as a % of net

operating revenues

-12.2 % -4.7 % Depreciation and amortization $ 861 $ 1,100 Equity

in earnings of unconsolidated affiliates $ (16 ) $ (43 )

Net loss attributable to Community Health

Systems, Inc. stockholders

$ (2,459 ) $ (1,721 ) -42.9 %

Net loss attributable to Community Health

Systems, Inc. stockholders as a % of net operating revenues

-16.0 % -9.3 % Adjusted EBITDA (e) $ 1,703 $ 2,225 -23.5 %

Adjusted EBITDA as a % of net operating

revenues

11.1 % 12.1 % Net cash provided by operating activities $ 773 $

1,137 -32.0 %

____

For footnotes, see pages 14, 15, 16, 17

and 18.

(1) This calculation excludes the

change in estimate related to net patient revenue to increase

contractual allowances recorded during the three months ended

December 31, 2017.

COMMUNITY HEALTH

SYSTEMS, INC. AND SUBSIDIARIES Condensed Consolidated

Balance Sheets (b) (In millions, except share data) (Unaudited)

December 31, 2017 December 31, 2016

ASSETS Current assets Cash and cash equivalents $ 563 $ 238

Patient accounts receivable, net of

allowance for doubtful accounts of $3,870 and $3,773 at December

31, 2017 and 2016, respectively

2,384 3,176 Supplies 444 480 Prepaid income taxes 17 17 Prepaid

expenses and taxes 198 187 Other current assets 462

568 Total current assets 4,068

4,666 Property and equipment: Land and improvements 671 782

Buildings and improvements 6,971 7,438 Equipment and fixtures

3,855 4,202 Property and equipment,

gross 11,497 12,422 Less accumulated depreciation and amortization

(4,445 ) (4,273 ) Property and equipment, net

7,052 8,149 Goodwill 4,723

6,521 Deferred income taxes 62

15

Other assets, net of accumulated

amortization of $883 and $929 at December 31, 2017 and 2016

1,545 2,593 Total assets $ 17,450

$ 21,944

LIABILITIES AND EQUITY Current

liabilities Current maturities of long-term debt $ 33 $ 455

Accounts payable 967 995 Accrued liabilities: Employee compensation

685 731 Accrued interest 229 207

Other

442 499 Total current liabilities

2,356 2,887 Long-term debt

13,880 14,789 Deferred income taxes 19

411 Other long-term liabilities 1,360

1,575 Total liabilities 17,615

19,662 Redeemable noncontrolling interests in equity

of consolidated subsidiaries 527 554

EQUITY Community Health Systems, Inc. stockholders’ (deficit)

equity: Preferred stock, $.01 par value per share, 100,000,000

shares authorized; none issued - -

Common stock, $.01 par value per share,

300,000,000 shares authorized; 114,651,004 shares issued and

outstanding at December 31, 2017, and 113,876,580 shares issued and

outstanding at December 31, 2016

1 1 Additional paid-in capital 2,014 1,975 Accumulated other

comprehensive loss (21 ) (62 ) Accumulated deficit (2,761 )

(299 ) Total Community Health Systems, Inc. stockholders’

(deficit) equity (767 ) 1,615 Noncontrolling interests in equity of

consolidated subsidiaries 75 113 Total

(deficit) equity (692 ) 1,728 Total

liabilities and equity $ 17,450 $ 21,944

____

For footnotes, see pages 14, 15, 16, 17

and 18.

COMMUNITY HEALTH SYSTEMS, INC. AND

SUBSIDIARIES Condensed Consolidated Statements of Cash Flows

(b) (In millions) (Unaudited)

Year Ended December 31,

2017 2016 Cash flows from operating

activities Net loss $ (2,396 ) $ (1,626 ) Adjustments to reconcile

net loss to net cash provided by operating activities: Depreciation

and amortization 861 1,100 Deferred income taxes (454 ) (116 )

Government and other legal settlements and related costs (j) 9 16

Stock-based compensation expense 24 46 Impairment of hospitals sold

or held for sale 6 8 Impairment and (gain) loss on sale of

businesses, net (i) 2,123 1,919 Loss from early extinguishment of

debt 40 30 Gain on sale of investments in unconsolidated affiliates

(k) - (94 ) Other non-cash expenses, net 35 31 Changes in operating

assets and liabilities, net of effects of acquisitions and

divestitures: Patient accounts receivable 732 (96 ) Supplies,

prepaid expenses and other current assets (33 ) 25 Accounts

payable, accrued liabilities and income taxes (69 ) (137 ) Other

(105 ) 31 Net cash provided by operating

activities 773 1,137 Cash flows

from investing activities Acquisitions of facilities and other

related businesses (6 ) (123 ) Purchases of property and equipment

(564 ) (744 ) Proceeds from disposition of hospitals and other

ancillary operations 1,692 143 Proceeds from sale of property and

equipment 7 15 Purchases of available-for-sale securities (125 )

(505 ) Proceeds from sales of available-for-sale securities 208 464

Proceeds from sale of investments in unconsolidated affiliates -

403 Distribution from Quorum Health Corporation - 1,219 Increase in

other investments (143 ) (242 ) Net cash provided by

investing activities 1,069 630

Cash flows from financing activities Repurchase of restricted stock

shares for payroll tax withholding requirements (5 ) (6 ) Deferred

financing costs and other debt-related costs (66 ) (26 ) Proceeds

from noncontrolling investors in joint ventures 5 - Redemption of

noncontrolling investments in joint ventures (6 ) (19 )

Distributions to noncontrolling investors in joint ventures (100 )

(92 ) Proceeds from sale-lease back - 159 Borrowings under credit

agreements 841 4,879 Issuance of long-term debt 3,100 - Proceeds

from receivables facility 105 107 Repayments of long-term

indebtedness (5,391 ) (6,715 ) Net cash used in

financing activities (1,517 ) (1,713 ) Net

change in cash and cash equivalents 325 54 Cash and cash

equivalents at beginning of period 238 184

Cash and cash equivalents at end of period $ 563 $

238

____

For footnotes, see pages 14, 15, 16, 17

and 18.

Footnotes to Financial Highlights, Financial

Statements and Selected Operating Data

(a) Continuing operating results exclude discontinued

operations for the three months and years ended December 31, 2017

and 2016. Both financial and statistical results exclude entities

in discontinued operations for all periods presented. Same-store

operating results and statistical data exclude information for the

hospitals sold during the period and the hospitals divested in the

spin-off of QHC in the comparable period in 2016. Such same-store

operating results and statistical information also exclude the

overall impact of the change in estimate related to net patient

revenue recorded in the fourth quarter of 2017. (b) The

contingent value right (“CVR”) entitles the holder to receive a

cash payment up to $1.00 per CVR (subject to downward adjustment

but not below zero), subject to the final resolution of certain

legal matters pertaining to Health Management Associates, Inc.

(“HMA”), as defined in the CVR agreement. If the aggregate amount

of applicable losses under the CVR agreement exceeds a deductible

of $18 million, then the amount payable in respect of each CVR

shall be reduced (but not below zero) by an amount equal to the

quotient obtained by dividing: (a) the product of (i) all losses in

excess of the deductible and (ii) 90%; by (b) the number of CVRs

outstanding on the date on which final resolution of the existing

litigation occurs. Since the HMA acquisition date of January 27,

2014, approximately $34 million in costs have been incurred and

approximately $30 million of settlements have been paid related to

certain HMA legal matters, which collectively exceed the deductible

of $18 million under the CVR agreement. The Company previously

recorded an estimated fair value of the remaining underlying claims

that will be covered by the CVR of $284 million as part of the

acquisition accounting for HMA, which, after consideration of

amounts paid and current estimates of valuation inputs, has been

adjusted to its estimated fair value of $256 million at December

31, 2017. In addition, although future legal fees (which are

expensed as incurred) associated with the HMA legal matters have

not been accrued or included in the table below, such legal fees

are taken into account in determining the total amount of

reductions applied to the amounts owed to CVR holders. The

following table presents the impact of the recorded amounts as

described above as applied to the CVR and the $18 million

deductible and 10% co-insurance amounts (in millions):

As of December 31, 2017 Legal

and other related costs incurred to date $ 34 Settlements 30

Estimated liability for probable contingencies - Estimated

liability for unresolved contingencies at fair value 256

Costs incurred plus certain estimated

liabilities for CVR-related matters

320 Allocated to: CHS deductible of $18 million (18 ) CHS

co-insurance at 10% (29 )

Recorded amounts that reduce CVR value

after giving effect to deductible and co-insurance

$ 273 CVRs outstanding 265 (c)

Included in discontinued operations for the three months and years

ended December 31, 2017 and 2016, are three smaller hospitals, two

of which are being actively marketed for sale and one hospital that

sold effective May 1, 2017. The after-tax loss for the sold or held

for sale hospitals, was approximately $3 million and $9 million for

the three months ended December 31, 2017 and 2016, respectively,

and approximately $12 million and $15 million for the years ended

December 31, 2017 and 2016, respectively.

Footnotes to Financial Highlights, Financial

Statements and Selected Operating Data (Continued)

(d) The following table provides information needed to

calculate loss per share, which is adjusted for income attributable

to noncontrolling interests (in millions):

Three Months Ended Year Ended

December 31, December 31, 2017 2016

2017 2016

Loss from continuing operations

attributable to Community Health Systems, Inc. common

stockholders:

Loss from continuing operations, net of taxes $ (2,004 ) $ (189 ) $

(2,384 ) $ (1,611 )

Less: Income from continuing operations

attributable to noncontrolling interests, net of taxes

6 22 63 95

Loss from continuing operations

attributable to Community Health Systems, Inc. common stockholders

— basic and diluted

$ (2,010 ) $ (211 ) $ (2,447 ) $ (1,706 )

Loss from discontinued operations

attributable to Community Health Systems, Inc. common

stockholders:

Loss from discontinued operations, net of taxes $ (3 ) $ (9 ) $ (12

) $ (15 )

Less: Loss from discontinued operations

attributable to noncontrolling interests, net of taxes

- - - -

Loss from discontinued operations

attributable to Community Health Systems, Inc. common stockholders

— basic and diluted

$ (3 ) $ (9 ) $ (12 ) $ (15 ) (e) EBITDA is a non-GAAP

financial measure which consists of net loss attributable to

Community Health Systems, Inc. before interest, income taxes, and

depreciation and amortization. Adjusted EBITDA, also a non-GAAP

financial measure, is EBITDA adjusted to add back net income

attributable to noncontrolling interests and to exclude the effect

of discontinued operations, loss from early extinguishment of debt,

impairment and (gain) loss on sale of businesses, gain on sale of

investments in unconsolidated affiliates, expense incurred related

to the spin-off of QHC, expense incurred related to the sale of a

majority ownership interest in the Company’s home care division,

expense (income) related to government and other legal settlements

and related costs, expense related to employee termination benefits

and other restructuring charges, (income) expense from fair value

adjustments on the CVR agreement liability accounted for at fair

value related to the HMA legal proceedings, and related legal

expenses, and the overall impact of the change in estimate related

to net patient revenue recorded in the fourth quarter of 2017

resulting from the increase in contractual allowances and the

provision for bad debts. During the three months ended December 31,

2017, the Company increased contractual allowances and the

provision for bad debts after completing an extensive analysis of

the Company’s patient revenues and patient accounts receivable that

was initiated as part of the development of new accounting

processes and methodologies to adopt the new accounting standard on

revenue recognition as required by generally accepted accounting

principles on January 1, 2018. This analysis included an evaluation

during the fourth quarter of 2017 of the Company’s patient accounts

receivable retained after the divestiture of 30 hospitals during

2017 and additional allowances recorded on such accounts receivable

based on updated estimates of future collections, and certain other

revenues. The full impact of this change in estimate is included in

the reported results of operations for the three months and year

ended December 31, 2017. These changes in estimate are not expected

to have a material impact on the recognition of revenue on a

prospective basis. The Company has included this adjustment in the

calculation of Adjusted EBITDA based on its belief that these

changes in estimate are consistent with the intended purpose of

Adjusted EBITDA in assessing the Company’s operational performance

and compare the Company’s performance between periods. The Company

has from time to time sold noncontrolling interests in certain of

its subsidiaries or acquired subsidiaries with existing

noncontrolling interest ownership positions. The Company believes

that it is useful to present Adjusted EBITDA because it adds back

the portion of EBITDA attributable to these third-party interests

and clarifies for investors the Company’s portion of EBITDA

generated by continuing operations. The Company reports Adjusted

EBITDA as a measure of financial performance. Adjusted EBITDA is a

key measure used by management to assess the operating performance

of the Company’s hospital operations and to make decisions on the

allocation of resources. Adjusted EBITDA is also used to evaluate

the performance of the Company’s executive management team and is

one of the primary targets used to determine short-term cash

incentive compensation. In addition, management utilizes Adjusted

EBITDA in assessing the Company’s consolidated results of

operations and operational performance and in comparing the

Company’s results of operations between periods. The Company

believes it is useful to provide investors and other users of the

Company’s financial statements this performance measure to align

with how management assesses the Company’s results of operations.

Adjusted EBITDA also is comparable to a similar metric called

Consolidated EBITDA, as defined in the Company’s senior secured

credit facility, which is a key component in the determination of

the Company’s compliance with some of the covenants under the

Company’s senior secured credit facility (including the Company’s

ability to service debt and incur capital expenditures), and is

used to determine the interest rate and commitment fee payable

under the senior secured credit facility (although Adjusted EBITDA

does not include all of the adjustments described in the senior

secured credit facility).

Footnotes to Financial Highlights, Financial

Statements and Selected Operating Data (Continued)

Adjusted EBITDA is not a measurement of financial

performance under U.S. GAAP. It should not be considered in

isolation or as a substitute for net income, operating income, or

any other performance measure calculated in accordance with U.S.

GAAP. The items excluded from Adjusted EBITDA are significant

components in understanding and evaluating financial performance.

The Company believes such adjustments are appropriate as the

magnitude and frequency of such items can vary significantly and

are not related to the assessment of normal operating performance.

Additionally, this calculation of Adjusted EBITDA may not be

comparable to similarly titled measures reported by other

companies. The following table reflects the reconciliation

of Adjusted EBITDA, as defined, to net loss attributable to

Community Health Systems, Inc. stockholders as derived directly

from the condensed consolidated financial statements (in millions):

Three Months Ended

Year Ended December 31, December 31,

2017 2016 2017 2016

Net loss attributable to Community Health

Systems, Inc. stockholders

$ (2,013 ) $ (220 ) $ (2,459 ) $ (1,721 ) Adjustments: (Benefit

from) provision for income taxes (375 ) 37 (449 ) (104 )

Depreciation and amortization 196 261 861 1,100 Net income

attributable to noncontrolling interests 6 22 63 95 Loss from

discontinued operations 3 9 12 15 Interest expense, net 225 232 931

962 Loss from early extinguishment of debt 5 - 40 30 Impairment and

(gain) loss on sale of businesses, net 1,760 224 2,123 1,919

Change in estimate for contractual

allowances and provision for bad debts

591 - 591 - Gain on sale of investments in unconsolidated

affiliates - - - (94 )

Expense (income) from government and other

legal settlements and related costs

1 5 (31 ) 16

(Income) expense from fair value

adjustments and legal expenses related to cases covered by the

CVR

- (6 ) 6 (6 ) Expense related to the sale of a majority interest in

home care division - - 1 1 Expense related to the spin-off of QHC -

- - 12

Expense related to employee termination

benefits and other restructuring charges

10 - 14 -

Adjusted EBITDA $ 409 $ 564 $ 1,703 $ 2,225

(f) Included in non-same-store loss from operations

and loss from continuing operations are pre-tax charges related to

acquisition costs of less than $1 million and $1 million for the

three months ended December 31, 2017 and 2016, respectively, and $2

million and $5 million for the years ended December 31, 2017 and

2016, respectively. (g) The following table sets forth

components reconciling the basic weighted-average number of shares

to the diluted weighted-average number of shares (in millions):

Three Months Ended

Year Ended December 31, December 31,

2017 2016 2017 2016

Weighted-average number of shares

outstanding - basic

112 111 112 111 Add effect of dilutive securities: Stock awards and

options - - - -

Weighted-average number of shares

outstanding - diluted

112 111 112 111 The Company generated a loss from continuing

operations attributable to Community Health Systems, Inc. common

stockholders for the three months and years ended December 31, 2017

and 2016, so the effect of dilutive securities is not considered

because their effect would be antidilutive. If the Company had

generated income from continuing operations, the effect of

restricted stock awards on the diluted shares calculation would

have been an increase of 3,000 shares and 650,071 shares during the

three months ended December 31, 2017 and 2016, respectively, and

111,464 shares and 331,518 shares during the years ended December

31, 2017 and 2016, respectively.

Footnotes to Financial Highlights, Financial

Statements and Selected Operating Data (Continued)

(h) The following supplemental tables reconcile loss from

continuing operations and net loss attributable to Community Health

Systems, Inc. common stockholders, as reported, on a per share

(diluted) basis, with the adjustments described herein (total per

share amounts may not add due to rounding). The Company believes

that the presentation of non-GAAP adjusted loss from continuing

operations per share (diluted) and non-GAAP adjusted net loss

attributable to Community Health Systems, Inc. common stockholders

presents useful information to investors through highlighting the

impact on earnings per share of selected items used in calculating

Adjusted EBITDA.

Three Months

Ended Year Ended December 31, December 31,

2017 2016 2017 2016 Loss from

continuing operations, as reported $ (17.95 ) $ (1.91 ) $ (21.89 )

$ (15.41 ) Adjustments: Loss from early extinguishment of debt 0.03

- 0.23 0.17 Impairment and (gain) loss on sale of businesses, net

13.94 2.35 16.84 16.07

Expense (income) from government and other

legal settlements and related costs

- 0.03 (0.18 ) 0.09

(Income) expense from fair value

adjustments and legal expenses related to cases covered by the

CVR

- (0.04 ) 0.04 (0.04 ) Gain on sale of investments in

unconsolidated affiliates - - - (0.54 ) Expense related to the

spin-off of QHC - 0.02 - 0.10

Expense related to the sale of a majority

interest in home care division

- - - 0.01

Expense related to employee termination

benefits and other restructuring charges

0.06 - 0.08 -

Change in estimate for contractual

allowances and provision for bad debts

3.38 - 3.38 - Expense related to change in Corporate income tax

rate 0.29 - 0.29 -

(Loss) income from continuing operations,

excluding adjustments

$ (0.25 ) $ 0.46 $ (1.20 ) $ 0.46

Three Months Ended Year Ended December 31,

December 31, 2017 2016 2017 2016

Net loss, as reported $ (17.98 ) $ (1.99 ) $ (22.00 ) $

(15.54 ) Adjustments: Loss from early extinguishment of debt 0.03 -

0.23 0.17 Impairment and (gain) loss on sale of businesses, net

13.94 2.35 16.84 16.07

Expense (income) from government and other

legal settlements and related costs

- 0.03 (0.18 ) 0.09

(Income) expense from fair value

adjustments and legal expenses related to cases covered by the

CVR

- (0.04 ) 0.04 (0.04 ) Gain on sale of investments in

unconsolidated affiliates - - - (0.54 ) Expense related to the

spin-off of QHC - 0.02 - 0.10

Expense related to the sale of a majority

interest in home care division

- - - 0.01

Expense related to employee termination

benefits and other restructuring charges

0.06 - 0.08 -

Change in estimate for contractual

allowances and provision for bad debts

3.38 - 3.38 - Expense related to change in Corporate income tax

rate 0.29 - 0.29 - Impairment of long-lived assets in discontinued

operations - 0.06 0.05

0.07 Net (loss) income, excluding adjustments $ (0.28

) $ 0.43 $ (1.26 ) $ 0.40

Footnotes to Financial Highlights, Financial

Statements and Selected Operating Data (Continued)

(i) Both loss from operations and loss from continuing

operations for the three months and year ended December 31, 2017,

included non-cash expense of approximately $1.760 billion and

$2.123 billion, respectively, primarily from an impairment charge

with respect to the value of goodwill for the Company’s hospital

reporting unit and impairment charges to reduce the value of

long-lived assets at hospitals that the Company has sold or

identified for sale and at certain under-performing hospitals. Both

income from operations and loss from continuing operations for the

three months ended December 31, 2016, included non-cash net expense

of approximately $224 million, primarily related to impairment

charges totaling approximately $315 million to reduce the value of

long-lived assets, primarily allocated goodwill, at certain

under-performing hospitals and hospitals that the Company had

identified for sale, which were partially offset by the gain of $91

million on the sale of a majority ownership interest in the

Company’s home care division. Both loss from operations and loss

from continuing operations for the year ended December 31, 2016,

included an impairment charge of approximately $1.919 billion, of

which $1.395 billion was a charge related to the write-down of a

portion of the goodwill for the Company’s hospital operation

reporting unit, and $598 million was a charge related to the

adjustment of the fair value of long-lived assets at certain of the

Company’s underperforming hospitals and some of the hospitals that

the Company was marketing for sale that had experienced declining

operating results or had a decline in their estimated fair value

since the Company’s previous impairment review. These impairment

charges were partially offset by the gain on the sale of a majority

ownership interest in the Company’s home care division of $91

million. Also, included in loss from operations and loss from

continuing operations for the year ended December 31, 2016, was an

impairment charge of approximately $17 million incurred during the

three months ended March 31, 2016, related to the write-down of a

portion of the goodwill allocated to the divestitures of Lehigh

Regional Medical Center and Bartow Regional Medical Center, as well

as the impairment of certain long-lived assets at one of the

Company’s smaller hospitals where the decision was made during the

quarter ended March 31, 2016, to permanently close the hospital.

These impairment charges do not have an impact on the calculation

of the Company’s financial covenants under the Company’s Credit

Facility. (j) The $0.18 per share (diluted) of income for

“Government and other legal settlements and related costs” for the

year ended December 31, 2017, is primarily the impact of the

shareholder derivative action settled during the year ended

December 31, 2017, net of related legal expenses. The $(0.03) and

$(0.09) per share (diluted) of expense for “Government and other

legal settlements and related costs” for the three months and year

ended December 31, 2016, respectively, is the net impact of several

lawsuits settled in principle during the three months and year

ended December 31, 2016, and related legal expenses. (k) On

April 29, 2016, the Company sold its unconsolidated minority equity

interests in Valley Health System, LLC, a joint venture with

Universal Health Systems, Inc. (“UHS”) representing four hospitals

in Las Vegas, Nevada, in which the Company owned a 27.5% interest,

and in Summerlin Hospital Medical Center, LLC, a joint venture with

UHS representing one hospital in Las Vegas, Nevada, in which the

Company owned a 26.1% interest. The Company received $403 million

in cash in return for the sale of its equity interests and

recognized a $94 million gain on sale of investments in

unconsolidated affiliates during the year ended December 31, 2016.

(l) Total per share amounts may not add due to rounding.

Regulation FD Disclosure

Set forth below is selected information concerning the Company’s

projected consolidated operating results for the year ending

December 31, 2018. These projections are based on the Company’s

historical operating performance, current trends and other

assumptions that the Company believes are reasonable at this time.

The 2018 guidance should be considered in conjunction with the

assumptions included herein. See pages 21 and 22 for a list of

factors that could affect the future results of the Company or the

healthcare industry generally.

The following is provided as guidance to analysts and

investors:

2018 Projection Range Net operating

revenues (in millions) $ 13,600 to $ 13,900 Adjusted EBITDA (in

millions) $ 1,550 to $ 1,650 Loss from continuing operations per

share - diluted $ (1.50 ) to $ (1.10 ) Same-store hospital annual

adjusted admissions (0.5 ) % to 0.5 % Weighted-average diluted

shares, in millions 113.0 to 114.0

The following assumptions were used in developing the 2018

guidance provided above:

- The guidance above includes

approximately $1.0 billion of net operating revenues with low to

mid-single digit Adjusted EBITDA margins, related to divestitures

we anticipate to occur throughout 2018. The operations associated

with these anticipated divestitures generated approximately $2.0

billion of net operating revenues in 2017 with mid-single digit

Adjusted EBITDA margins.

- The Company’s projections also exclude

the following:

- Payments related to the CVRs issued in

connection with the HMA acquisition, and changes in the valuation

of liabilities underlying the CVR;

- Effect of potential debt refinancing

activities, including losses from the early extinguishment of

debt;

- Impairment of goodwill and long-lived

assets;

- Gains or losses from the sales of

businesses;

- Employee termination benefits and

restructuring costs;

- Resolution of government investigations

or other significant legal settlements;

- Costs incurred in connection with

divestitures;

- Insurance recoveries that may be

received for property losses and business interruption coverage

related to Hurricanes Harvey and Irma;

- Changes in the estimated impact of the

Tax Cuts and Jobs Act on our deferred tax assets and liabilities;

and

- Other significant gains or losses that

neither relate to the ordinary course of business nor reflect the

Company’s underlying business performance.

Other assumptions used in the above guidance:

- Health Information Technology (HITECH)

electronic health records incentive reimbursement will be zero for

the year ending December 31, 2018.

- Same-store hospital annual adjusted

admissions decline of (0.5)% to growth of 0.5% for 2018, which does

not take into account service closures and weather-related or other

unusual events.

- Expressed as a percentage of net

operating revenues, depreciation and amortization of approximately

5.0% to 5.1% for 2018. Additionally, this is a fixed cost and the

percentages may change as revenue varies. Such amounts exclude the

possible impact of any future hospital fixed asset

impairments.

- Interest expense, expressed as a

percentage of net operating revenues, of approximately 6.5% to

6.6%; however, interest expense may vary as revenue varies.

Interest expense has been adjusted to reflect the repayment of debt

with proceeds from the anticipated divestitures, based on the

expected timing of those divestitures. Total fixed rate debt,

including swaps, is expected to average approximately 85% to 95% of

total debt during 2018.

- Expressed as a percentage of net

operating revenues, net income attributable to noncontrolling

interests of approximately 0.5% to 0.6% for 2018.

- Expressed as a percentage of net

operating revenues, provision for income taxes of approximately

0.5% to 0.6% for 2018.

A reconciliation of the Company’s projected 2018 Adjusted

EBITDA, a forward-looking non-GAAP financial measure, to the

Company’s projected net loss attributable to Community Health

Systems, Inc. stockholders, the most directly comparable GAAP

financial measure, is shown below:

Year Ending December 31, 2018

Low High

Net loss attributable to Community Health

Systems, Inc. stockholders (1)

$ (171 ) $ (124 ) Adjustments: Depreciation and amortization 690

700 Interest expense, net 890 910 Provision for income taxes 71 89

Net income attributable to noncontrolling interests 70

75 Adjusted EBITDA (1) $ 1,550 $ 1,650

(1) The Company does not include in

this reconciliation the impact of certain items not included in the

Company’s forecast set forth above that would be included in a

reconciliation of historical net loss attributable to Community

Health Systems, Inc. stockholders to Adjusted EBITDA such as, but

not limited to, losses from early extinguishment of debt,

impairment and (gain) loss on sale of businesses, and expense

(income) related to government and other legal settlements and

related costs, in light of the fact that such items are not

determinable and/or the inherent difficulty in quantifying such

projected amounts on a forward-looking basis.

- Capital expenditures are projected as

follows (in millions):

2018 Guidance Total $475 to $575

- Net cash provided by operating

activities, excluding cash flows related to the CVR and settlement

of legal contingencies, is projected as follows (in millions):

2018 Guidance Total $700 to $800

- Diluted weighted-average shares

outstanding are projected to be between approximately 113.0 million

to 114.0 million for 2018.

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995

that involve risk and uncertainties. All statements in this press

release other than statements of historical fact, including

statements regarding projections, expected operating results, and

other events that depend upon or refer to future events or

conditions or that include words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “estimates,” “thinks,” and similar

expressions, are forward-looking statements. Although the Company

believes that these forward-looking statements are based on

reasonable assumptions, these assumptions are inherently subject to

significant economic and competitive uncertainties and

contingencies, which are difficult or impossible to predict

accurately and may be beyond the control of the Company.

Accordingly, the Company cannot give any assurance that its

expectations will in fact occur and cautions that actual results

may differ materially from those in the forward-looking statements.

A number of factors could affect the future results of the Company

or the healthcare industry generally and could cause the Company’s

expected results to differ materially from those expressed in this

press release.

These factors include, among other things:

- general economic and business

conditions, both nationally and in the regions in which we

operate;

- the impact of changes made to the

Affordable Care Act, the potential for repeal or additional changes

to the Affordable Care Act, its implementation or its

interpretation (including through executive orders), as well as

changes in other federal, state or local laws or regulations

affecting our business;

- the extent to which states support

increases, decreases or changes in Medicaid programs, implement

health insurance exchanges or alter the provision of healthcare to

state residents through regulation or otherwise;

- the future and long-term viability of

health insurance exchanges and potential changes to the beneficiary

enrollment process;

- risks associated with our substantial

indebtedness, leverage and debt service obligations, and the fact

that a substantial portion of our indebtedness will mature and

become due in the near future, including our ability to refinance

such indebtedness on acceptable terms or to incur additional

indebtedness;

- demographic changes;

- changes in, or the failure to comply

with, governmental regulations;

- potential adverse impact of known and

unknown government investigations, audits, and federal and state

false claims act litigation and other legal proceedings;

- our ability, where appropriate, to

enter into and maintain provider arrangements with payors and the

terms of these arrangements, which may be further affected by the

increasing consolidation of health insurers and managed care

companies and vertical integration efforts involving payors and

healthcare providers;

- changes in, or the failure to comply

with, contract terms with payors and changes in reimbursement rates

paid by federal or state healthcare programs or commercial

payors;

- any potential additional impairments in

the carrying value of goodwill, other intangible assets, or other

long-lived assets, or changes in the useful lives of other

intangible assets;

- changes in inpatient or outpatient

Medicare and Medicaid payment levels and methodologies;

- the effects related to the continued

implementation of the sequestration spending reductions and the

potential for future deficit reduction legislation;

- increases in the amount and risk of

collectability of patient accounts receivable, including decreases

in collectability which may result from, among other things,

self-pay growth and difficulties in recovering payments for which

patients are responsible, including co-pays and deductibles;

- the efforts of insurers, healthcare

providers, large employer groups and others to contain healthcare

costs, including the trend toward value-based purchasing;

- our ongoing ability to demonstrate

meaningful use of certified electronic health record technology and

recognize income for the related Medicare or Medicaid incentive

payments, to the extent such payments have not expired;

- increases in wages as a result of

inflation or competition for highly technical positions and rising

supply and drug costs due to market pressure from pharmaceutical

companies and new product releases;

- liabilities and other claims asserted

against us, including self-insured malpractice claims;

- competition;

- our ability to attract and retain, at

reasonable employment costs, qualified personnel, key management,

physicians, nurses and other healthcare workers;

- trends toward treatment of patients in

less acute or specialty healthcare settings, including ambulatory

surgery centers or specialty hospitals;

- changes in medical or other

technology;

- changes in U.S. generally accepted

accounting principles;

- the availability and terms of capital

to fund any additional acquisitions or replacement facilities or

other capital expenditures;

- our ability to successfully make

acquisitions or complete divestitures, including the disposition of

hospitals and non-hospital businesses pursuant to our portfolio

rationalization and deleveraging strategy, our ability to complete

any such acquisitions or divestitures on desired terms or at all

(including to realize the anticipated amount of proceeds from

contemplated dispositions), the timing of the completion of any

such acquisitions or divestitures, and our ability to realize the

intended benefits from any such acquisitions or divestitures;

- the impact that changes in our

relationships with joint venture or syndication partners could have

on effectively operating our hospitals or ancillary services or in

advancing strategic opportunities;

- our ability to successfully integrate

any acquired hospitals, or to recognize expected synergies from

acquisitions;

- the impact of seasonal severe weather

conditions, including the timing and amount of insurance recoveries

in relation to severe weather events such as Hurricanes Harvey and

Irma;

- our ability to obtain adequate levels

of general and professional liability insurance;

- timeliness of reimbursement payments

received under government programs;

- effects related to outbreaks of

infectious diseases;

- the impact of prior or potential future

cyber-attacks or security breaches;

- any failure to comply with the terms of

the Corporate Integrity Agreement;

- the concentration of our revenue in a

small number of states;

- our ability to realize anticipated cost

savings and other benefits from our current strategic and

operational cost savings initiatives;

- changes in interpretations, assumptions

and expectations regarding the Tax Act; and

- the other risk factors set forth in our

other public filings with the Securities and Exchange

Commission.

The consolidated operating results for the three months and year

ended December 31, 2017, are not necessarily indicative of the

results that may be experienced for any future periods. The Company

cautions that the projections for calendar year 2018 set forth in

this press release are given as of the date hereof based on

currently available information. The Company undertakes no

obligation to revise or update any forward-looking statements, or

to make any other forward-looking statements, whether as a result

of new information, future events or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180227006595/en/

Community Health Systems, Inc.Thomas J. Aaron,

615-465-7000Executive Vice Presidentand Chief Financial Officer

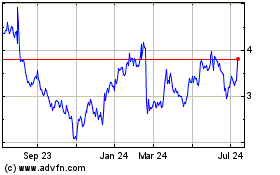

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Aug 2024 to Sep 2024

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Sep 2023 to Sep 2024