Current Report Filing (8-k)

November 09 2017 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 9, 2017

CIRCOR INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

DELAWARE

|

001-14962

|

04-3477276

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Commission file number)

|

(I.R.S. Employer

Identification No.)

|

30 CORPORATE DRIVE, SUITE 200

BURLINGTON, MASSACHUSETTS 01803-4238

(Address of principal executive offices) (Zip Code)

(781) 270-1200

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 7.01. Regulation FD Disclosure.

In connection with its previously announced agreement to acquire the fluid handling business of Colfax Corporation (the “Transaction”), CIRCOR International, Inc. (the “Company”) will provide certain financial and other information, including the information attached as Exhibits 99.1, 99.2, and 99.3 to this Current Report on Form 8-K, to prospective lenders for the $785 million secured term loan facility and $150 million revolving credit facility to be entered into by the Company in connection with the Transaction.

The information contained herein includes financial measures of the Company that are not calculated in accordance with accounting principles generally accepted in the United States (“GAAP”). The Company’s management believes that these non-GAAP financial measures provide supplemental information that enhances management’s, investors’ and prospective lenders’ ability to evaluate the Company’s operating results and ability to repay its obligations.

These non-GAAP financial measures are not intended to be used in isolation and should not be considered a substitute for any other performance measure determined in accordance with GAAP. Investors and potential investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool, including that other companies may calculate similar non-GAAP financial measures differently than as defined in the attached materials, limiting their usefulness as a comparative tool. The Company compensates for these limitations by providing specific information regarding the GAAP amounts excluded from the non-GAAP financial measures. The Company further compensates for the limitations of its use of non-GAAP financial measures by presenting comparable GAAP measures. Investors and potential investors are encouraged to review the reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures contained herein.

The information in this Item 7.01 of Current Report on Form 8-K and Exhibits 99.1, 99.2, and 99.3 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

Exhibit No.

|

Description of Exhibit

|

|

|

Excerpts from materials to be provided to prospective lenders

|

|

|

Colfax’s fluid handling business audited financial statements

|

|

|

Colfax’s fluid handling business interim financial statements

|

Forward-Looking Statements

This Current Report on Form 8-K and Exhibit 99.1 attached hereto contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements may often be identified by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” “potential,” and similar terms and expressions. Reliance should not be placed on forward-looking statements because they involve unknown risks, uncertainties and other factors, which are, in some cases, beyond the control of the Company. Any statements in this Current Report on Form 8-K that are not statements of historical fact are forward-looking statements, including, but not limited to, statements regarding the Company’s proposed debt financing, the benefits and synergies of the proposed Transaction, including the effect of the Transaction on revenue, cost savings, cash flow and operating margin; the expected timing for completing the Transaction; and the Company’s expected product offerings, market position and market opportunities. The following important factors and uncertainties, among others, could cause actual events, performance or results to differ materially from the anticipated events, performance or results expressed or implied by such forward-looking statements: the ability to satisfy the conditions to closing of the proposed Transaction, on the expected timing or at all; the ability to obtain required regulatory approvals for the proposed Transaction, on the expected timing or at all; the occurrence of any event that could give rise to the termination of the purchase agreement relating to the Transaction; higher than expected or unexpected costs associated with or relating to the Transaction; the risk that expected benefits, synergies and growth prospects of the Transaction may not be achieved in a timely manner, or at all; the risk that the fluid handling business may not be successfully integrated with the Company’s business following the closing of the Transaction; the risk that the Company will be unable to retain and hire key personnel; and the risk that disruption from the Transaction may adversely affect the Company’s business and relationships with its customers, suppliers or employees. For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to the Company’s filings with the Securities and Exchange Commission, including the risk factors contained in the Company’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CIRCOR INTERNATIONAL, INC.

|

|

|

|

|

Date: November 9, 2017

|

By: /s/ Rajeev Bhalla

|

|

|

Name: Rajeev Bhalla

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

CIRCOR (NYSE:CIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

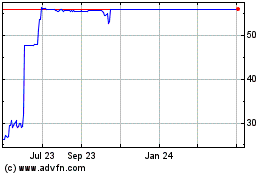

CIRCOR (NYSE:CIR)

Historical Stock Chart

From Apr 2023 to Apr 2024