Highlights

- Reaffirming 2017 guidance and average

annual growth of 8% to 10% in Adjusted EPS and Consolidated Free

Cash Flow through 2020

- Results were adversely affected by a

higher quarterly tax rate and recent hurricanes in the Caribbean;

Diluted EPS was $0.23, a $0.03 decrease compared to the third

quarter of 2016 and Adjusted EPS was $0.24, an $0.08 decrease

compared to the third quarter of 2016

- On track to achieve $400 million in

annual cost savings and revenue enhancements by year-end 2020 and

aggressively evaluating additional opportunities

- Significantly increasing asset sales

target and now expects to realize $2 billion in proceeds from 2018

through 2020

The AES Corporation (NYSE: AES) today reported financial results

for the three months ended September 30, 2017.

Third quarter 2017 Diluted Earnings Per Share from Continuing

Operations (Diluted EPS) was $0.23, a decrease of $0.03 compared to

the third quarter of 2016, reflecting a higher quarterly tax rate

and the impact of recent hurricanes. These impacts were partially

offset by unrealized foreign currency gains and lower impairment

expense. Third quarter 2017 Adjusted Earnings Per Share (Adjusted

EPS, a non-GAAP financial measure) decreased $0.08 to $0.24,

reflecting a $0.05 impact from a higher quarterly adjusted

effective tax rate of 35% versus 23% in the third quarter of 2016

and a $0.02 impact largely for the reserves booked for

hurricane-related damages to the Company's businesses in Puerto

Rico and the U.S. Virgin Islands. On a full year 2017 basis, the

Company continues to expect a $0.03 to $0.05 impact of recent

hurricanes in the Caribbean and a full year 2017 adjusted effective

tax rate of 31% to 33%.

"We are upsizing our asset sales target in order to accelerate

our strategy and now expect to realize $2 billion of proceeds from

2018 to 2020. Further, while we are on track to achieve $400

million in annual cost savings and revenue enhancements by 2020 is

on track, we are aggressively reviewing our cost structure and see

potential for additional improvement," said Andrés Gluski, AES

President and Chief Executive Officer. "These initiatives will

allow us to continue to simplify our business mix and redeploy

capital to deliver an attractive total return to shareholders."

"Based on our year-to-date performance and outlook, we are

reaffirming our 2017 guidance and expectations through 2020," said

Tom O'Flynn, AES Executive Vice President and Chief Financial

Officer. "As a result of our growing cash flow and continued Parent

debt pay down, including $300 million this year, we expect to

achieve investment grade credit status by 2020."

Consolidated Net Cash Provided by Operating Activities for the

third quarter of 2017 was $735 million, a decrease of $84 million

compared to the third quarter of 2016. This decrease was primarily

driven by higher working capital requirements at the Company's

Brazil, US, and Mexico, Central America and the Caribbean (MCAC)

Strategic Business Units (SBU), which more than offset higher

consolidated margins. Third quarter 2017 Consolidated Free Cash

Flow (a non-GAAP financial measure) decreased $64 million to $601

million, compared to the third quarter of 2016, primarily due to

the same drivers as Consolidated Net Cash Provided by Operating

Activities.

Table 1: Key Financial Results

Third

Quarter

Year-to-DateSeptember

30,

Full Year 2017 Guidance $ in Millions, Except Per

Share Amounts

2017 2016

2017 2016 Diluted EPS from Continuing

Operations $ 0.23 $ 0.26 $ 0.27 $ 0.31 N/A Adjusted

EPS 1 $ 0.24 $ 0.32 $ 0.66 $ 0.64 $1.00-$1.10 2 Consolidated Net

Cash Provided by Operating Activities $ 735 $ 819 $ 1,689 $ 2,182

$2,000-$2,800 Consolidated Free Cash Flow 1 $ 601

$ 665 $ 1,253 $ 1,709

$1,400-$2,000 1 A non-GAAP financial measure. See

“Non-GAAP Financial Measures” for definitions and reconciliations

to the most comparable GAAP financial measures. 2 On October 9,

2017, the Company announced that it expected to be in the lower

half of the range.

Guidance and Expectations

The Company is reaffirming its 2017 guidance and expectations

through 2020. As disclosed on October 9, 2017, the Company expects

its Adjusted EPS to be in the lower half of the range due to the

$0.03 to $0.05 full year impact of recent hurricanes in the

Caribbean.

Table 2: Guidance and Expectations

$ in Millions, Except Per Share

Amounts

2017 Guidance 2020 Expectations

Adjusted EPS 1,2 $1.00-$1.10

8%-10% growth from mid-point of2016

guidance of $0.95-$1.05

Consolidated Net Cash Provided by Operating Activities

$2,000-$2,800 N/A Consolidated Free Cash Flow 1

$1,400-$2,000

8%-10% growth from mid-point of2016

expectation of $1,300-$2,200

1 A non-GAAP financial measure. See “Non-GAAP Financial

Measures” for definitions and reconciliations to the most

comparable GAAP financial measures. 2 The Company is not able to

provide a corresponding GAAP equivalent for its Adjusted EPS

guidance. In providing its full year 2017 Adjusted EPS guidance,

the Company notes that there could be differences between expected

reported earnings and estimated operating earnings, including the

items listed below. Therefore, management is not able to estimate

the aggregate impact, if any, of these items on reported earnings.

As of September 30, 2017, the impact of these items was as follows:

(a) unrealized gains or losses related to derivative transactions

represent a gain of $5 million, (b) unrealized foreign currency

gains or losses represent a gain of $34 million, (c) gains or

losses and associated benefits and costs due to dispositions and

acquisitions of business interests, including early plant closures,

and the tax impact of the repatriation of sales proceeds represent

a loss of $83 million, (d) losses due to impairments of $182

million and (e) gains, losses and costs due to the early retirement

of debt represent a loss of $29 million.

The Company expects 8% to 10% average annual growth in Parent

Free Cash Flow (a non-GAAP financial metric) through 2020 from the

mid-point of its 2016 expectation of $525 to $625 million. Subject

to Board approval, and in line with this reaffirmed expectation,

the Company continues to expect its shareholder dividend to grow 8%

to 10% annually on average, as well.

The Company's 2017 guidance is based on foreign currency and

commodity forward curves as of September 30, 2017. The Company's

expectations through 2020 are based on foreign currency and

commodity forward curves as of December 31, 2016.

Additional Highlights

- In July 2017, the Company and Siemens

announced the formation of Fluence, a joint venture to sell the

companies' energy storage platforms in more than 160 countries.

- The transaction is expected to close in

the fourth quarter of 2017, subject to customary regulatory

approvals.

- In September 2017, as a result of

Hurricanes Irma and Maria, the Company sustained modest damage to

its 24 MW Ilumina solar plant and minor damage to its 524 MW AES

Puerto Rico coal-fired plant, both located in Puerto Rico. Although

the transmission lines are out of service, both plants are

available to generate electricity and meet their obligations under

their Power Purchase Agreements (PPA). The Company's 5 MW USVI

Solar I plant in the U.S. Virgin Islands was materially damaged.

- As disclosed in October 2017, the full

year impact on the Company's 2017 Adjusted EPS is expected to be

$0.03 to $0.05, which is related to the damage to the three plants,

business interruption and deductibles under the Company's captive

insurance policy. In the third quarter of 2017 the Company recorded

an impact of $0.02, largely attributable to reserves booked for

hurricane-related damages.

- AES Puerto Rico continues to work

closely with first responders, including FEMA, the Puerto Rican

Electric Power Authority (PREPA) and all levels of government in

Puerto Rico, to put existing electric infrastructure assets back

on-line to help restore electric service as soon as possible.

- AES Puerto Rico has offered emergency

power and diesel to municipalities, hospitals and police

departments.

- AES Puerto Rico donated and helped

distribute thousands of gallons of water and canned food to both

AES people and local municipalities.

- In September 2017, the Company

completed two new lithium-ion battery-based energy storage

projects, for a total of 20 MW, in the Dominican Republic.

- The two projects played a key role in

maintaining grid reliability in September 2017 when Hurricanes Irma

and Maria struck the Dominican Republic.

- In the third quarter of 2017, the

Company invested in long-term renewable growth projects with

attractive returns.

- In July 2017, the Company

and Alberta Investment Management Corporation (AIMCo)

closed the acquisition of FTP Power LLC (sPower).

- In July 2017, the Company signed an

agreement to acquire the 306 MW Mesa La Paz wind development

project in Mexico. Subsequently, the Company contracted the project

under a 25-year PPA.

- Utilizing the debt capacity at Tiete in

Brazil, in September 2017, the Company finalized the acquisition of

the 75 MW Boa Hora solar project and signed an agreement to acquire

the 150 MW Bauru solar project. Both of these projects are

contracted under 20-year PPAs.

- In October 2017, the Public Utilities

Commission of Ohio approved DPL's Electric Security Plan (ESP), in

line with the terms in the previously executed Stipulation

Agreement.

- The Company currently has 4,795 MW of

capacity under construction and expected to come on-line through

2021.

- The Company is on track to achieve its

previously disclosed target of $400 million in annual run-rate cost

savings and revenue enhancements by 2020. This includes $250

million already realized through December 2016 and the remaining

$150 million to be realized through 2020.

Non-GAAP Financial Measures

See Non-GAAP Financial Measures for definitions of Consolidated

Free Cash Flow, Adjusted Earnings Per Share and Adjusted Pre-Tax

Contributions, as well as reconciliations to the most comparable

GAAP financial measures.

Attachments

Condensed Consolidated Statements of Operations, Segment

Information, Condensed Consolidated Balance Sheets, Condensed

Consolidated Statements of Cash Flows, Non-GAAP Financial Measures,

Parent Financial Information 2016 Financial Guidance Elements and

2017 Financial Guidance Elements.

Conference Call Information

AES will host a conference call on Thursday, November 2,

2017 at 9:00 a.m. Eastern Daylight Time (EDT). Interested parties

may listen to the teleconference by dialing 1-888-317-6003 at least

ten minutes before the start of the call. International callers

should dial +1-412-317-6061. The Conference ID for this call is

9189879. Internet access to the conference call and presentation

materials will be available on the AES website

at www.aes.com by selecting “Investors” and then

“Presentations and Webcasts.”

A webcast replay, as well as a replay in downloadable MP3

format, will be accessible at www.aes.com beginning

shortly after the completion of the call.

About AES

The AES Corporation (NYSE: AES) is a Fortune 200 global power

company. We provide affordable, sustainable energy to 16 countries

through our diverse portfolio of distribution businesses as well as

thermal and renewable generation facilities. Our workforce of

19,000 people is committed to operational excellence and meeting

the world’s changing power needs. Our 2016 revenues were $14

billion and we own and manage $36 billion in total assets. To learn

more, please visit www.aes.com. Follow AES on Twitter

@TheAESCorp.

Safe Harbor Disclosure

This news release contains forward-looking statements within the

meaning of the Securities Act of 1933 and of the Securities

Exchange Act of 1934. Such forward-looking statements include, but

are not limited to, those related to future earnings, growth and

financial and operating performance. Forward-looking statements are

not intended to be a guarantee of future results, but instead

constitute AES’ current expectations based on reasonable

assumptions. Forecasted financial information is based on certain

material assumptions. These assumptions include, but are not

limited to, our accurate projections of future interest rates,

commodity price and foreign currency pricing, continued normal

levels of operating performance and electricity volume at our

distribution companies and operational performance at our

generation businesses consistent with historical levels, as well as

achievements of planned productivity improvements and incremental

growth investments at normalized investment levels and rates of

return consistent with prior experience.

Actual results could differ materially from those projected in

our forward-looking statements due to risks, uncertainties and

other factors. Important factors that could affect actual results

are discussed in AES’ filings with the Securities and Exchange

Commission (the “SEC”), including, but not limited to, the risks

discussed under Item 1A “Risk Factors” and Item 7:

Management’s Discussion & Analysis in AES’ 2016 Annual

Report on Form 10-K and in subsequent reports filed with the SEC.

Readers are encouraged to read AES’ filings to learn more about the

risk factors associated with AES’ business. AES undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

Any Stockholder who desires a copy of the Company’s 2016 Annual

Report on Form 10-K dated on or about February 27, 2017 with

the SEC may obtain a copy (excluding Exhibits) without charge by

addressing a request to the Office of the Corporate Secretary, The

AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203.

Exhibits also may be requested, but a charge equal to the

reproduction cost thereof will be made. A copy of the Form 10-K may

be obtained by visiting the Company’s website

at www.aes.com.

THE AES CORPORATION Condensed Consolidated

Statements of Operations (Unaudited) Three Months

Ended September 30, Nine Months Ended

September 30, 2017 2016 2017

2016 (in millions, except per share amounts)

Revenue: Regulated $ 1,793 $ 1,785 $ 5,157 $ 4,926 Non-Regulated

1,839 1,757 5,437 5,116 Total revenue

3,632 3,542 10,594 10,042 Cost of

Sales: Regulated (1,574 ) (1,623 ) (4,640 ) (4,521 ) Non-Regulated

(1,347 ) (1,231 ) (3,980 ) (3,750 ) Total cost of sales (2,921 )

(2,854 ) (8,620 ) (8,271 ) Operating margin 711 688

1,974 1,771 General and administrative expenses (52 )

(40 ) (155 ) (135 ) Interest expense (353 ) (354 ) (1,034 ) (1,086

) Interest income 101 110 291 365 Loss on extinguishment of debt

(49 ) (16 ) (44 ) (12 ) Other expense (47 ) (13 ) (95 ) (42 ) Other

income 18 18 105 43 Gain (loss) on disposal and sale of businesses

(1 ) — (49 ) 30 Asset impairment expense (2 ) (79 ) (260 ) (473 )

Foreign currency transaction gains (losses) 21 (20 ) 13

(16 ) INCOME FROM CONTINUING OPERATIONS BEFORE TAXES AND

EQUITY IN EARNINGS OF AFFILIATES 347 294 746 445 Income tax expense

(110 ) (75 ) (270 ) (165 ) Net equity in earnings of affiliates 24

11 33 25 INCOME FROM CONTINUING

OPERATIONS 261 230 509 305 Loss from operations of discontinued

businesses, net of income tax benefit of $4 for the nine months

ended September 30, 2016 — (1 ) — (7 ) Net loss from disposal and

impairments of discontinued businesses, net of income tax benefit

of $401 for the nine months ended September 30, 2016 — —

— (382 ) NET INCOME (LOSS) 261 229 509 (84 ) Less:

Net income attributable to noncontrolling interests and redeemable

stock of subsidiaries (109 ) (54 ) (328 ) (97 ) NET INCOME (LOSS)

ATTRIBUTABLE TO THE AES CORPORATION $ 152 $ 175 $ 181

$ (181 ) AMOUNTS ATTRIBUTABLE TO THE AES CORPORATION COMMON

STOCKHOLDERS: Income from continuing operations, net of tax $ 152 $

176 $ 181 $ 208 Loss from discontinued operations, net of tax —

(1 ) — (389 ) NET INCOME (LOSS) ATTRIBUTABLE TO THE

AES CORPORATION $ 152 $ 175 $ 181 $ (181 )

BASIC EARNINGS PER SHARE: Income from continuing operations

attributable to The AES Corporation common stockholders, net of tax

$ 0.23 $ 0.26 $ 0.28 $ 0.31 Loss from discontinued operations

attributable to The AES Corporation common stockholders, net of tax

— — — (0.59 ) NET INCOME (LOSS) ATTRIBUTABLE

TO THE AES CORPORATION COMMON STOCKHOLDERS $ 0.23 $ 0.26

$ 0.28 $ (0.28 ) DILUTED EARNINGS PER SHARE: Income

from continuing operations attributable to The AES Corporation

common stockholders, net of tax $ 0.23 $ 0.26 $ 0.27 $ 0.31 Loss

from discontinued operations attributable to The AES Corporation

common stockholders, net of tax — — — (0.59 )

NET INCOME (LOSS) ATTRIBUTABLE TO THE AES CORPORATION COMMON

STOCKHOLDERS $ 0.23 $ 0.26 $ 0.27 $ (0.28 )

DILUTED SHARES OUTSTANDING 663 662 662 662

DIVIDENDS DECLARED PER COMMON SHARE $ 0.12 $ 0.11

$ 0.24 $ 0.22

THE AES

CORPORATION Strategic Business Unit (SBU) Information

(Unaudited) Three Months

Ended September 30, Nine Months Ended

September 30, (in millions) 2017 2016

2017 2016 REVENUE US $ 852 $ 916 $ 2,445 $

2,582 Andes 689 667 1,979 1,864 Brazil 1,085 1,027 3,106 2,761 MCAC

630 547 1,851 1,596 Eurasia 380 386 1,204 1,249 Corporate, Other

and Inter-SBU eliminations (4 ) (1 ) 9 (10 ) Total Revenue $

3,632 $ 3,542 $ 10,594 $ 10,042

THE AES CORPORATION Condensed Consolidated Balance

Sheets (Unaudited) September 30, December

31, 2017 2016

(in millions, except shareand

per share data)

ASSETS CURRENT ASSETS Cash and cash equivalents $ 1,398 $

1,305 Restricted cash 437 278 Short-term investments 563 798

Accounts receivable, net of allowance for doubtful accounts of $90

and $111, respectively 2,357 2,166 Inventory 660 630 Prepaid

expenses 89 83 Other current assets 1,080 1,151 Current assets of

held-for-sale businesses 76 — Total current assets

6,660 6,411 NONCURRENT ASSETS Property, Plant and

Equipment: Land 798 779 Electric generation, distribution assets

and other 29,916 28,539 Accumulated depreciation (10,199 ) (9,528 )

Construction in progress 3,841 3,057 Property, plant

and equipment, net 24,356 22,847 Other Assets:

Investments in and advances to affiliates 1,164 621 Debt service

reserves and other deposits 786 593 Goodwill 1,157 1,157 Other

intangible assets, net of accumulated amortization of $563 and

$519, respectively 474 359 Deferred income taxes 760 781 Service

concession assets, net of accumulated amortization of $182 and

$114, respectively 1,382 1,445 Other noncurrent assets 2,095

1,905 Total other assets 7,818 6,861 TOTAL

ASSETS $ 38,834 $ 36,119

LIABILITIES AND

EQUITY CURRENT LIABILITIES Accounts payable $ 2,091 $ 1,656

Accrued interest 353 247 Accrued and other liabilities 2,020 2,066

Non-recourse debt, includes $439 and $273, respectively, related to

variable interest entities 2,257 1,303 Current liabilities of

held-for-sale businesses 15 — Total current

liabilities 6,736 5,272 NONCURRENT LIABILITIES

Recourse debt 4,954 4,671 Non-recourse debt, includes $1,305 and

$1,502, respectively, related to variable interest entities 14,822

14,489 Deferred income taxes 742 804 Pension and other

postretirement liabilities 1,387 1,396 Other noncurrent liabilities

3,047 3,005 Total noncurrent liabilities 24,952

24,365 Commitments and Contingencies (see Note 8)

Redeemable stock of subsidiaries 967 782 EQUITY THE AES CORPORATION

STOCKHOLDERS’ EQUITY Common stock ($0.01 par value, 1,200,000,000

shares authorized; 816,312,913 issued and 660,386,566 outstanding

at September 30, 2017 and 816,061,123 issued and 659,182,232

outstanding at December 31, 2016) 8 8 Additional paid-in capital

8,670 8,592 Accumulated deficit (934 ) (1,146 ) Accumulated other

comprehensive loss (2,666 ) (2,756 ) Treasury stock, at cost

(155,926,347 and 156,878,891 shares at September 30, 2017 and

December 31, 2016, respectively) (1,892 ) (1,904 ) Total AES

Corporation stockholders’ equity 3,186 2,794 NONCONTROLLING

INTERESTS 2,993 2,906 Total equity 6,179 5,700

TOTAL LIABILITIES AND EQUITY $ 38,834 $ 36,119

THE AES CORPORATION Condensed Consolidated

Statements of Cash Flows (Unaudited)

Three Months EndedSeptember

30,

Nine Months Ended September 30, 2017

2016 2017 2016 (in millions)

(in millions) OPERATING ACTIVITIES: Net income (loss) $ 261

$ 229 $ 509 $ (84 ) Adjustments to net income (loss): Depreciation

and amortization 303 291 884 877 Loss (gain) on sales and disposals

of businesses 1 — 49 (30 ) Impairment expenses 2 79 260 475

Deferred income taxes 15 (32 ) (3 ) (475 ) Provisions for

contingencies 7 7 30 28 Loss on extinguishment of debt 49 16 44 12

Loss on sales of assets 15 12 34 26 Impairments of discontinued

operations — — — 783 Other (33 ) 27 61 106 Changes in operating

assets and liabilities (Increase) decrease in accounts receivable

(159 ) (31 ) (279 ) 335 (Increase) decrease in inventory (23 ) 24

(66 ) 36 (Increase) decrease in prepaid expenses and other current

assets (16 ) 197 140 670 (Increase) decrease in other assets (111 )

(65 ) (266 ) (237 ) Increase (decrease) in accounts payable and

other current liabilities 296 (10 ) 162 (567 ) Increase (decrease)

in income tax payables, net and other tax payables 57 (15 ) (4 )

(270 ) Increase (decrease) in other liabilities 71 90

134 497 Net cash provided by operating activities 735

819 1,689 2,182 INVESTING ACTIVITIES:

Capital expenditures (464 ) (515 ) (1,587 ) (1,770 ) Acquisitions

of businesses, net of cash acquired, and equity method investments

(604 ) (50 ) (606 ) (61 ) Proceeds from the sale of businesses, net

of cash sold, and equity method investments 6 1 39 157 Sale of

short-term investments 1,012 985 2,942 3,747 Purchase of short-term

investments (797 ) (991 ) (2,673 ) (3,797 ) Increase in restricted

cash, debt service reserves. and other assets (299 ) 19 (311 ) (123

) Other investing (28 ) 8 (86 ) (22 ) Net cash used in

investing activities (1,174 ) (543 ) (2,282 ) (1,869 ) FINANCING

ACTIVITIES: Borrowings under the revolving credit facilities 951

415 1,489 1,079 Repayments under the revolving credit facilities

(327 ) (175 ) (851 ) (856 ) Issuance of recourse debt 500 — 1,025

500 Repayments of recourse debt (493 ) (197 ) (1,353 ) (808 )

Issuance of non-recourse debt 871 584 2,703 2,118 Repayments of

non-recourse debt (749 ) (666 ) (1,731 ) (1,720 ) Payments for

financing fees (16 ) (31 ) (96 ) (86 ) Distributions to

noncontrolling interests (79 ) (120 ) (263 ) (356 ) Contributions

from noncontrolling interests and redeemable security holders 15 60

59 154 Proceeds from the sale of redeemable stock of subsidiaries —

— — 134 Dividends paid on AES common stock (80 ) (73 ) (238 ) (218

) Payments for financed capital expenditures (39 ) (21 ) (100 )

(108 ) Purchase of treasury stock — — — (79 ) Proceeds from sales

to noncontrolling interests 60 — 60 — Other financing — 9

(26 ) (12 ) Net cash provided by (used in) financing

activities 614 (215 ) 678 (258 ) Effect of exchange

rate changes on cash 3 (1 ) 9 7 (Increase) decrease in cash of

discontinued operations and held-for-sale businesses 7 —

(1 ) 6 Total increase in cash and cash equivalents

185 60 93 68 Cash and cash equivalents, beginning 1,213

1,265 1,305 1,257 Cash and cash equivalents,

ending $ 1,398 $ 1,325 $ 1,398 $ 1,325

SUPPLEMENTAL DISCLOSURES: Cash payments for interest, net of

amounts capitalized $ 185 $ 222 $ 797 $ 837 Cash payments for

income taxes, net of refunds $ 73 $ 78 $ 291 $ 425 SCHEDULE OF

NONCASH INVESTING AND FINANCING ACTIVITIES: Assets acquired through

capital lease and other liabilities $ — $ — $ — $ 5

Reclassification of Alto Maipo loans and accounts payable into

equity $ — $ — $ 279 $ —

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

RECONCILIATION OF ADJUSTED PRE-TAX

CONTRIBUTION (PTC) AND ADJUSTED EPS

Adjusted PTC is defined as pre-tax income from continuing

operations attributable to AES excluding gains or losses of the

consolidated entity due to (a) unrealized gains or losses

related to derivative transactions, (b) unrealized foreign

currency gains or losses, (c) gains or losses and associated

benefits and costs due to dispositions and acquisitions of business

interests, including early plant closures, and the tax impact from

the repatriation of sales proceeds, (d) losses due to

impairments, and (e) gains, losses and costs due to the early

retirement of debt. Adjusted PTC also includes net equity in

earnings of affiliates on an after-tax basis adjusted for the same

gains or losses excluded from consolidated entities.

Adjusted EPS is defined as diluted earnings per share from

continuing operations excluding gains or losses of both

consolidated entities and entities accounted for under the equity

method due to (a) unrealized gains or losses related to

derivative transactions, (b) unrealized foreign currency gains

or losses, (c) gains or losses and associated benefits and

costs due to dispositions and acquisitions of business interests,

including early plant closures, and the tax impact from the

repatriation of sales proceeds, (d) losses due to impairments,

and (e) gains, losses and costs due to the early retirement of

debt.

The GAAP measure most comparable to adjusted PTC is income from

continuing operations attributable to AES. The GAAP measure most

comparable to adjusted EPS is diluted earnings per share from

continuing operations. We believe that adjusted PTC and adjusted

EPS better reflect the underlying business performance of the

Company and are considered in the Company’s internal evaluation of

financial performance. Factors in this determination include

the variability due to unrealized gains or losses related to

derivative transactions, unrealized foreign currency gains or

losses, losses due to impairments and strategic decisions to

dispose of or acquire business interests or retire debt, which

affect results in a given period or periods. In addition, for

adjusted PTC, earnings before tax represents the business

performance of the Company before the application of statutory

income tax rates and tax adjustments, including the effects of tax

planning, corresponding to the various jurisdictions in which the

Company operates. Adjusted PTC and adjusted EPS should not be

construed as alternatives to income from continuing operations

attributable to AES and diluted earnings per share from continuing

operations, which are determined in accordance with GAAP.

For the year beginning January 1, 2017, the Company changed the

definition of adjusted PTC and adjusted EPS to exclude associated

benefits and costs due to acquisitions, dispositions, and early

plant closures; including the tax impact of decisions made at the

time of sale to repatriate sales proceeds. We believe excluding

these benefits and costs better reflect the business performance by

removing the variability caused by strategic decisions to dispose

or acquire business interests or close plants early. The Company

has also reflected these changes in the comparative period.

Three Months EndedSeptember 30,

2017

Three Months EndedSeptember 30,

2016

Nine Months EndedSeptember 30,

2017

Nine Months EndedSeptember 30,

2016

Net ofNCI(12)

Per Share(Diluted) Netof NCI(12)

Net ofNCI(12)

PerShare (Diluted)Netof NCI(12)

Net ofNCI(12)

Per Share(Diluted) Netof NCI(12)

Net ofNCI(12)

Per Share(Diluted) Netof NCI(12)

(in millions, except per share amounts) Income from

Continuing Operations, Net of Tax, Attributable to AES and Diluted

EPS $ 152 $ 0.23 $

176 $ 0.26 $ 181 $

0.27 $ 208 $ 0.31 Add: Income

Tax Expense from Continuing Operations Attributable to AES 71

47 144 66 Pre-Tax Contribution

$

223 $ 223 $ 325 $

274 Adjustments Unrealized Derivative Losses (Gains)

$ (8 ) $ (0.01 ) $ 5 $ — $ (7 ) $ (0.01 ) $ 1 $ — Unrealized

Foreign Currency Transaction Losses (Gains) (21 ) (0.03 ) 3 0.01

(54 ) (0.07 ) 12 0.01 Disposition/Acquisition Losses (Gains) 1 — (3

) — 107 0.16 (1) (5 ) — (2) Impairment Expense 2 — 24 0.03 (3) 264

0.40 (4) 309 0.47 (5) Losses on Extinguishment of Debt 48 0.07 (6)

20 0.04 (7) 43 0.06 (8) 26 0.05 (9) Less: Net Income Tax Benefit

(0.02 ) (10) (0.02 ) (0.15 ) (11) (0.20

) (11)

Adjusted PTC and Adjusted EPS $ 245

$ 0.24 $ 272

$ 0.32 $ 678 $

0.66 $ 617 $ 0.64

_____________________________ (1) Amount primarily

relates to loss on sale of Kazakhstan CHPs of $48 million, or $0.07

per share, realized derivative losses associated with the sale of

Sul of $38 million, or $0.06 per share; costs associated with early

plant closure of DPL of $20 million, or $0.03 per share. (2) Net

impact of zero relates to the gain on sale of DPLER of $22 million,

or $0.03 per share; offset by the loss on deconsolidation of UK

Wind of $20 million, or $0.03 per share. (3) Amount primarily

relates to the asset impairment at Buffalo Gap I of $78 million

($23 million, or $0.03 per share, net of NCI). (4) Amount primarily

relates to asset impairment at Kazakhstan hydroelectric plants of

$92 million, or $0.14 per share, at Kazakhstan CHPs of $94 million,

or $0.14 per share, and DPL of $66 million, or $0.10 per share. (5)

Amount primarily relates to asset impairments at DPL of $235

million, or $0.36 per share; $159 million at Buffalo Gap II ($49

million, or $0.07 per share, net of NCI); and $78 million at

Buffalo Gap I ($23 million, or $0.03 per share, net of NCI). (6)

Amount primarily relates to the losses on early retirement of debt

at the Parent Company of $38 million, or $0.06 per share (7) Amount

primarily relates to losses on early retirement of debt at the

Parent Company of $17 million, or $0.02 per share; and an

adjustment of $5 million, or $0.01 per share to record the DP&L

redeemable preferred stock at its redemption value. (8)

Amount primarily relates to losses on

early retirement of debt at the Parent Company of $92 million, or

$0.14 per share, partially offset by the gain on early retirement

of debt at Alicura of $65 million, or $0.10 per share.

(9) Amount primarily relates to losses on early retirement of debt

at the Parent Company of $19 million, or $0.03 per share; and an

adjustment of $5 million, or $0.01 per share, to record the

DP&L redeemable preferred stock at its redemption value. (10)

Amount primarily relates to the income tax benefit associated with

losses on early retirement of debt of $16 million, or $0.02 per

share in the three months ended September 30, 2017. (11) Amount

primarily relates to the income tax benefit associated with asset

impairment losses of $82 million, or $0.12 per share and $123

million, or $0.19 per share in the nine months ended September 30,

2017 and 2016, respectively. (12) NCI is defined as Noncontrolling

Interests

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

AES is a holding company that derives its income and cash flows

from the activities of its subsidiaries, some of which may not be

wholly-owned by the Company.

The Company's non-GAAP metrics are Consolidated Free Cash Flow,

Adjusted Pretax contribution (“Adjusted PTC”) and Adjusted Earnings

Per Share (“Adjusted EPS”) used by management and external users of

our consolidated financial statements such as investors, industry

analysts and lenders.

Consolidated Free Cash Flow (“Free Cash Flow”) is defined as

cash flows from operating activities (adjusted for service

concession asset capital expenditures), less maintenance capital

expenditures (including non-recoverable environmental capital

expenditures), net of reinsurance proceeds from third

parties. The company also excludes environmental capital

expenditures that are expected to be recovered through regulatory,

contractual or other mechanisms.

The GAAP measure most comparable to Free Cash Flow is net cash

provided by operating activities. We believe that Free Cash Flow is

a useful measure for evaluating our financial condition because it

represents the amount of cash generated by the business after the

funding of maintenance capital expenditures that may be available

for investing in growth opportunities or for repaying debt.

Three Months Ended Nine Months Ended

September 30, September 30, 2017

2016 2017 2016 (in millions)

Reconciliation of Total Capital Expenditures for Free Cash Flow

Calculation Below: Maintenance Capital Expenditures $ 140 $ 144

$ 434 $ 464 Environmental Capital Expenditures 18 43 57 198 Growth

Capital Expenditures 345 349 1,196 1,216

Total Capital Expenditures $ 503

$ 536 $ 1,687 $

1,878

Reconciliation of Free Cash Flow

Consolidated Operating Cash Flow $ 735 $ 819 $ 1,689 $ 2,182 Add:

Capital Expenditures Related to Service Concession Assets (1) 3 1 5

27 Less: Maintenance Capital Expenditures, net of reinsurance

proceeds (129 ) (144 ) (423 ) (464 ) Less: Non-Recoverable

Environmental Capital Expenditures (2) (8 ) (11 ) (18 ) (36 )

Free Cash Flow $ 601 $

665 $ 1,253 $

1,709 (1) Service concession asset

expenditures are included in net cash provided by operating

activities, but are excluded from the free cash flow non-GAAP

metric. (2) Excludes IPALCO’s recoverable environmental capital

expenditures of $10 million and $32 million for the three months

ended September 30, 2017 and September 30, 2016, respectively, as

well as, $39 million and $162 million for the nine months ended

September 30, 2017 and 2016 respectively.

The AES

Corporation Parent Financial Information

Parent only data:

last four quarters (in millions)

4 Quarters Ended September 30, June 30,

March 31, December 31, 2017 2017

2017 2016

Total subsidiary

distributions & returns of capital to Parent

Actual Actual Actual

Actual Subsidiary distributions (1) to Parent & QHCs $

1,170 $ 1,274 $ 1,236 $ 1,112 Returns of capital distributions to

Parent & QHCs 80 82 30

46

Total subsidiary distributions & returns of

capital to Parent $ 1,250 $

1,356 $ 1,266

$ 1,158 Parent only data: quarterly (in

millions)

Quarter Ended September 30, June 30,

March 31, December 31, 2017 2017

2017 2016

Total subsidiary

distributions & returns of capital to Parent

Actual Actual Actual

Actual Subsidiary distributions (1) to Parent & QHCs $

160 $ 375 $ 209 $ 426 Returns of capital distributions to Parent

& QHCs 2 66 0 12

Total subsidiary distributions & returns of capital to

Parent $ 162 $ 441

$ 209 $ 438

Parent Company

Liquidity (2)

(in millions)

Balance at September 30, June

30, March 31, December 31, 2017

2017 2017 2016 Actual

Actual Actual Actual Cash at

Parent & Cash at QHCs (3) $ 81 $ 127 $ 52 $ 100 Availability

under credit facilities 551 1,093 667

794

Ending liquidity $ 632

$ 1,220 $

719 $ 894 (1) Subsidiary

distributions should not be construed as an alternative to Net Cash

Provided by Operating Activities which is determined in accordance

with GAAP. Subsidiary distributions are important to the Parent

Company because the Parent Company is a holding company that does

not derive any significant direct revenues from its own activities

but instead relies on its subsidiaries’ business activities and the

resultant distributions to fund the debt service, investment and

other cash needs of the holding company. The reconciliation of the

difference between the subsidiary distributions and the Net Cash

Provided by Operating Activities consists of cash generated from

operating activities that is retained at the subsidiaries for a

variety of reasons which are both discretionary and

non-discretionary in nature. These factors include, but are not

limited to, retention of cash to fund capital expenditures at the

subsidiary, cash retention associated with non-recourse debt

covenant restrictions and related debt service requirements at the

subsidiaries, retention of cash related to sufficiency of local

GAAP statutory retained earnings at the subsidiaries, retention of

cash for working capital needs at the subsidiaries, and other

similar timing differences between when the cash is generated at

the subsidiaries and when it reaches the Parent Company and related

holding companies. (2) Parent Company Liquidity is defined

as cash at the Parent Company plus available borrowings under

existing credit facility plus cash at qualified holding companies

(QHCs). AES believes that unconsolidated Parent Company liquidity

is important to the liquidity position of AES as a Parent Company

because of the non-recourse nature of most of AES’ indebtedness.

(3) The cash held at QHCs represents cash sent to

subsidiaries of the company domiciled outside of the US. Such

subsidiaries had no contractual restrictions on their ability to

send cash to AES, the Parent Company. Cash at those subsidiaries

was used for investment and related activities outside of the US.

These investments included equity investments and loans to other

foreign subsidiaries as well as development and general costs and

expenses incurred outside the US. Since the cash held by these QHCs

is available to the Parent, AES uses the combined measure of

subsidiary distributions to Parent and QHCs as a useful measure of

cash available to the Parent to meet its international liquidity

needs.

THE AES CORPORATION 2016 FINANCIAL GUIDANCE

ELEMENTS(1) 2016 Financial Guidance As of

11/4/16 Income Statement Guidance Adjusted Earnings Per

Share 2 $0.95-$1.05

Cash Flow Guidance Consolidated Net Cash

Provided by Operating Activities $2,000-$2,900 million

Reconciliation of Free Cash Flow Guidance Consolidated Net

Cash Provided by Operating Activities $2,000-$2,900 million Less:

Maintenance Capital Expenditures $600-$800 million Free Cash Flow 3

$1,300-$2,200 million 1 2016 Guidance is based on

expectations for future foreign exchange rates and commodity prices

as of September 30, 2016. 2 Adjusted Earnings Per Share (a non-GAAP

financial measure) is defined as diluted earnings per share from

continuing operations excluding gains or losses of both

consolidated entities and entities accounted for under the equity

method due to (a) unrealized gains or losses related to derivative

transactions, (b) unrealized foreign currency gains or losses, (c)

gains or losses due to dispositions and acquisitions of business

interests, d) losses due to impairments, and (e) costs due to the

early retirement of debt. The GAAP measure most comparable to

Adjusted EPS is diluted earnings per share from continuing

operations. AES believes that adjusted earnings per share better

reflects the underlying business performance of the Company, and is

considered in the Company's internal evaluation of financial

performance. Factors in this determination include the variability

due to unrealized gains or losses related to derivative

transactions, unrealized foreign currency gains or losses, losses

due to impairments and strategic decisions to dispose or acquire

business interests or retire debt, which affect results in a given

period or periods. Adjusted earnings per share should not be

construed as an alternative to diluted earnings per share from

continuing operations, which is determined in accordance with GAAP.

3 Free Cash Flow is reconciled above. Free Cash Flow (a non-GAAP

financial measure) is defined as net cash from operating activities

(adjusted for service concession asset capital expenditures) less

maintenance capital expenditures (including non-recoverable

environmental capital expenditures), net of reinsurance proceeds

from third parties. AES believes that free cash flow is a useful

measure for evaluating our financial condition because it

represents the amount of cash generated by the business after the

funding of maintenance capital expenditures that may be available

for investing in growth opportunities or for repaying debt. Free

cash flow should not be construed as an alternative to net cash

from operating activities, which is determined in accordance with

GAAP.

THE AES CORPORATION 2017 FINANCIAL GUIDANCE

ELEMENTS(1) 2017 Financial Guidance As of

11/2/17 Income Statement Guidance Adjusted Earnings Per

Share 2 $1.00-$1.10

Cash Flow Guidance Consolidated Net Cash

Provided by Operating Activities $2,000-$2,800 million Consolidated

Free Cash Flow 3 $1,400-$2,000 million

Reconciliation of Free

Cash Flow Guidance Consolidated Net Cash from Operating

Activities $2,000-$2,800 million Less: Maintenance Capital

Expenditures $600-$800 million Consolidated Free Cash Flow 3

$1,400-$2,000 million 1 2017 Guidance is based on

expectations for future foreign exchange rates and commodity prices

as of September 30, 2017. 2 Adjusted Earnings Per Share (a non-GAAP

financial measure) is defined as diluted earnings per share from

continuing operations excluding gains or losses of both

consolidated entities and entities accounted for under the equity

method due to (a) unrealized gains or losses related to derivative

transactions, (b) unrealized foreign currency gains or losses, (c)

gains or losses and associated benefits and costs due to

dispositions and acquisitions of business interests, including

early plant closures, and the tax impact from the repatriation of

sales proceeds, (d) losses due to impairments, and (e) gains,

losses and costs due to the early retirement of debt. The GAAP

measure most comparable to Adjusted EPS is diluted earnings per

share from continuing operations. AES believes that adjusted

earnings per share better reflects the underlying business

performance of the Company, and is considered in the Company's

internal evaluation of financial performance. Factors in this

determination include the variability due to unrealized gains or

losses related to derivative transactions, unrealized foreign

currency gains or losses, losses due to impairments and strategic

decisions to dispose or acquire business interests or retire debt,

which affect results in a given period or periods. Adjusted

earnings per share should not be construed as an alternative to

diluted earnings per share from continuing operations, which is

determined in accordance with GAAP. 3 Free Cash Flow is reconciled

above. Free Cash Flow (a non-GAAP financial measure) is defined as

net cash from operating activities (adjusted for service concession

asset capital expenditures) less maintenance capital expenditures

(including non-recoverable environmental capital expenditures), net

of reinsurance proceeds from third parties. AES believes that free

cash flow is a useful measure for evaluating our financial

condition because it represents the amount of cash generated by the

business after the funding of maintenance capital expenditures that

may be available for investing in growth opportunities or for

repaying debt. Free cash flow should not be construed as an

alternative to net cash from operating activities, which is

determined in accordance with GAAP.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171102005378/en/

The AES CorporationInvestor Contact:Ahmed Pasha,

703-682-6451orMedia Contact:Amy Ackerman, 703-682-6399

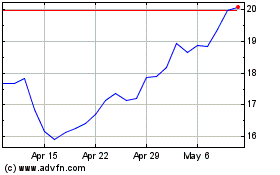

AES (NYSE:AES)

Historical Stock Chart

From Mar 2024 to Apr 2024

AES (NYSE:AES)

Historical Stock Chart

From Apr 2023 to Apr 2024