UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. __)

PAYMENT DATA SYSTEMS, INC.

----------------------------

(Name of Issuer)

Common Stock, $0.001 par value

----------------------------------------

(Title of Class of Securities)

70438S202

--------------

(CUSIP Number)

Vaden Landers

7231 Shagbark Lane

College Grove, TN 37046

-----------------------------------------------------------

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

September 1, 2017

-----------------------------------------------------

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d(g), check the following box.

o

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

(1) Name of reporting person

Vaden Landers

(2) Check the appropriate box if a member of a group

(a)

□

(b) x

(3) SEC USE ONLY

(4) Source of funds

OO

(5) Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

□

(6) Citizenship or place of organization

United States of America

Number of shares beneficially owned by each reporting person with:

(7) Sole voting power:

1,515,152

(8) Shared voting power:

0

(9) Sole dispositive power:

1,515,152

(10) Shared dispositive power:

0

(11) Aggregate amount beneficially owned by each reporting person:

1,515,152

(12) Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

x

(13) Percent of Class Represented by Amount in Row (11):

Based on 11,790,558 shares of common stock outstanding as of August 11, 2017:

12.9%

(14) Type of Reporting Person

IN

Item 1: Security and Issuer

This Schedule 13D relates to the beneficial ownership of common stock of the issuer, Payment Data Systems, Inc., whose principal executive office is located at 12500 San Pedro, Suite 120, San Antonio, TX 78216.

Item 2: Identity and Background

|

|

|

|

b.

|

7231 Shagbark Lane, College Grove, TN 37046

|

|

|

|

|

c.

|

Executive Vice President, Chief Revenue Officer at Payment Data Systems, Inc., 12500 San Pedro, Suite 120, San Antonio, TX 78216

|

|

|

|

|

d.

|

During the last 5 years, the reporting person has not been subject to any criminal proceeding.

|

|

|

|

|

e.

|

During the last 5 years, the reporting person has not been a party to a civil proceeding before a judicial or administrative body of competent jurisdiction resulting in a judgment, decree or final order enjoining future violation of, prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

|

|

|

f.

|

United States of America

|

Item 3: Source and Amount of Funds or Other Consideration

The reporting person is the former sole owner of Singular Payments, LLC, a Florida limited liability company. On September 1, 2017, the reporting person sold his membership interests in Singular Payments, LLC to the issuer, Payment Data Systems, Inc., for a purchase price of $5 million. The purchase price was paid in part with cash and in part with 1,515,152 shares of common stock of the issuer. Such shares are unregistered and subject to a lock-up agreement of 24 months.

In connection with the transaction, the reporting person was employed by the issuer as Executive Vice President and Chief Revenue Officer and entered into an employment contract with the issuer on September 1, 2017. Part of his employment compensation consists of 300,000 shares of common stock of the issuer to vest ten years from the date of issue or upon a change of control of the issuer and other events described in the employment contract.

Item 4: Purpose of Transaction

See also Item 3 above.

Except as set forth in this Item 4, the reporting person does not have any present plans or proposals that relate to or would result in any of the actions specified in clauses (a) through (j) of the instructions to Item 4 of Schedule 13D.

Item 5: Interest in Securities of the Issuer

|

|

|

|

a.

|

The reporting person is the beneficial owner of 1,515,152 shares or 12.9% of the common stock issued and outstanding of the issuer.

|

|

|

|

|

b.

|

The reporting person has sole voting power over 1,515,152 shares of common stock of the issuer. The reporting person has sole or shared dispositive power over 1,515,152 shares of common stock of the issuer.

|

|

|

|

|

c.

|

The reporting person effected the following transactions with respect to the common stock of the issuer during the past 60 days:

|

On March 6, 2017, the reporting person and the issuer entered into a letter of intent for the sale of all membership interests in Singular Payments, LLC with an exclusive term until May 30, 2017. The term was extended two times on June 6, 2017 to August 1, 2017, and on August 2, 2017 to August 30, 2017.

On March 7, 2017, Singular Payments, LLC and the issuer entered into a $500,000 secured line of credit promissory note. The term of the line of credit was amended two times on June 6, 2017 to August 1, 2017, and on August 2, 2017 to August 30, 2017. In addition, the line of credit was increased to $600,000 on August 2, 2017. The line of credit was secured by a security agreement of the same date granting a first security interest over all of Singular Payment’s property, inventory, proceeds, intellectual property, among others, a membership interest pledge agreement over 100% of all Singular Payments, LLC membership interests, and a personal guaranty agreement by the reporting person, the sole owner of Singular Payments.

On September 1, 2017, the reporting person and the issuer entered into a membership interest purchase agreement for sale of all membership interests in Singular Payments, LLC for a purchase price of $5 million. The purchase price was paid in part with cash and in part with 1,515,152 shares of common stock of the issuer. Such shares are unregistered and subject to a lock-up agreement of 24 months.

In connection with the transaction, on September 1, 2017, the reporting person was employed by the issuer as Executive Vice President and Chief Revenue Officer and entered into an employment contract with the issuer. Part of his employment compensation consists of 300,000 shares of common stock of the issuer to vest ten years from the date of issue or upon a change of control of the issuer and other events described in the employment contract.

Item 6: Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

None.

Item 7: Material to be Filed as Exhibits.

None.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: September 12, 2017

/s/ Vaden Landers

____________________________

By: Vaden Landers

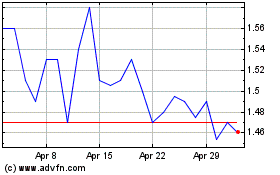

Usio (NASDAQ:USIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

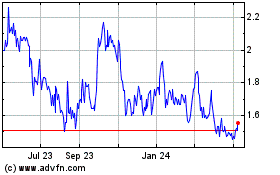

Usio (NASDAQ:USIO)

Historical Stock Chart

From Apr 2023 to Apr 2024