Current Report Filing (8-k)

September 11 2017 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 5, 2017

ROCKWELL MEDICAL, INC.

(Exact name of registrant as specified in its charter)

|

Michigan

|

|

000-23661

|

|

38-3317208

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

30142 Wixom Road, Wixom, Michigan

|

|

48393

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

(248) 960-9009

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01

Entry into a Material Definitive Agreement.

On September 5, 2017,

Board of Directors (the “Board”) of Rockwell Medical, Inc. (the “Company”) approved the entry into a form of indemnification agreement (an “Indemnification Agreement”) with each of its directors and executive officers (each an “Indemnitee”). Among other things, consistent with the Company’s Bylaws, the Indemnification Agreement generally requires that the Company (i) indemnify the Indemnitee from and against all expenses and liabilities with respect to proceedings to which Indemnitee may be subject by reason of the Indemnitee’s service to the Company to the fullest extent authorized or permitted by Michigan law and (ii) advance all expenses incurred by the Indemnitee in connection with the investigation, defense, settlement or appeal of any proceeding, and in connection with any proceeding to enforce the Indemnitee’s rights under the Indemnification Agreement. The Indemnification Agreement also establishes various related procedures and processes and generally requires the Company to maintain directors and officers liability insurance coverage.

The above description of the form of Indemnification Agreement does not purport to be a complete statement of the provisions thereof. Such description is qualified in its entirety by reference to the form of Indemnification Agreement, which will be filed as an exhibit to the Company’s next Quarterly Report on Form 10-Q.

Item 5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 5, 2017, the Board voted unanimously to expand the size of the Board from five to six directors and to appoint John G. Cooper as a director of the Company to fill the new vacancy as a Class II director.

Mr. Cooper, age 59, is currently Founder and Principal of JGC Advisors, providing corporate development and financial advisory services to the life sciences industry. From 2013 to 2016, Mr. Cooper served as President, Chief Executive Officer and member of the Board of Directors for Windtree Therapeutics Inc. (formerly Discovery Laboratories, Inc.), a publicly traded specialty pharmaceutical company. From 2001 to 2013 at Discovery Labs, Mr. Cooper served in the following roles: President and Chief Financial Officer (2010 – 2013), Executive Vice President and Chief Financial Officer (2002 – 2010) and Senior Vice President and Chief Financial Officer (2001 – 2002). Prior to Discovery Labs, Mr. Cooper served as Senior Vice President and Chief Financial Officer at Chrysalis International Corporation, a publicly traded drug development services company with operations in six countries, and its predecessor DNX Corporation, a public biotechnology company, where he managed its initial public offering and negotiated and integrated a number of strategic acquisitions. Previously, Mr. Cooper served in a senior financial management role at ENI Diagnostics, Inc., an international medical device and diagnostics company. Mr. Cooper earned a Certified Public Accountant credential in 1985 and a Bachelor of Science degree in Commerce from Rider University in 1980. Mr. Cooper brings to the Board extensive experience in the life sciences industry, including executive management of companies engaged in development of biotechnology products, drug development services and medical device development. He has significant public company accounting and financial

2

expertise, as well as experience in capital raising and alliance transactions in the life sciences industry.

There are no understandings or arrangements between Mr. Cooper and any other person pursuant to which Mr. Cooper was selected as a director of the Company. Mr. Cooper does not have any family relationship with any director or executive officer of the Company. Although he has not yet been appointed to any committees of the Board, it is anticipated that he will serve on the Audit Committee.

In connection with his

service as a director, Mr. Cooper will be compensated under the Company’s standard non-employee director compensation arrangement. The current arrangement is described in the Company’s 2017 annual meeting proxy statement. In addition, as an inducement to Mr. Cooper joining the Board, on September 5, 2017 Mr. Cooper received a grant of 23,000 stock appreciation rights (“SARs”) with an exercise price of $6.45 per SAR (the “Exercise Price”) pursuant to a Stock Appreciation Right Agreement (the “SAR Agreement”). Each SAR entitles Mr. Cooper to receive, upon exercise, an amount payable in cash equal to the excess of the reported closing price of the Company’s common stock on the Nasdaq Stock Market on the date of exercise over the Exercise Price. No shares of common stock will be issued upon exercise of a SAR. So long as Mr. Cooper continues to be a member of the Board, the SARs become exercisable in full upon the earliest to occur of any of the following performance conditions: (a) reported net sales of the Company in any four consecutive calendar quarters equals or exceeds $100,000,000, (b) the market capitalization of the Company is greater than $600,000,000 for ten consecutive trading days, and (c) one year following the date the Centers for Medicare & Medicaid Services assign the Company transitional add on reimbursement payment status for the drug product, Triferic

®

. The SARs would also fully vest and be paid in cash upon a “Change in Control” (as defined in the SAR Agreement). The SARs may not be exercised more than 10 years after the grant date.

The above description of the SAR Agreement does not purport to be a complete statement of the provisions thereof. Such description is qualified in its entirety by reference to the SAR Agreement, which will be filed as an exhibit to the Company’s next Quarterly Report on Form 10-Q.

In addition, Mr. Cooper entered into the Indemnification Agreement described under Item 1.01 of this Current Report on Form 8-K.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ROCKWELL MEDICAL, INC.

|

|

|

|

|

|

|

|

|

|

September 11, 2017

|

By:

|

/s/ Thomas E. Klema

|

|

|

|

Thomas E. Klema

|

|

|

|

Its: Chief Financial Officer

|

4

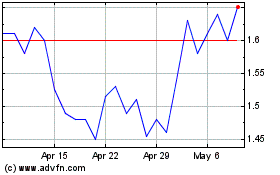

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Apr 2023 to Apr 2024