Reata Pharmaceuticals, Inc. (Nasdaq:RETA) (“Reata” or “the

Company”), a clinical-stage biopharmaceutical company, today

announced financial results for the second quarter ended June 30,

2017, and provided an update on the Company's business and product

development programs.

Financial Highlights

The Company incurred operating expenses of $24.0

million for the quarter ended June 30, 2017, with research and

development accounting for $17.9 million. This compares to

operating expenses of $13.8 million for the same period of the year

prior, when research and development accounted for $9.1

million. A net loss of $11.6 million was reported by the

Company for the quarter ended June 30, 2017, equating to a loss of

$0.52 per share, compared to net loss of $0.9 million or $0.05 per

share in the same period of the year prior.

The Company incurred operating expenses of $43.9

million for the six months ended June 30, 2017, with research and

development accounting for $32.5 million. This compares to

operating expenses of $26.5 million for the same period of the year

prior, when research and development accounted for $18.4

million. A net loss of $18.7 million was reported by the

Company for the six month period ended June 30, 2017, equating to a

loss of $0.84 per share, compared to net loss of $1.2 million or

$0.07 per share in the same period of the year prior.

Corporate Highlights

As of June 30, 2017, the Company had $65.2 million

in cash and cash equivalents.

On August 1, 2017, the Company closed a follow-on

underwritten public offering of 3,737,500 shares of its Class A

common stock, which included 487,500 shares of its Class A common

stock issued pursuant to an option granted to the underwriters, for

net proceeds of approximately $108.4 million, after deducting

underwriting discounts and commissions and estimated offering

expenses.

Product Development Highlights

Reata is a clinical stage biopharmaceutical company

focused on identifying, developing, and commercializing product

candidates to address serious and life-threatening diseases with

few or no approved therapies by targeting molecular pathways that

regulate cellular metabolism and inflammation. The Company’s

lead product candidates, bardoxolone methyl and omaveloxolone,

activate the important transcription factor Nrf2 to restore

mitochondrial function, reduce oxidative stress, and resolve

inflammation.

Bardoxolone Methyl in Chronic Kidney Disease (CKD)

Caused by Alport Syndrome

Reata is enrolling patients in the Phase 3 portion

of CARDINAL, a double-blind, randomized, placebo-controlled,

multi-center, international trial designed to evaluate the safety

and efficacy of bardoxolone methyl in patients with CKD caused by

Alport syndrome. The trial will enroll approximately 150

patients randomized evenly to either bardoxolone methyl or placebo.

The estimated glomerular filtration rate (eGFR) change will

be measured after 48 weeks while the patient is on treatment, or

on-treatment eGFR, and again after 52 weeks after the patient has

stopped taking the study drug for a four-week withdrawal period, or

retained eGFR. Based on guidance from the United States Food

and Drug Administration (FDA), the year one retained eGFR benefit

data may support accelerated approval under subpart H. After

withdrawal, patients will be restarted on study drug with their

original treatment assignments and will continue on study for a

second year. The second year on-treatment eGFR change will be

measured after 100 weeks, and the retained eGFR benefit will be

measured after withdrawal of drug for four weeks at week 104.

Based upon guidance from the FDA, the year two retained eGFR

benefit data may support full approval. Data from year one of

CARDINAL are expected to be available during the second half of

2019. In July 2017, Reata received orphan drug designation

for bardoxolone methyl for the treatment of Alport syndrome.

Bardoxolone Methyl in Pulmonary Arterial

Hypertension associated with Connective Tissue Disease

Reata is enrolling patients in CATALYST, an

international, randomized, double-blind, placebo-controlled Phase 3

trial examining the safety, tolerability, and efficacy of

bardoxolone methyl in patients with pulmonary arterial hypertension

associated with connective tissue disease (CTD-PAH) when added to

standard-of-care vasodilator therapy. Patients will be on up

to two background therapies and will be randomized 1:1 to

bardoxolone methyl or placebo, and the study drug will be

administered once daily for 24 weeks. Patients randomized to

bardoxolone methyl will start at 5 mg and will dose-escalate to 10

mg at Week 4 unless contraindicated clinically. The primary

endpoint of the study is the change from baseline in 6-minute walk

distance (6MWD) relative to placebo at Week 24. Secondary

endpoints include time to first clinical improvement as measured by

improvement in World Health Organization/New York Heart Association

functional class, increase from baseline in 6MWD by at least 10%,

or decrease from baseline in creatine kinase, which is a surrogate

biomarker for muscle injury and inflammation, by at least 10%.

The trial will enroll between 130 and 200 patients, with the

final sample size determined by a pre-specified, blinded sample

size re-calculation based on 6MWD variability and baseline

characteristics of the first 100 patients enrolled in the trial.

All patients who complete the treatment period are eligible

to continue into an extension trial to evaluate the intermediate

and long-term safety of bardoxolone methyl. Those patients

who had been receiving placebo will be converted to bardoxolone

methyl in the extension trial. Data from CATALYST are

expected to be available during the second half of 2018. In

2015, the FDA granted our request for orphan drug designation for

the treatment of PAH.

Omaveloxolone in Friedreich’s Ataxia (FA)

The Company is screening patients in Part 2 of the Phase 2 MOXIe

trial, a double-blind, randomized, placebo-controlled,

multi-center, international trial designed to evaluate the safety,

tolerability, and efficacy of omaveloxolone in patients with FA.

During August 2017, the FDA confirmed that the modified

Friedreich’s Ataxia Rating Scale (mFARS) was acceptable as the

primary endpoint for Part 2 of the MOXIe trial. The FDA

communication was made in response to the Company’s request that

the FDA confirm its prior guidance that, depending on the MOXIe

trial results, mFARS could be appropriate to support approval of

omaveloxolone for FA under Subpart H. In the recent

communication, FDA indicated that it may consider either

accelerated or full approval based on the overall results of the

trial and strength of the data. FDA also recommended that the

Company extend the treatment duration for Part 2 of the study and

add a straightforward patient-reported or performance-based outcome

endpoint to the study.

The trial will enroll approximately 100 FA patients

randomized evenly to either 150 mg of omaveloxolone or placebo.

The primary endpoint of the trial will be the change from

baseline in mFARS of omaveloxolone compared to placebo at 48

weeks. Additional endpoints will include the change from

baseline in peak work during maximal exercise testing, Patient

Global Impression of Change, and Clinical Global Impression of

Change. The Company plans to randomize the first patient

during the second half of 2017.

About Reata Pharmaceuticals,

Inc.

Reata is a clinical-stage biopharmaceutical company

that develops novel therapeutics for patients with serious or

life-threatening diseases by targeting molecular pathways involved

in the regulation of cellular metabolism and inflammation.

Reata’s two most advanced clinical candidates (bardoxolone methyl

and omaveloxolone) target the important transcription factor Nrf2

to restore mitochondrial function, reduce oxidative stress, and

resolve inflammation.

Forward-Looking Statements

This press release includes certain disclosures

which contain “forward-looking statements,” including, without

limitation, statements regarding the success, cost and timing of

our product development activities and clinical trials, our plans

to research, develop and commercialize our product candidates, and

our ability to obtain and retain regulatory approval of our product

candidates. You can identify forward-looking statements

because they contain words such as “believes,” “will,” “may,”

“aims,” “plans” and “expects.” Forward-looking statements are

based on Reata’s current expectations and assumptions.

Because forward-looking statements relate to the future, they are

subject to inherent uncertainties, risks, and changes in

circumstances that may differ materially from those contemplated by

the forward-looking statements, which are neither statements of

historical fact nor guarantees or assurances of future

performance. Important factors that could cause actual

results to differ materially from those in the forward-looking

statements include, but are not limited to (i) the timing, costs,

conduct, and outcome of our clinical trials and future preclinical

studies and clinical trials, including the timing of the initiation

and availability of data from such trials; (ii) the timing and

likelihood of regulatory filings and approvals for our product

candidates; (iii) the potential market size and the size of the

patient populations for our product candidates, if approved for

commercial use, and the market opportunities for our product

candidates; and (iv) other factors set forth in Reata’s filings

with the U.S. Securities and Exchange Commission, including its

Annual Report on Form 10-K, under the caption “Risk Factors.”

The forward-looking statements speak only as of the date made and,

other than as required by law, we undertake no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise.

|

|

|

Three Months ended |

|

|

Six Months ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

Unaudited Consolidated Statements of

Operations |

|

(in thousands, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License and milestone |

|

$ |

12,365 |

|

|

$ |

12,365 |

|

|

$ |

25,094 |

|

|

$ |

24,730 |

|

| Other

revenue |

|

|

441 |

|

|

|

1 |

|

|

|

444 |

|

|

|

74 |

|

| Total

collaboration revenue |

|

|

12,806 |

|

|

|

12,366 |

|

|

|

25,538 |

|

|

|

24,804 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

17,901 |

|

|

|

9,075 |

|

|

|

32,504 |

|

|

|

18,381 |

|

|

General and administrative |

|

|

5,990 |

|

|

|

4,537 |

|

|

|

11,163 |

|

|

|

7,744 |

|

|

Depreciation and amortization |

|

|

109 |

|

|

|

179 |

|

|

|

239 |

|

|

|

367 |

|

| Total

expenses |

|

|

24,000 |

|

|

|

13,791 |

|

|

|

43,906 |

|

|

|

26,492 |

|

| Other

income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income |

|

|

73 |

|

|

|

28 |

|

|

|

154 |

|

|

|

51 |

|

|

Interest expense |

|

|

(468 |

) |

|

|

- |

|

|

|

(473 |

) |

|

|

- |

|

| Total

other income |

|

|

(395 |

) |

|

|

28 |

|

|

|

(319 |

) |

|

|

51 |

|

| Loss

before provision (benefit) for taxes on income |

|

|

(11,589 |

) |

|

|

(1,397 |

) |

|

|

(18,687 |

) |

|

|

(1,637 |

) |

|

Provision (benefit) for taxes on income |

|

|

2 |

|

|

|

(461 |

) |

|

|

2 |

|

|

|

(443 |

) |

| Net

loss |

|

$ |

(11,591 |

) |

|

$ |

(936 |

) |

|

$ |

(18,689 |

) |

|

$ |

(1,194 |

) |

| Net

loss per share—basic and diluted |

|

$ |

(0.52 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.84 |

) |

|

$ |

(0.07 |

) |

|

Weighted-average number of common shares used in net loss |

|

|

22,365,663 |

|

|

|

18,562,302 |

|

|

|

22,358,092 |

|

|

|

17,274,574 |

|

|

per share basic and diluted |

|

|

|

As of |

|

|

As of |

|

|

|

|

|

June 30, 2017 |

|

|

December 31, 2016 |

|

|

|

|

(unaudited) |

|

|

|

|

(in thousands) |

|

|

Condensed Consolidated Balance Sheet Data |

|

|

|

|

|

|

|

|

| Cash

and cash equivalents |

|

$ |

65,176 |

|

|

$ |

84,732 |

|

|

Working capital |

|

|

17,545 |

|

|

|

27,652 |

|

| Total

Assets |

|

|

71,320 |

|

|

|

89,093 |

|

|

Deferred revenue (including current portion) |

|

|

266,448 |

|

|

|

291,041 |

|

|

Accumulated deficit |

|

|

(308,153 |

) |

|

|

(289,354 |

) |

| Total

stockholders' equity |

|

$ |

(230,308 |

) |

|

$ |

(215,048 |

) |

Contacts

Corporate:

Reata Pharmaceuticals, Inc.

(972) 865-2219

info@reatapharma.com

http://news.reatapharma.com

Investor:

Vinny Jindal

Vice President, Strategy

(855) 55-REATA

ir@reatapharma.com

Media:

Matt Middleman, M.D.

LifeSci Public Relations

(646) 627-8384

matt.middleman@lifescipublicrelations.com

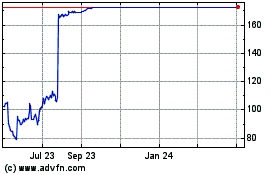

Reata Pharmaceuticals (NASDAQ:RETA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reata Pharmaceuticals (NASDAQ:RETA)

Historical Stock Chart

From Apr 2023 to Apr 2024