Filed Pursuant to Rule 424(b)(5)

Registration No. 333-212974

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of securities

to be registered

|

|

Amount

to be

registered

|

|

Proposed

maximum

offering price

per

security

|

|

Proposed

maximum

aggregate

offering price

|

|

Amount of

registration fee(2)(3)

|

|

0.599% Senior Subordinated Convertible Notes due

2024*

|

|

$495,000,000(1)

|

|

98%

|

|

$485,100,000(1)

|

|

$56,223.09

|

|

|

|

|

|

(1)

|

Includes up to $45,000,000 in aggregate principal amount of 0.599% Senior Subordinated Convertible Notes due 2024 that may be offered and sold pursuant to the exercise of the underwriters’ option to purchase

additional 0.599% Senior Subordinated Convertible Notes due 2024.

|

|

(2)

|

The filing fee is calculated in accordance with Rule 457(r) under the Securities Act of 1933, as amended (the “Securities Act”).

|

|

(3)

|

A registration fee of $56,223.09 is due for this offering. The “Calculation of Registration Fee” table shall be deemed to update the “Calculation of Registration Fee” table in Registration Statement

No. 333-212974 on Form S-3ASR.

|

|

*

|

Plus an indeterminate number of shares of common stock are being registered as may be issued from time to time upon conversion of the 0.599% Senior Subordinated Convertible Notes due 2024. Pursuant to Rule 416 under the

Securities Act, the registration statement shall include an indeterminate number of shares of common stock as may become issuable upon conversion by reason of adjustments in the conversion price. Pursuant to Rule 457(i) under the Securities Act,

there is no additional filing fee with respect to the shares of common stock issuable upon conversion of the 0.599% Senior Subordinated Convertible Notes due 2024 because no additional consideration will be received in connection with the exercise

of the conversion privilege.

|

PROSPECTUS SUPPLEMENT

(To prospectus dated August 8, 2016)

$450,000,000

0.599% Senior Subordinated Convertible Notes due 2024

Interest payable February 1 and August 1

We are offering

$450,000,000 in aggregate principal amount of 0.599% senior subordinated convertible notes due 2024, which we refer to as the “notes.” We will pay interest on the notes on February 1 and August 1 of each year, beginning on

February 1, 2018. The notes will mature on August 1, 2024, unless earlier repurchased or converted.

At any time before the

close of business on the second scheduled trading day immediately before the maturity date, holders may convert their notes at their option into shares of our common stock, together, if applicable, with cash in lieu of any fractional share, at the

then-applicable conversion rate.

The initial conversion rate for the notes will be 8.0212 shares of common stock per $1,000 principal

amount of notes (equivalent to an initial conversion price of approximately $124.67 per share of common stock). The conversion rate will be subject to adjustment in certain events but will not be adjusted for accrued and unpaid interest.

Following certain corporate transactions, we will, in certain circumstances, increase the conversion rate for a holder that elects to convert

its notes in connection with such corporate transactions by a number of additional shares of our common stock as described in this prospectus supplement.

We may not redeem the notes prior to the maturity date, and no sinking fund is provided for the notes.

If we undergo a fundamental change, as defined in this prospectus supplement, holders may, subject to a limited exception described in this

prospectus supplement, require us to repurchase all or a portion of their notes for cash at a price equal to 100% of the principal amount of the notes to be purchased plus any accrued and unpaid interest to, but excluding, the fundamental change

repurchase date, as defined herein.

The notes will be our senior subordinated, unsecured obligations and will be subordinated in right of

payment to the prior payment in full of all of our existing and future senior debt, equal in right of payment with our existing and future senior subordinated debt, senior in right of payment to our existing and future indebtedness that is expressly

subordinated in right of payment to the notes, effectively subordinated to our existing and future secured indebtedness, to the extent of the value of the collateral securing that indebtedness and structurally subordinated to all existing and future

indebtedness and other liabilities, including trade payables, and (to the extent we are not a holder thereof) preferred equity, if any, of our subsidiaries.

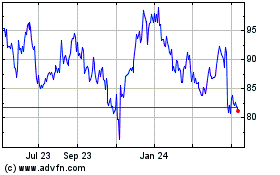

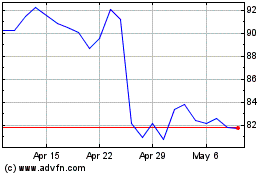

Our common stock is listed on the NASDAQ Global Select Market under the symbol “BMRN.” On August 7, 2017, the last sale price

for our common stock as reported on the NASDAQ Global Select Market was $89.05 per share.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Note

|

|

|

Total

|

|

|

Public offering price(1)

|

|

|

98.0

|

%

|

|

$

|

441,000,000

|

|

|

Underwriting discount(2)

|

|

|

0.5

|

%

|

|

|

$2,250,000

|

|

|

Proceeds to BioMarin (before expenses)

|

|

|

97.5

|

%

|

|

$

|

438,750,000

|

|

|

|

(1)

|

Plus accrued interest from August 11, 2017, if settlement occurs after that date.

|

|

|

(2)

|

We refer you to the “Underwriting” section of this prospectus supplement for additional information regarding underwriter compensation.

|

The underwriters may offer the notes for sale in one or more negotiated transactions or otherwise, at market prices prevailing at the time of

sale, at prices related to prevailing market prices or otherwise.

We have granted the underwriters an option to purchase, within a period

of 13 days from, and including, the date notes are first issued, up to an additional $45,000,000 principal amount of the notes.

Investing in the notes involves risks, including those described in the “

Risk factors

” section

beginning on page

S-16

of this prospectus supplement and in our Quarterly Report on Form

10-Q

for the quarterly period ended June 30, 2017, which is incorporated herein

by reference.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The notes will be ready for delivery in book entry form only through the facilities of The Depository Trust Company for the accounts of its

participants on or about August 11 , 2017.

|

|

|

|

|

|

|

BofA Merrill Lynch

|

|

Goldman Sachs & Co. LLC

|

|

J.P. Morgan

|

The date of this prospectus supplement is August 7, 2017.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only on the information contained or incorporated by reference in this prospectus supplement,

the accompanying prospectus, the documents incorporated by reference therein and any free writing prospectus we provide you. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides

you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the

i

offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this

prospectus supplement and the accompanying prospectus and any free writing prospectus we provide you is accurate only as of the date on those respective documents. Our business, financial condition, results of operations and prospects may have

changed since those dates. You should read this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, when making your investment

decision. You should also read and consider the information in the documents we have referred you to in the sections of this prospectus supplement entitled “Where you can find more information” and “Information incorporated by

reference.”

General information about us can be found on our website at

www.biomarin.com

. The information on our website is

for information only and should not be relied on for investment purposes. The information on our website is not incorporated by reference into either this prospectus supplement or the accompanying prospectus and should not be considered part of this

or any other report filed with the Securities and Exchange Commission (the “SEC”).

BioMarin

®

, Vimizim

®

, Naglazyme

®

,

Kuvan

®

and Firdapse

®

are our registered trademarks. Brineura

TM

is our trademark.

Aldurazyme

®

is a registered trademark of BioMarin/Genzyme LLC. All other brand names and service marks, trademarks and other trade names appearing in this prospectus supplement are the

property of their respective owners.

ii

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the SEC, utilizing a

“shelf” registration process. This prospectus supplement provides you with the specific details regarding this offering. The accompanying prospectus provides you with more general information, some of which does not apply to the offering

of the notes. To the extent information in this prospectus supplement is inconsistent with the accompanying prospectus or any of the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, you should rely

on this prospectus supplement. You should read and consider the information in both this prospectus supplement and the accompanying prospectus together with the additional information described under the headings “Where you can find more

information” and “Information incorporated by reference.”

S-1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the

accompanying prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this prospectus supplement, the accompanying prospectus or any document incorporated by reference in

this prospectus supplement and the accompanying prospectus are forward-looking statements.

Forward-looking statements include, but are

not limited to, statements about:

|

|

•

|

|

our expectations with respect to regulatory submissions and approvals and our clinical studies and trials;

|

|

|

•

|

|

any projection or expectation of earnings, revenue or other financial items;

|

|

|

•

|

|

the plans, strategies and objectives of management for future operations;

|

|

|

•

|

|

factors that may affect our operating results;

|

|

|

•

|

|

new products or services;

|

|

|

•

|

|

the demand for our products;

|

|

|

•

|

|

future capital expenditures;

|

|

|

•

|

|

effects of current or future economic conditions on performance;

|

|

|

•

|

|

industry trends and other matters that do not relate strictly to historical facts or statements of assumptions underlying any of the foregoing;

|

|

|

•

|

|

our success in any current and future litigation;

|

|

|

•

|

|

proceeds from this offering; and

|

|

|

•

|

|

our estimates regarding our capital requirements and our need for additional financing.

|

The

words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended

to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not

place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. We have identified some of the important

factors that could cause future events to materially differ from our current expectations and they are described in this prospectus supplement under the caption “Risk Factors” as well as in our most recent Quarterly Report on Form

10-Q

for the quarter ended June 30, 2017. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make. We do not

assume any obligation to update any forward-looking statement.

S-2

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus supplement. This summary

does not contain all the information that you should consider before investing in the notes. You should read the entire prospectus supplement and the accompanying prospectus carefully, including “Risk Factors,” the financial statements and

related footnotes thereto and other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus before making an investment decision. This prospectus supplement contains forward-looking statements

that involve risks and uncertainties. Our actual results could differ materially from the results anticipated in these forward-looking statements as a result of factors described under the “Risk factors” section and elsewhere in this

prospectus supplement and in our Quarterly Report on Form

10-Q

for the quarter ended June 30, 2017, which is incorporated by reference in this prospectus supplement and the accompanying prospectus. Unless the

context otherwise requires, any reference to “BioMarin,” “we,” “our” and “us” in this prospectus supplement refers to BioMarin Pharmaceutical Inc. and its subsidiaries.

BioMarin Pharmaceutical Inc.

Overview

BioMarin Pharmaceutical

Inc. is a global biotechnology company that develops and commercializes innovative therapies for people with serious and life-threatening rare diseases and medical conditions. We select product candidates for diseases and conditions that represent a

significant unmet medical need, have well-understood biology and provide an opportunity to be

first-to-market

or offer a significant benefit over existing products. Our

therapy portfolio consists of six products and multiple clinical and

pre-clinical

product candidates.

Our commercial products are Aldurazyme (laronidase) for Mucopolysaccharidosis I (“MPS I”), Brineura (cerliponase alfa) for the

treatment of late infantile neuronal ceroid lipofuscinosis (“CLN2”), Firdapse (amifampridine phosphate) for Lambert Eaton Myasthenic Syndrome (“LEMS”), Kuvan (sapropterin dihydrochloride) for phenylketonuria (“PKU”),

Naglazyme (galsulfase) for Mucopolysaccharidosis VI (“MPS VI”) and Vimizim (elosulfase alpha) for Mucopolysaccharidosis IV Type A (“MPS IV A”). All of these products, with the exception of Firdapse which we acquired late in its

development, received marketing approval in one or more jurisdictions within six years from the filing of the Investigational New Drug Application or Clinical Trial Application, as applicable.

We continue to invest in our clinical and

pre-clinical

product pipeline by committing significant

resources to research and development programs and business development opportunities within our areas of scientific, manufacturing and technical expertise. We are conducting clinical trials on several product candidates for the treatment of various

diseases. Our clinical product candidates include pegvaliase (formerly referred to as PEG PAL), an enzyme substitution therapy for the treatment of PKU; vosoritide (formerly referred to as BMN 111), a peptide therapeutic for the treatment of

achondroplasia, the leading cause of dwarfism; BMN 270, an AAV VIII vector and Factor VIII gene therapy drug development candidate for the treatment of hemophilia A; and BMN 250, a novel fusion of

alpha-N-acetyglucosaminidase

(“NAGLU”) with a peptide derived from insulin-like growth factor 2 (“IGF2”), for the treatment of Sanfilippo B syndrome, or mucopolysaccharidosis type IIIB

(“MPS IIIB”). We are conducting or planning to conduct preclinical development of several other product candidates for genetic and other metabolic diseases.

S-3

Summary of commercial products and development programs

A summary of our commercial products and major development programs, including key metrics as of June 30, 2017, is provided below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Products

|

|

Indication

|

|

|

United States

(“U.S.”)

Orphan

Drug

Exclusivity

Expiration(1)

|

|

|

U.S.

Biologic

Exclusivity

Expiration(2)

|

|

|

European

Union

(“EU”)

Orphan

Drug

Exclusivity

Expiration(1)

|

|

|

Six

months

ended

June 30, 2017

Total Net

Product

Revenues

(in millions)

|

|

|

Aldurazyme(3)

|

|

|

MPS I

|

(4)

|

|

|

Expired

|

|

|

|

Expired

|

|

|

|

Expired

|

|

|

$

|

39.3

|

|

|

Brineura(5)

|

|

|

CLN2

|

(6)

|

|

|

Yes

|

|

|

|

2029

|

|

|

|

Yes

|

|

|

|

0.3

|

|

|

Firdapse

|

|

|

LEMS

|

(7)

|

|

|

NA

|

(8)

|

|

|

NA

|

|

|

|

2019

|

|

|

|

8.9

|

|

|

Kuvan

|

|

|

PKU

|

(9)

|

|

|

Expired

|

|

|

|

NA

|

|

|

|

2020

|

(10)

|

|

|

194.3

|

|

|

Naglazyme

|

|

|

MPS VI

|

(11)

|

|

|

Expired

|

|

|

|

2017

|

|

|

|

Expired

|

|

|

|

166.3

|

|

|

Vimizim

|

|

|

MPS IVA

|

(12)

|

|

|

2021

|

|

|

|

2026

|

|

|

|

2024

|

|

|

|

209.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Major Products in Development

|

|

Target

Indication

|

|

|

U.S. Orphan

Designation

|

|

|

EU Orphan

Designation

|

|

|

Stage

|

|

|

Six

months

ended

June 30, 2017

Research &

Development

Expense

(in millions)

|

|

|

Pegvaliase

|

|

|

PKU

|

|

|

|

Yes

|

|

|

|

Yes

|

|

|

|

Marketing

authorization

regulatory

review

|

|

|

$

|

56.4

|

|

|

BMN 270(13)

|

|

|

Hemophilia A

|

|

|

|

Yes

|

|

|

|

Yes

|

|

|

|

Clinical

Phase 1/2

|

|

|

|

53.9

|

|

|

BMN 250

|

|

|

MPS IIIB

|

(14)

|

|

|

Yes

|

|

|

|

Yes

|

|

|

|

Clinical

Phase 1/2

|

|

|

|

20.9

|

|

|

Vosoritide

|

|

|

Achondroplasia

|

|

|

|

Yes

|

|

|

|

Yes

|

|

|

|

Clinical

Phase 3

|

|

|

|

25.9

|

|

|

(1)

|

See “Government Regulation—Orphan Drug Designation” in Part I, Item 3 of our Annual Report on

Form 10-K

for the year ended December 31, 2016 for further

discussion.

|

|

(2)

|

See “Government Regulation—Health Reform” in Part I, Item 3 of our Annual Report on Form

10-K

for the year ended December 31, 2016 for further discussion.

|

|

(3)

|

The Aldurazyme total net product revenues noted above are the total net product revenues recognized by us in accordance with the terms of our agreement with Genzyme Corporation (“Genzyme”). See “Major

commercial products—Aldurazyme” below for further discussion.

|

|

(4)

|

Mucopolysaccharidosis I (“MPS I”).

|

|

(5)

|

In April 2017, we announced that the U.S. Food and Drug Administration (the “FDA”) approved Brineura, and in June 2017, we announced that the European Commission (the “EC”) approved Brineura. See

“Recent developments—FDA approval of Brineura” and “Recent developments—EMA approval of Brineura” below for further discussion.

|

S-4

|

(6)

|

CLN2, or late infantile neuronal ceroid lipofuscinosis, is a lysosomal storage disorder primarily affecting the brain.

|

|

(7)

|

Lambert Eaton Myasthenic Syndrome (“LEMS”).

|

|

(8)

|

Firdapse has not received marketing approval in the U.S. We have licensed the North American rights to develop and market Firdapse to a third-party.

|

|

(9)

|

Phenylketonuria (“PKU”).

|

|

(10)

|

Kuvan has been granted orphan drug status in the EU, which together with pediatric exclusivity, confers 12 years of market exclusivity in the EU that expires in 2020. Furthermore, Merck Serono marketed Kuvan in the EU

until January 1, 2016. See “Major commercial products—Kuvan” below for further discussion.

|

|

(11)

|

Mucopolysaccharidosis VI (“MPS VI”).

|

|

(12)

|

Mucopolysaccharidosis IV Type A (“MPS IVA”).

|

|

(13)

|

BMN 270 is an investigational gene therapy for Hemophilia A, also called Factor VIII deficiency or classic hemophilia.

|

|

(14)

|

Sanfilippo B syndrome, or mucopolysaccharidosis type IIIB (“MPS IIIB”).

|

Recent developments

FDA approval of Brineura

On April 27, 2017, we announced that the FDA approved Brineura to slow the progression of loss of ambulation in symptomatic pediatric

patients 3 years of age and older with CLN2, a form of Batten disease, which is also known as tripeptidyl peptidase 1 (“TPP1”) deficiency. Brineura is the first treatment approved to slow the progression of loss of ambulation in

children with CLN2 disease. With this approval, the FDA also issued a Rare Pediatric Disease Priority Review Voucher, which confers priority review to a subsequent drug application that would not otherwise qualify for priority review. The rare

pediatric disease review voucher program is designed to encourage development of new drugs and biologics for the prevention or treatment of rare pediatric diseases. We have begun marketing Brineura in the U.S., and we began shipping the product in

the U.S. in mid-June 2017.

EMA approval of Brineura

On June 1, 2017, we announced that the EC granted marketing authorization for Brineura in the EU to treat children with CLN2 disease. Brineura

is the first treatment approved in the EU for the treatment of CLN2 disease and the marketing authorization for Brineura includes all 28 countries of the EU, Norway, Iceland and Liechtenstein. On April 21, 2017, the Committee for Medicinal Products

for Human Use (the “CHMP”), the scientific committee of the European Medicines Agency (the “EMA”), adopted a positive opinion for our Marketing Authorization Application (“MAA”) for Brineura following an accelerated

review procedure, reserved for medicinal products expected to be a major public health interest. The EMA revised process for accelerated assessment came into effect June 1, 2016. Brineura is one of the first therapies to go through this process. We

have begun marketing Brineura in the EU, and we began shipping the product in the EU in early July 2017.

S-5

Submission of Pegvaliase BLA to the FDA

On June 30, 2017, we submitted a Biologics License Application (“BLA”) to the FDA for pegvaliase, a PEGylated

phenylanine-metabolizing enzyme product, to reduce blood phenylalanine (“Phe”) levels in adult patients with PKU who have uncontrolled blood Phe levels greater than 600 µmol/L on on existing management. Following receipt of the BLA,

the FDA conducts an initial assessment of the application to determine whether to accept it for substantive review. We expect to hear from FDA within approximately two months of submission as to whether FDA is going to accept the application for

substantive review. We also intend to submit an application for registration of pegvaliase in the EU by the end of 2017.

Gene therapy

product candidate BMN 270 for the treatment of Hemophilia A

On July 11, 2017 we announced an update to our previously reported

interim results of an open-label Phase 1/2 study of BMN 270, an investigational gene therapy in patients with severe hemophilia A, which is defined by the World Federation of Hemophilia (“WFH”) as having Factor VIII activity levels less

than 1%, expressed as a percentage of normal factor activity in blood. The updated results were presented by John Pasi Ph.D. F.R.C.P., the primary investigator for the clinical trial, during an oral presentation at the International Society on

Thrombosis and Haemostasis 2017 Congress held in Berlin, Germany. In the open label Phase 1/2 study of BMN 270, patients with severe hemophilia A received a single dose of BMN 270, seven of whom were treated at a dose of 6e13 vg/kg and an additional

six of whom were subsequently treated at a lower dose of 4e13 vg/kg. The other two patients in the study were treated at lower doses as part of dose escalation in the study and did not achieve therapeutic efficacy. According to the WFH rankings of

severity of hemophilia A, the normal range of Factor VIII activity levels for people without disease is between 50% and 150%, expressed as a percentage of the normal factor activity in blood, and the mild hemophilia A range of Factor VIII activity

levels is between 5% and 40%.

As of the May 31, 2017 data cutoff, all patients at the 6e13 vg/kg dose had reached 52 weeks of

post-treatment follow-up. Median and mean Factor VIII levels from week 20 through 52 for the 6e13 vg/kg dose cohort had been consistently within the normal levels post treatment as a percentage calculated based on the number of International Units

per deciliter (IU/dL) of plasma. At one year after dosing, the median and mean Factor VIII levels of the 6e13 vg/kg cohort continued to be above 50%. For the six patients at the high dose and previously on a Factor VIII prophylactic regimen and

after reaching a Factor VIII level above 5%, the mean annualized bleeding rate was reduced by 97% from 16.3 before the BMN 270 infusion to 0.5 after the infusion. For those same six patients, the median annualized bleeding rate was reduced from 16.5

to zero, and the mean annualized Factor VIII infusions were reduced by 94% from 136.7 to 8.5 (median annualized Factor VIII infusions fell from 138.5 to zero). The seventh patient receiving Factor VIII on demand treatment before the study was not

included in this summary. On August 2, 2017, we announced updated data as of July 28, 2017 from six patient who in the 4e13 vg/kg cohort of our ongoing open-label Phase ½ study of BMN 270. Since the last data update presented at the ISTH 2017

Congress, the Factor VII activity levels in the 4e13 vg/kg cohort have continued to trend upwards and now support an additional Phase 3 study to the development program. A total of six patients received a single dose of BMN 270 at the 4e13 vg/kg

dose. Based on the most recent data, for the three patients who were given the 4e13 vg/kg dose in November/December 2016, at week 32, all are in or near to the normal range of Factor VIII activity levels, with both median and mean Factor VIII levels

of 51%. For the cohort of three patients who were given the 4e13 vg/kg dose in February/March 2017, at week 20, their Factor VIII activity levels have all moved into the mild range and two of the three are continuing to trend upward. For all

six patients who received a dose of 4e13 vg/kg, at week 20, the median Factor VIII level was 34% and the mean was 31%. All six patients who received a single dose of BMN 270 at 4e13 vg/kg dose had severe hemophilia A and had been treated with

prophylactic Factor VIII pre-study. After receiving BMN 270 and then reaching a Factor VIII activity level above 5%, through the July 28th data cut, the mean Annualized Bleed Rate (ABR) was reduced by 92% from 12.2 to 1.0. The median ABR

for those same patients was reduced from

S-6

8.0 to zero. The mean annualized Factor VIII infusions were reduced by 97% from 144.2 to 4.8. The median annualized Factor VIII infusions were reduced from 155.5 to zero.

Overall, BMN 270 was well tolerated by patients across all doses. No patients developed inhibitors to Factor VIII and no patients withdrew

from the study. The most common adverse event across all dose cohorts was alanine aminotransferase (“ALT”) elevations (10 of the 15 patients), all of which were non-serious as of the data cutoff. Two patients reported serious adverse

events during the study. One patient was hospitalized for observation after developing Grade 2 pyrexia with myalgia and headache within 24 hours of receiving BMN 270 (4e13 vg/kg dose). The event resolved within 48 hours following treatment with

paracetamol, an over-the-counter treatment for pain and fever. The event was assessed as related to BMN 270. The other serious adverse event was assessed as not related to BMN 270, and was attributed to a planned knee surgery to treat hemophilic

arthropathy, and was Grade 1 in severity. It resolved without any further complications.

We plan to initiate two Phase 3 studies with BMN

270, one with a dose of 4e13 vg/kg and the other with a 6e13 vg/kg close.

In addition, we have designed and constructed our first gene

therapy manufacturing facility located in Novato, California. We anticipate Good Manufacturing Practices production of BMN 270 to commence in 2017 to support ongoing clinical development activities and if approved, commercial demand.

In February 2017, we announced that the EMA granted access to its Priority Medicines (“PRIME”) regulatory initiative for BMN 270. To

be accepted for PRIME, an investigational therapy has to show its potential to benefit patients with unmet medical needs based on early clinical data.

Major commercial products

Aldurazyme

Aldurazyme

is approved for marketing in the U.S., the EU and other international markets for patients with MPS I. MPS I is a progressive and debilitating life-threatening genetic disease, for which no other drug treatment currently exists, that is caused

by the deficiency of

alpha-L-iduronidase,

a lysosomal enzyme normally required for the breakdown of glycosaminoglycans (“GAGs”). Patients with MPS I typically

become progressively worse and experience multiple severe and debilitating symptoms resulting from the

build-up

of carbohydrate residues in all tissues in the body. These symptoms include: inhibited growth,

delayed and regressed mental development (in the severe form of the disease), enlarged liver and spleen, joint deformities and reduced range of motion, impaired cardiovascular function, upper airway obstruction, reduced pulmonary function, frequent

ear and lung infections, impaired hearing and vision, sleep apnea, malaise and reduced endurance.

We developed Aldurazyme through

collaboration with Genzyme, now a wholly-owned subsidiary of Sanofi. Under our collaboration agreement with Genzyme, we are responsible for manufacturing Aldurazyme and supplying it to Genzyme. We receive payments ranging from 39.5% to 50% on

worldwide net Aldurazyme sales by Genzyme depending on sales volume. We recognize a portion of this amount as product transfer revenue when the product is released to Genzyme because all of our performance obligations are fulfilled at that point and

title to, and risk of loss for, the product has transferred to Genzyme. The product transfer revenue represents the fixed amount per unit of Aldurazyme that Genzyme is required to pay us if the product is unsold by Genzyme. The amount of product

transfer revenue will eventually be deducted from the calculated royalty rate when the product is sold by Genzyme. Additionally, Genzyme and we are members of BioMarin/Genzyme LLC, a 50/50 limited liability company (the “BioMarin/Genzyme

LLC”) that: (1) holds the intellectual property relating to Aldurazyme and other collaboration products and licenses all such intellectual property on a royalty-free basis to

S-7

us and Genzyme to allow us to exercise our rights and perform our obligations under the agreements related to the BioMarin/Genzyme LLC, and (2) engages in research and development activities

that are mutually selected and funded by Genzyme and us.

Aldurazyme net product revenues for the six months ended June 30, 2017 totaled

$39.3 million. Aldurazyme net product revenues for the years ended December 31, 2016, 2015 and 2014 totaled $93.8 million, $98.0 million and $105.6 million, respectively. In the future, to the extent that Genzyme net sales

of Aldurazyme remain consistent, we expect that our total Aldurazyme revenues will continue to approximate 39.5% to 50% of net product sales by Genzyme as described above.

Brineura

Brineura is a

recombinant human tripeptidyl peptidase 1 approved in the U.S. to slow the progression of loss of ambulation in symptomatic pediatric patients 3 years of age and older with CLN2, a form of Batten disease. CLN2 is an incurable, rapidly progressive

disease that ends in patient death by 8-12 years of age. Patients with CLN2 are initially healthy but begin to decline at approximately the age of three. We estimate that CLN2 occurs in one in 200,000 live births and that

1,200-1,600

cases exist worldwide. In January 2017, we released data from the open-label, dose-escalation Phase 1/2 study and the associated extension study for Brineura in 24 patients with CLN2 disease, which

indicates that in 20 of the 23 patients in the trial who were followed for at least 72 weeks, the treatment appeared to show stabilization of the disease compared to the natural history based on a standardized measure of motor and language function.

On April 27, 2017, we announced that the FDA approved Brineura to slow the progression of loss of ambulation in symptomatic pediatric patients 3 years of age and older with CLN2. Brineura is the first treatment approved to slow the progression

of loss of ambulation in children with CLN2 disease. We have begun marketing Brineura in the U.S., and we began shipping the product in the U.S. in mid-June 2017.

On June 1, 2017, we announced that the EC has granted marketing authorization for Brineura in the EU to treat children with CLN2 disease.

Brineura is the first treatment approved in the EU for the treatment of CLN2 disease and the marketing authorization for Brineura includes all 28 countries of the EU, Norway, Iceland and Liechtenstein. On April 21, 2017, the CHMP, the scientific

committee of the EMA adopted a positive opinion for our MAA for Brineura following an accelerated review procedure, reserved for medicinal products expected to be a major public health interest. The EMA revised process for accelerated assessment

came into effect June 1, 2016. Brineura is one of the first therapies to go through this process. We have begun marketing Brineura in the EU, and we began shipping the product in the EU in early July 2017.

Kuvan

Kuvan is a

proprietary synthetic oral form of

6R-BH4,

a naturally occurring enzyme

co-factor

for phenylalanine hydroxylase (“PAH”), indicated for patients with PKU. Kuvan

is the first drug for the treatment of PKU, which is an inherited metabolic disease that affects at least 50,000 diagnosed patients under the age of 40 in the developed world. We believe that approximately 30% to 50% of those with PKU could benefit

from treatment with Kuvan. PKU is caused by a deficiency of activity of an enzyme, PAH, which is required for the metabolism of Phe. Phe is an essential amino acid found in all protein-containing foods. Without sufficient quantity or activity of

PAH, Phe accumulates to abnormally high levels in the blood, resulting in a variety of serious neurological complications, including severe mental retardation and brain damage, mental illness, seizures and other cognitive problems. As a result of

newborn screening efforts implemented in the 1960s and early 1970s, virtually all PKU patients under the age of 40 in developed countries have been diagnosed at birth. Currently, PKU can be managed by a

Phe-restricted

diet, which is supplemented by nutritional replacement products, like formulas and specially manufactured foods; however, it is difficult for most patients to adhere to the strict diet to the

extent needed for achieving adequate control of blood Phe levels.

S-8

Kuvan tablets were granted marketing approval for the treatment of PKU in the U.S. in

December 2007 and in the EU in December 2008. In December 2013, the FDA approved the use of Kuvan powder for oral solution that is provided in a dose sachet packet allowing faster dissolution of powder in solution compared to the current tablet

form. We commenced the commercial launch of this new form of Kuvan in February 2014. We market Kuvan in the U.S. and Canada (and effective as of January 1, 2016, in the rest of the world, except for Japan). In certain international markets,

Kuvan is also approved for, or is only approved for, the treatment of primary BH4 deficiency, a different disorder than PKU. Kuvan net product revenues for the six months ended June 30, 2017 totaled $194.3 million. Kuvan net product revenues

for the years ended December 31, 2016, 2015 and 2014 totaled $348.0 million, $239.3 million and $203.0 million, respectively. In the year ended December 31, 2016, approximately $79 million of Kuvan net product revenues

were generated from countries outside of North America as a result of the completion of the transition of the

ex-North

American territories acquired in 2016. The increase in Kuvan net product revenues in 2016

was also attributable to an approximately 15% increase in patients on therapy in 2016 compared to 2015.

In the fourth quarter of 2015, we

entered into the Termination and Transition Agreement with Ares Trading S.A. (“Merck Serono”), as amended and restated on December 23, 2015 (the “A&R Kuvan Agreement”), to terminate the Development, License and

Commercialization Agreement, dated May 13, 2005, as amended (the “License Agreement”), including the license to Kuvan granted in the License Agreement from us to Merck Serono. Also in the fourth quarter of 2015, we and Merck Serono

entered into a Termination Agreement (the “Pegvaliase Agreement”) to terminate the license to pegvaliase granted in the License Agreement from us to Merck Serono.

On January 1, 2016, pursuant to the A&R Kuvan Agreement and the Pegvaliase Agreement, we completed the acquisition from Merck Serono

and its affiliates of certain rights and other assets, and the assumption from Merck Serono and its affiliates of certain liabilities, in each case with respect to Kuvan and pegvaliase. As a result, we acquired all global rights to Kuvan and

pegvaliase from Merck Serono, with the exception of Kuvan in Japan. Previously, we had exclusive rights to Kuvan in the U.S. and Canada and pegvaliase in the U.S. and Japan.

Pursuant to the A&R Kuvan Agreement, we paid Merck Serono $374.5 million, in cash, and are obligated to pay Merck Serono up to a

maximum of €60.0 million, in cash, if future sales milestones are met. Pursuant to the Pegvaliase Agreement, we are obligated to pay Merck Serono up to a maximum of €125.0 million, in cash, if future development milestones are

met. Merck Serono transferred certain inventory, regulatory materials and approvals, and intellectual property rights to us and will perform certain transition services for us. As of December 31, 2016, the inventory acquired from Merck Serono

had been sold through to customers.

We and Merck Serono have no further rights or obligations under the License Agreement with respect to

Kuvan or pegvaliase.

Two companies, Par and DRL, filed paragraph IV certifications and submitted abbreviated new drug applications to

produce sapropterin dihydrochloride tablets and powder. In September 2015, we entered into a settlement agreement with DRL regarding Kuvan tablets, and in April 2017, we entered into a settlement agreement with Par regarding Kuvan tablets and

powder. The settlement with DRL regarding Kuvan tablets and the settlement with Par regarding Kuvan tablets and powder does not affect pending litigation against DRL relating to Kuvan 100 mg oral powder. Please see “Government

Regulation—The Hatch-Waxman Act” in Part I, Item 3 of our Annual Report on Form

10-K

for the year ended December 31, 2016 and “Legal Proceedings” in Part II, Item 1 of our Quarterly

Report on Form

10-Q

for the quarterly period ended June 30, 2017 for additional information.

S-9

Naglazyme

Naglazyme is a recombinant form of

N-acetylgalactosamine

4-sulfatase

(arylsulfatase B) indicated for patients with MPS VI. MPS VI is a debilitating life-threatening genetic disease for which no other drug treatment currently exists and is caused by the deficiency of

arylsulfatase B, an enzyme normally required for the breakdown of certain complex carbohydrates known as GAGs. Patients with MPS VI typically become progressively worse and experience multiple severe and debilitating symptoms resulting from the

build-up

of carbohydrate residues in tissues in the body. These symptoms include: inhibited growth, spinal cord compression, enlarged liver and spleen, joint deformities and reduced range of motion, skeletal

deformities, impaired cardiovascular function, upper airway obstruction, reduced pulmonary function, frequent ear and lung infections, impaired hearing and vision, sleep apnea, malaise and reduced endurance.

Naglazyme is approved for marketing in the U.S., the EU and other international markets. Naglazyme net product revenues for the six months

ended June 30, 2017 totaled $166.3 million. Naglazyme net product revenues for the years ended December 31, 2016, 2015 and 2014 totaled $296.5 million, $303.1 million and $334.4 million, respectively.

Vimizim

Vimizim is an

enzyme replacement therapy for the treatment of MPS IV A, a lysosomal storage disorder. MPS IV A is a disease characterized by deficient activity of

Nacetylgalactosamine-6-sulfatase

(GALNS) causing excessive lysosomal storage of glycosaminoglycans such as keratan sulfate and chondroitin sulfate. This excessive

storage causes a systemic skeletal dysplasia, short stature, and joint abnormalities, which limit mobility and endurance. Malformation of the chest impairs respiratory function, and looseness of joints in the neck cause spinal instability and

potentially spinal cord compression. Other symptoms may include hearing loss, corneal clouding, and heart disease. Initial symptoms often become evident in the first five years of life. The disease substantially limits both the quality and length of

life of those affected. We have identified over 2,000 patients worldwide suffering from MPS IV A and estimate that the total number of patients suffering from MPS IV A worldwide could be as many as 3,000.

Vimizim was granted marketing approval in the U.S. and the EU in February 2014 and April 2014, respectively, and subsequently in several other

international markets. Vimizim net product revenues for the six months ended June 30, 2017 totaled $209.0 million. Vimizim net product revenues for the years ended December 31, 2016, 2015 and 2014 totaled $354.1 million,

$228.1 million and $77.3 million, respectively.

Product candidates in clinical development

Pegvaliase

Pegvaliase

is an investigational enzyme substitution therapy that we are developing as a subcutaneous injection for the treatment of PKU. We estimate that approximately 27,800 adult cases of PKU exist worldwide. In August 2010, we announced preliminary results

from a Phase 2, open-label dose finding clinical trial of pegvaliase that showed of the seven patients who received at least one mg/kg per week of pegvaliase for at least four weeks, six patients had achieved Phe levels below 600 micromoles per

liter. Mild to moderate self-limiting injection site reactions were the most commonly reported toxicity. In April 2011, we initiated an extension of the Phase 2 study to find a shorter induction and titration dosing regimen to an efficacious

maintenance dose. In March 2016, we announced that our pivotal Phase 3

PRISM-2

study for pegvaliase met the primary endpoint of change in blood Phe compared with placebo (p<0.0001). This ongoing Phase 3

clinical trial includes an open-label study to evaluate safety and blood Phe levels in naïve patients and a randomized controlled study of the Phase 2 extension study patients and patients from the open-label trial to evaluate blood Phe levels

and

S-10

neurocognitive endpoints. Although we met the primary endpoint of the Phase 3

PRISM-2

study, we did not demonstrate a statistically significant improvement

in inattention or mood scores, a key secondary clinical neurocognitive endpoint. The FDA has indicated that lowering Phe blood levels in adults could form the basis for an accelerated approval; however, a favorable outcome on prospectively-specified

analyses of inattention in patients with baseline problems with attention would likely be required for full approval. We filed a BLA for pegvaliase with the FDA in the second quarter of 2017, but there is no assurance that a reduction in blood Phe

alone will be sufficient to support the FDA’s full regulatory approval of pegvaliase.

Vosoritide

Vosoritide (formerly referred to as BMN 111) is a peptide therapeutic in development for the treatment of achondroplasia, the most common

form of dwarfism. We estimate that approximately 22,000 cases exist worldwide, with approximately 80% of those cases existing outside of the U.S. In September 2012, we announced the results of a Phase 1 clinical trial for vosoritide, which showed

vosoritide was generally well-tolerated over the range of single and repeat doses studied. Pharmacokinetic data indicated that the dose levels studied resulted in exposure levels that are expected to stimulate growth based on

non-clinical

findings. In April 2016, we reported

12-month

data for the patients in the 15 µg/kg/day cohort of the Phase 2 open-label, sequential cohort, dose-escalation

study of vosoritide in children who are

5-14

years old, which showed a durable and consistent increase in mean annualized growth velocity of

46%-65%

from baseline in the

group. Vosoritide continued to be well tolerated with no treatment-related serious adverse events or adverse events leading to discontinuation. As further described above under “Recent developments,” in October 2016 we provided a positive

update on our Phase 2 study of vosoritide. In December 2016, we initiated the pivotal Phase 3 study of vosoritide, which is a randomized, placebo-controlled

12-month

treatment study in approximately 110

children with achondroplasia, ages

5-14,

with a primary endpoint of annualized growth velocity. We anticipate completing enrollment in this study in

mid-2018.

BMN 270

BMN 270 is an

AAV-Factor VIII vector, designed to restore Factor VIII plasma concentrations, essential for blood clotting in patients with hemophilia A. Hemophilia A, also called Factor VIII (FVIII) deficiency or classic hemophilia, is a genetic disorder caused

by missing or defective Factor VIII, a clotting protein. People living with the disease are not able to form blood clots efficiently and are at risk for excessive bleeding from modest injuries, potentially endangering their lives. People with severe

hemophilia often bleed spontaneously into their muscles or joints. The gene therapy program for hemophilia A was originally licensed from University College London and St. Jude Children’s Research Hospital in February 2013 and has since been

developed at our facilities. According to the World Federation of Hemophilia rankings of severity of hemophilia A, the normal range of Factor VIII activity levels is between 50% and 150%, expressed as a percentage of normal factor activity in blood,

and the mild hemophilia A range of Factor VIII activity levels is between 5% and 40%. In July 2016, we announced positive

proof-of-concept

data from a Phase 1/2

dose-escalation study for BMN 270 in patients with severe hemophilia A, where six of the seven patients treated with the highest dose achieved Factor VIII levels above 50%, and the seventh was above 10%. Post-treatment

follow-up

ranges were from 12 to 28 weeks. As further described above under “Recent developments”, in July and August 2017 we announced updates to our interim results from the Phase 1/2 study.

Patients in the Phase 1/2 study will be monitored for safety and durability of effect for five years. We plan to initiate two Phase 3 studies with BMN 270; one with a dose of 4e13 vg/kg and the other with a 6e13 vg/kg dose.

BMN 250

BMN 250 is an

investigational enzyme replacement therapy designed to use a novel fusion NAGLU with a peptide derived from IGF2 for the treatment of MPS IIIB (also known as Sanfilippo Syndrome, Type B).

S-11

MPS IIIB is a rapidly progressive pediatric brain disease caused by NAGLU enzyme deficiency resulting in accumulation of heparan sulfate (“HS”) in the brain. The accumulation of HS

leads to progressive cognitive decline, loss of developmental milestones, severe hyperactivity, sleep disorders, loss of mobility, and early death. BMN 250 is designed to be delivered directly into the central nervous system via an

intracerebroventricular access device into the cerebrospinal fluid, which is intended to allow for the drug to bypass the blood brain barrier and distribute directly within the brain. As further described above under “Recent developments”,

in January 2017 we announced positive, preliminary results from a multicenter, international Phase 1/2 clinical trial for BMN 250, which began enrolling patients in April 2016. A complimentary observational study has also been initiated to study the

progression of MPS IIIB over time.

Company information

We were incorporated in Delaware in October 1996 and began operations on March 21, 1997. Our principal executive offices are located at

770 Lindaro Street, San Rafael, California 94901 and our telephone number is (415)

506-6700.

Our annual reports on Form

10-K,

quarterly reports on Form

10-Q,

proxy statements, current reports on Form

8-K

and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available

free of charge at

www.biomarin.com

as soon as reasonably practicable after electronically filing such reports with the SEC. Such reports and other information may be obtained by visiting the SEC’s Public Reference Room at 100 F Street,

NE, Washington, D.C. 20549 or by calling the SEC at

1-800-SEC-0330.

Additionally, these reports are available at the SEC’s

website at

www.sec.gov

. Information contained in our website is not part of this prospectus supplement or accompanying prospectus, or any report that we file with or furnish to the SEC.

S-12

THE OFFERING

The following is a brief summary of the terms of this offering. For a complete description of the terms of the notes, see “Description of

the notes” in this prospectus supplement.

|

Issuer

|

BioMarin Pharmaceutical Inc.

|

|

Notes to be offered

|

$

450,000,000 in aggregate principal amount of the notes.

|

|

|

We have also granted the underwriters an option to purchase, within a period of 13 days from, and including, the date notes are first issued, up to an additional $45,000,000 principal amount of the notes.

|

|

Maturity date

|

August 1, 2024, unless earlier repurchased or converted.

|

|

Interest and payment dates

|

0.599% per year, payable semiannually in arrears in cash on February 1 and August 1 of each year, beginning February 1, 2018.

|

|

Conversion rights

|

At any time before the close of business on the second scheduled trading day immediately before the maturity date, holders may convert their notes at their option into shares of our common stock, together, if applicable, with cash in lieu of any

fractional share, at the then-applicable conversion rate.

|

|

|

The conversion rate will initially be 8.0212 shares of common stock per $1,000 principal amount of notes (equivalent to an initial conversion price of approximately $124.67 per share of common stock), subject to

adjustment as described in this prospectus supplement.

|

|

|

See “Description of the notes—Conversion rights—Settlement upon conversion.”

|

|

Make-whole premium upon a make-whole fundamental change

|

If a make-whole fundamental change (as described in this prospectus supplement) occurs, we will, in certain circumstances, pay a make-whole premium on notes converted in connection with a make-whole fundamental change by increasing the

conversion rate on such notes.

|

|

|

The amount of the make-whole premium, if any, will be based on our common stock price and the effective date of the make-whole fundamental change. See “Description of the notes—Make-whole premium upon a

make-whole fundamental change.”

|

|

Repurchase of notes by us at the option of the holders upon a fundamental change

|

If we undergo a fundamental change (as described in this prospectus supplement), each holder will, subject to a limited exception described in this

prospectus supplement, have the option to require us to repurchase all or any portion of such holder’s notes. The

|

S-13

|

|

fundamental change repurchase price will be 100% of the principal amount of the notes to be repurchased plus accrued and unpaid interest, if any, to, but excluding, the fundamental change

repurchase date.

|

|

Ranking

|

The notes will be our senior subordinated, unsecured obligations and will be:

|

|

|

•

|

|

subordinated in right of payment to the prior payment in full of all of our existing and future senior debt;

|

|

|

•

|

|

equal in right of payment with our existing and future senior subordinated debt;

|

|

|

•

|

|

senior in right of payment to our existing and future indebtedness that is expressly subordinated in right of payment to the notes;

|

|

|

•

|

|

effectively subordinated to our existing and future secured indebtedness, to the extent of the value of the collateral securing that indebtedness; and

|

|

|

•

|

|

structurally subordinated to all existing and future indebtedness and other liabilities, including trade payables, and (to the extent we are not a holder thereof) preferred equity, if any, of our subsidiaries.

|

|

|

As of June 30, 2017, we had $759.3 million of indebtedness (excluding intercompany indebtedness), of which $9.3 million was secured indebtedness, consisting of collateralized standby letters

of credit, and $750.0 million (undiscounted) was senior subordinated, unsecured indebtedness, including indebtedness under our 0.75% senior subordinated convertible notes due in 2018 (the “2018 Notes”) and our 1.50% senior

subordinated convertible notes due in 2020 (the “2020 Notes”). As of June 30, 2017, our subsidiaries had $95.0 million of indebtedness and other liabilities, including trade payables but excluding intercompany liabilities.

|

|

Use of proceeds

|

We estimate that our net proceeds from the sale of the notes will be approximately $437.9 million (or, if the underwriters fully exercise their option to purchase additional notes, $481.8 million), after deducting the underwriting discounts and

commissions and estimated offering expenses that are payable to us.

|

|

|

We intend to use a majority of the net proceeds from this offering to repay, repurchase or settle in cash some or all of the 2018 Notes, although we do not intend to effect any such repayment or

repurchase concurrently with this offering. We intend to use the remaining net proceeds from this offering for general corporate purposes, including clinical trials of our product candidates and the expansion of our manufacturing capacity,

particularly with respect to our manufacturing capability for our gene therapy program. See “Use of proceeds.”

|

S-14

|

No redemption

|

We may not redeem the notes prior to the maturity date, and no sinking fund is provided for the notes, which means we are not required to redeem or retire the notes periodically.

|

|

Form and denomination

|

The notes will be issued only in minimum authorized denominations of $1,000 in principal amount and integral multiples of $1,000 in excess thereof.

|

|

Trading

|

The notes will not be listed on any securities exchange or included in any automated quotation system. The notes will be new securities for which there is currently no public market.

|

|

NASDAQ symbol for common stock

|

Our common stock is listed on the NASDAQ Global Select Market under the symbol “BMRN.”

|

|

Certain material U.S. federal income tax considerations

|

The notes and the shares of our common stock issuable upon conversion of the notes will be subject to special and complex U.S. federal income tax rules. Holders are encouraged to consult their tax advisors as to the U.S. federal, state,

local or other tax consequences of acquiring, owning and disposing of the notes. See “Certain material U.S. federal income tax considerations.”

|

|

Risk factors

|

See “Risk factors” and other information included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of

factors you should carefully consider before deciding to invest in the notes.

|

S-15

RISK FACTORS

An investment in the notes involves a high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous

risks and uncertainties. You should carefully consider the following risk factors and the risk factors discussed under the section entitled “Risk Factors” contained in our Quarterly Report on Form

10-Q

for the quarter ended June 30, 2017, which are incorporated by reference into this prospectus supplement in their entirety, together with all of the other information contained in this prospectus

supplement and the accompanying prospectus or incorporated by reference into this prospectus supplement and the accompanying prospectus. The risks and uncertainties described in these documents are not the only ones we face. Other risks and

uncertainties, including those that we do not currently consider material, may impair our business. If any of the risks discussed below or in our Quarterly Report on Form

10-Q

for the quarter ended

June 30, 2017 actually occur, our business, financial condition, operating results or cash flows could be materially adversely affected. This could cause the value of the notes to decline, and you may lose all or part of your investment.

Risks related to the notes and our common stock

The notes will be effectively subordinated to our existing and future secured indebtedness and structurally subordinated to the liabilities of our

subsidiaries.

The notes will be our senior subordinated, unsecured obligations and will be subordinated in right of payment to the

prior payment in full of all of our existing and future senior debt (as defined under “Description of the notes—Subordination”), equal in right of payment with our existing and future senior subordinated debt (as defined under

“Description of the notes—Subordination”), senior in right of payment to our existing and future indebtedness that is expressly subordinated in right of payment to the notes and effectively subordinated to our existing and future

secured indebtedness, to the extent of the value of the collateral securing that indebtedness. In addition, because none of our subsidiaries will guarantee the notes, the notes will be structurally subordinated to all existing and future

indebtedness and other liabilities, including trade payables, and (to the extent we are not a holder thereof) preferred equity, if any, of our subsidiaries.

As of June 30, 2017, we had $759.3 million of indebtedness (excluding intercompany indebtedness), of which $9.3 million was

secured indebtedness, consisting of collateralized standby letters of credit, and $750.0 million (undiscounted) was senior subordinated, unsecured indebtedness, including indebtedness under the 2018 Notes and the 2020 Notes. As of June 30,

2017, our subsidiaries had $95.0 million of indebtedness and other liabilities, including trade payables but excluding intercompany liabilities. The indenture governing the notes will not prohibit us or our subsidiaries from incurring

additional indebtedness, including senior indebtedness, which would be senior in right of payment to the notes, and secured indebtedness, which would be effectively senior to the notes to the extent of the value of the collateral securing that

indebtedness, or indebtedness that would rank equal in right of payment with the notes.

If a bankruptcy, liquidation, dissolution,

reorganization or similar proceeding occurs with respect to us, our assets will not be available to make payments under the notes unless all of our senior debt is first paid in full. Because of the subordination provisions as described under

“Description of the notes—Subordination,” if we become insolvent, funds that we would otherwise use to pay the holders of the notes can instead be required to be used to pay the holders of senior debt. As a result of these payments,

our general creditors may recover less, ratably, than holders of senior debt and such general creditors may recover more, ratably, than holders of the notes. The remaining assets, if any, would then be allocated pro rata among the holders of our

senior subordinated, unsecured indebtedness, including the notes. There may be insufficient assets to pay all amounts then due.

If a

bankruptcy, liquidation, dissolution, reorganization or similar proceeding occurs with respect to any of our subsidiaries, then we, as a direct or indirect common equity owner of that subsidiary (and, accordingly,

S-16

holders of our indebtedness, including the notes), will be subject to the prior claims of that subsidiary’s creditors, including trade creditors and preferred equity holders. We may never

receive any amounts from that subsidiary to satisfy amounts due under the notes.

Our indebtedness and liabilities could limit the cash flow available

for our operations, expose us to risks that could adversely affect our business, financial condition and results of operations and impair our ability to satisfy our obligations under the notes.

As of June 30, 2017, we had approximately $759.3 million of consolidated indebtedness. We will incur $450 million (or, if the

underwriters fully exercise their option to purchase additional notes, $495 million) of additional indebtedness as a result of this offering. We may also incur additional indebtedness to meet future financing needs, subject to certain limitations in

our credit agreement, dated as of November 29, 2016, by and among us, the lenders from time to time party thereto and Bank of America, N.A., as administrative agent, swing line lender and letter of credit issuer (the “Revolving Credit

Facility”). Our indebtedness could have significant negative consequences for our security holders and our business, results of operations and financial condition by, among other things:

|

|

•

|

|

increasing our vulnerability to adverse economic and industry conditions;

|

|

|

•

|

|

limiting our ability to obtain additional financing;

|

|

|

•

|

|

requiring the dedication of a substantial portion of our cash flow from operations to service our indebtedness, which will reduce the amount of cash available for other purposes;

|

|

|

•

|

|

limiting our flexibility to plan for, or react to, changes in our business;

|

|

|

•

|

|

diluting the interests of our existing stockholders as a result of issuing shares of our common stock upon conversion of the notes; and

|

|

|

•

|

|

placing us at a possible competitive disadvantage with competitors that are less leveraged than us or have better access to capital.

|

Our business may not generate sufficient funds, and we may otherwise be unable to maintain sufficient cash reserves, to pay amounts due under

our indebtedness, including the notes, and our cash needs may increase in the future. In addition, the Revolving Credit Facility, and any future indebtedness that we may incur, may contain financial and other restrictive covenants that limit our

ability to operate our business, raise capital or make payments under our other indebtedness. If we fail to comply with these covenants or to make payments under our indebtedness when due, then we would be in default under that indebtedness, which

could, in turn, result in that and our other indebtedness becoming immediately payable in full. For a description of our outstanding indebtedness, see “Description of other indebtedness.”

The notes contain no financial covenants and limited operational covenants.

The indenture will not contain any financial covenants, restrict our ability to repurchase our securities, pay dividends or make restricted

payments or contain covenants or other provisions to afford holders protection in the event of a transaction that substantially increases the level of our indebtedness. Furthermore, the indenture will contain only limited protections in the event of

a fundamental change. We could engage in many types of transactions, such as acquisitions, refinancings or recapitalizations, that could substantially affect our capital structure and the value of the notes and our common stock but would not

constitute a “fundamental change” permitting holders to require us to repurchase their notes under the indenture.

S-17

Volatility in the market price and trading volume of our common stock could adversely impact the trading price

of the notes.

The stock market in recent years has experienced significant price and volume fluctuations that have often been

unrelated to the operating performance of companies. The market price of our common stock could fluctuate significantly for many reasons, including in response to the risks described in this section, elsewhere in this prospectus supplement or the

documents we have incorporated by reference in this prospectus supplement or for reasons unrelated to our operations, such as reports by industry analysts, investor perceptions or negative announcements by our customers, competitors or suppliers

regarding their own performance, as well as industry conditions and general financial, economic and political instability. A decrease in the market price of our common stock would likely adversely impact the trading price of the notes. The market

price of our common stock could also be affected by possible sales of our common stock by investors who view the notes as a more attractive means of equity participation in us and by hedging or arbitrage trading activity that we expect to develop

involving our common stock. This trading activity could, in turn, affect the trading price of the notes.

Despite our current debt levels, we may still

incur substantially more debt or take other actions which would intensify the risks discussed above.

Despite our current consolidated

debt levels, we and our subsidiaries may be able to incur substantial additional debt in the future, subject to the restrictions contained in our debt instruments, some of which may be senior debt or secured debt. We will not be restricted under the

terms of the indenture governing the notes from incurring additional debt, securing existing or future debt, recapitalizing our debt or taking a number of other actions that are not limited by the terms of the indenture governing the notes that

could have the effect of diminishing our ability to make payments on the notes when due. The Revolving Credit Facility restricts our ability to incur additional indebtedness, including secured indebtedness, but if the facility matures or is repaid,

we may not be subject to such restrictions under the terms of any subsequent indebtedness.

We may not have the ability to raise the funds necessary to

repurchase notes upon a fundamental change.

You may, subject to a limited exception described in this prospectus supplement, require

us to repurchase all or a portion of your notes upon the occurrence of a fundamental change at a repurchase price equal to 100% of the principal amount of the notes to be repurchased, plus accrued and unpaid interest, if any, as described under

“Description of the notes—Repurchase at option of holders upon a fundamental change.” If you were to require us to repurchase your notes, we cannot assure you that we will be able to pay the amount required in cash. Our ability to

repurchase the notes is subject to our liquidity position at the time, and may be limited by law and by indebtedness and agreements that we may enter into in the future, which may replace, supplement or amend our existing or future debt. In

addition, if we did not have sufficient cash to meet our obligations, while we could seek to obtain third-party financing to pay for any amounts due in cash upon such events, we cannot be sure that such third-party financing will be available on

commercially reasonable terms, if at all. In circumstances in which we were obligated to do so, our failure to repurchase the notes in cash would constitute an event of default under the indenture under which we issued the notes, which might

constitute an event of default under the terms of our other indebtedness at that time.

The make-whole premium that may be payable upon conversion in

connection with a make-whole fundamental change may not adequately compensate you for the lost option value of your notes as a result of such change in control.

If you convert notes in connection with a make-whole fundamental change, we may be required to pay a make-whole premium by increasing the

conversion rate. The make-whole payment is described under “Description of the notes—Make-whole premium upon a make-whole fundamental change.” While the make-whole premium is designed to compensate you for the lost option value of

your notes as a result of a make-whole fundamental change, the make-whole amount is only an approximation of such lost value and may not adequately

S-18

compensate you for such loss. In addition, in some other cases described below under “Description of the notes—Make-whole premium upon a make-whole fundamental change,” there will

be no such make-whole premium.

Our obligation to increase the conversion rate for notes converted in connection with a make-whole

fundamental change could be considered a penalty, in which case the enforceability thereof would be subject to general principles of reasonableness and equitable remedies.

Because your right to require us to repurchase the notes is limited, the market price of the notes may decline if we enter into a transaction that is not a

fundamental change under the indenture.

As described in this prospectus supplement, you may, subject to a limited exception described

in this prospectus supplement, require us to repurchase your notes if a fundamental change occurs. However, the term “fundamental change” is limited and may not include every event that might cause the market price of the notes to decline.

The term “fundamental change” does not apply to, among other things, transactions in which 90% or more of the consideration paid for our common stock, excluding cash payments for fractional shares and cash payments made in respect of

dissenters’ appraisal rights, in a merger or similar transaction is publicly traded common stock. Our obligation to repurchase the notes upon a fundamental change may not preserve the value of the notes in the event of a highly leveraged

transaction, reorganization, merger or similar transaction. See “Description of the notes—Repurchase at option of holders upon a fundamental change.”

Sales of the common stock issuable upon conversion of the notes could adversely affect our stock price.

Any sales in the public market of the common stock issuable upon conversion of the notes could adversely affect prevailing market prices of

our common stock. In addition, the existence of the notes may encourage short selling by market participants because the conversion of the notes could depress the price of our common stock. If you convert your notes into shares of common stock, you