Prospectus Filed Pursuant to Rule 424(b)(7) (424b7)

August 01 2017 - 1:13PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(7)

Registration No. 333-215399

Prospectus Supplement No. 1

(to prospectus dated January 10, 2017)

CLEAN DIESEL TECHNOLOGIES, INC.

6,232,750 Shares

Common Stock

This prospectus supplement updates and amends certain information contained in the prospectus dated January 10, 2017 (the “Prospectus”) relating to the offer and sale from time to time by certain selling stockholders of up to an aggregate of 6,232,750 shares of our common stock.

This prospectus supplement should be read in conjunction with the Prospectus and is qualified by reference to the Prospectus, except to the extent that the information presented herein supersedes the information contained in the Prospectus. This prospectus supplement is not complete without, and may not be delivered or utilized except in conjunction with, the Prospectus, including any amendments or supplements thereto.

We are not offering any shares of common stock for sale under this prospectus supplement, and we will not receive any of the proceeds from the sale or other disposition of the shares of common stock offered hereby.

Investing in our common stock involves risks. You should carefully consider the risks described under “Risk Factors” in Item 1A of our most recent Annual Report on Form 10-K and Item 1A of any subsequently filed Quarterly Reports on Form 10-Q (which documents are incorporated by reference in the Prospectus), as well as the other information contained or incorporated by reference in the Prospectus or in any prospectus supplement thereto before making a decision to invest in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is July 31, 2017.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is being filed to supplement the information that appears under the caption “Selling Stockholders” in the Prospectus to identify and provide information with respect to certain selling stockholders not previously included therein.

SELLING STOCKHOLDERS

Following the date of the Prospectus, MDB Capital Group, LLC (the “Transferor”), a selling stockholder identified in the Prospectus, assigned certain of the shares of common stock and warrants to purchase shares of common stock it acquired from us in the 2016 private placement financing to certain affiliates of the Transferor, each of whom is an associated person of the Transferor and acquired the securities for their own account.

The information appearing under the heading “Selling Stockholders” in the Prospectus is hereby amended by the addition and substitution of the following selling stockholders in place of the Transferor’s initial entry. The number and percentage of shares of common stock beneficially owned by the selling stockholder is presented as of July 31, 2017, and is based upon information provided to us by the selling stockholder for use in this prospectus supplement. The information presented in the table is based on

15,722,537

shares of our common stock outstanding on July 31, 2017.

|

|

|

Shares Beneficially Owned

|

|

Maximum

Number of

Shares to be

|

|

Shares Beneficially Owned

After the Sale of the

Maximum Number of Shares

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

Percentage

|

|

Sold Hereunder

|

|

Number

|

|

Percentage

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MDB Capital Group, LLC

(28)

|

|

541,026

|

|

3.4%

|

|

541,026

|

|

0

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Christopher Marlett

(39)

|

|

242,290

|

|

1.5%

|

|

242,290

|

|

0

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anthony DiGiandomenico

(40)

|

|

80,764

|

|

*

|

|

80,764

|

|

0

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kevin Cotter

(41)

|

|

68,526

|

|

*

|

|

68,526

|

|

0

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

George Brandon

(42)

|

|

68,526

|

|

*

|

|

68,526

|

|

0

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gary Schuman

(43)

|

|

29,368

|

|

*

|

|

29,368

|

|

0

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Edgardo Javier Rayo Mendoza

(44)

|

|

10,000

|

|

*

|

|

10,000

|

|

0

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alex Zapanta

(45)

|

|

8,000

|

|

*

|

|

8,000

|

|

0

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ivonne Hanoi Bordas Bonilla

(46)

|

|

6,000

|

|

*

|

|

6,000

|

|

0

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carlos Jose Herrera Urbina

(47)

|

|

6,000

|

|

*

|

|

6,000

|

|

0

|

|

--

|

|

|

*

|

Represents beneficial ownership of less than one percent.

|

|

|

|

|

(28)

|

Consists of (i) 311,288 shares of common stock and (ii) 229,738 shares of common stock that may be acquired from us upon exercise of warrants that are exercisable commencing on May 4, 2017 (with respect to 94,996 shares) and June 16, 2017 (with respect to 134,742 shares). As principals of MDB, Messrs. DiGiandomenico and Marlett have joint voting and dispositive power over these shares. Excludes 242,290 shares held by Mr. Marlett, 80,764 shares held by Mr. DiGiandomenico and 196,420 shares held by other associated persons and employees of MDB.

|

|

|

|

|

(39)

|

Consists of (i) 121,145 shares of common stock and (ii) 121,145 shares of common stock that may be acquired from us upon exercise of warrants that are exercisable commencing on June 16, 2017.

|

|

|

|

|

(40)

|

Consists of (i) 40,382 shares of common stock and (ii) 40,382 shares of common stock that may be acquired from us upon exercise of warrants that are exercisable commencing on June 16, 2017.

|

|

|

|

|

(41)

|

Consists of (i) 34,263 shares of common stock and (ii) 34,263 shares of common stock that may be acquired from us upon exercise of warrants that are exercisable commencing on June 16, 2017.

|

|

|

|

|

(42)

|

Consists of (i) 34,263 shares of common stock and (ii) 34,263 shares of common stock that may be acquired from us upon exercise of warrants that are exercisable commencing on June 16, 2017.

|

|

|

|

|

(43)

|

Consists of (i) 14,684 shares of common stock and (ii) 14,684 shares of common stock that may be acquired from us upon exercise of warrants that are exercisable commencing on June 16, 2017.

|

|

(44)

|

Consists of (i) 5,000 shares of common stock and (ii) 5,000 shares of common stock that may be acquired from us upon exercise of warrants that are exercisable commencing on June 16, 2017.

|

|

|

|

|

(45)

|

Consists of (i) 4,000 shares of common stock and (ii) 4,000 shares of common stock that may be acquired from us upon exercise of warrants that are exercisable commencing on June 16, 2017.

|

|

|

|

|

(46)

|

Consists of (i) 3,000 shares of common stock and (ii) 3,000 shares of common stock that may be acquired from us upon exercise of warrants that are exercisable commencing on June 16, 2017.

|

|

|

|

|

(47)

|

Consists of (i) 3,000 shares of common stock and (ii) 3,000 shares of common stock that may be acquired from us upon exercise of warrants that are exercisable commencing on June 16, 2017.

|

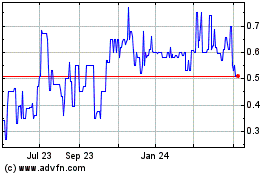

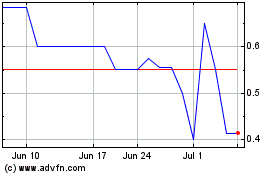

CDTI Advanced Materials (PK) (USOTC:CDTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

CDTI Advanced Materials (PK) (USOTC:CDTI)

Historical Stock Chart

From Apr 2023 to Apr 2024