UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington

D.C. 20549

SCHEDULE

14F-1

INFORMATION

STATEMENT

Pursuant

to Section 14(F) of the Securities Exchange Act of 1934

and

Rule 14f-1 thereunder

BESPOKE

EXTRACTS, INC.

(Exact

name of registrant as specified in its charter)

000-52759

(Commission

File Number)

|

Nevada

|

|

22-1831409

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(I.R.S.

Employer

Identification No.)

|

323

Sunny Isles Blvd., Suite 700

Sunny

Isles, Florida, 33160

(Address

of principal executive offices)

(855)

633-3738

(Registrant's

telephone number)

Copies

to:

Thomas

Rose, Esq.

Sichenzia

Ross Ference Kesner LLP

61

Broadway, 32nd Floor

New

York, New York 10006

Phone:

(212) 930-9700

Fax:

(212) 930-9725

BESPOKE

EXTRACTS, INC.

323

Sunny Isles Blvd., Suite 700

Sunny

Isles, Florida, 33160

INFORMATION

STATEMENT PURSUANT TO

SECTION

14(f) OF

THE

SECURITIES EXCHANGE ACT OF 1934

AND

RULE 14f-1 THEREUNDER

NOTICE

OF CHANGE IN MAJORITY OF THE BOARD OF DIRECTORS

July

18, 2017

INTRODUCTION

This

Information Statement is being mailed to shareholders of record as of July 11, 2017 of the shares of common stock, no par value

per share (the “

Common Stock

”), of Bespoke Extracts, Inc., a Nevada corporation (the “

Company

”),

in accordance with the requirements of Section 14(f) of the Securities Exchange Act of 1934, as amended, and Rule 14f-1 promulgated

thereunder. Section 14(f) of the Exchange Act and Rule 14f-1 require the mailing to our shareholders of record of the information

set forth in this Information Statement at least 10 days prior to the date a change in a majority of our directors occurs (otherwise

than at a meeting of our shareholders). Accordingly, the change in a majority of our directors described herein will not

occur until at least 10 days following the mailing of this Information Statement.

As

used in this Information Statement, unless the context otherwise requires or where otherwise indicated, “we”, “our”,

“us”, the “Company” and similar expressions refer to Bespoke Extracts, Inc., and its consolidated subsidiaries,

collectively.

THIS

INFORMATION STATEMENT IS BEING PROVIDED SOLELY FOR INFORMATIONAL PURPOSES AND NOT IN CONNECTION WITH ANY VOTE OF THE SHAREHOLDERS

OF BESPOKE EXTRACTS, INC.

NO

PROXIES ARE BEING SOLICITED AND YOU ARE NOT REQUESTED TO SEND A PROXY OR TAKE ANY OTHER ACTION.

VOTING

SECURITIES

As

of the date of this Information Statement, the Company is authorized to issue 800,000,000 shares of Company Common Stock, $0.001

par value per share and 50,000,000 shares of preferred stock, par value $0.001 per share, all of which have been designated as

Series A Convertible Stock. As of July 11, 2017, 25,823,907 shares of Common Stock and no shares of Preferred Stock were issued

and outstanding, respectively. Each share of Company Common Stock entitles the holder thereof to one vote. The holders of record

of the Series A Convertible Preferred Stock have no voting rights.

SECURITY

OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

As

of July 11, 2017, we had 25,823,907 shares of common stock issued and outstanding. The following table sets forth information

known to us relating to the beneficial ownership of such shares as of such date by:

|

|

●

|

each

person who is known by us to be the beneficial owner of more than 5% of our outstanding

voting stock;

|

|

|

●

|

each

named executive officer; and

|

|

|

●

|

all

named officers and directors as a group.

|

Unless

otherwise indicated, the business address of each person listed is care of Bespoke Extracts, Inc., at 323 Sunny Isles Blvd., Suite

700, Sunny Isles, Florida, 33160. The percentages in the table have been calculated on the basis of treating as outstanding

for a particular person, all shares of our common stock outstanding on that date and all shares of our common stock issuable to

that holder in the event of exercise of outstanding options, warrants, rights or conversion privileges owned by that person at

that date which are exercisable within 60 days of July 11, 2017. Except as otherwise indicated, the persons listed below have

sole voting and investment power with respect to all shares of our common stock owned by them, except to the extent that power

may be shared with a spouse.

|

Name of Beneficial Owner

|

|

Amount of Beneficial Ownership

|

|

|

Percent of Class

|

|

|

Executive Officers and Directors:

|

|

|

|

|

|

|

|

Roberto Fata

|

|

|

410,000

|

|

|

|

1.79

|

%

|

|

Barry Tenzer

|

|

|

394,000

|

|

|

|

1.53

|

%

|

|

Marc Yahr

|

|

|

20,000,000

|

|

|

|

77.45

|

%

|

|

Officers and Directors as a group (3 persons):

|

|

|

20,804,000

|

|

|

|

80.56

|

%

|

|

5% Holders:

|

|

|

|

|

|

|

|

|

|

McGlothlin Holdings, Ltd. (1)

|

|

|

4,802,667

|

|

|

|

17.62

|

%

|

|

(1)

|

Includes

a convertible debenture in the principal amount of $540,000 that is presently convertible

into 540,000 shares of common stock and a warrant to purchase 900,000 shares of common

stock of the Company. McGlothlin Holdings, Ltd.’s address is PO Box 590, Luling,

Texas, 78649, and its control person is Stan McGlothlin.

|

DIRECTORS

AND EXECUTIVE OFFICERS

Current

Officers and Directors of the Company

The

following discussion sets forth information regarding our current executive officers and directors.

|

Name

|

|

Age

|

|

Title

|

|

Marc

Yahr

|

|

50

|

|

Chief

Executive Officer, President and Director

|

|

Roberto

Fata

|

|

47

|

|

Executive

Vice President of Business Development

|

|

Barry

Tenzer

|

|

83

|

|

Director

|

Marc

Yahr.

Mr. Yahr served as our President, Chief Executive Officer and as a member of the Company’s Board of Directors

(the “

Board

”) since May 22, 2017. There are no family relationships between Mr. Yahr and any of our other officers

and directors. Since June 2009, Marc Yahr has served as Vice President of Sales and Marketing at L&L International, a boutique

luxury private aircraft brokerage firm. In addition, since December 2007, Mr. Yahr has served as Manager of Yahr Aviation LLC.

From August 2015 until June 2016, he served as Chief Operating Officer and President of Lynx Fitness, a fitness equipment company.

Mr. Yahr received a Bachelor of Science degree in Business from Fairleigh Dickinson University.

Roberto

Fata.

Mr. Fata

served as our Executive Vice President of Business Development since November 10, 2011, and has

served as a member of the Board from November 10, 2011 until March 14, 2017. Since 1991, Mr. Fata has been employed by the

FATA Organization (“FATA”), a New York City-based real estate company that has owned and managed commercial and residential

properties in Manhattan, New York for over 70 years. As FATA’s President and Managing Director, he has played a leadership

role in the revitalization of Harlem, one of Manhattan’s most famous neighborhoods. He currently serves on the Board of

Directors for both the Greater Harlem Board of Realtors and the 125

th

Street Business Improvement District. In

2006, Mr. Fata founded DiMi PA, Inc. to commercialize

DiMiSpeaks

, a facility management software and hosting

solution that he developed to better manage the many building operating systems that support all of FATA’s real estate properties.

In 2010, Mr. Fata sold the assets of DiMi PA to DiMi Telematics, Inc., which pursuant to a Share Exchange Agreement dated

October 28, 2011, became a wholly owned subsidiary of the Company.

Barry

Tenzer

. Mr. Tenzer served as our President and Chief Executive Officer from November 10, 2011 until May 22, 2017, and has

served as a member of the Board since November 10, 2011. Mr. Tenzer founded, managed and served as a board member of numerous

private and public companies operating in a broad range of industries, including real estate, property management, construction,

legal services, commercial packaging, cemetery, auto sales and chartered aviation services. From 1968 to 1981, he was General

Partner of 527 Madison Avenue Company NY, LP, and No. 34

th

St. Company, L.P., and Limited Partner in approximately

20 real estate investments. From 1976 to 2003, Mr. Tenzer was the CEO of HIG Corporation, which owned and operated six cemeteries

in Maryland, Virginia and Florida. From 1997 to 2003, Mr. Tenzer also founded and served as President and CEO of Motorcars

Auto Group, Inc., a company engaged in the ownership and operation of exotic, high performance car dealerships and auto accessory

businesses. Mr. Tenzer currently serves as General Partner of Northerly Company, a real estate partnership. Mr. Tenzer graduated

from Cornell University, where he was awarded his BA degree, in 1953, and from New York University Law School, where he earned

his LLB, in 1956. Mr. Tenzer was admitted to the New York Bar in 1957 and practiced law in private practice until 1961.

Officers

and Directors Following the Company Meeting its Information Requirements under the Securities Exchange Act of 1934

|

Name

|

|

Age

|

|

Title

|

|

Marc

Yahr

|

|

50

|

|

Chief

Executive Officer, President and Director

|

|

Roberto

Fata

|

|

47

|

|

Executive

Vice President of Business Development

|

|

Barry

Tenzer

|

|

83

|

|

Director

|

Background

information with respect to Marc Yahr, Roberto Fata and Barry Tenzer are in the “Current Officers and Directors of the Company”

section above.

Terms

of Office

Our

directors are appointed for one year terms in accordance with our charter documents and hold office until the earlier of (i) the

next annual meeting of our shareholders, (ii) until they are removed from the board or (iii) until they resign.

Family

Relationships

There

are no family relationships among the executive officers and directors of the Company who are expected take office upon the

Company meeting its information requirements under the Securities Exchange Act of 1934 (the “

Exchange Act

”).

Legal

Proceedings

Involvement

in Certain Legal Proceedings

During

the past ten years, none of our current directors, executive officers, promoters, control persons, or nominees has been:

|

|

●

|

the subject of any

bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either

at the time of the bankruptcy or within two years prior to that time;

|

|

|

●

|

convicted in a criminal

proceeding or is subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

|

●

|

subject to any order,

judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or any Federal

or State authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any

type of business, securities or banking activities;

|

|

|

●

|

found by a court

of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated

a federal or state securities or commodities law.

|

|

|

●

|

the subject of,

or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed,

suspended or vacated, relating to an alleged violation of (a) any Federal or State securities or commodities law or regulation;

(b) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary

or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist

order, or removal or prohibition order; or (c) any law or regulation prohibiting mail or wire fraud or fraud in connection

with any business entity; or

|

|

|

●

|

the subject of,

or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization

(as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section

1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization

that has disciplinary authority over its members or persons associated with a member.

|

Change

of Control Arrangements

We

have no pension or compensatory plans or other arrangements which provide for compensation to our directors or officers in the

event of a change in our control. There are no arrangements known to us the operation of which may at a later date result in a

change in control of our company.

TRANSACTIONS

WITH RELATED PERSONS

On

April 17, 2017, the Company issued convertible promissory notes to its shareholder in exchange for promissory notes dated as of

August 15, 2016, May 17, 2016 and November 14, 2016, which were issued by the Company to such shareholder.

SECTION

16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section

16(a) of the Exchange Act requires the Company's officers and directors, and certain persons who own more than 10% of a registered

class of the Company's equity securities (collectively, "

Reporting Persons

"), to file reports of ownership and

changes in ownership ("

Section 16 Reports

") with the Securities and Exchange Commission (the "

SEC

").

Reporting Persons are required by the SEC to furnish the Company with copies of all Section 16 Reports they file. Based solely

on its review of the copies of such Section 16 Reports received by the Company, or written representations received from certain

Reporting Persons, all Section 16(a) filing requirements applicable to the Company's Reporting Persons during and with respect

to the fiscal year ended August 31, 2016 have been complied with on a timely basis, except that the Forms 4 filed by Messrs. Tenzer

and Fata and the Forms 3 filed by the Company’s two 10% shareholders who appear under “Security Ownership of Certain

Beneficial Owners and Management” were not filed on a timely basis.

CORPORATE

GOVERNANCE

Director

Independence

We

do not have any independent directors.

Board

of Directors’ Meetings

During

the fiscal year ended August 31, 2016, our Board did not hold any meetings but adopted resolutions pursuant to unanimous written

consents. We encourage, but do not require, our Board members to attend the annual meeting of shareholders.

Board

Leadership Structure and Role on Risk Oversight

Mr.

Tenzer serves as Chairman of the Board.

Our

Board is primarily responsible for overseeing our risk management processes. The Board receives and reviews periodic reports from

management, auditors, legal counsel, and others, as considered appropriate regarding the Company’s assessment of risks.

The Board focuses on the most significant risks facing the Company and the Company’s general risk management strategy, and

also ensures that risks undertaken by the Company are consistent with the board’s appetite for risk. While the Board oversees

the Company’s risk management, management is responsible for day-to-day risk management processes. We believe this division

of responsibilities is the most effective approach for addressing the risks facing the Company and that our board leadership structure

supports this approach.

Code

of Ethics

We

have adopted the Code of Ethical Conduct that applies to our principal executive officer, principal financial officer, principal

accounting officer, controller or person performing similar functions. The Code of Ethical Conduct is designed to deter wrongdoing

and to promote honest and ethical conduct and compliance with applicable laws and regulations. We will disclose any substantive

amendments to the Code of Ethical Conduct or any waivers, explicit or implicit, from a provision of the Code in a current report

on Form 8-K. Upon request to our President and CEO, Marc Yahr, we will provide without charge, a copy of our Code of Ethical Conduct.

Stockholder

Communication with the Board of Directors

Stockholders

may send communications to our Board of Directors by writing to Bespoke Extracts, Inc., 323 Sunny Isles Blvd., Suite 700, Sunny

Isles, Florida, 33160, Attention: Corporate Secretary.

COMPENSATION

OF DIRECTORS AND EXECUTIVE OFFICERS

Summary

Compensation Table

The

following table summarizes all compensation recorded by using 2016 and 2015 for our then principal executive officer and other

executive officer serving as such whose annual compensation exceeded $100,000, and up to one additional individuals for whom disclosure

would have been made in this table but for the fact that the individual was not serving as an executive officer of our company

at August 31, 2016. The value attributable to any option awards is computed in accordance with FASB ASC Topic 718.

|

Name and Principal Position

|

|

Year

|

|

|

Salary

|

|

|

Bonus

|

|

|

Stock

Awards

|

|

|

Option

Awards

|

|

|

Non-Equity

Incentive

Plan

Compensation

|

|

|

Nonqualified

Deferred

Compensation

Earnings

|

|

|

All Other

Compensation

|

|

|

Total

|

|

|

(a)

|

|

(b)

|

|

|

(c)

|

|

|

(d)

|

|

|

(e)

|

|

|

(f)

|

|

|

(g)

|

|

|

(h)

|

|

|

(i)

|

|

|

(j)

|

|

Barry Tenzer

CEO, President,

|

|

|

2016

|

|

|

|

84,000

|

|

|

|

10,000

|

|

|

|

94,000

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

Secretary

|

|

|

2015

|

|

|

|

74,342

|

|

|

|

8,000

|

|

|

|

105,000

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Roberto Fata

|

|

|

2016

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

Exec VP

|

|

|

2015

|

|

|

|

--

|

|

|

|

--

|

|

|

|

105,000

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

Outstanding

Equity Awards at Fiscal Year-End

None.

Compensation

of Directors

We

have not established standard compensation arrangements for our directors and do not have any agreements or understandings to

compensate directors for their services as such.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

are required to file periodic reports, proxy statements and other information with the SEC. You may read and copy this information

at the Public Reference Room of the SEC, 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation

of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You may also obtain a copy of these reports by accessing the

SEC’s website at http://www.sec.gov. You may also send communications to our Board of Directors at Bespoke Extracts, Inc.,

323 Sunny Isles Blvd., Suite 700, Sunny Isles, Florida, 33160, Attention: Corporate Secretary.

NO

STOCKHOLDER ACTION REQUIRED

This

Information Statement is being provided for informational purposes only, and does not relate to any meeting of stockholders. Neither

applicable securities laws, nor the corporate laws of the State of Nevada require approval of the any transaction referred to

herein. No vote or other action is being requested of the Company’s stockholders. This Information Statement is provided

for informational purposes only. This Information Statement has been filed with the Securities and Exchange Commission and is

available electronically on EDGAR at www.sec.gov.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Company has duly caused this Information Statement to be signed

on its behalf by the undersigned hereunto duly authorized.

Date:

July 18, 2017

|

|

BESPOKE

EXTRACTS, INC.

|

|

|

|

|

|

|

By:

|

/s/

Marc Yahr

|

|

|

|

Marc

Yahr

|

|

|

|

Chief

Executive Officer

|

8

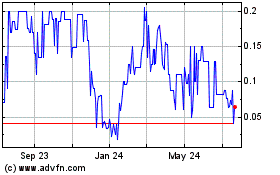

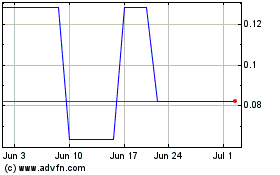

Bespoke Extracts (QB) (USOTC:BSPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bespoke Extracts (QB) (USOTC:BSPK)

Historical Stock Chart

From Apr 2023 to Apr 2024