Securities Registration (foreign Private Issuer) (f-3)

July 10 2017 - 8:49AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on July 10, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Mesoblast Limited

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into English)

|

Australia

|

|

Not Applicable

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification Number)

|

Level 38, 55 Collins Street

Melbourne, VIC 3000

Australia

Tel: +61 3 9639 6036

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mesoblast, Inc.

505 Fifth Avenue, Third Floor

New York, NY 10017

Tel: (212) 880 2060

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Andrew S. Reilly

Baker & McKenzie

50 Bridge Street, Level 27

Sydney, NSW 2000, Australia

Tel: +61 2 9225 0200

Fax: +61 2 9225 1595

|

|

Marc R. Paul

Baker & McKenzie LLP

815 Connecticut Avenue, N.W.

Washington, DC 20006

Tel: (202) 452-7000

Fax: (202) 416-7035

|

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement as determined in light of market conditions.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

☐

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

Amount to be registered

|

Proposed maximum aggregate price per unit

|

Proposed maximum aggregate offering price

(2)

|

Amount of registration fee

(3)

|

|

Ordinary shares, no par value per share, in the form of American Depositary Shares

(1)

|

|

|

$180,000,000

|

$

20,862

|

(1)

American Depositary Shares (as evidenced by American Depositary Receipts, each representing five ordinary shares) have been registered on a separate registration statement on Form F-6 filed

on October 9, 2015 (File No. 333-207378).

(2)

The registrant is hereby registering an indeterminate number of the securities of the registrant as may from time to time be offered at unspecified prices. The maximum aggregate offering price of all securities

covered by this Registration Statement will not exceed $180,000,000. The registrant has estimated the proposed maximum aggregate offering price solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). The securities registered hereunder include securities that may be purchased by underwriters to cover over-allotments, if any.

(3)

Calculated pursuant to Rule 457(o) under the Securities Act.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement that we have filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated July 10, 2017.

Prospectus

Mesoblast Limited

$180,000,000

American Depositary Shares

r

epresenting Ordinary Shares

________________________________

We may offer our ordinary shares in the form of American Depositary Shares, or ADSs, from time to time in one or more offerings in such amounts, at prices and on terms to be determined at or prior to the time of the offering. This prospectus describes the general manner in which the ADS may be offered using this prospectus. We will provide specific terms and offering prices of the ADSs in supplements to this prospectus. Any supplement to this prospectus may also add, update or change information contained in this prospectus. You should read this prospectus and the accompanying prospectus supplements carefully before you invest in the ADSs. Each ADS represents five ordinary shares.

We may offer the ADSs through underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents or directly to investors, on a continuous or delayed basis. The supplement to this prospectus for each offering of ADSs will describe in detail the plan of distribution for that offering. For general information about the distribution of the ADSs, you should refer to the section entitled “Plan of Distribution.” The net proceeds we expect to receive from such sale will also be set forth in a supplement to this prospectus.

The ADSs are listed on the Nasdaq Global Select Market under the symbol “MESO”. Our ordinary shares are listed on the Australian Securities Exchange under the symbol “MSB”.

________________________________

Investing in our ADSs involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus and under similar headings in any amendment or supplement to this prospectus or as updated by any subsequent filing with the Securities and Exchange Commission that is incorporated by reference herein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2017

TABLE OF CONTENTS

You should rely only on the information provided by this prospectus, any prospectus supplement and any information incorporated by reference. We have not authorized anyone else to provide you with different or additional information or to make any representations other than those contained in or incorporated by reference to this prospectus or any accompanying prospectus supplement.

We have not taken any action to permit a public offering of the ADSs outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must observe any restrictions relating to the offering of the ADSs and the distribution of this prospectus outside of the United States. This prospectus is not an offer to sell, or solicitation of an offer to buy, any securities in any circumstances under which the offer of solicitation is unlawful.

2

ABOUT THIS

PROSPECTUS

This prospectus is part of a registration statement on Form F-3 that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this process, we may, from time to time, sell the ADSs in one or more offerings up to a total aggregate amount of $180,000,000.

This prospectus provides you with a general description of the ADSs that we may offer. Each time we sell the ADSs, we will provide a prospectus supplement that will contain specific information about the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus, and may also contain information about any material federal income tax considerations relating to the ADSs. You should read both this prospectus and any prospectus supplement, together with additional information described below under the heading “Where You Can Find More Information,” before purchasing any of the ADSs. This prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering of the ADSs, you should refer to the registration statement, including the exhibits. You may access the registration statement, exhibits and other reports we file with the SEC on the SEC’s website. More information regarding how you can access this and other information is included under the heading “Where You Can Find More Information” below.

The information in this prospectus is accurate as of the date on the front cover of this prospectus, and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Neither the delivery of this prospectus nor the sale of any securities means that information contained in this prospectus is correct after the date of this prospectus or as of any other date. To the extent there is any conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date, the statement in the document having the later date modifies or supersedes the earlier statement. Any information incorporated by reference is only accurate as of the date of the document incorporated by reference.

Unless otherwise indicated or the context implies otherwise:

|

|

•

|

“ADSs” refers to our American depositary shares, each of which represents five ordinary shares, and “ADRs” refers to the American depositary receipts that evidence our ADSs;

|

|

|

•

|

“ASX” refers to the Australian Securities Exchange, where our ordinary shares are listed;

|

|

|

•

|

“A$” or “Australian dollars” refers to the legal currency of Australia;

|

|

|

•

|

“IFRS” refers to the International Financial Reporting Standards as issued by the International Accounting Standards Board, or IASB; and

|

|

|

•

|

“Mesoblast,” “we,” “us” or “our” refer to Mesoblast Limited, an Australian corporation (Australian Business Number 68 109 431 870), and its subsidiaries.

|

All references to “$”, “US$” and “U.S. dollar” in this prospectus refer to United States dollars. Except as otherwise stated, all monetary amounts in this prospectus are presented in United States dollars. Unless otherwise indicated, the consolidated financial statements and related notes included, or incorporated by reference, in this prospectus have been prepared in accordance with Australian Accounting Standards and also comply with IFRS, which differs in certain significant respects from Generally Accepted Accounting Principles in the United States. Our fiscal year ends on June 30 of each year. References to “fiscal 2016” means the 12-month period ended June 30, 2016 and other fiscal years are referred to in a corresponding manner.

We own or have rights to trademarks and trade names that we use in connection with the operation of our business, including our corporate name, logos, product names and website names. Other trademarks and trade names appearing in this prospectus and the documents incorporated by reference are the property of their respective owners. Solely for your convenience, some of the trademarks and trade names referred to in this prospectus and the documents incorporated by reference are listed without the ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks and trade names.

3

CAUTIONARY NOTE REGARDING F

ORWARD-LOOKING STATEMENTS

Certain statements in this prospectus, any prospectus supplement, any free writing prospectus and in the documents incorporated by reference may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Words such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “targets,” “likely,” “will,” “would,” “could,” and similar expressions or phrases identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and future events and financial trends that we believe may affect our financial condition, results of operation, business strategy and financial needs. Forward-looking statements include, but are not limited to, statements about:

|

|

•

|

the initiation, timing, progress and results of our preclinical and clinical studies, and our research and development programs;

|

|

|

•

|

our ability to advance product candidates into, enroll and successfully complete, clinical studies, including multi-national clinical trials;

|

|

|

•

|

our ability to advance our manufacturing capabilities;

|

|

|

•

|

the timing or likelihood of regulatory filings and approvals, manufacturing activities and product marketing activities, if any;

|

|

|

•

|

the commercialization of our product candidates, if approved;

|

|

|

•

|

regulatory or public perceptions and market acceptance surrounding the use of stem-cell based therapies;

|

|

|

•

|

the potential for our product candidates, if any are approved, to be withdrawn from the market due to patient adverse events or deaths;

|

|

|

•

|

the potential benefits of strategic collaboration agreements and our ability to enter into and maintain established strategic collaborations;

|

|

|

•

|

our ability to establish and maintain intellectual property on our product candidates and our ability to successfully defend these in cases of alleged infringement;

|

|

|

•

|

the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology;

|

|

|

•

|

estimates of our expenses, future revenues, capital requirements and our needs for additional financing;

|

|

|

•

|

our financial performance;

|

|

|

•

|

developments relating to our competitors and our industry;

|

|

|

•

|

the pricing and reimbursement of our product candidates, if approved; and

|

|

|

•

|

other risks and uncertainties, including those listed under the caption “Risk Factors” in our Annual Report on Form 20-F, and our other reports and filings we make with the SEC from time to time.

|

You should read thoroughly this prospectus, any prospectus supplement, any free writing prospectus and in the documents incorporated by reference with the understanding that our actual future results may be materially different from and/or worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements. Other sections of this

prospectus and in the documents incorporated by reference

include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

This

prospectus and documents incorporated by reference may

contain third-party data relating to the biopharmaceutical market that includes projections based on a number of assumptions. The biopharmaceutical market may not grow at the rates projected by market data, or at all. The failure of this market to grow at the projected rates may have a material adverse effect on our business and the

4

market price of our ADSs. Furthermore, if any one or more of the assumptions underlying the market data turns out to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue

reliance on these forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus (or, in the case of a document incorporated by reference, the date on which the statements are made in such document). We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

5

PROSPECTUS

SUMMARY

This summary highlights selected information from this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, including the risks of investing in our ADSs discussed under the heading “Risk Factors” and under similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Overview

We are a global leader in developing innovative cellular medicines. We have leveraged our proprietary technology platform, which is based on specialized cells known as mesenchymal lineage adult stem cells, or MLCs, to establish a broad portfolio of late-stage product candidates.

Our allogeneic or “off-the-shelf” product candidates target advanced stages of diseases with high, unmet medical needs including cardiovascular diseases, immunologic and inflammatory conditions, orthopedic disorders, and oncology and hematology conditions. We also have a promising emerging pipeline of products for follow-on indications.

Each product candidate has distinct technical characteristics, target indications, individual reimbursement strategy, separate commercialization potential, and unique partnering opportunities.

We have prioritized our therapeutic programs into tiers based on stage of development, largest market opportunities and nearest term revenue potential. Tier 1 programs represent our lead programs where we focus the majority of our time and resources. Tier 2 programs are continually evaluated, and we may advance these programs into Tier 1 depending on merit of clinical data generated, market opportunity or collaboration opportunity.

We have three Tier 1 Phase 3 clinical trials actively recruiting in the United States, including MPC-150-IM for chronic heart failure, MPC-06-ID for chronic low back pain, and MSC-100-IV for acute graft versus host disease in children. We have another Tier 1 product candidate, MPC-300-IV for immune mediated diseases, which has been evaluated in Phase 2 trials in biologic refractory rheumatoid arthritis, and also diabetic kidney disease and type 2 diabetes. Our licensee in Japan, JCR Pharmaceuticals Co. Ltd, has launched the first allogeneic cell-based product in Japan on February 24, 2016, for the treatment of acute graft versus host disease. Our Tier 2 lead product candidates are being developed for the treatment of acute cardiac ischemia and for the treatment of Crohn’s disease, among other indications.

Corporate Information

Mesoblast Limited was incorporated in June 2004 in Australia under the Corporations Act. In December 2004 we completed an initial public offering of our ordinary shares in Australia and our shares have since been listed on the ASX under the symbol “MSB.” In November 2015 we completed an initial public offering of ADSs in the United States and our ADSs have since been listed on the NASDAQ Global Select Market, or NASDAQ, under the symbol “MESO”. JPMorgan Chase Bank N.A. acts as the depositary for our ADSs, each of which represents five ordinary shares.

Our principal executive offices are located at Level 38, 55 Collins Street, Melbourne, Victoria 3000, Australia. Our telephone number at this address is +61 3 9639 6036. Our website is www.mesoblast.com. Information contained on our website is not part of this prospectus. Our agent for service of process in the United States is our subsidiary Mesoblast, Inc., located at 505 Fifth Avenue, Third Floor, New York, NY 10017.

6

RISK FA

CTORS

Investing in the ADSs involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” in our Annual Report on Form 20-F for fiscal 2016 and in our Current Report on Form 6-K for the three and nine months ended March 31, 2017 filed with the SEC, and all other information contained in or incorporated by reference in this prospectus and any prospectus supplement or related free writing prospectus before deciding whether to purchase any of our ADSs. If any of those risks actually occurs, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our ADSs could decline, and you may lose part or all of your investment.

Such risks are not exclusive. We may face additional risks that are presently unknown to us or that we believe to be immaterial as of the date of this prospectus. Known and unknown risks and uncertainties may significantly impact and impair our business operations.

USE OF PROCEEDS

Unless otherwise indicated in an accompanying prospectus supplement, we intend to use the net proceeds from the sale of the securities under this prospectus for general corporate purposes. We may also use a portion of the net proceeds to acquire or invest in businesses, products and technologies that we own or that are complementary to our own. Pending these uses, we intend to invest our net proceeds from this offering primarily in investment grade, interest-bearing instruments. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds we may have upon completion of an offering or offerings. Accordingly, we will retain broad discretion over the use of these proceeds.

CAPITALIZATION

A prospectus supplement or report on Form 6-K incorporated by reference into the registration statement of which this prospectus forms a part will include information on our consolidated capitalization.

7

PRICE HISTORY OF AMERICAN DEPOSI

TARY SHARES AND ORDINARY SHARES

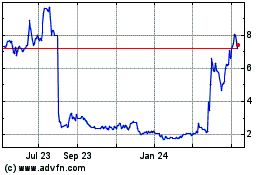

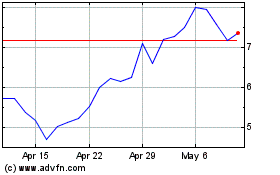

The NASDAQ Stock Market

Since November 2015, our ordinary shares in the form of ADSs have been trading on NASDAQ under the symbol “MESO.” The following table sets forth the high and low market prices for our ADSs reported on NASDAQ for the periods indicated in U.S. dollars.

|

|

|

US$ High

|

|

|

US$ Low

|

|

|

Annual:

|

|

|

|

|

|

|

|

|

|

Fiscal year ended

|

|

|

|

|

|

|

|

|

|

June 30, 2016

|

|

|

15.56

|

|

|

|

3.50

|

|

|

June 30, 2017

|

|

|

12.50

|

|

|

|

3.90

|

|

|

Quarterly:

|

|

|

|

|

|

|

|

|

|

Fiscal year ended June 30, 2016

|

|

|

|

|

|

|

|

|

|

First quarter ended September 30, 2015

|

|

|

15.56

|

|

|

|

10.27

|

|

|

Second quarter ended December 31, 2015

|

|

|

13.00

|

|

|

|

4.50

|

|

|

Third quarter ended March 31, 2016

|

|

|

10.89

|

|

|

|

4.26

|

|

|

Fourth quarter ended June 30, 2016

|

|

|

9.79

|

|

|

|

3.50

|

|

|

Fiscal year ending June 30, 2017

|

|

|

|

|

|

|

|

|

|

First quarter ended September 30, 2016

|

|

|

6.57

|

|

|

|

3.90

|

|

|

Second quarter ended December 31, 2016

|

|

|

5.90

|

|

|

|

4.01

|

|

|

Third quarter ending March 31, 2017

|

|

9.78

|

|

|

5.28

|

|

|

Fourth quarter ended June 30, 2017

|

|

12.50

|

|

|

7.55

|

|

|

Most recent six months:

|

|

|

|

|

|

|

|

|

|

Month ended January 31, 2017

|

|

|

6.33

|

|

|

|

5.28

|

|

|

Month ended February 28, 2017

|

|

|

6.59

|

|

|

|

5.39

|

|

|

Month ended March 31, 2017

|

|

9.78

|

|

|

6.43

|

|

|

Month ended April 30, 2017

|

|

12.50

|

|

|

8.84

|

|

|

Month ended May 31, 2017

|

|

12.02

|

|

|

7.60

|

|

|

Month ended June 30, 2017

|

|

9.64

|

|

|

7.55

|

|

8

Australian Securities Exchange

Since December 2004, our ordinary shares have been listed in Australia on the ASX trading under the symbol “MSB”. The following table sets forth the high and low market prices for our ordinary shares reported on the ASX for the periods indicated in Australian dollars.

|

|

|

A$ High

|

|

|

A$ Low

|

|

|

Annual:

|

|

|

|

|

|

|

|

|

|

Fiscal year ended

|

|

|

|

|

|

|

|

|

|

June 30, 2013

|

|

|

7.49

|

|

|

|

4.22

|

|

|

June 30, 2014

|

|

|

6.80

|

|

|

|

4.18

|

|

|

June 30, 2015

|

|

|

5.88

|

|

|

|

3.17

|

|

|

June 30, 2016

|

|

|

4.06

|

|

|

|

1.01

|

|

|

June 30, 2017

|

|

|

3.44

|

|

|

|

1.03

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarterly:

|

|

|

|

|

|

|

|

|

|

Fiscal year ended June 30, 2016

|

|

|

|

|

|

|

|

|

|

First quarter ended September 30, 2015

|

|

|

4.06

|

|

|

|

2.91

|

|

|

Second quarter ended December 31, 2015

|

|

|

3.50

|

|

|

|

1.35

|

|

|

Third quarter ended March 31, 2016

|

|

|

3.03

|

|

|

|

1.14

|

|

|

Fourth quarter ended June 30, 2016

|

|

|

2.70

|

|

|

|

1.01

|

|

|

Fiscal year ending June 30, 2017

|

|

|

|

|

|

|

|

|

|

First quarter ended September 30, 2016

|

|

|

1.925

|

|

|

|

1.025

|

|

|

Second quarter ended December 31, 2016

|

|

|

1.545

|

|

|

|

1.07

|

|

|

Third quarter ended March 31, 2017

|

|

2.50

|

|

|

1.43

|

|

|

Fourth quarter ended June 30, 2017

|

|

3.44

|

|

|

1.93

|

|

|

Most recent six months:

|

|

|

|

|

|

|

|

|

|

Month ended January 31, 2017

|

|

|

1.815

|

|

|

|

1.43

|

|

|

Month ended February 28, 2017

|

|

|

1.705

|

|

|

|

1.425

|

|

|

Month ended March 31, 2017

|

|

2.50

|

|

|

1.633

|

|

|

Month ended April 30, 2017

|

|

3.44

|

|

|

2.28

|

|

|

Month ended May 31, 2017

|

|

3.23

|

|

|

1.955

|

|

|

Month ended June 30, 2017

|

|

2.25

|

|

|

1.93

|

|

In connection with Mesoblast’s initial public offering in the United States, we requested a suspension of trading of our ordinary shares on the ASX from October 30, 2015 through November 15, 2015.

9

DESCRIPTION OF

SHARE CAPITAL

General

We are a public company limited by shares registered under the Corporations Act by the Australian Securities and Investments Commission, or ASIC. Our corporate affairs are principally governed by our Constitution, the Corporations Act, the ASX Listing Rules and NASDAQ Marketplace Rules. Our ordinary shares trade on the ASX and our ADSs trade on the NASDAQ Global Select Market.

The Australian law applicable to our Constitution is not significantly different than a U.S. company’s charter documents except we do not have the concept of, or a limit on, our authorized share capital, the concept of par value is not recognized under Australian law and as further discussed under “—Our Constitution.”

Subject to restrictions on the issue of securities in our Constitution, the Corporations Act and the ASX Listing Rules and any other applicable law, we may at any time issue ordinary shares and grant options or warrants on any terms, with the rights and restrictions and for the consideration that our board of directors determines.

The rights and restrictions attaching to ordinary shares are derived through a combination of our Constitution, the common law applicable to Australia, the ASX Listing Rules, the Corporations Act and other applicable law. A general summary of some of the rights and restrictions attaching to our ordinary shares is set forth below. Each shareholder is entitled to receive notice of, and to be present, vote and speak at, general meetings.

Changes to Our Share Capital

As of June 30, 2017, we had (i) 428,221,398 fully paid ordinary shares outstanding and (ii) employee options outstanding to purchase 22,200,246 of our ordinary shares at a weighted average exercise price of A$3.29.

Since July 1, 2013, the following changes have been made to our ordinary share capital:

|

|

•

|

In October 2013, we issued 70,164 ordinary shares as consideration for the acquisition of certain assets from Provasculon, Inc. Consideration per share was A$5.96.

|

|

|

•

|

In December 2013, we issued 2,948,729 ordinary shares to Osiris Therapeutics, Inc. as consideration for taking delivery of the assigned and other assets pursuant to the purchase agreement for the acquisition of the entire culture expanded mesenchymal stem cell assets of Osiris Therapeutics, Inc. Consideration per share was A$5.69.

|

|

|

•

|

In April 2015, we issued 15,298,837 ordinary shares to Celgene Corporation. Consideration per share was A$3.82.

|

|

|

•

|

In November 2015, we issued 42,675,295 ordinary shares (in the form of ADSs) in an initial public offering in the United States. Consideration received was US$68.3 million, before deducting underwriting discounts and commissions.

|

|

|

•

|

In February 2016, we issued 1,277,210 ordinary shares to Robert Sackstein as consideration for the license of certain intellectual property assets relating to proprietary cell targeting technology. Consideration per share was A$1.62.

|

|

|

•

|

In August 2016, we issued 280,911 ordinary shares to Robert Sackstein as consideration for consulting services. Consideration per share was A$1.14.

|

|

|

•

|

In January 2017, we issued 20,044,771 ordinary shares to Mallinckrodt Pharmaceuticals at a price of A$1.4761 per share.

|

|

|

•

|

In March 2017, we issued 26,250,000 ordinary shares to various institutional investors at a price of A$2.00 per share.

|

In addition, during the past three fiscal years, we issued the following fully-paid ordinary shares upon exercise of employee options:

|

|

•

|

1,043,798 ordinary shares in fiscal 2015;

|

|

|

•

|

422,903 ordinary shares in fiscal 2016; and

|

|

|

•

|

272,579 ordinary shares in fiscal 2017.

|

10

Our Constitution

Our Constitution is similar in nature to the bylaws of a U.S. corporation. It does not provide for or prescribe any specific objectives or purposes of Mesoblast. Our Constitution is subject to the terms of the ASX Listing Rules and the Corporations Act. It may be modified or repealed and replaced by special resolution passed at a meeting of shareholders, which is a resolution passed by at least 75% of the votes cast by shareholders (including proxies and representatives of shareholders) entitled to vote on the resolution.

Under Australian law, a company has the legal capacity and powers of an individual both within and outside Australia. The material provisions of our Constitution are summarized below. This summary is not intended to be complete nor to constitute a definitive statement of the rights and liabilities of our shareholders. Our Constitution is incorporated by reference as an exhibit to the registration statement of which this prospectus forms a part.

Directors

Interested Directors

Except as permitted by the Corporations Act and the ASX Listing Rules, a director must not vote in respect of any contract or arrangement in which the director has any direct or indirect material personal interest or any lesser interest according to our Constitution. Such director must not be counted in a quorum, must not vote on the matter and must not be present at the meeting while the matter is being considered.

Pursuant to our Constitution, a director is liable to us for any profits derived with regard to any matter in which the director has a material interest unless the director:

|

|

•

|

declares the director’s interest in the matter as soon as practicable after the relevant facts come to the director’s knowledge; and

|

|

|

•

|

does not contravene our Constitution or the Corporations Act in relation to the matter.

|

Unless a relevant exception applies, the Corporations Act requires our directors to provide disclosure of certain interests and prohibits directors of companies listed on the ASX from voting on matters in which they have a material personal interest and from being present at the meeting while the matter is being considered. In addition, unless a relevant exception applies, the Corporations Act and the ASX Listing Rules require shareholder approval of any provision of financial benefits (including the issue by us of ordinary shares and other securities) to our directors, including entities controlled by them and certain members of their families.

Borrowing Powers Exercisable by Directors

Pursuant to our Constitution, our business is managed by our board of directors. Our board of directors has the power to raise or borrow money, and incur liens on or grant a security interest in any of our property or business or any uncalled portion of any partly paid shares, and may issue debentures or give any other security for any of our debts, liabilities or obligations or of any other person, in each case, in the manner and on terms it deems fit.

Election, Removal and Retirement of Directors

We may appoint or remove any director by resolution passed in the general meeting of shareholders. Additionally, our directors are elected to serve three-year terms in a manner similar to a “staggered” board of directors under Delaware law. At every annual general meeting, one-third of the previously elected directors or, if their number is not a multiple of three then the number nearest to but not exceeding one-third, must retire from office and are eligible for re-election. Additionally, no director except the Managing Director (currently designated as our chief executive officer, Silviu Itescu) may hold office for a period in excess of three years, or beyond the third annual general meeting following the director’s last election, whichever is the longer, without submitting himself or herself for re-election.

A director who is appointed during the year by the other directors only holds office until the next general meeting at which time the director may stand for election by shareholders at that meeting.

In addition, provisions of the Corporations Act apply where at least 25% of the votes cast on a resolution to adopt our remuneration report (which resolution must be proposed each year at our annual general meeting) are against the adoption of the report at two successive annual general meetings. Where these provisions apply, a resolution must be put to a vote at the second annual general meeting to the effect that a further meeting, or a spill meeting, take place within 90 days. At the spill meeting, the directors in office when

11

the remuneration report was considered at the second annual general meeting (other than the Managing Director) cease to hold office and resolutions to appoint directors (which may involve re-appointing the former directors) are put to a vo

te.

Voting restrictions apply in relation to the resolutions to adopt our remuneration report and to propose a spill meeting. These restrictions apply to our key management personnel and their closely related parties. See “Rights and Restrictions on Classes of Shares—Voting Rights” below.

Pursuant to our Constitution, no person is eligible to be elected as a director unless a notice of the director’s candidature is given to us at least 35 business days (30 business days for a meeting shareholders have requested directors to call) before the meeting. This restriction does not apply to a retiring director or to the election of a director previously appointed by the directors during the year.

Share Qualifications

There are currently no requirements for directors to own our ordinary shares in order to qualify as directors.

Rights and Restrictions on Classes of Shares

Subject to the Corporations Act and the ASX Listing Rules, the rights attaching to our ordinary shares are detailed in our Constitution. Our Constitution provides that any of our ordinary shares may be issued with preferred, deferred or other special rights, whether in relation to dividends, voting, return of share capital, payment of calls or otherwise as our board of directors may determine from time to time. Subject to the Corporations Act, the ASX Listing Rules and any rights and restrictions attached to a class of shares, we may issue further ordinary shares on such terms and conditions as our board of directors resolve. Currently, our outstanding ordinary share capital consists of only one class of ordinary shares.

Dividend Rights

Our board of directors may from time to time determine to pay dividends to shareholders. All unclaimed dividends may be invested or otherwise made use of by our board of directors for our benefit until claimed or otherwise disposed of in accordance with our Constitution.

Voting Rights

Under our Constitution, any resolution to be considered at a meeting of the shareholders shall be decided on a show of hands unless a poll is demanded by the shareholders at or before the declaration of the result of the show of hands. A poll may be demanded by the chairman of the meeting; by at least five shareholders present and having the right to vote on at the meeting; any shareholder or shareholders representing at least 5% of the votes that may be cast on the resolution on a poll; or any shareholder or shareholders holding our shares conferring a right to vote at the meeting on which an aggregate sum has been paid up equal to not less than 5% of the total sum paid up on all the shares conferring that right. On a show of hands, each shareholder entitled to vote at the meeting has one vote regardless of the number of ordinary shares held by such shareholder. If voting takes place on a poll, rather than a show of hands, each shareholder entitled to vote has one vote for each ordinary share held and a fractional vote for each ordinary share that is not fully paid, such fraction being equivalent to the proportion of the amount that has been paid to such date on that ordinary share.

Under Australian law, an ordinary resolution is passed on a show of hands if it is approved by a simple majority (more than 50%) of the votes cast by shareholders present (in person or by proxy) and entitled to vote. If a poll is demanded, an ordinary resolution is passed if it is approved by holders representing a simple majority of the total voting rights of shareholders present (in person or by proxy) who (being entitled to vote) vote on the resolution. Special resolutions require the affirmative vote of not less than 75% of the votes cast by shareholders present (in person or by proxy) at the meeting.

Pursuant to our Constitution, each shareholder entitled to attend and vote at a meeting may attend and vote in person or by proxy or attorney and by representative. Shareholders may not vote electronically. Under Australian law, shareholders of a public listed company are not permitted to approve corporate matters by written consent. Our Constitution does not provide for cumulative voting.

Note that ADS holders may not directly vote at a meeting of the shareholders but may instruct the depositary to vote the number of deposited ordinary shares their ADSs represent. Under voting by a show of hands, multiple “yes” votes by ADS holders will only count as one “yes” vote and will be negated by a single “no” vote, unless a poll is demanded.

There are a number of circumstances where the Corporations Act or the ASX Listing Rules prohibit or restrict certain shareholders or certain classes of shareholders from voting. For example, key management personnel whose remuneration details are included

12

elsewhere in this prospectus are prohibited from voting on the resolution that must be proposed at each annual general meeting

to adopt our remuneration report, as well as any resolution to propose a spill meeting. An exception applies to exercising a directed proxy which indicates how the proxy is to vote on the proposed resolution on behalf of someone other than the key managem

ent personnel or their closely related parties; or that person is chair of the meeting and votes an undirected proxy where the shareholder expressly authorizes the chair to exercise that power. Key management personnel and their closely related parties are

also prohibited from voting undirected proxies on remuneration related resolutions. A similar exception to that described above applies if the proxy is the chair of the meeting.

Right to Share in Our Profits

Subject to the Corporations Act and pursuant to our Constitution, prior to our liquidation, our shareholders are entitled to participate in our profits only by payment of dividends. Our board of directors may from time to time determine to pay dividends to the shareholders; however, no dividend is payable except in accordance with the thresholds set out in the Corporations Act.

Rights to Share in the Surplus in the Event of Liquidation

Our Constitution provides for the right of shareholders to participate in a surplus in the event of our liquidation.

Redemption Provisions

There are no redemption provisions in our Constitution in relation to ordinary shares. Under our Constitution and subject to the Corporations Act, any preference shares may be issued on the terms that they are, or may at our option or at the option of the holder be, liable to be redeemed.

Sinking Fund Provisions

Our Constitution allows our directors to, at their discretion, set aside any sums they think proper out of our profits as reserves, which may be applied for any proper purpose.

Liability for Further Capital Calls

According to our Constitution, our board of directors may make any calls from time to time upon shareholders in respect of all monies unpaid on partly paid shares respectively held by them, subject to the terms upon which any of the partly paid shares have been issued. Each shareholder is liable to pay the amount of each call in the manner, at the time and at the place specified by our board of directors. Calls may be made payable by installment.

Provisions Discriminating Against Holders of a Substantial Number of Shares

There are no provisions under our Constitution discriminating against any existing or prospective holders of a substantial number of our ordinary shares.

Variation or Cancellation of Share Rights

The rights attached to shares in a class of shares may only be varied or cancelled by a special resolution of shareholders, together with either:

|

|

•

|

a special resolution passed at a separate meeting of members holding shares in the class; or

|

|

|

•

|

the written consent of members with at least 75% of the votes in the class.

|

General Meetings of Shareholders

General meetings of shareholders may be called by our board of directors or, under the Corporations Act, by a single director. Except as permitted under the Corporations Act, shareholders may not convene a meeting. Under the Corporations Act, shareholders with at least 5% of the votes that may be cast at a general meeting may call and arrange to hold a general meeting. The Corporations Act requires the directors to call and arrange to hold a general meeting on the request of shareholders with at least 5% of the votes that may be cast at a general meeting. Notice of the proposed meeting of our shareholders is required at least 28 days prior to such meeting under the Corporations Act.

13

Quorum for General Meetings of Shareholders

No business shall be transacted at any general meeting unless a quorum is present at the time when the meeting proceeds to business. Under our Constitution, the presence, in person or by proxy, attorney or representative, of five shareholders constitutes a quorum, or if we have less than five shareholders, then the shareholders present at a meeting constitute a quorum. If a quorum is not present within 15 minutes after the time appointed for the meeting, the meeting must be either dissolved if it was summoned by shareholders or adjourned in any other case. A meeting adjourned for lack of a quorum is adjourned to the same day in the following week at the same time and place, unless otherwise decided by our directors. The reconvened meeting is dissolved if a quorum is not present within 15 minutes after the time appointed for the meeting.

Foreign Ownership Regulation

There are no limitations on the rights to own securities imposed by our Constitution. However, acquisitions and proposed acquisitions of shares in Australian companies may be subject to review and approval by the Australian Federal Treasurer under the Foreign Acquisitions and Takeovers Act 1975, or the FATA, which generally applies to acquisitions or proposed acquisitions:

|

|

•

|

by a foreign person (as defined in the FATA) or associated foreign persons that would result in such persons having an interest in 20% or more of the issued shares of, or control of 20% or more of the voting power in, an Australian company; and

|

|

|

•

|

by non-associated foreign persons that would result in such foreign person having an interest in 40% or more of the issued shares of, or control of 40% or more of the voting power in, an Australian company.

|

In addition, foreign government investors are generally required to obtain approval to acquire an interest in an Australian company regardless of the percentage interest acquired.

The Australian Federal Treasurer may prevent a proposed acquisition in the above categories or impose conditions on such acquisition if the Treasurer is satisfied that the acquisition would be contrary to the national interest. If a foreign person acquires shares or an interest in shares in an Australian company in contravention of the FATA, the Australian Federal Treasurer may order the divestiture of such person’s shares or interest in shares in Mesoblast. The Australian Federal Treasurer may order divestiture pursuant to the FATA if he determines that the acquisition has resulted in that foreign person, either alone or together with other non-associated or associated foreign persons, controlling Mesoblast and that such control is contrary to the national interest.

Ownership Threshold

There are no provisions in our Constitution that require a shareholder to disclose ownership above a certain threshold. The Corporations Act, however, requires a substantial shareholder to notify us and the ASX once a 5% interest in our ordinary shares is obtained. Further, once a shareholder has (alone or together with associates) a 5% or greater interest in us, such shareholder must notify us and the ASX of any increase or decrease of 1% or more in its interest in our ordinary shares. Following our initial public offering in the United States, our shareholders are also subject to disclosure requirements under U.S. securities laws.

Issues of Shares and Change in Capital

Subject to our Constitution, the Corporations Act, the ASX Listing Rules and any other applicable law, we may at any time issue shares and grant options or warrants on any terms, with preferred, deferred or other special rights and restrictions and for the consideration and other terms that the directors determine. Our power to issue shares includes the power to issue bonus shares (for which no consideration is payable to Mesoblast), preference shares and partly paid shares.

Subject to the requirements of our Constitution, the Corporations Act, the ASX Listing Rules and any other applicable law, including relevant shareholder approvals, we may consolidate or divide our share capital into a smaller or larger number by resolution, reduce our share capital (provided that the reduction is fair and reasonable to our shareholders as a whole, does not materially prejudice our ability to pay creditors and obtains the necessary shareholder approval) or buy back our ordinary shares including under an equal access buy-back or on a selective basis.

Change of Control

Takeovers of listed Australian public companies, such as Mesoblast, are regulated by the Corporations Act, which prohibits the acquisition of a “relevant interest” in issued voting shares in a listed company if the acquisition will lead to that person’s or someone else’s voting power in Mesoblast increasing from 20% or below to more than 20% or increasing from a starting point that is above 20% and below 90%, subject to a range of exceptions.

14

Generally, a person will have a relevant interest in securities if the person:

|

|

•

|

is the holder of the securities;

|

|

|

•

|

has power to exercise, or control the exercise of, a right to vote attached to the securities; or

|

|

|

•

|

has the power to dispose of, or control the exercise of a power to dispose of, the securities (including any indirect or direct power or control).

|

If, at a particular time, a person has a relevant interest in issued securities and the person:

|

|

•

|

has entered or enters into an agreement with another person with respect to the securities;

|

|

|

•

|

has given or gives another person an enforceable right, or has been or is given an enforceable right by another person, in relation to the securities; or

|

|

|

•

|

has granted or grants an option to, or has been or is granted an option by, another person with respect to the securities, and the other person would have a relevant interest in the securities if the agreement were performed, the right enforced or the option exercised;

|

then, the other person is taken to already have a relevant interest in the securities.

There are a number of exceptions to the above prohibition on acquiring a relevant interest in issued voting shares above 20%. In general terms, some of the more significant exceptions include:

|

|

•

|

when the acquisition results from the acceptance of an offer under a formal takeover bid;

|

|

|

•

|

when the acquisition is conducted on market by or on behalf of the bidder under a takeover bid and the acquisition occurs during the bid period;

|

|

|

•

|

when shareholders of Mesoblast approve an acquisition that would otherwise breach the prohibition, by resolution passed at general meeting;

|

|

|

•

|

an acquisition by a person if, throughout the six months before the acquisition, that person or any other person has had voting power in Mesoblast of at least 19% and, as a result of the acquisition, none of the relevant persons would have voting power in Mesoblast more than three percentage points higher than they had six months before the acquisition;

|

|

|

•

|

as a result of a rights issue;

|

|

|

•

|

as a result of dividend reinvestment schemes;

|

|

|

•

|

as a result of certain underwriting arrangements;

|

|

|

•

|

through operation of law;

|

|

|

•

|

an acquisition that arises through the acquisition of a relevant interest in another company listed on the ASX, certain other Australian financial markets or a foreign stock exchange approved in writing by ASIC;

|

|

|

•

|

arising from an auction of forfeited shares; or

|

|

|

•

|

arising through a compromise, arrangement, liquidation or buy-back.

|

A formal takeover bid may either be a bid for all securities in the bid class or a fixed proportion of such securities, with each holder of bid class securities receiving a bid for that proportion of their holding. Under our Constitution, a proportionate takeover bid must first be approved by resolution of our shareholders in a general meeting before it may proceed.

Breaches of the takeovers provisions of the Corporations Act are criminal offenses. In addition, ASIC and, on application by ASIC or an interested party, such as a shareholder, the Australian Takeovers Panel have a wide range of powers relating to breaches of takeover provisions, including the ability to make orders canceling contracts, freezing transfers of, and rights (including voting rights) attached to, securities, and forcing a party to dispose of securities including by vesting the securities in ASIC for sale. There are certain defenses to breaches of the takeover provisions provided in the Corporations Act.

Access to and Inspection of Documents

Inspection of our records is governed by the Corporations Act. Any member of the public has the right to inspect or obtain copies of our share registers on the payment of a prescribed fee. Shareholders are not required to pay a fee for inspection of our share registers

15

or minute books of the meetings of shareholders. Other corporate records, including minutes of directors’ meetings, financial records and other documents, are not open for inspection by shareholders. Where a shareholder is acting in good fait

h and an inspection is deemed to be made for a proper purpose, a shareholder may apply to the court to make an order for inspection of our books.

16

DESCRIPTION OF AMERIC

AN DEPOSITARY SHARES

American Depositary Receipts

JPMorgan Chase Bank, N.A., as depositary, will register and deliver ADSs. Each ADS represents an ownership interest in five ordinary shares deposited with a custodian, as agent of the depositary, under the deposit agreement among ourselves, the depositary and ADS holders. Each ADS will also represent any securities, cash or other property deposited with the depositary but which they have not distributed directly to you. Unless certificated American Depositary Receipts, or ADRs, are specifically requested by you, all ADSs will be issued on the books of our depositary in book-entry form and periodic statements will be mailed to you which reflect your ownership interest in such ADSs. The depositary’s office is located at 4 New York Plaza, Floor 12, New York, New York, 10004.

You may hold ADSs either directly or indirectly through your broker or other financial institution. If you hold ADSs directly, by having an ADS registered in your name on the books of the depositary, you are an ADR holder. This description assumes you hold your ADSs directly. If you hold the ADSs through your broker or financial institution nominee, you must rely on the procedures of such broker or financial institution to assert the rights of an ADR holder described in this section. You should consult with your broker or financial institution to find out what those procedures are.

As an ADR holder, we will not treat you as a shareholder of ours and you will not have any shareholder rights. Australian law governs shareholder rights. Because the depositary or its nominee will be the shareholder of record for the ordinary shares represented by all outstanding ADSs, shareholder rights rest with such record holder. Your rights are those of an ADR holder. Such rights derive from the terms of the deposit agreement to be entered into among us, the depositary and all registered holders from time to time of ADSs issued under the deposit agreement. The obligations of the depositary and its agents are also set out in the deposit agreement. Because the depositary or its nominee will actually be the registered owner of the ordinary shares, you must rely on it to exercise the rights of a shareholder on your behalf. The deposit agreement and the ADSs are governed by New York law. Under the deposit agreement, as an ADR holder, you agree that any legal suit, action or proceeding against or involving us or the depositary, arising out of or based upon the deposit agreement or transactions contemplated thereby, may only be instituted in a state or federal court in New York, New York, and you irrevocably waive any objection which you may have to the laying of venue of any such proceeding and irrevocably submit to the exclusive jurisdiction of such courts in any such suit, action or proceeding.

The following is a summary of what we believe to be the material terms of the deposit agreement. Notwithstanding this, because it is a summary, it may not contain all the information that you may otherwise deem important. For more complete information, you should read the entire deposit agreement and the form of ADR which contains the terms of your ADSs. You can read a copy of the deposit agreement which is filed as an exhibit to the registration statement of which this prospectus forms a part. You may also obtain a copy of the deposit agreement at the SEC’s Public Reference Room which is located at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-732-0330. You may also find the registration statement and the attached deposit agreement on the SEC’s website at http://www.sec.gov.

Ordinary Share Dividends and Other Distributions

How will I receive dividends and other distributions on the ordinary shares underlying my ADSs?

We may make various types of distributions with respect to our securities. The depositary has agreed that, to the extent practicable, it will pay to you the cash dividends or other distributions it or the custodian receives on ordinary shares or other deposited securities, after converting any cash received into U.S. dollars (if it determines such conversion may be made on a reasonable basis) and, in all cases, making any necessary deductions provided for in the deposit agreement. The depositary may utilize a division, branch or affiliate of JPMorgan Chase Bank, N.A., to direct, manage and/or execute any public and/or private sale of securities under the deposit agreement. Such division, branch and/or affiliate may charge the depositary a fee in connection with such sales, which fee is considered an expense of the depositary. You will receive these distributions in proportion to the number of underlying securities that your ADSs represent.

Except as stated below, the depositary will deliver such distributions to ADR holders in proportion to their interests in the following manner:

|

|

•

|

Cash

. The depositary will distribute any U.S. dollars available to it resulting from a cash dividend or other cash distribution or the net proceeds of sales of any other distribution or portion thereof (to the extent applicable), on an averaged or other practicable basis, subject to (i) appropriate adjustments for taxes withheld, (ii) such distribution being impermissible or impracticable with respect to certain registered ADR holders, and (iii) deduction of the depositary’s and/or its agents’ expenses in (1) converting any foreign currency to U.S. dollars to the extent that it determines that such conversion may be made on a reasonable basis, (2) transferring foreign currency or U.S. dollars to the United States by such means as the depositary may determine to the extent that it determines that such transfer may be made on a reasonable basis, (3) obtaining any approval or license of any governmental authority required for such conversion or transfer, which is obtainable at a

|

17

|

|

|

reasonable cost a

nd within a reasonable time and (4) making any sale by public or private means in any commercially reasonable manner.

If exchange rates fluctuate during a time when the depositary cannot convert a foreign currency, you may lose some or all of the value of

the distribution.

|

|

|

•

|

Ordinary shares

. In the case of a distribution in ordinary shares, the depositary will issue additional ADRs to evidence the number of ADSs representing such ordinary shares. Only whole ADSs will be issued. Any ordinary shares which would result in fractional ADSs will be sold and the net proceeds will be distributed in the same manner as cash to the ADR holders entitled thereto.

|

|

|

•

|

Rights to receive additional ordinary shares

. In the case of a distribution of rights to subscribe for additional ordinary shares or other rights, if we timely provide evidence satisfactory to the depositary that it may lawfully distribute such rights, the depositary will distribute warrants or other instruments in the discretion of the depositary representing such rights. However, if we do not timely furnish such evidence, the depositary may:

|

|

|

o

|

sell such rights if practicable and distribute the net proceeds in the same manner as cash to the ADR holders entitled thereto; or

|

|

|

o

|

if it is not practicable to sell such rights by reason of the non-transferability of the rights, limited markets therefor, their short duration or otherwise, do nothing and allow such rights to lapse, in which case ADR holders will receive nothing and the rights may lapse.

|

|

|

•

|

Other Distributions

. In the case of a distribution of securities or property other than those described above, the depositary may either (i) distribute such securities or property in any manner it deems equitable and practicable or (ii) to the extent the depositary deems distribution of such securities or property not to be equitable and practicable, sell such securities or property and distribute any net proceeds in the same way it distributes cash.

|

|

|

•

|

Elective Distributions

. In the case of a dividend payable at the election of our shareholders in cash or in additional ordinary shares, we will notify the depositary at least 30 days prior to the proposed distribution stating whether or not we wish such elective distribution to be made available to ADR holders. The depositary shall make such elective distribution available to ADR holders only if (i) we shall have timely requested that the elective distribution is available to ADR holders, (ii) the depositary shall have determined that such distribution is reasonably practicable and (iii) the depositary shall have received satisfactory documentation and opinions within the terms of the deposit agreement. If the above conditions are not satisfied, the depositary shall, to the extent permitted by law, distribute to the ADR holders, on the basis of the same determination as is made in the local market in respect of the ordinary shares for which no election is made, either (i) cash or (ii) additional ADSs representing such additional ordinary shares. If the above conditions are satisfied, the depositary shall establish procedures to enable ADR holders to elect the receipt of the proposed dividend in cash or in additional ADSs. There can be no assurance that ADR holders generally, or any ADR holder in particular, will be given the opportunity to receive elective distributions on the same terms and conditions as the holders of ordinary shares.

|

If the depositary determines in its discretion that any distribution described above is not practicable with respect to any specific registered ADR holder, the depositary may, after consultation with us if practicable, choose any method of distribution that it deems practicable for such ADR holder, including the distribution of foreign currency, securities or property, or it may retain such items, without paying interest on or investing them, on behalf of the ADR holder as deposited securities, in which case the ADSs will also represent the retained items.

Any U.S. dollars will be distributed by checks drawn on a bank in the United States for whole dollars and cents. Fractional cents will be withheld without liability and dealt with by the depositary in accordance with its then current practices.

The depositary is not responsible if it decides that it is unlawful or not reasonably practicable to make a distribution available to any ADR holders. There can be no assurance that the depositary will be able to convert any currency at a specified exchange rate or sell any property, rights, ordinary shares or other securities at a specified price, nor that any of such transactions can be completed within a specified time period. For further information about the general sale and/or purchase of securities see https://www.adr.com.

Deposit, Withdrawal and Cancellation

How does the depositary issue ADSs?

The depositary will issue ADSs if you or your broker deposit ordinary shares or evidence of rights to receive ordinary shares with the custodian and pay the fees and expenses owing to the depositary in connection with such issuance. In the case of the ADSs to be issued under this prospectus, we will arrange with the underwriters named herein to deposit such ordinary shares.

18

Ordinary shares deposited in the future with the custodian must be accompanied by certain delivery documentation and shall, at the time of such deposit, be

registered in the name of JPMorgan Chase Bank, N.A., as depositary for the benefit of holders of ADRs or in such other name as the depositary shall direct.

The custodian will hold all deposited ordinary shares (including those being deposited by or on our behalf in connection with the offering to which this prospectus relates) for the account of the depositary. ADR holders thus have no direct ownership interest in the ordinary shares and only have such rights as are contained in the deposit agreement. The custodian will also hold any additional securities, property and cash received on or in substitution for the deposited ordinary shares. The deposited ordinary shares and any such additional items are referred to as “deposited securities”.

Upon each deposit of ordinary shares, receipt of related delivery documentation and compliance with the other provisions of the deposit agreement, including the payment of the fees and charges of the depositary and any taxes or other fees or charges owing, the depositary will issue an ADR or ADRs in the name or upon the order of the person entitled thereto evidencing the number of ADSs to which such person is entitled. All of the ADSs issued will, unless specifically requested to the contrary, be part of the depositary’s direct registration system, and a registered holder will receive periodic statements from the depositary which will show the number of ADSs registered in such holder’s name. An ADR holder can request that the ADSs not be held through the depositary’s direct registration system and that a certificated ADR be issued.

How do ADR holders cancel an ADS and obtain deposited securities?

When you turn in your ADR certificate at the depositary’s office, or when you provide proper instructions and documentation in the case of direct registration ADSs, the depositary will, upon payment of certain applicable fees, charges and taxes, deliver the underlying ordinary shares to you or upon your written order. At your risk, expense and request, the depositary may deliver deposited securities at such other place as you may request.

The depositary may only restrict the withdrawal of deposited securities in connection with:

|

|

•

|

temporary delays caused by closing our transfer books or those of the depositary or the deposit of ordinary shares in connection with voting at a shareholders’ meeting, or the payment of dividends;

|

|

|

•

|

the payment of fees, taxes and similar charges; or

|

|

|

•

|

compliance with any U.S. or foreign laws or governmental regulations relating to the ADRs or to the withdrawal of deposited securities.

|

This right of withdrawal may not be limited by any other provision of the deposit agreement.

Record Dates

The depositary may, after consultation with us if practicable, fix record dates for the determination of the registered ADR holders who will be entitled (or obligated, as the case may be):

|

|

•

|

to receive any distribution on or in respect of ordinary shares;

|

|

|

•

|

to give instructions for the exercise of voting rights at a meeting of holders of ordinary shares;

|

|

|

•

|

to pay the fee assessed by the depositary for administration of the ADR program and for any expenses as provided for in the ADR; or

|

|

|

•

|

to receive any notice or to act in respect of other matters,

|

all subject to the provisions of the deposit agreement.

Voting Rights

How do I vote?

If you are an ADR holder and the depositary asks you to provide it with voting instructions, you may instruct the depositary how to exercise the voting rights for the ordinary shares which underlie your ADSs. As soon as practicable after receiving notice of any meeting or solicitation of consents or proxies from us, the depositary will distribute to the registered ADR holders a notice stating such information as is contained in the voting materials received by the depositary and describing how you may instruct the depositary to exercise the voting rights for the ordinary shares which underlie your ADSs, including instructions for giving a discretionary proxy to a

19

person designated by us. For instructions to be valid, the depositary must receive them in the m

anner, and on or before the date specified. The depositary will try, as far as is practical, subject to the provisions of and governing the underlying ordinary shares or other deposited securities, to vote or to have its agents vote the ordinary shares or

other deposited securities as you instruct. The depositary will only vote or attempt to vote as you instruct. Holders are strongly encouraged to forward their voting instructions to the depositary as soon as possible. Voting instructions will not be deemed

to be received until such time as the ADR department responsible for proxies and voting has received such instructions notwithstanding that such instructions may have been physically received by the depositary prior to such time. The depositary will not i

tself exercise any voting discretion. Furthermore, neither the depositary nor its agents are responsible for any failure to carry out any voting instructions, for the manner in which any vote is cast or for the effect of any vote. Notwithstanding anything

contained in the deposit agreement or any ADR, the depositary may, to the extent not prohibited by law or regulations, or by the requirements of the stock exchange on which the ADSs are listed, in lieu of distribution of the materials provided to the depos

itary in connection with any meeting of, or solicitation of consents or proxies from, holders of deposited securities, distribute to the registered holders of ADRs a notice that provides such holders with, or otherwise publicizes to such holders, instructi

ons on how to retrieve such materials or receive such materials upon request (i.e., by reference to a website containing the materials for retrieval or a contact for requesting copies of the materials).

There is no guarantee that you will receive voting materials in time to instruct the depositary to vote and it is possible that you, or persons who hold their ADSs through brokers, dealers or other third parties, will not have the opportunity to exercise a right to vote.

Reports and Other Communications

Will ADR holders be able to view our reports?