Current Report Filing (8-k)

July 07 2017 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported)

July 3, 2017

|

MOVADO GROUP, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

New York

|

|

(State or other jurisdiction of incorporation)

|

|

|

|

1-16497

|

13-2595932

|

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

650 From Road, Suite 375

Paramus, NJ

|

07652-3556

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

(201) 267-8000

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

NOT APPLICABLE

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

Item 1.01

.

|

Entry into a Material Definitive Agreement.

|

On July 3, 2017, MGS Distribution Ltd (“MGS”), a wholly owned United Kingdom subsidiary of Movado Group, Inc. (the “Company”), entered into a Sale and Purchase Agreement (the “Purchase Agreement”) with Lesa Bennett and Jemma Fennings (the “Sellers”) pursuant to which MGS acquired JLB Brands Ltd (“JLB Brands”)

for consideration of

60.0 million British Pounds Sterling (£) in cash, subject to working capital and other closing adjustments

. After giving effect to the closing adjustments, the purchase price was approximately

£60.9 million net of cash acquired of approximately £4.4 million. The purchase price was funded by available cash of the Company’s non-US subsidiaries and no debt was assumed in the acquisition.

The Purchase Agreement includes customary warranties and indemnities by the Sellers related to the business acquired. The Sellers’ liability for breaches of these warranties and indemnities is generally limited to

£

300,000, although the Company procured a warranties and indemnities insurance policy with a limit of

£

18 million covering most such breaches, in each case subject to specified exceptions.

The Sellers have also generally agreed to indemnify MGS for all unpaid and unaccrued taxes of JLB Brands up to March 31, 2017 (the date of JLB Brands’ last audited financial statements) and for all non-ordinary course taxes arising from March 31, 2017 until the date of acquisition.

JLB Brands, which is the owner of the Olivia Burton brand, was founded by the Sellers in the United Kingdom in 2011 and began selling fashion watches under the Olivia Burton brand in 2012, adding jewelry in 2016. In connection with the Purchase Agreement, the Sellers entered into employment agreements with MGS and agreed not to compete with JLB Brands for three years.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement

. T

he Company intends to file the Purchase Agreement as an exhibit to its next periodic report.

In connection with the acquisition, the Company issued a press release on July 5, 2017, which is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item 2.01.

|

Item 2.01

.

|

Completion of Acquisition or Disposition of Assets

|

The information set forth under Item 1.01 is incorporated into this Item 2.01 by reference.

|

Item 9.01

.

|

Financial Statements and Exhibits

|

|

(d) Exhibits

|

|

|

|

|

|

99.1

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 7, 2017

|

|

MOVADO GROUP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Mitchell C. Sussis

|

|

|

|

|

Name: Mitchell C. Sussis

|

|

|

|

|

Title: Senior Vice President and

General Counsel

|

|

|

|

|

|

|

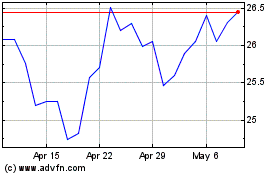

Movado (NYSE:MOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

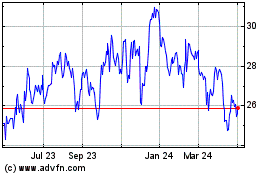

Movado (NYSE:MOV)

Historical Stock Chart

From Apr 2023 to Apr 2024