Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

July 03 2017 - 2:26PM

Edgar (US Regulatory)

|

Prospectus Supplement

|

Filed Pursuant to Rule 424(b)(3)

|

|

To Prospectus dated March 31, 2017

|

Registration Statement No. 333-216031

|

PROSPECTUS SUPPLEMENT

664,000 Class A Units Consisting

of

Common Stock and Warrants and

3,502 Class B Units Consisting

of Series A Convertible

Preferred Stock and Warrants

We are supplementing the prospectus dated March 31, 2017 covering

the sale of up to 664,000 Class A Units, consisting of Common Stock and Warrants, and 3,502 Class B Units, consisting of Series

A Convertible Preferred Stock and Warrants, to add certain information as described below.

This prospectus supplement supplements information contained in

the prospectus dated March 31, 2017 and should be read in conjunction therewith. This prospectus supplement is not complete without,

and may not be delivered or utilized except in connection with, the prospectus dated March 31, 2017.

Investing in our common stock and warrants involves certain risks.

See “Risk Factors” beginning on page 5 of the prospectus dated March 31, 2017 for a discussion of these risks.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or determined if this prospectus supplement in truthful or

complete. Any representation to the contrary is a criminal offense.

WARRANT EXERCISE ARRANGEMENT

On June 29, 2017, we offered to modify the

rights (the “Temporary Modification”) of the holders of the Warrants sold pursuant to the prospectus (the “Warrants”).

In accordance with Sections 2 and 3 of the Warrants, the Temporary Modification included: (a) lowering the exercise price of the

Warrants to $0.26 per share, (b) setting the applicable “VWAP” (as defined in the Warrant) price at $0.52 per share,

and (c) allowing for temporary cashless exercise of the Warrants for all holders that accepted the Temporary Modification before

8:00 a.m. Eastern daylight time on June 30, 2017. Holders of Warrants to purchase a total of approximately 3.0 million shares

of Common Stock accepted the offer resulting in the cancellation of those warrants and the issuance of a total of approximately

1.5 million shares of Common Stock (including shares held in abeyance pursuant to the following). The shares of Common Stock are

expected to be delivered on or about June 30, 2017 and are registered under the Securities Act of 1933, as amended. If delivery

of the shares of Common Stock pursuant to the foregoing would result in the holder exceeding the 4.99% “Beneficial Ownership

Limitation” (as defined in the Warrant) then the shares in excess of such 4.99% will be held by us in abeyance pending further

instruction from the holder. In connection with the Temporary Modification, we agreed to extend the "Lock-up Period"

contained in section 3.16.1 of the underwriting agreement between us and Aegis Capital Corp., dated March 28, 2017, by 45 days

and the Company agreed not to enter into any further amendments to the Warrants during such extended Lock-up Period. The

Company further agreed not to amend or waive the Lock-Up Period without the prior written consent of the holder accepting the

Temporary Modification. As a result of the Temporary Modification and in accordance with the terms of the Warrants, the Warrant

exercise price was lowered to $0.26 per share for all Warrants that were not exercised as part of the Temporary Modification.

The date of this Prospectus Supplement is June

30, 2017.

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

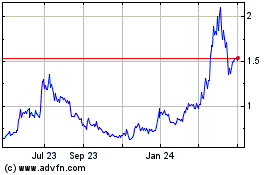

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Apr 2023 to Apr 2024