Not for distribution directly or indirectly

in the United States, Canada, Australia or Japan

Regulatory News:

Carrefour (Paris:CA) announces that Atacadão

S.A. (Grupo Carrefour Brasil), the parent company of all Groupe

Carrefour’s activities in Brazil, filed on June 28th, 2017 with the

Brazilian Securities Commission (CVM) the Brazilian Preliminary

Prospectus in connection with its initial public offering (IPO),

aiming at listing the shares of Grupo Carrefour Brasil on the Novo

Mercado segment of the São Paulo stock exchange. This second filing

follows the first filing announced on May 23rd, 2017, and is also

the object today of a notice to the market in Brazil. Grupo

Carrefour Brasil’s activities include Carrefour’s hypermarkets,

supermarkets, convenience stores, financial solutions and

complementary services as well as Atacadão’s cash & carry and

wholesale operations.

The IPO will consist in a base offering including (i) a primary

offering of 205,882,353 shares to be issued by Grupo Carrefour

Brasil as part of a share capital increase representing 10.4% of

its share capital after completion of the base offering and (ii) a

secondary offering of 91,261,489 shares to be sold by Carrefour and

Península. As part of the secondary tranche of the base offering,

Carrefour and Península will offer respectively, 34,461,489 and

56,800,000 shares of Grupo Carrefour Brasil, representing 1.7% and

2.9% of its share capital after completion of the base

offering.

In addition to the base offering, Península may sell up to an

aggregate of 59,428,768 additional shares at the date of the

pricing (“Secondary Hot Issue”). Furthermore, Carrefour has granted

an option to the Brazilian underwriters in connection with this

offering to place up to 44,571,576 additional shares held by

Carrefour to cover over-allotments, if any, exercisable up to

30 days after the starting date of trading of Grupo Carrefour

Brasil’s shares on the São Paulo stock exchange (“Secondary

Greenshoe”).

The indicative price range of the IPO is between R$15.0 and

R$19.0 per share, which would result in a total base offering size

of between R$4.5bn (€1.2bn1) and R$5.6bn (€1.5bn), and an overall

equity value, post-money, of Grupo Carrefour Brasil at IPO of

between R$29.7bn (€7.9bn) and R$37.6bn (€10.0bn).

Subject to market conditions, it is expected that the IPO will

be priced on July 18th, 2017 and that Grupo Carrefour Brasil’s

shares will start trading on the São Paulo stock exchange on July

20th, 2017.

Information regarding the potential IPO of Grupo Carrefour

Brasil, including the Brazilian Preliminary Prospectus, is

available in Portuguese on the websites of Grupo Carrefour Brasil

(at http://www.grupocarrefourbrasil.com.br), the Brazilian

underwriters, the CVM and the São Paulo stock exchange.

____________________

1 Reference exchange rate EUR/BRL: 3.757

Península’s call option

On June 15th, 2017, Península notified the exercise of its call

option to acquire from Carrefour 71,003,063 Grupo Carrefour Brasil

shares, representing 4.0% of its share capital prior to the

completion of the IPO. Consummation of the purchase and sale of the

shares subject to Península’s call option is conditional to the

completion of the IPO.

Grupo Carrefour Brasil shareholding

structure after completion of the IPO

Following completion of the base offering of the IPO and after

the transfer of the shares subject to Península’s call option,

Carrefour would hold 73.5% of Grupo Carrefour Brasil, Península

would hold 11.5% and Grupo Carrefour Brasil’s free float would be

15.0%. If both the Secondary Hot Issue and the Secondary Greenshoe

are exercised, and after the transfer of the shares subject to

Península’s call option, Carrefour would hold 71.3% of Grupo

Carrefour Brasil, Península would hold 8.5% and Grupo Carrefour

Brasil‘s free float would be 20.3%. In any case, Groupe Carrefour’s

stake in Grupo Carrefour Brasil upon completion of the IPO shall

not be below 71.3%.

The shares of Grupo Carrefour Brasil held by Carrefour and

Península will be subject to customary lock-up restrictions

pursuant to Novo Mercado regulations and market practices.

Grupo Carrefour Brasil will trade on the São Paulo stock

exchange under the ticker CRFB3.

Change in the date of Groupe

Carrefour’s Q2 2017 sales release

As a consequence of the IPO of Grupo Carrefour Brasil, Carrefour

is advancing to July 6th, 2017 (post-market closing) the

publication of its 2017 second quarter sales release, previously

scheduled for July 12th, 2017 (pre-market opening). Carrefour

confirms that its 2017 half-year results will be presented on

August 30th, 2017 (post-market closing).

This press release does not constitute an offer of securities

for sale in Brazil. Grupo Carrefour Brasil’s IPO shall take place,

should market conditions permit to do so, by means of the offering

documents filed with the CVM to be released in compliance with the

Brazilian securities regulation, including Portuguese language

Prospectuses. Investors must carefully read the Prospectuses,

especially the "Risk Factors" section of Grupo Carrefour Brasil’s

Prospectuses and Reference Form, prior to making any investment in

Grupo Carrefour Brasil's shares, if and when any offering takes

place.

This press release is not intended for publication or

distribution, directly or indirectly, in or into the United States.

This press release does not constitute an offer of securities for

sale in the United States. The securities mentioned in this press

release have not been, and will not be, registered under the U.S.

Securities Act of 1933, as amended (the Securities Act), or any

state securities laws, and they may not be offered or sold in the

United States absent registration or an applicable exemption from

the registration requirements of the Securities Act.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170628006353/en/

Investor relations (Groupe Carrefour):Mathilde Rodié,

Anne-Sophie Lanaute, Louis IgonetTel France: +33 (0)1 41 04 28

83orShareholder relations:Tel France: +33 (0)805 902 902 (n°

vert)orGroup press relations:Tel France: +33 (0)1 41 04 26 17

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

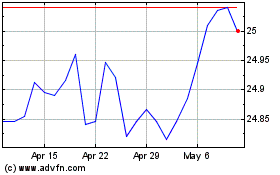

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024