Trane 401K and Thrift

Statements of Changes in Net Assets Available for Benefits

Years Ended December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Additions to net assets attributable to:

|

|

|

|

|

|

Plan's interest in investment income (loss) of the Ingersoll-Rand Employee Savings Plan Master Trust (Note 4)

|

|

$

|

15,657,175

|

|

|

$

|

(206,258

|

)

|

|

Interest income on notes receivable from participants

|

|

145,540

|

|

|

139,844

|

|

|

Contributions:

|

|

|

|

|

|

Participant

|

|

6,468,532

|

|

|

6,012,688

|

|

|

Employer

|

|

3,095,955

|

|

|

1,851,814

|

|

|

Total additions

|

|

25,367,202

|

|

|

7,798,088

|

|

|

Deductions from net assets attributable to:

|

|

|

|

|

|

Participant withdrawals and distributions

|

|

12,621,890

|

|

|

15,166,351

|

|

|

Administrative expenses

|

|

73,921

|

|

|

68,421

|

|

|

Total deductions

|

|

12,695,811

|

|

|

15,234,772

|

|

|

Net increase (decrease) in net assets

|

|

12,671,391

|

|

|

(7,436,684

|

)

|

|

Net assets available for benefits

|

|

|

|

|

|

Beginning of year

|

|

139,329,410

|

|

|

146,766,094

|

|

|

End of year

|

|

$

|

152,000,801

|

|

|

$

|

139,329,410

|

|

The accompanying notes are an integral part of these financial statements.

Trane 401K and Thrift

Notes to Financial Statements

December 31, 2016 and 2015

|

|

|

|

|

|

1

|

Description of the Plan

|

The following description of the Trane 401K and Thrift Plan (the “Plan”) provides only general information. More complete descriptions are found in the governing Plan documents and the summary plan descriptions.

History

The Plan is a defined contribution plan sponsored by Trane U.S. Inc., a U.S. subsidiary of Ingersoll-Rand plc ("IR-plc") (IR-plc, Trane U.S. Inc. and Ingersoll-Rand Company are collectively referred to as the "Company").

General

The Plan is a defined contribution plan with a 401(k) feature generally covering eligible employees under certain collective bargaining agreements, as defined in the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA").

Fidelity Management Trust Company (“Fidelity”) is the trustee and recordkeeper of the Plan and the Plan’s assets are part of the Ingersoll-Rand Employee Savings Plan Master Trust ("Master Trust").

The Ingersoll-Rand Company Benefits Administration Committee (the “Committee”) administers the Plan and is responsible for carrying out the provisions thereof on behalf of the Company. The IR-plc Benefits Design Committee approves recommended design changes to the Plan. The Plan requires that the Ingersoll-Rand Stock Fund be an investment option under the Plan. The other investment options available under the Plan from time to time are selected by the IR-plc Benefits Investment Committee. The IR-plc Benefits Investment Committee monitors the investment options offered in the Plan other than those offered through the self-directed brokerage link. Participants direct investments among the Plan's investment options. The Plan intends to meet the requirements and regulations of ERISA Section 404(c).

Contributions

Participants may elect to contribute up to 50% (in whole percentages) of their eligible compensation, as defined by the Plan, and subject to limits under the U.S. Internal Revenue Code of 1986, as amended (the “IRC”). Participants who have attained age 50 before the end of the plan year are eligible to make catch-up contributions. Participants may change their contribution amounts in accordance with administrative procedures established by the Committee. Participants are also allowed to rollover Plan amounts from certain other tax-qualified plans to the Plan.

The Company may make matching or non-matching contributions subject to the terms of the applicable collective bargaining agreements. All employer contributions will be made in cash and invested in the same manner as the participant contributions. If a participant does not have an investment election on file, Company contributions are invested in the Plan's default investment fund which is the target date retirement fund corresponding to the participant's anticipated retirement date based on his or her date of birth.

Participant Accounts

Each participant’s account is credited with the participant’s contribution and allocations of (a) the Company’s matching contributions or non-matching contributions (if applicable), and (b) Plan earnings (losses) net of investment management fees. Each participant’s account is charged for any fees associated with participant withdrawals and disbursements and applicable administrative expenses. Allocations are based on participant contributions, earnings or account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting

Participants are vested immediately in their elective contributions plus actual earnings thereon. Vesting in the Company’s contribution (whether matching or non-matching) portion of their accounts (if applicable) varies based on the specific collective bargaining agreements. All participants are 100% vested after 3 years of service as defined by the Plan. All Company contributions, not otherwise vested, become 100% vested upon the participant’s death or disability (while employed).

Notes Receivable from Participants

Subject to certain limitations, participants may borrow up to 50% of their savings balance (excluding the balances attributable to Company contributions), but no more than $50,000 at any one time. The two types of loans available are general purpose loans and home purchase loans (of a principal residence). There is no minimum loan repayment period. The maximum repayment period is five years for a general purpose loan and thirty years for a home purchase loan. The interest rate will be equal to the prime

Trane 401K and Thrift

Notes to Financial Statements

December 31, 2016 and 2015

interest rate plus 1.0% in effect on the first day of the month in which the loan application is received. As of December 31, 2016, outstanding loans bore interest rates ranging from 3.25% to 9.50%. Principal and interest are paid ratably through payroll deductions.

Participant Withdrawals and Distributions

On termination of service, Plan distributions may be in the form of lump sum or fixed installments. In the case of an employee's termination because of death, the entire account balance is paid to the designated beneficiary under the Plan or, if none is designated, then pursuant to the terms of the Plan. In case of termination because of any reasons other than death, the participant is entitled to the vested balance. The participant may, under certain conditions, take certain in-service withdrawals from the Plan while employed, subject to certain limitations as to purpose and source of the funds.

Forfeited Accounts

At December 31, 2016 and 2015, forfeited non-vested accounts were $6,100 and $58,995, respectively. Forfeited non-vested amounts may be used to reduce future employer contributions. In 2016 and 2015, employer contributions were reduced by $61,993 and $6,455 respectively, from forfeited non-vested accounts.

|

|

|

|

|

|

2

|

Summary of Accounting Policies

|

Basis of Accounting

The financial statements of the Plan are prepared on the accrual basis of accounting in conformity with accounting principles generally accepted in the United States of America ("GAAP").

Use of Estimates

The preparation of financial statements in conformity with GAAP requires the Committee to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Valuation of Investments

Plan investments are included in the Master Trust, which provides unified investment management. Fidelity invests plan assets in various trust investment options at the direction of plan participants and as required by the Plan. Separate participant accounts are maintained by investment option. These accounts record contributions, withdrawals, transfers, earnings and changes in market value.

Investments in the Master Trust are reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Benefits Investment Committee determines the Plan's valuation policies utilizing information provided by investment advisors and custodians. See Notes 3 and 4 for discussion of fair value measurements.

Realized gains or losses on security transactions are recorded on the trade date. Realized gains or losses are the difference between the proceeds received and the security’s unit cost. Dividend income is recorded on the record date and interest income is recorded when earned.

Certain investment management fees and expenses charged to the Plan for the investment in the Master Trust are deducted from income earned on a daily basis and are not separately reflected. Consequently, certain investment management fees and operating expenses are reflected as a reduction of investment returns for such investments in the form of an expense ratio.

The Statements of Changes in Net Assets Available for Benefits include unrealized appreciation or depreciation in accordance with the policy of stating investments at fair value. Net appreciation or depreciation of investments reflects both realized gains and losses and the change in unrealized appreciation and depreciation of investments.

Valuation of Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Related fees are recorded as administrative expenses and are expensed when incurred. No allowance for credit losses has been recorded as of December 31, 2016 and 2015. Delinquent participant loans are reclassified as distributions based upon the terms of the Plan document.

Trane 401K and Thrift

Notes to Financial Statements

December 31, 2016 and 2015

Expenses of the Plan

Certain expenses associated with the administration of the Plan and the Master Trust are paid for by the Company and are excluded from these financial statements. General administrative fees are deducted quarterly from Plan accounts and included in these financial statements. Expenses of the funds related to the investment and reinvestment of assets are included in the cost of the related investments. Participant directed transaction expenses such as loan fees, withdrawal fees and fees related to investments in the brokerage accounts are paid by the participant and are included in these financial statements.

Participant Withdrawals and Distributions

Distributions are recorded in the Plan's financial statements when paid. There are no approved and unpaid amounts as of December 31, 2016 and 2015.

Transfer of Assets from Other Plans

Employees may transfer their savings from other plans qualified under the IRC.

New Accounting Pronouncements

In May 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2015-07

, Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent)

, which exempts investments measured using the net asset value (“NAV”) (or its equivalent) as a practical expedient in Accounting Standards Codification 820,

Fair Value Measurement

, from categorization within the fair value hierarchy. Instead, such investments will be provided as a reconciling item so that the total fair value amount of investments in the disclosure is consistent with the fair value investment balance on the statement of net assets available for benefits. This guidance requires retrospective application and is effective for annual reporting periods beginning on or after December 15, 2015. As such, the Plan has removed all investments from the fair value hierarchy for which fair value is measured using the NAV per share practical expedient. The adoption has been reflected in Note 4.

In July 2015, the FASB issued ASU 2015-12,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), and Health and Welfare Benefit Plans (Topic 965): Part (I) Fully Benefit-Responsive Investment Contracts, Part (II) Plan Investment Disclosures, Part (III) Measurement Date Practical Expedient.

This three-part standard simplifies employee benefit plan reporting with respect to fully benefit-responsive investment contracts and plan investment disclosures, and provides for a measurement-date practical expedient. Part I eliminated the requirement to measure and disclose the fair value of fully benefit-responsive contracts. Contract value is the only required measure for fully benefit-responsive investment contracts. Part II eliminates the requirement to disclose individual investments which comprise 5% or more of the total net assets available for benefits, as well as the net appreciation or depreciation of fair values by type. Part II also requires plans to continue to disaggregate investments that are measured using fair value by general type; however, plans are no longer required to disaggregate investments by nature, characteristics and risks. Furthermore, the disclosure of information about fair value measurements shall be provided by general type of plan asset. Part III allows plans to measure investments using values from the end of the calendar month closest to the plan's fiscal year end. Part I and Part II are effective for fiscal years beginning after December 15, 2015, and should be applied retrospectively, with early application permitted. Part III is effective for fiscal years beginning after December 15, 2015, and should be applied prospectively, with early application permitted. The adoption of Parts I and III had no effect on the financial statement presentation. The adoption of Part II eliminated the requirement to disaggregate investments by nature, characteristics and risks. The adoption has been reflected in Note 4.

In February 2017, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2017-06

, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting.

This guidance requires the disclosure of the Plan's dollar amount of their interest in each general type of investment held by the master trust. In addition, the guidance requires disclosure of the master trust's other asset and liability balances and the Plan's interest in each of those other assets and liability balances. This guidance requires retrospective application and is effective for annual reporting periods beginning on or after December 15, 2018. Early adoption is permitted. The Company does not expect the adoption of this accounting guidance to have a significant impact on the Plan’s financial statements.

|

|

|

|

|

|

3

|

Fair Value Measurements

|

Fair value is defined as the exchange price that would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Fair value measurements are based on a framework that utilizes the inputs market participants use to determine

Trane 401K and Thrift

Notes to Financial Statements

December 31, 2016 and 2015

the fair value of an asset or liability and establishes a fair value hierarchy to prioritize those inputs. The fair value hierarchy is comprised of three levels that are described below:

|

|

|

|

Level 1

|

Inputs to the valuation methodology are based on quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

|

|

|

|

|

Level 2

|

Observable inputs other than Level 1. Inputs to the valuation methodology include:

|

•

Quoted prices for similar assets or liabilities in active markets;

•

Quoted prices for identical or similar assets or liabilities in markets that are not active;

|

|

|

|

•

|

Other inputs that are observable or can be corroborated by observable market data for substantially the full term of the asset or liability

|

|

|

|

|

Level 3

|

Inputs to the valuation methodology are unobservable inputs based on little or no market activity and that are significant to the fair value of the assets and liabilities.

|

The fair value hierarchy requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. Observable inputs are obtained from independent sources and can be validated by a third party, whereas unobservable inputs reflect assumptions regarding what a third party would use in pricing an asset or liability based on the best information available under the circumstances. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

Not all assets held in the Master Trust are available for investment by participants of the Plan. Other than the adoption of ASU 2015-07, there have been no changes in the methodologies used as of December 31, 2016 and 2015. There have been no significant transfers between Level 1 and Level 2 categories. Following is a description of the valuation methodologies used for the Master Trust assets measured at fair value.

Ingersoll-Rand Stock Fund

: The Ingersoll-Rand Stock Fund represents investment in IR-plc ordinary shares, along with a minor amount of short-term investments, to provide liquidity. There are no unfunded commitments, redemption frequency restrictions, or other redemption restrictions. The shares of the fund are valued at the daily net asset value (“NAV”) of shares held by the Master Trust at year end. NAV per share or the equivalent is used for fair value purposes as a practical expedient. NAVs are calculated by the investment manager or sponsor of the fund. The fund primarily invests in ordinary shares of IR-plc, which is traded on the NYSE and is valued at its quoted market price at the daily close of the NYSE. A small portion of the fund is invested in short-term money market instruments.

Schlumberger (formerly Cameron) Stock Fund

: The Schlumberger Stock Fund represents investment in shares of Schlumberger Limited. On April 1, 2016, Schlumberger Limited purchased all outstanding shares of Cameron International Corporation. There are no unfunded commitments, redemption frequency restrictions, or other redemption restrictions. The Schlumberger Stock Fund is a closed investment option, available only to participants in the Ingersoll-Rand Individual Account Retirement Plan for Bargaining Unit Employees at the Buffalo, New York Plant. The fund invests in shares of Schlumberger Limited, which is traded on the NYSE and is valued at its quoted market price at the daily close of the NYSE. The Schlumberger Stock Fund was eliminated effective August 24, 2016 with all remaining participant balances in the fund liquidated and reinvested in the Plan's target date retirement fund corresponding to the participant's date of birth. Such assets are classified as Level 1.

Allegion Stock Fund

: The shares of the fund were valued at the daily NAV of shares held by the Master Trust at year end. NAV per share or the equivalent was used for fair value purposes as a practical expedient. NAVs were calculated by the investment manager or sponsor of the fund. The fund primarily invested in ordinary shares of Allegion, which is traded on the NYSE and was valued at its quoted market price at the daily close of the NYSE. A small portion of the fund is invested in short-term money market instruments. The Allegion Stock Fund was eliminated effective November 30, 2015 with all remaining participant balances in the fund liquidated and reinvested in the Plan's target date retirement fund corresponding to the participant's date of birth

Mutual funds:

The shares of registered investment companies are valued at quoted market prices in an exchange or active market, which represent the daily NAV of shares held by the Master Trust at year end. Investments in registered investment companies generally may be redeemed daily and are classified as Level 1.

Common collective trusts - index funds:

These assets represent investment in common collective trusts that hold equity or fixed income securities. These funds have no unfunded commitments, redemption frequency restrictions, or other redemption restrictions. These assets are not available in an exchange or active market; however, the fair value is determined based on the daily NAV of the underlying assets as traded in an exchange or active market. NAV per share or the equivalent is used for fair value purposes as a practical expedient. NAVs are calculated by the investment manager or sponsor of the fund.

Trane 401K and Thrift

Notes to Financial Statements

December 31, 2016 and 2015

Common collective trusts - target date retirement funds:

These assets represent investment in an asset mix that seeks to generate a level of risk and return appropriate for the fund’s particular time frame. The asset mix is determined by factors such as the investor’s age, projected level of risk aversion and the length of time until the principal will be withdrawn. These funds have no unfunded commitments, redemption frequency restrictions, or other redemption restrictions. These assets are not available in an exchange or active market; however, the fair value is determined based on the daily NAV of the underlying assets as traded in an exchange or active market. NAV per share or the equivalent is used for fair value purposes as a practical expedient. NAVs are calculated by the investment manager or sponsor of the fund.

Separate accounts - fixed income bond funds:

Investments are privately managed investments created for a single group of plans in a single master trust maintained by the employer. The fund seeks to maximize price appreciation and current income with volatility similar to its index, the Barclay U.S. Aggregate Bond Index. There are no unfunded commitments, redemption frequency restrictions, or other redemption restrictions. The fair value is determined based on the daily NAV of the underlying assets as traded in an exchange or active market. NAV per share or the equivalent is used for fair value purposes as a practical expedient. NAVs are calculated by the investment manager or sponsor of the fund.

Separate accounts - stable value funds:

Investments are privately managed investments created for a single group of plans in a single master trust maintained by the employer. As the account primarily consists of investment contracts issued by financial institutions and other eligible stable value investments, the assets are valued at fair value by discounting the related cash flows based on current yields of similar instruments with comparable durations considering the credit-worthiness of the issuer. There are no unfunded commitments or redemption frequency restrictions. Transfers to other investment funds could be limited under certain conditions. Such assets are classified as Level 2.

Self-directed brokerage accounts:

Investments in the self-directed brokerage accounts are at current value based on published market quotations from individual investments composing the brokerage accounts. Such assets are classified as Level 1.

The preceding methods may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

|

|

|

|

|

|

4

|

Investment in the Master Trust

|

The Plan’s investments are held in the Master Trust which was established for the investment of assets of the Plan and several other retirement plans sponsored by the Company. The assets of the Master Trust are held by Fidelity, the trustee for the Plan. Each participating retirement plan has an identifiable interest in the Master Trust; however, investment options for participants may vary by plan. Fidelity maintains separate accounting of all contributions, benefit payments and expenses and allocates income earned and received by the Master Trust on the basis of the adjusted value of each plan at each measurement date. As of December 31, 2016 and 2015, the Plan had a 3.45% and 3.47%, respectively, participation in the Master Trust.

Trane 401K and Thrift

Notes to Financial Statements

December 31, 2016 and 2015

Summarized Master Trust information follows at December 31:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Investments, at fair value

|

|

|

|

|

|

Mutual funds

|

|

$

|

375,178,274

|

|

|

$

|

322,644,868

|

|

|

Self-directed brokerage accounts

|

|

302,715,812

|

|

|

279,854,045

|

|

|

Common collective trusts

|

|

2,363,704,938

|

|

|

2,243,013,900

|

|

|

Separate accounts

|

|

344,515,553

|

|

|

329,374,802

|

|

|

Ingersoll-Rand Stock Fund

|

|

862,147,714

|

|

|

702,688,416

|

|

|

Schlumberger (formerly Cameron) Stock Fund

|

|

—

|

|

|

1,804,966

|

|

|

Investments, at fair value

|

|

$

|

4,248,262,291

|

|

|

$

|

3,879,380,997

|

|

The following summarizes the net realized and unrealized (depreciation) appreciation of investments and interest and dividend income for the Master Trust for the years ended December 31:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Investment income (loss):

|

|

|

|

|

|

Net appreciation (depreciation) in fair value of investments

|

|

|

|

|

|

Mutual funds

|

|

$

|

31,034,661

|

|

|

$

|

(35,214,995

|

)

|

|

Self-directed brokerage accounts

|

|

15,702,537

|

|

|

(8,000,533

|

)

|

|

Common collective trusts

|

|

127,968,265

|

|

|

38,013,463

|

|

|

Separate accounts

|

|

7,548,141

|

|

|

1,826,009

|

|

|

Ingersoll-Rand Stock Fund

|

|

216,157,182

|

|

|

(97,693,639

|

)

|

|

Schlumberger (formerly Cameron) Stock Fund

|

|

75,061

|

|

|

797,208

|

|

|

Allegion Stock Fund

|

|

150,005

|

|

|

37,810,715

|

|

|

|

|

398,635,852

|

|

|

(62,461,772

|

)

|

|

Interest and dividend income

|

|

28,451,874

|

|

|

30,577,444

|

|

|

Total investment income (loss)

|

|

$

|

427,087,726

|

|

|

$

|

(31,884,328

|

)

|

Trane 401K and Thrift

Notes to Financial Statements

December 31, 2016 and 2015

The following summarizes the classification of the Master Trust investments by classification and method of valuation as of December 31, 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Master Trust

|

|

|

|

|

|

|

|

|

|

Investments at fair value:

|

|

|

|

|

|

|

|

|

|

Separate accounts:

|

|

|

|

|

|

|

|

|

|

Stable value funds

|

|

$

|

—

|

|

|

$

|

179,564,496

|

|

|

$

|

—

|

|

|

$

|

179,564,496

|

|

|

Mutual funds

|

|

375,178,274

|

|

|

—

|

|

|

—

|

|

|

375,178,274

|

|

|

Self-directed brokerage accounts

|

|

302,715,812

|

|

|

—

|

|

|

—

|

|

|

302,715,812

|

|

|

Total investments in the fair value hierarchy

|

|

677,894,086

|

|

|

179,564,496

|

|

|

—

|

|

|

857,458,582

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments measured at net asset value:

(a)

|

|

|

|

|

|

|

|

|

|

Common collective trusts:

|

|

|

|

|

|

|

|

|

|

Index funds

|

|

|

|

|

|

|

|

|

949,865,814

|

|

|

Target date retirement funds

|

|

|

|

|

|

|

|

1,413,839,124

|

|

|

Separate accounts:

|

|

|

|

|

|

|

|

|

|

Fixed income bond funds

|

|

|

|

|

|

|

|

164,951,057

|

|

|

Ingersoll-Rand Stock Fund

|

|

|

|

|

|

|

|

862,147,714

|

|

|

Total investments measured at net asset value

|

|

|

|

|

|

|

|

3,390,803,709

|

|

|

Investments, at fair value

|

|

|

|

|

|

|

|

|

|

|

$

|

4,248,262,291

|

|

(a) In accordance with ASU 2015-07, certain investments that are measured at fair value using the NAV per share (or its equivalent) as a practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented on the summarized Master Trust Investments, at fair value earlier in this Note.

Trane 401K and Thrift

Notes to Financial Statements

December 31, 2016 and 2015

The following summarizes the classification of the Master Trust investments by classification and method of valuation as of December 31, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Master Trust

|

|

|

|

|

|

|

|

|

|

Investments at fair value:

|

|

|

|

|

|

|

|

|

|

Separate accounts:

|

|

|

|

|

|

|

|

|

|

Stable value funds

|

|

$

|

—

|

|

|

$

|

152,471,304

|

|

|

$

|

—

|

|

|

$

|

152,471,304

|

|

|

Mutual funds

|

|

322,644,868

|

|

|

—

|

|

|

—

|

|

|

322,644,868

|

|

|

Self-directed brokerage accounts

|

|

279,854,045

|

|

|

—

|

|

|

—

|

|

|

279,854,045

|

|

|

Cameron Stock Fund

|

|

1,804,966

|

|

|

—

|

|

|

—

|

|

|

1,804,966

|

|

|

Total investments in the fair value hierarchy

|

|

604,303,879

|

|

|

152,471,304

|

|

|

—

|

|

|

756,775,183

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments measured at net asset value:

(a)

|

|

|

|

|

|

|

|

|

|

Common collective trusts:

|

|

|

|

|

|

|

|

|

|

Index funds

|

|

|

|

|

|

|

|

982,677,618

|

|

|

Target date retirement funds

|

|

|

|

|

|

|

|

1,260,336,282

|

|

|

Separate accounts:

|

|

|

|

|

|

|

|

|

|

Fixed income bond funds

|

|

|

|

|

|

|

|

176,903,498

|

|

|

Ingersoll-Rand Stock Fund

|

|

|

|

|

|

|

|

702,688,416

|

|

|

Total investments measured at net asset value

|

|

|

|

|

|

|

|

3,122,605,814

|

|

|

Investments, at fair value

|

|

|

|

|

|

|

|

$

|

3,879,380,997

|

|

(a) In accordance with ASU 2015-07, certain investments that are measured at fair value using the NAV per share (or its equivalent) as a practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented on the summarized Master Trust Investments, at fair value earlier in this Note.

The U.S. Internal Revenue Service ("IRS") has determined and informed the Company by a letter dated March 27, 2012, that the Plan and related trust are designed in accordance with applicable sections of the IRC to be exempt from U.S. federal income tax. The Plan has been amended and restated effective January 1, 2015 since receiving the favorable determination letter and the Company submitted a request for a favorable letter of determination for the amended and restated Plan in January 2016. Plan management, the Committee and the Plan's counsel believe that the Plan is being operated in material compliance with the applicable requirements of the IRC and therefore no provision for U.S. federal income tax is required.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The plan administrator has analyzed the tax positions taken by the Plan and has concluded that as of December 31, 2016 and 2015, there are no uncertain positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The plan administrator believes it is no longer subject to income tax examinations for years prior to 2013.

|

|

|

|

|

|

6

|

Party-In-Interest Transactions

|

Certain plan investments held in the Master Trust are managed by Fidelity Management Trust Company, the Plan’s trustee and recordkeeper. These transactions qualify as permitted party-in-interest transactions.

Certain Master Trust investments are units of the Ingersoll-Rand Stock Fund which primarily invests in ordinary shares of IR-plc. These transactions qualify as permitted party-in-interest transactions.

Although it has not expressed any intent to do so, the Company has the right under the Plan to modify or discontinue its contributions at any time and to terminate the Plan subject to the provisions of the Plan, ERISA and applicable collective bargaining agreements. In the event of Plan termination, all affected participants would become 100% vested in any unvested Company contributions in accordance with applicable law.

|

|

|

|

|

|

8

|

Risks and Uncertainties

|

Through the Master Trust, the Plan provides for investment options in any combination of equity and fixed income investments in the U.S. and abroad through various investment options. Investment asset classes are exposed to various risks, such as market, interest rate, inflation, foreign currency, economic, political and credit risks. Due to the level of risk associated with the Plan’s investments, it is reasonably possible that changes in risks in the near term would materially affect participants' account balances and the amounts reported in the Statements of Net Assets Available for Benefits and the Statements of Changes in Net Assets Available for Benefits.

Trane 401K and Thrift

Schedule H, line 4i – Schedule of Assets (Held at End of Year)

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

Plan Sponsor:

|

|

Trane U.S. Inc.

|

|

Employer Identification:

|

|

25-0900465

|

|

Plan Number:

|

|

043

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Identity of issue, borrower

lessor, or similar party

|

|

Description of investment,

including maturity date,

rate of interest, collateral

par, or maturity value

|

|

Cost

|

|

Current

Value

|

|

(a)

|

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

*

|

|

Plan's interest in Ingersoll-Rand Master Trust, excluding participant loans

|

|

Master Trust

3.45% participation

|

|

**

|

|

$

|

146,384,085

|

|

|

***

|

|

Notes receivable from participants

|

|

Due 01/01/2017 - 06/22/2044

3.25% - 9.50%

|

|

—

|

|

4,652,755

|

|

|

|

|

TOTAL ASSETS (Held at End of Year)

|

|

|

|

|

|

$

|

151,036,840

|

|

|

|

|

|

|

|

*

|

Includes assets which represent permitted party-in-interest transactions to the Plan.

|

|

|

|

|

|

|

**

|

Cost information is not required for participant directed investments; therefore, this information is omitted.

|

|

|

|

|

|

|

***

|

The accompanying financial statements classify participant loans as notes receivable from participants.

|

Schedule II

Trane 401K and Thrift

Schedule H, Part IV, Line 4a – Schedule of Delinquent Participant Contributions

For the year ended December 31, 2016

Plan Sponsor: Trane U.S. Inc,

Employer Identification: 25-0900465

Plan Number: 043

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total That Constitutes Nonexempt Prohibited

Transactions

|

|

|

|

Participant

contributions

transferred late

to the Plan

|

|

Check

Here if Late

Participant

Loan

Repayments

are Included

|

|

Contributions

Not Corrected

|

|

Contributions

Corrected

Outside

Voluntary

Fiduciary

Correction

Program

|

|

Contributions

Pending

Correction in

Voluntary

Fiduciary

Correction

Program

|

|

Total Fully

Corrected

Under

Voluntary

Fiduciary

Correction

Program and

PTE 2002-51

|

|

$

|

80

|

|

|

|

|

$

|

—

|

|

|

$

|

80

|

|

|

$

|

—

|

|

|

—

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

TRANE 401K AND THRIFT PLAN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: June 23, 2017

|

|

By:

|

|

/s/ Paul Longstreet

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: Paul Longstreet

|

|

|

|

Title: Benefits Administration Committee

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

23.1

|

|

Consent of Cherry Bekaert LLP

|

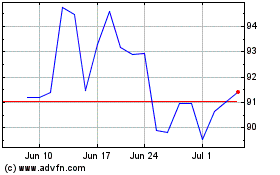

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

From Apr 2023 to Apr 2024