SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of

the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

x

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Pursuant

to § 240.14a-12

|

|

Aytu BioScience, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement if other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

|

|

|

|

AYTU BIOSCIENCE, INC.

373 Inverness Parkway, Suite 206

Englewood, Colorado 80112

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD JULY 26, 2017

TO THE STOCKHOLDERS OF

AYTU BIOSCIENCE, INC.

The 2017 special meeting of stockholders of

Aytu BioScience, Inc. will be held at Public Chicago, 1301 North State Parkway, Chicago, Illinois 60610-2117, on Wednesday, July

26, 2017, at 9:00 a.m. Central time, for the following purposes:

|

|

1.

|

To approve an amendment to our Certificate of Incorporation to effect a reverse stock split at a ratio of any whole

number up to 1-for-20, as determined by our board of directors, at any time before November 14, 2018 (or such other date that

is one year after the date of our fiscal 2018 annual meeting of shareholders), if and as determined by our board of directors;

|

|

|

2.

|

To approve an amendment to our 2015 Stock Option and Incentive Plan to (i) increase

the

number of authorized shares of common stock reserved for issuance thereunder from 2,000,000 to 3,000,000, (ii) increase the number

of shares that may be issued as incentive stock options,

and (iii) increase the maximum number of shares of common stock

(A) underlying stock options or stock appreciation rights that may be granted to any one individual during any calendar year period,

and (B) granted to any one individual that is intended to qualify as “performance-based compensation” under Section 162(m)

of the Internal Revenue Code of 1986, as amended, for any performance cycle, as more specifically described in the proxy statement

accompanying this notice; and

|

|

|

3.

|

To act upon such other matters as may properly come before the meeting or any adjournment thereof.

|

These matters are more fully described in the

proxy statement accompanying this notice.

The Board has fixed the close of business on

May 30, 2017 as the record date for the determination of stockholders entitled to notice of and to vote at the meeting or any adjournment

thereof. A list of stockholders eligible to vote at the meeting will be available for review during our regular business hours

at our principal offices in Englewood, Colorado for the 10 days prior to the meeting for review for any purposes related to the

meeting.

You are cordially invited to attend the meeting

in person. However, to assure your representation at the meeting, you are urged to vote by proxy by following the instructions

contained in the proxy statement. You may revoke your proxy in the manner described in the proxy statement at any time before it

has been voted at the meeting. Any stockholder attending the meeting may vote in person even if he or she has returned a proxy.

Your vote is important

.

Whether or not you plan to attend the special meeting, we hope that you will vote as soon as possible.

We are pleased to take advantage of the Securities

and Exchange Commission, or SEC, rules that allow us to furnish proxy materials, including this notice and the proxy statement

(including an electronic proxy card for the meeting) via the Internet. Taking advantage of these rules allows us to lower the cost

of delivering special meeting materials to our stockholders and reduce the environmental impact of printing and mailing these materials.

Englewood, Colorado

Dated: June 16, 2017

By Order of the Board of Directors

Joshua R. Disbrow

Chairman and Chief Executive Officer

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 26, 2017:

This proxy statement is available at:

www.aytubio.com

.

QUESTIONS AND ANSWERS ABOUT THE 2017 SPECIAL

MEETING

|

|

Q:

|

Who may vote at the meeting?

|

|

|

A:

|

The Board of Directors has set May 30, 2017 as the

record date for the meeting. If you owned shares of our common stock at the close of business on May 30, 2017, you may attend

and vote at the meeting. Each stockholder is entitled to one vote for each share of common stock held on all matters to be voted

on. As of May 30, 2017, there were 16,426,607 shares of our common stock outstanding and entitled to vote at the meeting.

|

|

|

Q:

|

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

|

|

|

A:

|

If your shares are registered directly in your name with our transfer agent, VStock Transfer, LLC, you are considered, with

respect to those shares, a “stockholder of record.” If you are a stockholder of record, we have sent these proxy materials

to you directly.

|

|

|

|

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial

owner” of shares held in street name. In that case, these proxy materials have been forwarded to you by your broker, bank,

or other holder of record who is considered, with respect to those shares, the stockholder of record. As the beneficial owner,

you have the right to direct your broker, bank, or other holder of record on how to vote your shares by using the voting instruction

card included in the mailing.

|

|

|

Q:

|

What is the quorum requirement for the meeting?

|

|

|

A:

|

A majority of our outstanding shares of capital stock entitled to vote as of the record date must be present at the meeting

in order for us to hold the meeting and conduct business. This is called a quorum. Your shares will be counted as present at the

meeting if you:

|

|

|

·

|

are present and entitled to vote in person at the meeting; or

|

|

|

·

|

properly submitted a proxy card or voter instruction card in advance of or at the meeting.

|

If you are present in person or by proxy at the meeting,

but abstain from voting on any or all proposals, your shares are still counted as present and entitled to vote. Each proposal listed

in this proxy statement identifies the votes needed to approve or ratify the proposed action.

|

|

Q:

|

What proposals will be voted on at the meeting?

|

|

|

A:

|

The two proposals to be voted on at the meeting are as follows:

|

|

|

1.

|

To approve a reverse stock split at a ratio of any whole number up to 1-for-20, as determined by our board of directors,

at any time before November 14, 2018 (or such other date that is one year after the date of our fiscal 2018 annual meeting

of shareholders), if and as determined by our board of directors; and

|

|

|

2.

|

To approve an amendment to our 2015 Stock Option and Incentive Plan to (i) increase

the

number of authorized shares of common stock reserved for issuance thereunder from 2,000,000 to 3,000,000, (ii) increase the number

of shares that may be issued as incentive stock options,

and (iii) increase the maximum number of shares of common stock

(A) underlying stock options or stock appreciation rights that may be granted to any one individual during any calendar year period,

and (B) granted to any one individual that is intended to qualify as “performance-based compensation” under Section 162(m)

of the Internal Revenue Code of 1986, as amended, for any performance cycle, as more specifically described under Proposal 2 in

this proxy statement

.

|

We will also consider any other business that properly

comes before the meeting. As of the record date, we are not aware of any other matters to be submitted for consideration at the

meeting. If any other matters are properly brought before the meeting, the persons named in the proxy card or voter instruction

card will vote the shares they represent using their best judgment.

|

|

Q:

|

How may I vote my shares in person at the meeting?

|

|

|

A:

|

If your shares are registered directly in your name with our transfer agent, VStock Transfer, LLC, you are considered, with

respect to those shares, the stockholder of record. As the stockholder of record, you have the right to vote in person at the meeting.

You will need to present a form of personal photo identification in order to be admitted to the meeting. If your shares are held

in a brokerage account or by another nominee or trustee, you are considered the beneficial owner of shares held in street name.

As the beneficial owner, you are also invited to attend the meeting. Because a beneficial owner is not the stockholder of record,

you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from your broker, nominee,

or trustee that holds your shares, giving you the right to vote the shares at the meeting.

|

|

|

Q:

|

How can I vote my shares without attending the meeting?

|

|

|

A:

|

Whether you hold shares directly as a registered stockholder of record or beneficially in street name, you may vote without

attending the meeting.

If your common stock is held by a broker, bank

or other nominee, they should send you instructions that you must follow in order to have your shares voted. If you hold shares

in your own name, you may vote by proxy in any one of the following ways:

|

|

|

·

|

Via the Internet by accessing the proxy

materials on the secured website

https://www.proxyvote.com

and following the voting instructions on that website;

|

|

|

·

|

Via telephone by calling toll free 1-800-690-6903 in the United States

and following the recorded instructions; or

|

|

|

·

|

By requesting that printed copies of the proxy materials be mailed

to you pursuant to the instructions provided in the Notice of Internet Availability of Proxy Materials and completing, dating,

signing and returning the proxy card that you receive in response to your request.

|

The Internet and telephone voting procedures are designed

to authenticate stockholders’ identities by use of a control number to allow stockholders to vote their shares and to confirm

that stockholders’ instructions have been properly recorded. Voting via the Internet or telephone must be completed by 11:59

p.m. Eastern Time on July 25, 2017. If stockholders have any questions or need assistance voting their proxy, please call Gregory

A. Gould at our headquarters at 1-720-437-6580. Of course, you can always come to the meeting and vote your shares in person. If

you submit or return a proxy card without giving specific voting instructions, your shares will be voted as recommended by the

Board of Directors.

|

|

Q:

|

How can I change my vote after submitting it?

|

|

|

A:

|

If you are a stockholder of record, you can revoke your proxy before your shares are voted at the meeting by:

|

|

|

·

|

Filing a written notice of revocation bearing a later date than the proxy with our Corporate Secretary either before the meeting

or at the meeting at 373 Inverness Parkway, Suite 206, Englewood, Colorado 80112;

|

|

|

·

|

Duly executing a later-dated proxy relating to the same shares and delivering it to our Corporate Secretary either before or

at the meeting and before the taking of the vote, at 373 Inverness Parkway, Suite 206, Englewood, Colorado 80112; or

|

|

|

·

|

Attending the meeting and voting in person (although attendance at the meeting will not in and of itself constitute a revocation

of a proxy).

|

If you are a beneficial owner of shares, you may submit

new voting instructions by contacting your bank, broker, or other holder of record. You may also vote in person at the meeting

if you obtain a legal proxy from them as described in the answer to a previous question.

|

|

Q:

|

Where can I find the voting results of the meeting?

|

|

|

A:

|

We will announce the voting results at the special meeting. We will publish the results in a Form 8-K filed with the SEC within

four business days of the special meeting.

|

AYTU BIOSCIENCE,

INC.

373 Inverness Parkway, Suite 206

Englewood, Colorado 80112

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

JULY 26, 2017

This proxy statement has been prepared by the

management of Aytu BioScience, Inc. “We,” “our” and the “Company” each refers to Aytu BioScience,

Inc.

In accordance with the rules of the SEC,

instead of mailing a printed copy of our proxy materials to each stockholder of record, we are furnishing proxy materials,

including the notice, this proxy statement and a proxy card for the meeting, by providing access to them on the Internet to

save printing costs and benefit the environment. These materials were first available on the Internet on or about June 16,

2017. We mailed a Notice of Internet Availability of Proxy Materials on or about June 16, 2017 to our stockholders of

record and beneficial owners as of May 30, 2017, the record date for the meeting. This proxy statement and the Notice of

Internet Availability of Proxy Materials contain instructions for accessing and reviewing our proxy materials on the Internet

and for voting by proxy over the Internet. You will need to obtain your own Internet access if you choose to access the proxy

materials and/or vote over the Internet. If you prefer to receive printed copies of our proxy materials, the Notice of

Internet Availability of Proxy Materials contains instructions on how to request the materials by mail. You will not receive

printed copies of the proxy materials unless you request them. If you elect to receive the materials by mail, you may also

vote by proxy on the proxy card or voter instruction card that you will receive in response to your request.

GENERAL INFORMATION ABOUT SOLICITATION VOTING AND ATTENDING

Who Can Vote

You are entitled to attend the meeting and

vote your common stock if you held shares as of the close of business on May 30, 2017. At the close of business on May 30, 2017,

a total of 16,426,607 shares of common stock were outstanding and entitled to vote. Each share of common stock has one vote.

Counting Votes

Consistent with state law and our bylaws, the

presence, in person or by proxy, of at least a majority of the shares entitled to vote at the meeting will constitute a quorum

for purposes of voting on a particular matter at the meeting. Once a share is represented for any purpose at the meeting, it is

deemed present for quorum purposes for the remainder of the meeting and any adjournment thereof unless a new record date is set

for the adjournment. Shares held of record by stockholders or their nominees who do not vote by proxy or attend the meeting in

person will not be considered present or represented and will not be counted in determining the presence of a quorum. Signed proxies

that withhold authority or reflect abstentions and “broker non-votes” will be counted for purposes of determining whether

a quorum is present. “Broker non-votes” are proxies received from brokerage firms or other nominees holding shares

on behalf of their clients who have not been given specific voting instructions from their clients with respect to matters being

voted on. Broker non-votes will be counted for purposes of establishing a quorum to conduct business at the meeting, but not for

determining the number of shares voted FOR, AGAINST, ABSTAINING or WITHHELD FROM with respect to any matters.

Assuming the presence of a quorum at the meeting:

|

|

·

|

The affirmative vote of the holders of a majority of the total outstanding shares of our common stock as of the record date

is necessary to approve the reverse stock split. Withheld votes and broker non-votes, if any, are not treated as votes cast, and

therefore will effectively be a vote against this proposal.

|

|

|

·

|

The amendments to our 2015 Stock Option and Incentive Plan require the affirmative vote of a majority of the votes cast at

the meeting. Withheld votes and broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on this

proposal.

|

We strongly encourage you to provide instructions

to your bank, brokerage firm, or other nominee by voting your proxy. This action ensures that your shares will be voted in accordance

with your wishes at the meeting.

Cost of this Proxy Solicitation

We will pay the cost of this proxy solicitation.

In addition to soliciting proxies by mail, our directors and employees might solicit proxies personally and by telephone. None

of these individuals will receive any additional compensation for this. As of the date of this proxy statement, we have not retained

a proxy solicitor to assist in the forwarding and solicitation of proxies, although we may do so if we determine that it would

be advisable.

Attending the Special Meeting

If you are a holder of record and plan to attend

the special meeting, please bring a photo identification to confirm your identity. If you are a beneficial owner of common stock

held by a bank or broker, i.e., in “street name,” you will need proof of ownership to be admitted to the meeting. A

recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote in person your

common stock held in street name, you must get a proxy in your name from the registered holder.

PROPOSAL NO. 1 —APPROVAL OF AN AMENDMENT

TO OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT AT THE DISCRETION OF OUR BOARD OF DIRECTORS

General

Our Board believes it is in our best interests

and the best interests of our stockholders to authorize a reverse stock split of the Company’s outstanding common stock.

The Board is asking our stockholders to

approve a reverse stock split at a ratio of any whole number up to 1-for-20 (the “Reverse Stock Split”), as

determined by our board of directors, at any time before November 14, 2018 (or such other date that is one year after the

date of our fiscal 2018 annual meeting of shareholders), if and as determined by our board of directors. If the proposal is

approved by our stockholders, our Board will have authority to effect the Reserve Stock Split if and at such time and in such

ratio as it determines to be appropriate. The principal effect of the Reverse Stock Split would be to decrease the

outstanding number of shares of common stock, while maintaining the authorized number of shares at their current levels.

The Board is asking that our stockholders approve

a range of exchange ratios for the Reverse Stock Split because it is not possible at this time to predict market conditions at

the time the split would be implemented. If approved by our stockholders, the Board will be authorized to implement a reverse stock

split at a ratio of any whole number up to 1-for-20, or to abandon the split, as determined at the discretion of the Board. The

Board will set the ratio for the Reverse Stock Split or abandon the Reverse Stock Split as it determines is advisable considering

relevant market conditions at the time the reverse split is to be implemented or abandoned.

To implement the Reverse Stock Split, we would,

at a meeting of the Board or by written consent in lieu of a meeting, resolve to effect the Reverse Stock Split, and the number

of issued and outstanding shares of common stock would thereby be reduced by a ratio of one share for every selected whole number

of shares outstanding (up to 20 shares), depending on the ratio chosen by the Board. If our Board determines that effecting the

reverse stock split is in our best interest, the Reverse Stock Split will become effective upon filing of an amendment to our Certificate

of Incorporation with the Secretary of State of the State of Delaware. The amendment filed thereby will set forth the number of

shares to be combined into one share of our common stock within the limits set forth in this proposal. Except for adjustments that

may result from the treatment of fractional shares as described below, each stockholder will hold the same percentage of our outstanding

common stock immediately following the Reverse Stock Split as such stockholder holds immediately prior to the reverse split.

The text of the form of amendment to the Certificate

of Incorporation, which would be filed with the Secretary of State of the State of Delaware to effect the Reverse Stock Split,

is set forth in

Appendix A

to this proxy statement. The text of the form of amendment accompanying this proxy statement

is, however, subject to amendment to reflect the exact ratio for the Reverse Stock Split and any changes that may be required by

the office of the Secretary of State of the State of Delaware or that the Board of Directors may determine to be necessary or advisable

ultimately to comply with applicable law and to effect the Reverse Stock Split.

Under Delaware law, our stockholders would

not be entitled to dissenters’ rights or rights of appraisal in connection with the implementation of the Reverse Stock Split,

and we will not independently provide our stockholders with any such rights.

Purpose

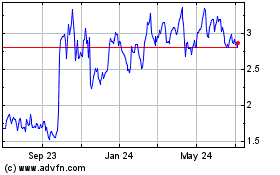

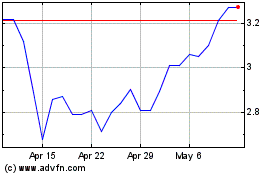

The Board is proposing the Reverse Stock Split

in an effort to decrease the number of shares of our common stock outstanding and increase the market price of our shares.

The Board believes that the Reverse Stock Split

will enhance our ability to obtain an initial listing on a national securities exchange. The NYSE MKT and The NASDAQ Capital Market

each requires, among other items, an initial bid price of least $3.00 per share, in the case of the NYSE MKT, or at least

$4.00 per share, in the case of The NASDAQ Capital Market, and, following initial listing, maintenance of a continued price of

at least $1.00 per share in the case of The NASDAQ Capital Market and an undesignated “low selling price” in the case

of the NYSE MKT. Reducing the number of outstanding shares of our common stock should, absent other factors, increase the per share

market price of our common stock, although we cannot provide any assurance that the minimum bid price would be achieved following

any Reverse Stock Split or that any listing on an exchange would be obtained.

Among the other factors considered by the Board

in reaching its decision to recommend the Reverse Stock Split, the Board considered the potential effects of having a stock that

trades at a low price; our closing stock price on May 23, 2017, was $0.68 per share as quoted on the OTCQX. For example, certain

brokerage firms have internal practices and policies that discourage individual brokers from dealing in stocks trading below a

particular dollar level. Further, since the brokerage commissions on stock with a low trading price generally represent a higher

percentage of the stock price than commissions on higher priced stock, investors in stocks with a low trading price pay transaction

costs (commissions, markups, or markdowns) at a higher percentage of their total share value, which may limit the willingness

of individual investors and institutions to purchase our common stock. The Board also believes that certain institutional investors,

such as mutual funds or pension plans, have policies or procedures that discourage or prohibit acquisitions of shares priced at

less than $5.00 per share, making our shares less attractive. Each of these factors could weaken the market for our common stock.

We previously sought and received stockholder

approval in November 2016 for a reverse stock split to help us meet the stock price listing standard, to be effected at a ratio

of any whole number between 1-for-2 and 1-for-4, and to be effected at any time before November 15, 2017, if and as determined

by our board of directors. We have abandoned this approval, however, because we believe that the ratios approved would not yield

the desired increase on our stock price to meet the uplisting standards. As an alternative, we are seeking the approval of the

Reverse Stock Split to be voted on at the special meeting.

As stated above, reducing the number of outstanding

shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market

price of our common stock. However, other factors, such as financial results and market conditions, may adversely affect the market

price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the

intended benefits described above, that the market price of our common stock will increase proportionately following the Reverse

Stock Split, or that the market price of our common stock will not decrease in the future. Accordingly, the total market capitalization

of our common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

Additionally, if implemented, the Reverse Stock Split may result in some stockholders owning “odd-lots” of less than

100 shares of common stock. Brokerage commissions and other costs of transactions in odd-lots may be higher, particularly on a

per-share basis, than the cost of transactions in even multiples of 100 shares.

The Board will not decrease the authorized

common stock in connection with the Reverse Stock Split, which will result in a significant increase in the availability of authorized

shares of common stock. Any additional common stock so authorized will be available for issuance by the Board for stock splits

or stock dividends, acquisitions, raising additional capital, conversion of our debt into equity, stock options or other corporate

purposes, and any such issuances may be dilutive to current stockholders.

Other than as disclosed in this proxy statement,

we have no other specific plans, arrangements or understandings regarding the issuance of shares of our common stock that may become

available for issuance as a result of implementation of the Reverse Stock Split if this proposal is approved by our stockholders.

Effects of the Reverse Stock Split

To implement the Reverse Stock Split, we would,

at a meeting of the Board or by written consent in lieu of a meeting, resolve to effect the Reverse Stock Split. Upon such resolution

and without further action on the part of our stockholders, the shares of our common stock held by stockholders of record as of

the effective time of the amendment to our Certificate of Incorporation would be converted into the number of shares of common

stock (the “New Common Stock”) calculated based on the reverse split ratio determined and approved by the Board pursuant

to such resolution.

No fractional shares or scrip would be issued

in the Reverse Stock Split. Instead, we will issue one whole share in lieu of any fractional shares left after the Reverse Stock

Split has been effected, even to stockholders who would be entitled to only a fractional share as a result of the Reverse Stock

Split.

All outstanding stock options, warrants and

convertible securities will be adjusted to reduce the number of shares to be issued upon exercise or conversion of such options,

warrants or convertible securities, and increase the exercise or conversion price thereof, proportionately.

Board Discretion to Implement the Reverse Stock Split

If this proposal is approved by the stockholders,

the Reverse Stock Split will be effected, if at all, only upon a determination by the Board that a reverse stock split (at a ratio

determined by the Board as described above) is in the best interests of our Company and our stockholders. The Board’s determination

as to whether the Reverse Stock Split will be effected and, if so, at what ratio, will be based upon certain factors, including

existing and expected marketability and liquidity of our common stock, prevailing market conditions, and the likely effect on the

market price of our common stock. If the Board determines to effect the Reverse Stock Split, the Board will consider various factors

in selecting the ratio, including the overall market conditions at the time, the effect of a particular ratio on the market for

our common stock, and the recent trading history of the common stock.

Exchange of Stock Certificates

If we effect the Reverse Stock Split, each

stock certificate representing common shares will automatically be deemed for all corporate purposes after the Reverse Stock Split

to represent the shares of New Common Stock based on the Reverse Stock Split ratio, plus one additional whole share of New Common

Stock in lieu of any fractional share.

If you hold your shares in “street name”

— that is, through an account at a brokerage firm, bank, dealer, or other similar organization – you will not be required

to take any further action. The number of shares you hold will automatically be adjusted to reflect the Reverse Stock Split.

Likewise, you will not be required to take

any further action if your shares are registered directly in your name with our transfer agent and your shares are held in book-entry

form (i.e. your shares are not represented by a physical stock certificate). The number of shares you hold will automatically be

adjusted to reflect the Reverse Stock Split.

Similarly, shareholders who hold stock certificates

will not be required to take any further action. If you wish to exchange your stock certificate for a new certificate representing

shares of New Common Stock as a result of the Reverse Stock Split, VStock Transfer, LLC, our transfer agent, upon notice to them,

will furnish you with the necessary materials and instructions for exchanging your stock certificates. You should not submit any

stock certificates until required to do so.

Material U.S. Federal Income Tax Consequences

The following is a summary of material U.S.

federal income tax consequences of the Reverse Stock Split to a U.S. stockholder (as defined below), and does not purport to be

a complete discussion of all of the possible U.S. federal income tax consequences of the Reverse Stock Split. The summary assumes

that the pre-Reverse Stock Split shares were, and the post-Reverse Stock Split shares will be, held as “capital assets”

as defined in the Internal Revenue Code of 1986, as amended, or the Code, which generally means property held for investment. It

does not address stockholders subject to special rules, such as non-U.S. stockholders, financial institutions, tax-exempt organizations,

insurance companies, dealers in securities, traders in securities that elect the mark-to-market method of accounting, mutual funds,

S corporations, partnerships or other pass-through entities, U.S. persons with a functional currency other than the U.S. dollar,

stockholders who hold the pre-Reverse Stock Split shares as part of a straddle, hedge, integration, constructive sale or conversion

transaction, stockholders who hold the pre-Reverse Stock Split shares as qualified small business stock within the meaning of Section

1202 of the Code, stockholders who are subject to the alternative minimum tax provisions of the Code, and stockholders who acquired

their pre-Reverse Stock Split shares pursuant to the exercise of employee stock options or otherwise as compensation. This summary

is based upon the provisions of the U.S. federal income tax law as of the date hereof, which are subject to change, possibly with

retroactive effect. It does not address tax considerations under state, local, non-U.S, and non-income tax laws. Furthermore, we

have not obtained a ruling from the Internal Revenue Service or an opinion of legal or tax counsel with respect to the consequences

of the Reverse Stock Split.

As used herein, the term “U.S. stockholder”

means a beneficial owner of common stock that is a United States citizen or resident, United States corporation or other United

States entity taxable as a corporation, an estate the income of which is subject to United States federal income taxation regardless

of its source, or a trust if a court within the United States is able to exercise primary jurisdiction over the administration

of the trust and one or more United States persons have the authority to control all substantial decisions of the trust.

We believe that the Reverse Stock Split

will qualify as a recapitalization under Section 368(a)(1)(E) of the Code, in which case a stockholder generally will not recognize

gain or loss on the Reverse Stock Split (except possibly for stockholders receiving a whole share of common stock in lieu of a

fractional share, as noted below). The aggregate tax basis of the post-Reverse Stock Split shares received will be equal to the

aggregate tax basis of the pre-Reverse Stock Split shares exchanged therefor, and the holding period of the post-Reverse Stock

Split shares received will include the holding period of the pre-Reverse Stock Split shares exchanged.

The treatment of the fractional shares being

rounded up to the next whole share is uncertain and a stockholder who receives a whole share of common stock in lieu of a fractional

share may possibly recognize gain in an amount not to exceed the excess of the fair market value of such whole share over the fair

market value of the fractional shares to which the stockholder was otherwise entitled. Stockholders should consult their own tax

advisors regarding the U.S. federal income tax and other tax consequences of fractional shares being rounded to the next whole

share.

United States Treasury Regulations will require

stockholders to retain permanent records relating to the Reverse Stock Split, including information about the amount, basis, and

fair market value of all transferred property. In addition, for each stockholder that owns, immediately before the Reverse Stock

Split, at least 5% of the outstanding stock of our Company (whether by voting power or value) or that has tax basis of at least

$1,000,000 in our Company’s stock, United States Treasury Regulations Section 1.368-3 will require a statement to be included

in the stockholder’s U.S. federal income tax return for the year of the Reverse Stock Split setting forth (i) the name and

employer identification number of our Company, (ii) the date of the Reverse Stock Split, and (iii) the fair market value and the

adjusted tax basis of the stockholder’s shares of our Company’s common stock immediately before the Reverse Stock Split.

The information for these first two items will be found in the Internal Revenue Service Form 8937 that we will prepare.

TAX MATTERS ARE COMPLICATED, AND THE TAX CONSEQUENCES OF THE REVERSE

STOCK SPLIT DEPEND UPON THE PARTICULAR CIRCUMSTANCES OF EACH STOCKHOLDER. ACCORDINGLY, EACH STOCKHOLDER IS ADVISED TO CONSULT

HIS, HER OR ITS TAX ADVISOR WITH RESPECT TO ALL OF THE POTENTIAL TAX CONSEQUENCES TO HIM, HER OR IT OF THE REVERSE STOCK SPLIT.

Vote Required

Approval of the amendment to our Certificate

of Incorporation to effect the Reverse Stock Split at the discretion of our Board requires the receipt of the affirmative vote

of a majority of the shares of our common stock issued and outstanding as of the record date.

Recommendation

The Board of Directors recommends that

you vote

FOR

approval of the amendment to our Company’s Certificate of Incorporation to effect the Reverse Stock

Split at a ratio of any whole number up to 1-for-20, as determined by our board of directors, at any time before November 14,

2018 (or such other date that is one year after the date of our fiscal 2018 annual meeting of shareholders), if and as

determined by our board of directors.

PROPOSAL NO. 2 – APPROVAL OF THE AMENDMENTS

TO THE 2015 STOCK OPTION AND INCENTIVE PLAN

Our 2015 Stock Option and Incentive Plan, or

the 2015 Plan, is part of our equity incentive program. We believe that the 2015 Plan is critical to our effort to build stockholder

value. Our equity incentive program is broad-based and equity incentive awards are also an important component of our executive

and non-executive employees’ compensation. Our Board believes we must offer a competitive equity compensation program in

order to attract, retain and motivate the talented and qualified employees necessary for our continued growth and success. Our

compensation philosophy reflects broad-based eligibility for equity incentive awards, and we grant awards to substantially all

of our employees. By doing so, we link employee interests with stockholder interests throughout the organization and motivate our

employees to act as owners of the business.

As of March 31, 2017, an aggregate of 2,000,000

shares were authorized for issuance under the 2015 Plan. Through March 31, 2017, options issued under the 2015 Plan and still outstanding

totaled 736,966 shares. As a result, as of March 31, 2017, there were only 1,263,034 shares currently available for issuance under

the 2015 Plan. As we continue to grow our company and continue the commercialization of our approved products, we believe that

it will be critical to attracting and retaining individuals to be able to offer larger equity awards under the 2015 Plan as an

important incentive. Our Board believes that the remaining 1,263,034 shares of common stock available for issuance under the 2015

Plan as of March 31, 2017 under the 2015 Plan is insufficient to accomplish the purposes of the 2015 Plan as described above.

To provide sufficient shares under the 2015

Plan, our Board has approved increasing (i) the number of shares of common stock available under the 2015 Plan, as well as (ii)

increasing the number of shares that may be issued as incentive stock options under the

2015 Plan,

and (iii) increasing the maximum number of shares of common stock (A) underlying stock options or stock appreciation

rights that may be granted to any one individual during any calendar year period

under the

2015 Plan

, and (B) granted to any one individual

under the 2015 Plan

that

is intended to qualify as “performance-based compensation” under Section 162(m) of the Internal Revenue Code

of 1986, as amended, for any performance cycle, and at the time set forth below, which takes into account the proposal to approve

the Reverse Stock Split:

If approved at the special meeting, the amendments

to the 2015 Plan will be effective immediately after the special meeting. In addition, if the Reverse Stock Split is approved,

the same increase in share amounts will be made immediately after the effective time of the Reverse Stock Split.

To effect the

increase in the aggregate number of shares of our common stock that may be issued under the 2015 Plan, as well as the related

increases in the number of shares that may be issued as incentive stock options or granted to any one individual in any calendar

year, as described above, it is proposed that immediately after approval at the special meeting (i) Section 3(a) of the 2015 Plan

be deleted in its entirety and replaced with the following, (ii) a new Section 3(e) be added, and (iii) Section 12(d) of the 2015

Plan be deleted in its entirety and replaced with the following, respectively:

“3(a)

Stock Issuable

. The maximum number

of shares of Stock reserved and available for issuance under the Plan shall be three million (3,000,000) shares, subject to adjustment

as provided in this Section 3. For purposes of this limitation, the shares of Stock underlying any Awards that are forfeited,

canceled, held back upon exercise of an Option or settlement of an Award to cover the exercise price or tax withholding, reacquired

by the Company prior to vesting, satisfied without the issuance of Stock or otherwise terminated (other than by exercise) shall

be added back to the shares of Stock available for issuance under the Plan. In the event the Company repurchases shares of Stock

on the open market, such shares shall not be added to the shares of Stock available for issuance under the Plan. Subject to such

overall limitations, shares of Stock may be issued up to such maximum number pursuant to any type or types of Award; provided,

however, that Stock Options or Stock Appreciation Rights with respect to no more than two million (2,000,000) shares of Stock may

be granted to any one individual grantee during any one calendar year period, and no more than three million (3,000,000) shares

of the Stock may be issued in the form of Incentive Stock Options. The shares available for issuance under the Plan may be authorized

but unissued shares of Stock or shares of Stock reacquired by the Company.”

“3(e) In the event that the Company effects a

reverse stock split prior to November 14, 2018, in accordance with shareholder approval granted on July 26, 2017 (should such

approval be granted), immediately after the effective time of such reverse stock split, (i) the maximum number of shares of

Stock reserved and available for issuance under the Plan shall be automatically increased to three million (3,000,000)

shares, subject to adjustment as provided in this Section 3, (ii) the maximum number of shares of Stock that may be

issued pursuant to any type or types of Award shall be automatically increased to three million (3,000,000) shares, (iii) the

number of shares that may be granted to any one individual grantee during any one calendar year period as Stock Options or

Stock Appreciation Rights shall be automatically increased to two million (2,000,000) shares of Stock, and (iv) the number of

shares of Stock that may be issued in the form of Incentive Stock Options shall be automatically increased to three million

(3,000,000) shares of Stock.”

“12(d)

Maximum

Award Payable

. The maximum Performance-Based Award payable to any one Covered Employee under the Plan for a Performance Cycle

is two million (2,000,000) shares of Stock (subject to adjustment as provided in Section 3(c) hereof) or five million dollars

($5,000,000) in the case of a Performance-Based Award that is a Cash-Based Award.”

If the amendment to the 2015 Plan

is approved at the special meeting, immediately thereafter there will be a total of 3,000,000 shares of common stock

reserved for issuance under the 2015 Plan with a total of 2, 263,034 shares available for issuance in the form of new grants

(assuming the amendment had been effective at March 31, 2017).

Following is a summary of the principal

features of the 2015 Plan, as proposed to be amended. The summary is qualified by the full text of the 2015 Plan, as amended, attached

to this proxy statement as

Appendix B

.

Key Provisions

Following are the key provisions of the 2015

Plan, as proposed to be amended:

|

Provisions of 2015 Plan

|

|

Description

|

|

Eligible Participants

|

|

Employees, directors, consultants, advisors and other independent contractors of our company, its subsidiaries and any

successor entity that adopts the 2015 Plan.

|

|

Share Reserve

|

|

·

Total

of 3,000,000 shares (to be reset at 3,000,000 shares if the Reverse Stock Split is approved and occurs) of our common stock.

·

Shares

of common stock that are issued under the 2015 Plan or that are subject to outstanding awards will be applied to reduce the number

of shares reserved for issuance under the 2015 Plan.

·

Except

as otherwise required by Section 162(m) of the Internal Revenue Code, or the Code, in the event that a stock option granted under

the 2015 Plan expires or is terminated or cancelled unexercised or unvested as to any shares of common stock, or in the event that

shares of common stock are issued as restricted stock or as part of another award under the 2015 Plan and thereafter forfeited

or reacquired by us, such shares will return to the share reserve and will again be issuable under the 2015 Plan.

|

|

Award Types

|

|

·

Incentive

stock options

·

Non-qualified

stock options

·

Restricted

stock

·

Restricted

stock units

·

Unrestricted

stock

|

|

Provisions of 2015 Plan

|

|

Description

|

|

|

|

·

Performance

shares

·

Stock

appreciation rights

·

Dividend

equivalent rights

·

Cash-based

awards

|

|

Vesting

|

|

Determined by the Compensation Committee of the Board of Directors

|

|

Award Limits

|

|

Stock options and stock appreciation rights covering no more than 2,000,000 shares (to be reset at 2,000,000 shares if the Reverse Stock Split is approved and occurs) may be issued to a single participant pursuant to awards under the 2015 Plan in a calendar year. Awards granted to any one individual that is intended to qualify as “performance-based compensation” under Section 162(m) of the Code for any performance cycle may be no more than 2,000,000 shares (to be rest at 2,000,000 shares if the Reverse Stock Split is approved and occurs).

|

|

2015 Plan Termination Date

|

|

April 16, 2025

|

Summary of the 2015 Plan

The following description of certain features

of the 2015 Plan is intended to be a summary only. The summary is qualified in its entirety by the full text of the 2015 Plan that

is attached hereto as

Appendix B

.

Plan Administration

. The 2015 Plan is

administered by the Board or a committee designated by the Board (the “

Committee

” and, either the Board

or the Committee, as applicable, the “

Administrator

”). The Administrator has full power to select, from

among the individuals eligible for awards, the individuals to whom awards will be granted, to make any combination of awards to

participants, and to determine the specific terms and conditions of each award, subject to the provisions of the 2015 Plan. The

Administrator may delegate to our Chief Executive Officer the authority to grant stock options and other awards to employees who

are not subject to the reporting and other provisions of Section 16 of the Exchange Act and not subject to Section 162(m)

of the Code, subject to certain limitations and guidelines.

Eligibility

. Persons eligible to participate

in the 2015 Plan are those full or part-time officers, employees, non-employee directors, directors and other key persons of the

Company (including current and prior consultants, former employees and employees and directors of the former parent company) as

selected from time to time by the Administrator in its discretion. As of the date of this proxy statement, approximately 25 individuals

are currently eligible to participate in the 2015 Plan, which includes three officers, 18 employees who are not officers,

and four non-employee directors.

Plan Limits

. The maximum award of

stock options or stock appreciation rights granted to any one individual will not exceed 3,000,000 shares of common stock

(subject to adjustment for stock splits and similar events, but further subject to automatic increase to 3,000,000 shares

immediately after the Reverse Stock Split if the Reverse Stock Split is effected) for any calendar year period. If any award

of restricted stock, restricted stock units or performance shares granted to an individual is intended to qualify as

“performance-based compensation” under Section 162(m) of the Code, then the maximum award shall not exceed

2,000,000 shares of common stock (subject to adjustment for stock splits and similar events, but further subject to automatic

increase to 2,000,000 shares immediately after the Reverse Stock Split is effected) to any one such individual in any

performance cycle. If any cash-based award is intended to qualify as “performance-based compensation” under

Section 162(m) of the Code, then the maximum award to be paid in cash in any performance cycle may not exceed $5,000,000. In

addition, no more than 3,000,000 shares will be issued in the form of incentive stock options.

Effect of Awards

. For purposes of determining

the number of shares of common stock available for issuance under the 2015 Plan, the grant of any award will be counted as one

share for each share of common stock actually subject to the award.

Stock Options

. The 2015 Plan permits

the granting of (1) options to purchase common stock intended to qualify as incentive stock options under Section 422 of the Code

and (2) options that do not so qualify. Options granted under the 2015 Plan will be non-qualified stock options if they fail to

qualify as incentive stock options or exceed the annual limit on incentive stock options. Incentive stock options may only be granted

to employees of the Company and its subsidiaries. Non-qualified stock options may be granted to any persons eligible to receive

incentive stock options and to non-employee directors and key persons. The option exercise price of each option will be determined

by the Administrator but may not be less than 100 percent of the fair market value of the common stock on the date of grant.

The term of each option will be fixed by the

Administrator and may not exceed ten years from the date of grant. The Compensation Committee will determine at what time or times

each option may be exercised. Options may be made exercisable in installments and the exercisability of options may be accelerated

by the Administrator. In general, unless otherwise permitted by the Administrator, no option granted under the 2015 Plan is transferable

by the optionee other than by will or by the laws of descent and distribution, and options may be exercised during the optionee’s

lifetime only by the optionee, or by the optionee’s legal representative or guardian in the case of the optionee’s incapacity.

Upon exercise of options, the option exercise

price must be paid in full either in cash, by certified or bank check or other instrument acceptable to the Administrator or by

delivery (or attestation to the ownership) of shares of common stock that are beneficially owned by the optionee for at least six

months or were purchased in the open market. Subject to applicable law, the exercise price may also be delivered to the Company

by a broker pursuant to irrevocable instructions to the broker from the optionee. In addition, the Administrator may permit non-qualified

stock options to be exercised using a net exercise feature which reduces the number of shares issued to the optionee by the number

of shares with a fair market value equal to the exercise price.

To qualify as incentive stock options, options

must meet additional federal tax requirements, including a $100,000 limit on the value of shares subject to incentive stock options

that first become exercisable by a participant in any one calendar year.

Stock Appreciation Rights

. The Administrator

may award stock appreciation rights subject to such conditions and restrictions as the Administrator may determine. Stock appreciation

rights entitle the recipient to shares of common stock equal to the value of the appreciation in the stock price over the exercise

price. The exercise price is the fair market value of the common stock on the date of grant. The maximum term of a stock appreciation

right is ten years.

Restricted Stock

. The Administrator

may award shares of common stock to participants subject to such conditions and restrictions as the Administrator may determine.

These conditions and restrictions may include the achievement of certain performance goals (as summarized above) and/or continued

employment with us through a specified restricted period.

Restricted Stock Units

. The Administrator

may award restricted stock units to any participants. Restricted stock units are ultimately payable in the form of shares of common

stock and may be subject to such conditions and restrictions as the Administrator may determine. These conditions and restrictions

may include the achievement of certain performance goals (as summarized above) and/or continued employment with the Company through

a specified vesting period. In the Administrator’s sole discretion, it may permit a participant to make an advance election

to receive a portion of his or her future cash compensation otherwise due in the form of a deferred stock unit award, subject to

the participant’s compliance with the procedures established by the Administrator and requirements of Section 409A of the

Code. During the deferral period, the deferred stock awards may be credited with dividend equivalent rights.

Unrestricted Stock Awards

. The Administrator

may also grant shares of common stock, which are free from any restrictions under the 2015 Plan. Unrestricted stock may be granted

to any participant in recognition of past services or other valid consideration and may be issued in lieu of cash compensation

due to such participant.

Performance Share Awards

. The Administrator

may grant performance share awards to any participant which entitle the recipient to receive shares of common stock upon the achievement

of certain performance goals (as summarized above) and such other conditions as the Administrator shall determine. Except in the

case of retirement, death, disability or a change in control, these awards granted to employees will have a vesting period of at

least one year.

Dividend Equivalent Rights

. The Administrator

may grant dividend equivalent rights to participants which entitle the recipient to receive credits for dividends that would be

paid if the recipient had held specified shares of common stock. Dividend equivalent rights granted as a component of another award

subject to performance vesting may be paid only if the related award becomes vested. Dividend equivalent rights may be settled

in cash, shares of common stock or a combination thereof, in a single installment or installments, as specified in the award.

Cash-Based Awards

. The Administrator

may grant cash bonuses under the 2015 Plan to participants. The cash bonuses may be subject to the achievement of certain performance

goals (as summarized above).

Change of Control Provisions

. The 2015

Plan provides that upon the effectiveness of a “sale event” as defined in the 2015 Plan, except as otherwise provided

by the Administrator in the award agreement, all stock options, stock appreciation rights and other awards will be assumed or continued

by the successor entity and adjusted accordingly to take into account the impact of the transaction. To the extent, however, that

the parties to such sale event do not agree that all stock options, stock appreciation rights or any other awards shall be assumed

or continued, then such stock options and stock appreciation rights shall become fully exercisable and the restrictions and conditions

on all such other awards with time-based conditions will automatically be deemed waived. Awards with conditions and restrictions

relating to the attainment of performance goals may become vested and non-forfeitable in connection with a sale event in the Committee’s

discretion. In addition, in the case of a sale event in which the Company’s stockholders will receive cash consideration,

the Company may make or provide for a cash payment to participants holding options and stock appreciation rights equal to the difference

between the per share cash consideration and the exercise price of the options or stock appreciation rights in exchange for the

cancellation thereto.

Adjustments for Stock Dividends, Stock Splits,

Etc.

The 2015 Plan requires the Administrator to make appropriate adjustments to the number of shares of common stock that

are subject to the 2015 Plan, to certain limits in the 2015 Plan, and to any outstanding awards to reflect stock dividends, stock

splits, extraordinary cash dividends and similar events (subject to automatic increase to 3,000,000 immediately after the Reverse

Stock Split if the Reverse Stock Split is effected).

Tax Withholding

. Participants in the

2015 Plan are responsible for the payment of any federal, state or local taxes that the Company is required by law to withhold

upon the exercise of options or stock appreciation rights or vesting of other awards. Subject to approval by the Administrator,

participants may elect to have the minimum tax withholding obligations satisfied by authorizing the Company to withhold shares

of common stock to be issued pursuant to the exercise or vesting of such award.

Amendments and Termination

. The Board

may at any time amend or discontinue the 2015 Plan and the Administrator may at any time amend or cancel any outstanding award

for the purpose of satisfying changes in the law or for any other lawful purpose. However, no such action may adversely affect

any rights under any outstanding award without the holder’s consent. To the extent required under the rules of any exchange

on which the Company’s stock is listed, any amendments that materially change the terms of the 2015 Plan will be subject

to approval by our stockholders. Amendments shall also be subject to approval by our stockholders if and to the extent determined

by the Administrator to be required by the Code to preserve the qualified status of incentive stock options or to ensure that compensation

earned under the 2015 Plan qualifies as performance-based compensation under Section 162(m) of the Code.

Effective Date of 2015 Plan

. The Board

adopted the 2015 Plan on April 16, 2015, and the 2015 Plan became effective on the date it was approved by stockholders, which

was June 1, 2016. The 2015 Plan was subsequently amended with stockholder approval in November 2016. Awards of incentive stock

options may be granted under the 2015 Plan until April 16, 2025. No other awards may be granted under the 2015 Plan after the date

that is 10 years from the date of stockholder approval.

If approved, the proposed amendments to the

2015 Plan will be effective immediately after such approval.

Summary of Federal income Tax Consequences of the 2015 Plan

The following is a summary of the

principal U.S. federal income tax consequences of certain transactions under the 2015 Plan. The summary is intended only as a

general guide and it does not describe all federal tax consequences under the 2015 Plan, nor does it describe state or local,

foreign, or other tax consequences. The summary does not attempt to describe all possible federal income tax consequences

based on particular circumstances. Furthermore, the tax consequences are complex and subject to change, and a

taxpayer’s particular situation may be such that some variation of the described rules is applicable. Recipients

of awards under the 2015 Plan should consult their own tax advisors to determine the tax consequences to them as a result of

their particular circumstances.

Incentive Stock Options

. No taxable

income is generally recognized for regular income tax purposes by the optionee upon the grant or exercise of an incentive stock

option. If shares of common stock issued to an optionee pursuant to the exercise of an incentive stock option are sold or transferred

after two years from the date of grant and after one year from the date of exercise, then (i) upon sale of such shares, any amount

realized in excess of the option price (the amount paid for the shares) will be taxed to the optionee as a long-term capital gain,

and any loss sustained will be a long-term capital loss, and (ii) the Company will not be entitled to any deduction for federal

income tax purposes.

The difference between the option exercise

price and the fair market value of the shares of common stock on the exercise date of an incentive stock option is treated as an

adjustment in computing the participant’s alternative minimum taxable income and may be subject to the alternative minimum

tax, which is paid if such tax exceeds the regular tax for the year. Special rules may apply with respect to (i) certain subsequent

sales of the shares in a disqualifying disposition, (ii) certain basis adjustments for purposes of computing the alternative minimum

taxable income on a subsequent sale of the shares, and (iii) certain tax credits that may arise with respect to participants subject

to the alternative minimum tax.

If shares of common stock acquired upon the

exercise of an incentive stock option are disposed of prior to the expiration of the two-year and one-year holding periods described

above (a “disqualifying disposition”), generally (i) the optionee will realize ordinary income in the year of disposition

in an amount equal to the excess (if any) of the fair market value of the shares of common stock at exercise (or, if less, the

amount realized on a sale of such shares of common stock) over the option price thereof, and (ii) we will be entitled to deduct

such amount (subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code, and the satisfaction

of a tax-reporting obligation). Any gain in excess of that amount will be a capital gain. If a loss is recognized, there will be

no ordinary income, and such loss will be a capital loss. Special rules apply where all or a portion of the exercise price of the

incentive stock option is paid by tendering shares of common stock.

If an incentive stock option is exercised at

a time when it no longer qualifies for the tax treatment described above, the option is treated as a non-qualified stock option.

Generally, an incentive stock option will not be eligible for the tax treatment described above if it is exercised more than three

months following termination of employment (or one year in the case of termination of employment by reason of disability). In the

case of termination of employment by reason of death, the three-month rule does not apply.

Non-Qualified Stock Options

. No income

is realized by the optionee at the time the option is granted. Generally (i) at exercise, ordinary income is realized by the optionee

in an amount equal to the difference between the option price and the fair market value of the shares of common stock on the date

of exercise (and withholding of income and employment taxes will apply if the participant is or was an employee), and we receive

a tax deduction for the same amount (subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code,

and the satisfaction of a tax-reporting obligation), and (ii) at disposition, appreciation or depreciation after the date of exercise

is treated as either short-term or long-term capital gain or loss depending on how long the shares of common stock have been held.

Special rules apply where all or a portion of the exercise price of the non-qualified stock option is paid by tendering shares

of common stock. Upon exercise, the optionee will also be subject to Social Security taxes on the excess of the fair market value

over the exercise price of the option.

Stock Appreciation Rights.

A

participant recognizes no taxable income upon the receipt of a stock appreciation right. Upon the exercise of a stock appreciation

right, the participant will recognize ordinary income in an amount equal to the excess of the fair market value of the underlying

shares of common stock on the exercise date over the exercise price. If the participant is an employee, such ordinary income

generally is subject to withholding of income and employment taxes. We generally should be entitled to a deduction equal to

the amount of ordinary income recognized by the participant in connection with the exercise of the stock appreciation right, except

to the extent such deduction is limited by applicable provisions of the Code.

Restricted Stock

.

A participant

acquiring restricted stock generally will recognize ordinary income equal to the difference between the fair market value of the

shares on the “determination date” (as defined below) and their purchase price, if any. If the participant is

an employee, such ordinary income generally is subject to withholding of income and employment taxes. The “determination

date” is the date on which the participant acquires the shares unless they are subject to a substantial risk of forfeiture

and are not transferable, in which case the determination date is the earlier of (i) the date on which the shares become transferable,

or (ii) the date on which the shares are no longer subject to a substantial risk of forfeiture. If the determination date

will be after the date on which the participant acquires the shares, the participant may elect, pursuant to Section 83(b) of the

Code, to have the date of acquisition be the determination date by filing an election with the Internal Revenue Service, or IRS,

no later than 30 days after the date the shares are acquired. Upon the taxable disposition of shares acquired pursuant to

a restricted stock award, any gain or loss, based on the difference between the sale price and the fair market value on the determination

date, will generally be taxed as capital gain or loss; however, for any shares returned to the Company pursuant to a forfeiture

provision, a participant’s loss may be computed based only on the purchase price (if any) of the shares and may not take

into account any income recognized by reason of a Section 83(b) election. Such gain or loss will be long-term or short-term

depending on whether the stock was held for more than one year. We generally will be entitled (subject to the requirement of reasonableness,

the provisions of Section 162(m) of the Code, and the satisfaction of a tax reporting obligation) to a corresponding

income tax deduction in the year in which such ordinary income is recognized by the participant.

Restricted Stock Units.

No taxable

income is recognized upon receipt of a restricted stock unit award. In general, the participant will recognize ordinary income

in the year in which the units vest and are settled in an amount equal to any cash received and the fair market value of any nonrestricted

shares received. If the participant is an employee, such ordinary income generally is subject to withholding of income and employment

taxes. We generally will be entitled (subject to the requirement of reasonableness, the provisions of Section 162(m) of

the Code, and the satisfaction of a tax reporting obligation) to an income tax deduction equal to the amount of ordinary income

recognized by the participant. In general, the deduction will be allowed for the taxable year in which such ordinary income is

recognized by the participant.

Other Awards

. The Company generally

will be entitled to a tax deduction in connection with an award under the 2015 Plan in an amount equal to the ordinary income realized

by the participant at the time the participant recognizes such income (subject to the requirement of reasonableness, the provisions

of Section 162(m) of the Code, and the satisfaction of a tax-reporting obligation). Participants typically are subject

to income tax and recognize such tax at the time that an award is exercised, vests or becomes non-forfeitable, unless the award

provides for a further deferral.

Parachute Payments

. The vesting of any

portion of an option or other award that is accelerated due to the occurrence of a change in control (such as a sale event) may

cause a portion of the payments with respect to such accelerated awards to be treated as “parachute payments” as defined

in the Code. Any such parachute payments may be non-deductible to the Company, in whole or in part, and may subject the recipient

to a non-deductible 20 percent federal excise tax on all or a portion of such payment (in addition to other taxes ordinarily payable).

Limitation on Deductions

. Under Section 162(m)

of the Code, the Company’s deduction for certain awards under the 2015 Plan may be limited to the extent that the Chief Executive

Officer or other executive officer whose compensation is required to be reported in the summary compensation table (other than

the Principal Financial Officer) receives compensation in excess of $1 million a year (other than performance-based compensation

that otherwise meets the requirements of Section 162(m) of the Code). The 2015 Plan is structured to allow certain awards

to qualify as performance-based compensation under Section 162(m) of the Code.

Vote Required

The affirmative vote of a majority of the votes

cast at the meeting is required to approve the amendments to the 2015 Plan.

Recommendation

The Board of Directors recommends that you

vote

FOR

approval of the amendments to the 2015 Plan.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth information

with respect to the beneficial ownership of our common stock as of April 30, 2017 for:

|

|

·

|

each beneficial owner of more than 5% of our outstanding

common stock;

|

|

|

·

|

each of our director and named executive officers; and

|

|

|

·

|

all of our directors and executive officers as a group.

|

Beneficial ownership is determined in accordance

with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared

voting power or investment power with respect to those securities and include common stock that can be acquired within 60 days

of May 5, 2017. The percentage ownership information shown in the table is based upon 16,426,607 shares of common stock outstanding

as of May 5, 2017.

Except as otherwise indicated, all of the shares

reflected in the table are shares of common stock and all persons listed below have sole voting and investment power with respect

to the shares beneficially owned by them, subject to applicable community property laws. The information is not necessarily indicative

of beneficial ownership for any other purpose.

In computing the number of shares of common

stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of common stock

subject to options and warrants held by that person that are immediately exercisable or exercisable within 60 days of May 5, 2017.

We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. Beneficial

ownership representing less than 1% is denoted with an asterisk (*). The information in the table below is based on information

known to us or ascertained by us from public filings made by the stockholders. Except as otherwise indicated in the table below,

addresses of the director, executive officers and named beneficial owners are in care of Aytu BioScience, Inc., 373 Inverness Parkway,

Suite 206, Englewood, Colorado 80112.

|

Name of Beneficial Owner

|

|

Number of

Shares

Beneficially

Owned

|

|

|

Percentage

of Shares

Beneficially

Owned

|

|

|

5% Stockholders:

|

|

|

|

|

|

|

|

|

|

Galileo Partners, LLC

(1)

|

|

|

876,250

|

|

|

|

5.2

|

%

|

|

Alpha Venture Capital Partners, L.P.

(2)

|

|

|

837,300

|

|

|

|

5.1

|

%

|

|

Directors and Named Executive Officers:

|

|

|

|

|

|

|

|

|

|

Joshua R. Disbrow

(3)

|

|

|

675,785

|

|

|

|

4.1

|

%

|

|

Jarrett T. Disbrow

(4)

|

|

|

617,672

|

|

|

|

3.8

|

%

|

|

Gregory A. Gould

(5)

|

|

|

361,065

|

|

|

|

2.2

|

%

|

|

Michael Macaluso

(6)

|

|

|

130,406

|

|

|

|

*%

|

|

|

Carl C. Dockery

(7)

|

|

|

915,634

|

|

|

|

5.6

|

%

|

|

John Donofrio

(8)

|

|

|

76,250

|

|

|

|

*%

|

|

|

Gary Cantrell

(9)