UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Amendment No. 3

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) or 13(e)(1) OF

THE SECURITIES EXCHANGE ACT OF 1934

GREAT ELM

CAPITAL CORP.

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Common Stock, par value of $0.01 per share

(Title of Class of Securities)

390320109

(CUSIP

Number of Class

of Securities)

Peter A. Reed

Chief Executive Officer

Great Elm Capital Corp.

200 Clarendon Street, 51

st

Floor

Boston, MA 02116

(617)

375-3006

(Name, address and telephone number of person authorized to receive notices and

communications on behalf of filing person)

Copy to:

Michael K. Hoffman

Michael J. Schwartz

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New

York, New York 10036-6522

(212)

735-3000

CALCULATION OF FILING FEE

|

|

|

|

|

Transaction Valuation

(1)

|

|

Amount of Filing Fee

(2)

|

|

$10,000,000

|

|

$1,159

|

|

|

|

(1)

|

Calculated solely for purposes of determining the amount of the filing fee. This amount is based upon the offer to purchase up to $10,000,000 in cash of common stock, par value of $0.01 per share, of Great Elm Capital

Corp., representing up to 869,565 shares at the minimum tender offer price of $11.50 per share.

|

|

(2)

|

The amount of the filing fee, calculated in accordance with Rule

0-11

under the Securities Exchange Act of 1934, as amended, equals $115.90 per million dollars of the value of the

transaction.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule

0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: $1,159

|

|

Filing Party: Great Elm Capital Corp.

|

|

Form or Registration No.: Schedule TO

|

|

Date Filed: April 6, 2017

|

|

☐

|

Check the box if filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third-party tender offer subject to Rule

14d-1.

|

|

|

☒

|

issuer tender offer subject to Rule

13e-4.

|

|

|

☐

|

going-private transaction subject to Rule

13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule

13d-2.

|

Check the following box

if the filing is a final amendment reporting the results of the tender offer: ☒

This Amendment No. 3 (this “Amendment”) amends and supplements the Tender Offer Statement on

Schedule TO (the “Schedule TO”) originally filed with the U.S. Securities and Exchange Commission by Great Elm Capital Corp., a Maryland corporation (“GECC”), on April 6, 2017, in connection with the offer by GECC to

purchase for cash up to $10,000,000 of its shares of its common stock, par value $0.01 per share (the “Shares”), pursuant to (i) auction tenders at prices specified by the tendering shareholders of not greater than $12.17 per Share

nor less than $11.50 per Share or (ii) purchase price tenders pursuant to which shareholders indicate they are willing to sell their Shares to GECC at the purchase price determined in the offer, in either case, net to the seller in cash, less

any applicable withholding taxes and without interest, upon the terms and subject to the conditions described in the Offer to Purchase, dated April 5, 2017 (the “Offer to Purchase”), a copy of which was filed with the Schedule TO as

Exhibit (a)(1)(A), and in the related Letter of Transmittal (the “Letter of Transmittal,” which together with the Offer to Purchase, as they may be amended or supplemented from time to time, constitute the “Tender Offer”), a copy

of which was filed with the Schedule TO as Exhibit (a)(1)(B).

The information contained in the Offer to Purchase and the Letter of Transmittal is hereby

incorporated by reference into this Amendment, except that such information is hereby amended and supplemented to the extent specifically provided herein.

|

Item 11.

|

Additional Information.

|

Item 11 of the Schedule TO is hereby amended and supplemented by adding at the

end thereof the following text:

Great Elm Capital Corp. (the “Company”) finalized the calculations under its modified “Dutch auction”

self-tender offer that expired at 5:00 p.m., New York City time, on May 5, 2017.

In accordance with the previously announced self-tender offer to

purchase for cash up to $10 million of its common stock outstanding, the Company expects to repurchase 869,565 shares, representing 6.94 percent of its outstanding shares, for payment on or about May 12, 2017 at a price of $11.50 per

share on a pro rata basis, except for tenders of odd lots, which will be accepted in full, for a total cost of approximately $10 million, excluding fees and expenses relating to the self-tender offer.

The proration factor for the tender offer, after giving effect to the priority of odd lots, is approximately 9.7 percent. The purchase price of properly

tendered shares represents 85% of net asset value per share based on the December 31, 2016 NAV per share. A total of 7,518,408 shares, including 144,326 shares through notice of guaranteed delivery, were properly tendered at the final purchase

price of $11.50 per share and not withdrawn by May 5, 2017, the final date for withdrawals. Therefore, on a

pro-rated

basis, approximately 11.4 percent of the shares tendered by each tendering

stockholder have been accepted for payment. The Company will fund the repurchase of common stock using a portion of its cash and cash equivalents on hand.

Janney Montgomery Scott LLC (the “Dealer Manager”) is serving as dealer manager for the tender offer. MacKenzie Partners, Inc. (the

“Information Agent”) is serving as information agent for the tender offer and American Stock Transfer & Trust Company, LLC (the “Depositary”) is serving as depositary for the tender offer. For more information about the

tender offer, please contact MacKenzie Partners, Inc. at +1 (800)

322-2885

(toll-free).

Cautionary Statement

Regarding Forward-Looking Statements

Statements in this communication that are not historical facts are “forward-looking” statements within

the meaning of the federal securities laws. These statements are often, but not always, made through the use of words or phrases such as “believe,” “expect,” “anticipate,” “should,” “planned,”

“will,” “may,” “intend,” “estimated,” “aim,” “target,” “opportunity,” “sustained,” “positioning,” “designed,” “create,” “seek,”

“would,” “could”, “potential,” “continue,” “ongoing,” “upside,” “increases,” and “potential,” and similar expressions. All such forward-looking statements involve

estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ

materially from those projected in the forward-looking statements are the following: the success of the tender offer, the satisfaction of the conditions to the tender offer, conditions in the credit markets, the price of the Company’s common

stock, performance of the Company’s portfolio and investment manager. Additional information concerning these and other factors can be found in the Company’s Annual Report on Form

10-K

and other

reports filed with the SEC. The Company assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations

except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

1

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

GREAT ELM CAPITAL CORP.

|

|

|

|

|

By:

|

|

/s/ Peter A. Reed

|

|

Name:

|

|

Peter A. Reed

|

|

Title:

|

|

Chief Executive Officer

|

Date: May 15, 2017

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

(a)(1)(A)*

|

|

Offer to Purchase, dated April 5, 2017.

|

|

|

|

|

(a)(1)(B)*

|

|

Letter of Transmittal.

|

|

|

|

|

(a)(1)(C)*

|

|

Notice of Guaranteed Delivery.

|

|

|

|

|

(a)(1)(D)*

|

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated April 5, 2017.

|

|

|

|

|

(a)(1)(E)*

|

|

Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated April 5, 2017.

|

|

|

|

|

(a)(2)

|

|

None.

|

|

|

|

|

(a)(3)

|

|

Not applicable.

|

|

|

|

|

(a)(4)

|

|

Not applicable.

|

|

|

|

|

(a)(5)(A)

|

|

Press release announcing intention to commence the Tender Offer, dated March 29, 2017 (incorporated by reference to Exhibit 99.4 to the Form

8-K

filed March 30, 2017).

|

|

|

|

|

(a)(5)(B)*

|

|

Press release announcing commencement of the Tender Offer, dated April 5, 2017.

|

|

|

|

|

(a)(5)(C)

|

|

Conference call script, dated March 29, 2017 (incorporated by reference to the Schedule

TO-C

filed on March 30, 2017).

|

|

|

|

|

(a)(5)(D)

|

|

Presentation dated March 29, 2017 (incorporated by reference to Exhibit 99.2 to the Form

8-K

filed March 30, 2017).

|

|

|

|

|

(a)(5)(E)**

|

|

Press release announcing preliminary results of the Tender Offer, dated May 8, 2017.

|

|

|

|

|

(b)

|

|

None.

|

|

|

|

|

(d)(1)

|

|

Investment Management Agreement, dated as of September 27, 2016, by and between Great Elm Capital Corp. and Great Elm Capital Management, Inc. (incorporated by reference to Exhibit 10.1 to the Form

8-K

filed on November 7, 2016).

|

|

|

|

|

(d)(2)

|

|

Agreement and Plan of Merger, dated as of June 23, 2016, by and between Full Circle Capital Corporation (“Full Circle”) and Great Elm Capital Corp. (incorporated by reference to the Rule 425 filing on June 27,

2016).

|

|

|

|

|

(d)(3)

|

|

Subscription Agreement, dated as of June 23, 2016, by and among Great Elm Capital Corp., Great Elm Capital Group, Inc. and the investment funds signatory thereto (incorporated by reference to the Rule 425 filing on

June 27, 2016).

|

|

|

|

|

(d)(4)

|

|

Amended and Restated Registration Rights Agreement, dated as of November 4, 2016, by and among Great Elm Capital Corp. and the holders named therein (incorporated by reference to Exhibit 10.3 to the Form

8-K

filed on November 7, 2016).

|

|

|

|

|

(d)(5)

|

|

Administration Agreement, dated as of September 27, 2016, by and between Great Elm Capital Corp. and GECM (incorporated by reference to Exhibit 10.2 to the Form

8-K

filed on

November 7, 2016).

|

|

|

|

|

(d)(6)

|

|

Form of Indemnification Agreement (incorporated by reference to Exhibit 10.4 to the Form

8-K

filed on November 7, 2016).

|

|

*

|

Previously filed with the Schedule TO filed on April 5, 2017.

|

|

**

|

Previously filed with Amendment No. 2 to the Schedule TO filed on May 8, 2017.

|

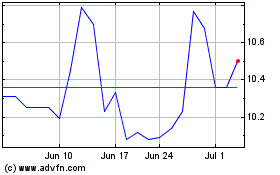

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Mar 2024 to Apr 2024

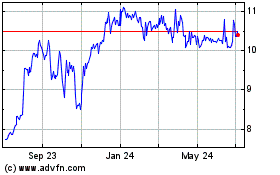

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Apr 2023 to Apr 2024