- Net Income attributable to common

stockholders improved to $0.3 million, or $0.08 per diluted

share.

- Total Revenue Increased 5.8% to

$10.3 million.

- Homebuilding Revenue Increased 5.7%

to $10.1 million from 25 Home Deliveries.

- Backlog at March 31, 2017 expanded

47.1% to $23.9 million on 44 Units and has continued to expand in

the current period.

Comstock Holding Companies, Inc., (NASDAQ: CHCI), announced

results for the first quarter ended March 31, 2017:

Highlights of First Quarter 2017, as compared to First

Quarter 2016:

- Net income attributable to common

stockholders of $0.3 million, or $0.08 per diluted share, compared

to net loss attributable to common stockholders of $(1.8) million,

or $(0.55) per diluted share;

- Total revenue of $10.3 million,

including $10.1 million from 25 home deliveries, as compared to

$9.7 million, including $9.5 million from 22 home deliveries;

- Backlog of $23.9 million on 44 units,

compared to $16.3 million on 38 units;

- G&A expense of $1.2 million, as

compared to $1.5 million;

- Controlled and open community counts of

15 and 12, respectively, as compared to 17 and 10.

- The Series B Preferred Stock was

exchanged for Series C Preferred Stock, reducing the Company’s cost

of capital.

Chairman and CEO, Christopher Clemente commented, “Comstock’s

First Quarter 2017 results demonstrate our continued focus and

successes in reducing fixed operating expenses and costs of capital

while improving bottom line results. Traffic at our projects has

improved in quantity and quality this year, generating increases in

revenue and backlog, providing visibility to increasing future

revenue. Improving market fundamentals and our expanding pipeline

gives me reason to be optimistic about our ability to generate

improved results during 2017 and beyond.”

COMSTOCK COMMUNITIES NOW OPEN

Comstock currently has 12 communities open for sale in Virginia,

Maryland, and Washington, D.C., including townhomes, condominiums,

single-family homes and villas priced from the high $200s to the

$900s. For further details on the open communities, see the

attached Pipeline Report as of March 31, 2017 and the Form 10-Q

filed by the company on May 15, 2017.

COMSTOCK COMMUNITIES COMING SOON

In addition to the 12 communities already open, Comstock has

three communities in various stages of planning and development.

The communities, located in Maryland and Virginia, include

townhomes and single-family homes to be priced from the lower

$300s. For further details on the communities in planning, see the

attached Pipeline Report as of March 31, 2017 and the Form 10-Q

filed by the company on May 15, 2017.

About Comstock Holding Companies, Inc.

Comstock is a homebuilding and multi-faceted real estate

development and services company that builds a wide range of

housing products under its Comstock Homes brand through its wholly

owned subsidiary, Comstock Homes of Washington, LC. Our track

record of developing numerous successful new home communities and

nearly 6,000 homes, together with our substantial experience in

building a diverse range of products including apartments,

single-family homes, townhomes, mid-rise condominiums, high-rise

condominiums and mixed-use (residential and commercial)

developments has positioned Comstock as a leading developer and

homebuilder in the Washington, D.C. metropolitan area.

Comstock is a publicly traded company, trading

on NASDAQ under the symbol CHCI. For more information

about Comstock or its new home communities, please visit

www.comstockhomes.com.

Cautionary Statement Regarding Forward-Looking

Statements

This release includes "forward-looking" statements that are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements can

be identified by use of words such as "anticipate," "believe,"

"estimate," "may," "intend," "expect," "will," "should," "seeks" or

other similar expressions. Forward-looking statements are based

largely on our expectations and involve inherent risks and

uncertainties, many of which are beyond our control. You should not

place undue reliance on any forward-looking statement, which speaks

only as of the date made. Some factors which may affect the

accuracy of the forward-looking statements apply generally to the

real estate industry, while other factors apply directly to us. Any

number of important factors which could cause actual results to

differ materially from those in the forward-looking statements

include, without limitation: completion of Comstock's financial

accounting and review procedures; general economic and market

conditions, including interest rate levels; our ability to service

our debt; inherent risks in investment in real estate; our ability

to compete in the markets in which we operate; economic risks in

the markets in which we operate, including actions related to

government spending; delays in governmental approvals and/or land

development activity at our projects; regulatory actions;

fluctuations in operating results; our anticipated growth

strategies; shortages and increased costs of labor or building

materials; the availability and cost of land in desirable areas;

adverse weather conditions or natural disasters; our ability to

raise debt and equity capital and grow our operations on a

profitable basis; and our continuing relationships with affiliates.

Additional information concerning these and other important risk

and uncertainties can be found under the heading "Risk Factors" in

our Annual Report on Form 10-K, as filed with the Securities

and Exchange Commission, for the fiscal year ended December

31, 2016. Our actual results could differ materially from these

projected or suggested by the forward-looking statements. Comstock

claims the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995 for all forward-looking statements contained herein.

Comstock specifically disclaims any obligation to update or revise

any forward-looking statements, whether as a result of new

information, future developments or otherwise.

COMSTOCK HOLDING COMPANIES, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and

per share data)

March 31, 2017

December 31, 2016

(unaudited)

ASSETS Cash and cash equivalents $ 3,702 $ 5,761

Restricted cash 1,519 1,238 Trade receivables 144 613 Real estate

inventories 49,438 49,842 Fixed assets, net 219 255 Other assets,

net 1,374 2,112 TOTAL ASSETS $ 56,396

$ 59,821

LIABILITIES AND STOCKHOLDERS’

EQUITY Accounts payable and accrued liabilities $ 6,935 $ 7,721

Notes payable - secured by real estate inventories, net of deferred

financing charges 26,665 26,927 Notes payable - due to affiliates,

unsecured, net of discount and deferred financing charges 15,944

15,866 Notes payable - unsecured, net of deferred financing charges

959 911 Income taxes payable 19 19

TOTAL LIABILITIES 50,522 51,444

Commitments and contingencies (Note 8) STOCKHOLDERS’ EQUITY

(DEFICIT) Series C preferred stock $0.01 par value, 3,000,000

shares authorized, 772,210 and 0 shares issued and liquidation

preference of $3,861 and $0 at March 31, 2017 and December 31,

2016, respectively $ 588 $ - Series B preferred stock $0.01 par

value, 3,000,000 shares authorized, 0 and 841,848 shares issued and

liquidation preference of $0 and $4,209 at March 31, 2017 and

December 31, 2016, respectively - 1,280 Class A common stock, $0.01

par value, 11,038,071 shares authorized, 3,050,746 and 3,035,922

issued, and outstanding, respectively 30 30 Class B common stock,

$0.01 par value, 390,500 shares authorized, issued, and outstanding

4 4 Additional paid-in capital 177,012 176,251 Treasury stock, at

cost (85,570 shares Class A common stock) (2,662 ) (2,662 )

Accumulated deficit (185,425 ) (184,778 ) TOTAL

COMSTOCK HOLDING COMPANIES, INC. DEFICIT (10,453 ) (9,875 )

Non-controlling interests 16,327 18,252

TOTAL EQUITY 5,874 8,377 TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY $ 56,396 $ 59,821

COMSTOCK HOLDING COMPANIES, INC. AND

SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Amounts in thousands, except per share

data)

Three Months Ended March 31,

2017 2016 Revenues Revenue—homebuilding

$ 10,064 $ 9,523 Revenue—other 204 183

Total revenue 10,268 9,706 Expenses Cost of

sales—homebuilding 9,101 8,645 Cost of sales—other 224 91 Sales and

marketing 381 483 General and administrative 1,246 1,542 Interest

and real estate tax expense - 216

Operating loss (684 ) (1,271 ) Other income, net 20

8 Loss before income tax expense (664 ) (1,263 )

Income tax expense - (25 ) Net loss (664 )

(1,288 ) Net (loss) income attributable to non-controlling

interests (17 ) 436 Net loss attributable to

Comstock Holding Companies, Inc. (647 ) (1,724 ) Paid-in-kind

dividends on Series B Preferred Stock 78

86 Extinguishment of Series B Preferred Stock (1,011 )

- Net income (loss) attributable to common

stockholders $ 286 $ (1,810 ) Basic net income (loss)

per share $ 0.09 $ (0.55 ) Diluted net income (loss) per share $

0.08 $ (0.55 ) Basic weighted average shares outstanding

3,343 3,304 Diluted weighted average shares outstanding 3,373 3,304

Pipeline Report as of March 31,

2017 Project State

ProductType (1)

EstimatedUnits atCompletion

UnitsSettled

Backlog (8)

UnitsOwnedUnsold

Units UnderControl (2)

Total UnitsOwned,Unsettled andUnder

Control

AverageNew OrderRevenue PerUnit to

Date

City Homes at the Hampshires DC SF 38 38

- - - - $ 747 Townes at the

Hampshires (3) DC TH 73 73 - - - - $ 551 Estates at Falls Grove VA

SF 19 18 - 1 - 1 $ 543 Townes at Falls Grove VA TH 110 92 9 9 - 18

$ 303 Townes at Shady Grove Metro MD TH 36 27 - 9 - 9 $ 583 Townes

at Shady Grove Metro (4) MD SF 3 3 - - - - $ - Momentum | Shady

Grove Metro (5) MD Condo 110 - - 110 - 110 $ - Estates at Emerald

Farms MD SF 84 82 2 - - 2 $ 426 Townes at Maxwell Square MD TH 45

45 - - - - $ 421 Townes at Hallcrest VA TH 42 42 - - - - $ 465

Estates at Leeland VA SF 24 6 6 12 - 18 $ 446 Villas | Preserve at

Two Rivers 28' MD TH 6 5 1 - - 1 $ 458 Villas | Preserve at Two

Rivers 32' MD TH 10 9 1 - - 1 $ 504 Marrwood East (7) VA SF 35 2 17

16 - 33 $ 641 Townes at Totten Mews (6) DC TH 40 - 3 37 - 40 $ 627

The Towns at 1333 VA TH 18 - 1 17 - 18 $ 995 The Woods at Spring

Ridge MD SF 21 - 4 17 - 21 $ 644 Solomons Choice MD SF 56 - - 56 -

56 $ - Townes at Richmond Station VA TH 104 - - - 104 104 $ -

Condominiums at Richmond Station VA MF 54 - -

- 54 54 $ -

Total 928

442 44 284 158

486 (1) "SF" means single family home,

"TH" means townhouse, "Condo" means condominium, "MF" means

multi-family. (2) Under land option purchase contract, not owned.

(3) 3 of these units are subject to statutory affordable dwelling

unit program. (4) Units are subject to statutory moderately priced

dwelling unit program; not considered a separate community. (5) 16

of these units are subject to statutory moderately priced dwelling

unit program. (6) 5 of these units are subject to statutory

affordable dwelling unit program. (7) 1 of these units is subject

to statutory affordable dwelling unit program. (8) "Backlog" means

we have an executed order with a buyer but the settlement did not

occur prior to report date.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170515005442/en/

Company:Comstock Holding Companies, Inc.Christopher

Conover, 703-230-1985Chief Financial OfficerorInvestor

Relations:LHAJody Burfening / Harriet Fried,

212-838-3777hfried@lhai.com

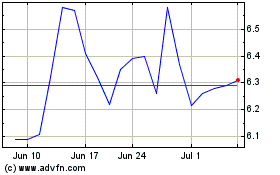

Comstock Holding Companies (NASDAQ:CHCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comstock Holding Companies (NASDAQ:CHCI)

Historical Stock Chart

From Apr 2023 to Apr 2024