Total Gabon: First-Quarter 2017 Results

May 12 2017 - 12:05PM

Business Wire

Regulatory News:

Total Gabon (Paris:EC):

Main Financial Indicators

Q1 17

Q1 16

Q1 17vs.Q1 16

Average Brent price $/b

53.7 33.9

+58% Average Total Gabon crude price $/b

48.7 28.4 +71%

Crude oil production from fields

operatedby Total Gabon

kb/d1

53.7 55.6 -3%

Crude oil production from Total

Gaboninterests2

kb/d

46.0 47.0 -2% Sales volumes

Mb3

3.79 4.91 -23% Revenues

M$

201 161 +25% Funds generated

from operations M$

95 14 x7

Capital expenditures M$

18 36

-50% Net income (loss) M$

11 (16)

N/A

(1) kb/d: thousands of barrels a day.(2) Including tax oil

reverting to the Gabonese Republic as per production sharing

contracts.(3) Mb: million barrels.

First-Quarter 2017 Results

Selling Prices

Reflecting the higher Brent price, in first-quarter 2017 the

selling price of the Mandji and Rabi Light crude oil grades

marketed by Total Gabon averaged 48.7 $/b, up 71% compared to

first quarter 2016.

Production

Total Gabon's equity share of operated and non-operated oil

production1 declined 3%, thanks mainly to an increase of Anguille’s

produced water content partly offset by the impact in first-quarter

2016 of the planned shutdown on Coucal / Avocette in February for

work on the digital control system and the unblocking of the

flowline of well ATO012.

Revenues

Revenues were 201 Million USD (M$) in first-quarter 2017, up 25%

over the first quarter 2016 thanks mainly to higher selling prices

of the crude oil grades marketed (+19.8 $/b or +88 M$), partly

offset by lower volumes sold over the period, linked to the lifting

schedule (-697 kb or -43 M$), and lower revenues from third parties

(-5 M$).

Funds generated from operations

Funds generated from operations were up 81 M$ compared to

first quarter 2016 thanks to higher revenues and lower operating

costs as a result of the cost-cutting program implemented by the

Company.

Capital expenditures

Capital expenditures were 18 M$ , down 50% compared to the first

quarter of 2016 and included mainly work to improve the integrity

and longevity of offshore facilities (Anguille, Torpille, Grondin)

and onshore (Cap Lopez terminal) and geophysical and development

surveys and studies.

Net Income

A net income of 11 M$ was reported, a 27 M$ improvement

over the first quarter 2016 16M$ loss primarily due to higher

revenues in the context of higher crude prices and lower operating

costs.

Highlights since the beginning of first-quarter 2017

Refocusing of Total Gabon on its principal offshore

assets

On February 27, 2017 Total Gabon announced its refocusing on its

principal offshore assets via the sale to Perenco of interests in

five mature fields and the Rabi-Coucal-Cap Lopez pipeline network.

Production from the fields being divested represents about 5,000

b/d, or 10% of Total Gabon’s 2016 production. The transaction

represents a value of 177 M$ before adjustments and is subject to

approval by the authorities.

Board of Directors Meeting on April 4, 2017

The Board of Directors approved on April 4, 2017 the accounts

for the year ending December 31, 2016. The annual Shareholders'

Meeting was scheduled for May 19, 2017.

Pre-emption rights exercised on the Baudroie-Mérou

license

On April 24, 2017 Total Gabon announced that it had exercised

its pre-emption right to acquire the 50% interest in the

Baudroie-Mérou license held by MPDC GABON Co., Ltd. Total Gabon

owns the remaining 50% interest and at completion of the

transaction will become 100% owner and operator of the license. The

transaction represents a value of 40 M$ and is subject to approval

by the authorities.

1 Including tax oil reverting to the Gabonese Republic as per

production sharing contracts.

Société anonyme incorporated in Gabon

with a Board of Directors and share capital of

$76,500,000Headquarters: Boulevard Hourcq, Port-Gentil, BP

525, Gabonese Republicwww.total.gaRegistered in

Port-Gentil: 2000 B 00011

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170512005502/en/

Total GabonMedia Contact :Florent

CAILLETflorent.caillet@total.com

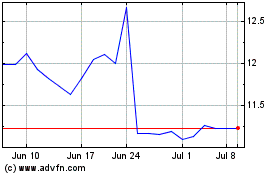

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Apr 2024 to May 2024

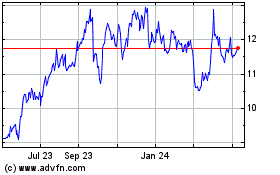

Ecopetrol (NYSE:EC)

Historical Stock Chart

From May 2023 to May 2024