Key Highlights

- Completed drop down to NRG Yield of

311 net MWs of utility-scale solar assets for total cash

consideration of $130 million1

- Reaffirming 2017 Adjusted EBITDA and

Free Cash Flow before Growth (FCFbG) guidance

- Established the Business Review

Committee to make recommendations to the full Board on its stated

initiatives

- Offered to NRG Yield remaining 25%

interest in NRG Wind TE Holdco, an 814 net MW portfolio of 12 wind

facilities

- Commenced construction at Carlsbad

Energy Center in the first quarter 2017; COD expected in the fourth

quarter of 2018

NRG Energy, Inc. (NYSE:NRG) today reported first quarter net

loss of $203 million, or $0.52 per diluted common share compared to

net income of $47 million, or $0.24 per diluted common share for

the first three months of 2016. Adjusted EBITDA for the three

months ended March 31, 2017 was $412 million and year-to-date cash

used by operations totaled $68 million.

“We are pleased to reaffirm our financial guidance amid

challenging market conditions this quarter,” said Mauricio

Gutierrez, NRG President and Chief Executive Officer. “We remain

focused on our strategic priorities of simplifying and streamlining

the business, optimizing our portfolio and strengthening the

balance sheet.”

Consolidated Financial Results

Three Months Ended ($ in millions)

3/31/17

3/31/16 Net (Loss)/Income $ (203 ) $ 47 Cash (Used

by)/From Operations $ (68 ) $ 554 Adjusted EBITDA $ 412 $ 812 Free

Cash Flow Before Growth Investments (FCFbG) $ (96 )

$ 249

1 Prior to working capital adjustments

Segment Results

Table 1: Net (Loss)/Income

($ in millions)

Three Months Ended Segment

3/31/17 3/31/16 Generation $ 67 $ 191

Retail (33 ) 150 Renewables 1 (31 ) (40 ) NRG Yield 1 (1 ) 2

Corporate (205 ) (256 ) Net (Loss)/Income 2 $ (203 ) $ 47

1. In accordance with GAAP, 2016 results have been restated to

include full impact of the assets in the NRG Yield Drop Down

transactions which closed on September 1, 2016, and March 27,

2017.2. Includes mark-to-market gains and losses of economic

hedges.

Table 2: Adjusted EBITDA

($ in millions)

Three Months Ended Segment

3/31/17 3/31/16 Generation 1 $ 111 $

466 Retail 133 156 Renewables 2 25 33 NRG Yield 2 184 198 Corporate

(41 ) (41 ) Adjusted EBITDA 3 $ 412 $ 812

1. See Appendices A-4 through A-5 for Generation regional Reg G

reconciliations.2. In accordance with GAAP, 2016 results have been

restated to include full impact of the assets in the NRG Yield Drop

Down transactions which closed on September 1, 2016, and March 27,

2017.3. See Appendices A-1 through A-2 for Operating Segment Reg G

reconciliations.

Generation: First quarter Adjusted EBITDA was $111

million, $355 million lower than first quarter 2016 primarily

driven by:

- Gulf Coast Region: $117 million

decrease due primarily to lower realized energy margins in Texas

from lower realized prices, including the impact of hedges, and

lower cleared auction prices in PJM resulting in lower capacity

revenues in South Central

- East Region: $136 million decrease due

to lower capacity prices, lower realized energy margins on lower

dispatch, monetization of hedges from 2017 in 2016, and assets sold

in 2016; partially offset by reduced operating costs from fewer

planned outages and plant deactivations

- West Region: $54 million decrease due

to the gain from sale of emissions credits in the first quarter of

2016 and the retirement of Pittsburg on January 1, 2017

- Other Generation: $48 million decrease

driven mainly by lower trading results at BETM

Retail: First quarter Adjusted EBITDA was $133 million,

$23 million lower than first quarter 2016 due primarily to lower

margin from mild weather and associated supply costs, which was

partially offset by customer growth.

Renewables: First quarter Adjusted EBITDA was $25

million, $8 million lower than first quarter 2016 due to a

transmission outage at Agua Caliente and lower solar insolation,

partially offset by higher generation at Ivanpah.

NRG Yield: First quarter Adjusted EBITDA was $184

million, $14 million lower than first quarter 2016 due to a forced

outage at El Segundo Energy Center, lower solar and wind resource

primarily in California, which led to decreased production,

partially offset by the acquisition of the Utah utility-scale solar

assets.

Corporate: First quarter Adjusted EBITDA was unchanged

from the first quarter 2016 as higher advisory spend incurred to

assist the Company in its strategic review as well as advisory

services associated with GenOn was offset by lower operating losses

at residential solar.

Liquidity and Capital Resources

Table 3: Corporate Liquidity

($ in millions)

3/31/17 12/31/16 Cash at

NRG-Level 1 $ 381 $ 570 Revolver Availability 1,364 1,217

NRG-Level Liquidity $ 1,745 $

1,787 Restricted cash 397 446 Cash at Non-Guarantor

Subsidiaries 1,132 1,403

Total Liquidity $ 3,274

$ 3,636

1 Includes unrestricted cash held at Midwest Generation (a

non-guarantor subsidiary), which can be distributed to NRG without

limitation.

NRG-Level cash as of March 31, 2017, was $381 million, a

decrease of $189 million from December 31, 2016, and $1.4 billion

was available under the Company’s credit facilities at the end of

the first quarter 2017. Total liquidity was $3.3 billion, including

restricted cash and cash at non-guarantor subsidiaries (primarily

GenOn and NRG Yield). On February 28, 2017, GenOn drew $125 million

on letters of credit under its intercompany revolver with NRG to

support the GenOn Mid-Atlantic operating leases; NRG subsequently

drew $125 million on its revolver facility to fund the GenOn

intercompany draw.

NRG Strategic Developments

On May 1, 2017, NRG offered its remaining 25% interest in NRG

Wind TE Holdco, an 814 net MW portfolio of twelve wind projects to

NRG Yield. NRG Yield currently owns a 75% interest in the

portfolio, which it acquired in 2015. The acquisition is subject to

negotiation and approval by NRG Yield's independent directors.

Drop Down to NRG Yield

On March 27, 2017, the Company sold to NRG Yield, Inc.: (i) a

16% interest in the Agua Caliente solar project, representing

ownership of approximately 46 net MW of capacity and (ii) NRG's

interests in seven utility-scale solar projects located in Utah

representing 265 net MW of capacity. NRG Yield Inc. paid cash

consideration of $130 million, plus $1 million in working capital

adjustments, and assumed non-recourse debt of approximately $463

million2.

Business Review Committee

During the quarter, the NRG Board of Directors established the

Business Review Committee (BRC). The BRC was established to

evaluate and make recommendations to the Board regarding the

Company’s (a) operational and cost excellence initiatives, (b)

potential portfolio and/or asset de-consolidations, dispositions

and optimization, (c) capital structure and allocation and (d)

broader strategic initiatives. NRG plans to update the market as

soon as practicable following a recommendation from the BRC.

2017 Guidance

NRG is reaffirming its guidance range for fiscal year 2017 with

respect to both Adjusted EBITDA and FCF before growth

investments.

2 Approximately $328 million on balance sheet and $135 million

pro-rata share of unconsolidated debt

Table 4: 2017 Adjusted EBITDA and FCF

before Growth Investments Guidance

2017 ($ in millions)

Guidance Adjusted EBITDA1

$2,700 - $2,900 Cash From Operations $1,355 - $1,555 Free Cash Flow

Before Growth Investments (FCFbG) $800 - $1,000

1. Non-GAAP financial measure; see Appendix Tables A-1 through

A-5 for GAAP Reconciliation to Net Income that excludes fair value

adjustments related to derivatives. The Company is unable to

provide guidance for Net Income due to the impact of such fair

value adjustments related to derivatives in a given year.

Capital Allocation Update

On April 7, 2017, NRG declared a quarterly dividend on the

company's common stock of $0.03 per share, payable May 15, 2017, to

stockholders of record as of May 1, 2017, representing $0.12 on an

annualized basis.

The Company’s common stock dividend, debt reduction and share

repurchases are subject to available capital, market conditions and

compliance with associated laws and regulations.

Earnings Conference Call

On May 2, 2017 NRG will host a conference call at 8:00 a.m.

Eastern to discuss these results. Investors, the news media and

others may access the live webcast of the conference call and

accompanying presentation materials by logging on to NRG’s website

at http://www.nrg.com and clicking on

“Investors.” The webcast will be archived on the site for those

unable to listen in real time.

About NRG

NRG is the leading integrated power company in the U.S., built

on the strength of the nation’s largest and most diverse

competitive electric generation portfolio and leading retail

electricity platform. A Fortune 200 company, NRG creates value

through best in class operations, reliable and efficient electric

generation, and a retail platform serving residential and

commercial customers. Working with electricity customers, large and

small, we continually innovate, embrace and implement sustainable

solutions for producing and managing energy. We aim to be pioneers

in developing smarter energy choices and delivering exceptional

service as our retail electricity providers serve almost 3 million

residential and commercial customers throughout the country. More

information is available at www.nrg.com. Connect with NRG Energy on

Facebook and follow us on Twitter @nrgenergy.

Safe Harbor Disclosure

In addition to historical information, the information presented

in this communication includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Exchange Act. These statements involve

estimates, expectations, projections, goals, assumptions, known and

unknown risks and uncertainties and can typically be identified by

terminology such as “may,” “should,” “could,” “objective,”

“projection,” “forecast,” “goal,” “guidance,” “outlook,” “expect,”

“intend,” “seek,” “plan,” “think,” “anticipate,” “estimate,”

“predict,” “target,” “potential” or “continue,” or the negative of

these terms or other comparable terminology. Such forward-looking

statements include, but are not limited to, statements about the

Company’s future revenues, income, indebtedness, capital structure,

plans, expectations, objectives, projected financial performance

and/or business results and other future events, and views of

economic and market conditions.

Although NRG believes that its expectations are reasonable, it

can give no assurance that these expectations will prove to be

correct, and actual results may vary materially. Factors that could

cause actual results to differ materially from those contemplated

herein include, among others, GenOn’s and certain of its

subsidiaries’ ability to continue as a going concern, general

economic conditions, hazards customary in the power production

industry and power generation operations, weather conditions

(including wind and solar conditions), competition in wholesale

power markets, the volatility of energy and fuel prices, failure of

customers to perform under contracts, changes in the wholesale

power markets, the effectiveness of our risk management policies

and procedures, changes in government regulations, the condition of

capital markets generally, our ability to borrow funds and access

capital markets, unanticipated outages at our generation

facilities, adverse results in current and future litigation,

failure to identify, execute or successfully implement

acquisitions, repowerings or asset sales, our ability to implement

value enhancing improvements to plant operations and companywide

processes, our ability to proceed with projects under development

or the inability to complete the construction of such projects on

schedule or within budget, risks related to project siting,

financing, construction, permitting, government approvals and the

negotiation of project development agreements, our ability to

progress development pipeline projects, the inability to maintain

or create successful partnering relationships, our ability to

operate our businesses efficiently including NRG Yield, our ability

to retain retail customers, our ability to realize value through

our commercial operations strategy and the creation of NRG Yield,

the ability to successfully integrate businesses of acquired

companies, our ability to realize anticipated benefits of

transactions (including expected cost savings and other synergies)

or the risk that anticipated benefits may take longer to realize

than expected, our ability to close the drop down transactions with

NRG Yield, and our ability to execute our capital allocation plan.

Debt and share repurchases may be made from time to time subject to

market conditions and other factors, including as permitted by

United States securities laws. Furthermore, any common stock

dividend is subject to available capital and market conditions.

NRG undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. The adjusted

EBITDA, cash from operations, and free cash flow guidance are

estimates as of May 2, 2017. These estimates are based on

assumptions the company believed to be reasonable as of that date.

NRG disclaims any current intention to update such guidance, except

as required by law. The foregoing review of factors that could

cause NRG’s actual results to differ materially from those

contemplated in the forward-looking statements included in this

Earnings press release should be considered in connection with

information regarding risks and uncertainties that may affect NRG’s

future results included in NRG’s filings with the Securities and

Exchange Commission at www.sec.gov.

NRG ENERGY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three months ended March 31,

(In millions,

except for per share amounts)

2017 2016 Operating Revenues

Total operating revenues $ 2,759 $ 3,229

Operating

Costs and Expenses Cost of operations 2,125 2,194 Depreciation

and amortization 300 313 Selling, general and administrative 272

252 Development activity expenses 17 26 Total

operating costs and expenses 2,714 2,785 Gain on sale of assets 2

32

Operating Income 47 476

Other Income/(Expense) Equity in earnings/(losses) of

unconsolidated affiliates 5 (7 ) Impairment loss on investment —

(146 ) Other income, net 12 18 (Loss)/gain on debt extinguishment,

net (2 ) 11 Interest expense (269 ) (284 ) Total other expense (254

) (408 )

(Loss)/Income Before Income Taxes (207 ) 68 Income

tax (benefit)/expense (4 ) 21

Net (Loss)/Income (203

) 47 Less: Net loss attributable to noncontrolling interest and

redeemable noncontrolling interests (40 ) (35 )

Net

(Loss)/Income Attributable to NRG Energy, Inc. (163 ) 82

Dividends for preferred shares — 5

(Loss)/Income

Available for Common Stockholders $ (163 ) $ 77

(Loss)/Earnings per Share Attributable to NRG Energy, Inc.

Common Stockholders Weighted average number of common shares

outstanding — basic 316 315

(Loss)/Earnings per Weighted Average

Common Share — Basic $ (0.52 ) $ 0.24 Weighted average

number of common shares outstanding — diluted 316 315

(Loss)/Earnings per Weighted Average Common Share — Diluted

$ (0.52 ) $ 0.24

Dividends Per Common Share $ 0.03

$ 0.15

NRG ENERGY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME/(LOSS)

(Unaudited)

Three months ended March 31, 2017

2016 (In millions) Net (loss)/income $

(203 ) $ 47

Other comprehensive income/(loss), net of tax

Unrealized income/(loss) on derivatives, net of income tax expense

of $1, and $1 4 (32 ) Foreign currency translation adjustments, net

of income tax expense of $0, and $0 7 6 Available-for-sale

securities, net of income tax expense of $0, and $0 — 3 Defined

benefit plans, net of income tax expense of $0, and $0 — 1

Other comprehensive income/(loss) 11 (22 )

Comprehensive (loss)/income (192 ) 25 Less: Comprehensive

loss attributable to noncontrolling interest and redeemable

noncontrolling interests (39 ) (52 )

Comprehensive (loss)/income

attributable to NRG Energy, Inc. (153 ) 77 Dividends for

preferred shares — 5

Comprehensive (loss)/income

available for common stockholders $ (153 ) $ 72

NRG ENERGY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

March 31, 2017 December 31, 2016

(In millions,

except shares)

(unaudited) ASSETS Current Assets Cash

and cash equivalents $ 1,513 $ 1,973 Funds deposited by

counterparties 3 2 Restricted cash 397 446 Accounts receivable, net

974 1,166 Inventory 1,140 1,111 Derivative instruments 682 1,062

Cash collateral paid in support of energy risk management

activities 277 203 Current assets held-for-sale — 9 Prepayments and

other current assets 454 423 Total current assets

5,440 6,395

Property, plant and equipment, net

17,942 17,912

Other Assets Equity investments

in affiliates 1,148 1,120 Notes receivable, less current portion 13

17 Goodwill 662 662

Intangible assets, net

1,957 2,036 Nuclear decommissioning trust fund 627 610 Derivative

instruments 226 189 Deferred income taxes 223 225 Non-current

assets held-for-sale 10 10 Other non-current assets 1,172

1,179 Total other assets 6,038 6,048

Total

Assets $ 29,420 $ 30,355

LIABILITIES AND

STOCKHOLDERS’ EQUITY Current Liabilities Current portion

of long-term debt and capital leases $ 1,688 $ 1,220 Accounts

payable 872 895 Derivative instruments 747 1,084 Cash collateral

received in support of energy risk management activities 3 2

Accrued expenses and other current liabilities 887 1,181

Total current liabilities 4,197 4,382

Other

Liabilities Long-term debt and capital leases 17,672 18,006

Nuclear decommissioning reserve 291 287 Nuclear decommissioning

trust liability 352 339 Deferred income taxes 20 20 Derivative

instruments 315 294 Out-of-market contracts, net 1,017 1,040

Non-current liabilities held-for-sale 12 12 Other non-current

liabilities 1,487 1,483 Total non-current liabilities

21,166 21,481

Total Liabilities 25,363

25,863

Redeemable noncontrolling interest in

subsidiaries 44 46

Commitments and Contingencies

Stockholders’ Equity Common stock 4 4 Additional paid-in

capital 8,375 8,358 Retained deficit (4,238 ) (3,787 ) Less

treasury stock, at cost — 101,858,284 and 102,140,814 shares,

respectively (2,392 ) (2,399 ) Accumulated other comprehensive loss

(124 ) (135 ) Noncontrolling interest 2,388 2,405

Total Stockholders’ Equity 4,013 4,446

Total Liabilities and Stockholders’ Equity $ 29,420 $

30,355

NRG ENERGY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Three months ended March 31, 2017

2016 (In millions) Cash Flows from

Operating Activities Net (loss)/income $ (203 ) $ 47

Adjustments to reconcile net (loss)/income to net cash provided by

operating activities: Distributions and equity in earnings of

unconsolidated affiliates 8 17 Depreciation and amortization 300

313 Provision for bad debts 9 10 Amortization of nuclear fuel 12 13

Amortization of financing costs and debt discount/premiums 1 1

Adjustment for debt extinguishment — (11 ) Amortization of

intangibles and out-of-market contracts 10 26 Amortization of

unearned equity compensation 8 8 Impairment losses — 146 Changes in

deferred income taxes and liability for uncertain tax benefits 1

(25 ) Changes in nuclear decommissioning trust liability 36 9

Changes in derivative instruments 25 (50 ) Changes in collateral

posted in support of risk management activities (74 ) 156 Proceeds

from sale of emission allowances — 47 Gain on sale of assets (2 )

(32 ) Cash used by changes in other working capital (199 ) (121 )

Net Cash (Used) Provided by Operating Activities (68 ) 554

Cash Flows from Investing Activities Acquisitions of

businesses, net of cash acquired (3 ) (6 ) Capital expenditures

(268 ) (279 ) Decrease/(increase)in restricted cash, net 13 (12 )

Decrease in restricted cash to support equity requirements for U.S.

DOE funded projects 36 39 Decrease in notes receivable 4 1

Purchases of emission allowances (9 ) (12 ) Proceeds from sale of

emission allowances 11 7 Investments in nuclear decommissioning

trust fund securities (153 ) (200 ) Proceeds from the sale of

nuclear decommissioning trust fund securities 117 191 Proceeds from

renewable energy grants and state rebates — 8 Proceeds from sale of

assets, net of cash disposed of 14 120 Investments in

unconsolidated affiliates (12 ) (4 ) Other 18 4

Net Cash Used by Investing Activities (232 ) (143 )

Cash

Flows from Financing Activities Payment of dividends to common

and preferred stockholders (9 ) (48 ) Net receipts from settlement

of acquired derivatives that include financing elements 1 39

Proceeds from issuance of long-term debt 192 61 Payments for short

and long-term debt (177 ) (316 ) Payment for credit support in

long-term deposits (130 ) — Proceeds from draw on revolving credit

facility for long-term deposits 125 — Increase in long-term

deposits (125 ) — Contributions to, net of distributions from,

noncontrolling interest in subsidiaries (5 ) 10 Payment of debt

issuance costs (15 ) — Other - contingent consideration (10 ) (10 )

Net Cash Used by Financing Activities (153 ) (264 ) Effect

of exchange rate changes on cash and cash equivalents (7 ) (6 )

Net (Decrease)/ Increase in Cash and Cash Equivalents (460 )

141

Cash and Cash Equivalents at Beginning of Period 1,973

1,518

Cash and Cash Equivalents at End of

Period $ 1,513 $ 1,659

Appendix Table A-1: First Quarter 2017

Adjusted EBITDA Reconciliation by Operating Segment

The following table summarizes the

calculation of Adj. EBITDA and provides a reconciliation to net

(loss)/income:

($ in millions) Generation Retail

Renewables NRG Yield Corp/Elim Total

Net (Loss)/Income 67

(33 ) (31 ) (1

) (205 ) (203 )

Plus: Interest expense, net 20 1 21 76 147 265 Income tax — 3 (6 )

(1 ) — (4 ) Loss on debt extinguishment — — 2 — — 2 Depreciation

and amortization 138 28 49 75 10 300 ARO Expense 13 — — 1 — 14

Amortization of contracts (5 ) 1 — 17 — 13 Amortization of leases

(12 ) — — —

— (12 )

EBITDA 221 —

35

167 (48 ) 375 Adjustment to reflect NRG

share of adjusted EBITDA in unconsolidated affiliates 13 (3 ) (4 )

13 — 19 Acquisition-related transaction & integration costs — —

— 1 — 1 Reorganization costs — — — — 8 8 Deactivation costs 3 — — —

1 4 Other non recurring charges (1 ) (1 ) — 3 (2 ) (1 ) Mark to

market (MtM) (gains)/losses on economic hedges (125 )

137 (6 ) — —

6

Adjusted EBITDA 111

133 25

184 (41 ) 412

First Quarter 2017 condensed financial

information by Operating Segment:

($ in millions) Generation Retail

Renewables NRG Yield Corp/Elim Total

Operating revenues 1,208 1,334 92 235 (223 ) 2,646 Cost of sales

600 997 4

16 (213 ) 1,404

Economic gross

margin 608 337 88 219 (10

) 1,242 Operations & maintenance and other cost

of operations (a) 414 80 34 67 (12 ) 583 Selling, marketing,

general and administrative(b) 82 119 15 4 43 263 Other

expense/(income) 1 5 14

(36 ) — (16 )

Adjusted

EBITDA 111 133

25 184 (41

) 412

(a) Excludes deactivation costs of $4 million.(b) Excludes

reorganization costs of $8 million and integration costs of $1

million.

The following table reconciles the

condensed financial information to Adjusted EBITDA:

($ in millions) Condensed financial

information Interest, tax, depr., amort. MtM

Deactivation Other adj. Adjusted EBITDA Operating

revenues 2,759 15 (128 ) — — 2,646 Cost of operations

1,536 2 (134 ) — —

1,404

Gross margin 1,223

13 6 — —

1,242 Operations & maintenance

and other cost of operations 589 (2 ) — (4 ) — 583 Selling,

marketing, general & administrative (a) 272 — — — (9 ) 263

Other expense/(income) 565 (582 )

— — 1 (16 )

Net

Loss (203 ) 597

6 4

8 412

(a) Other adj. includes reorganization costs of $8 million and

integration costs of $1 million.

Appendix Table A-2: First Quarter 2016

Adjusted EBITDA Reconciliation by Operating Segment

The following table summarizes the

calculation of Adjusted EBITDA and provides a reconciliation to net

income/(loss):

($ in millions) Generation Retail

Renewables NRG Yield Corp/Elim Total

Net Income/(Loss) 191

150 (40 ) 2

(256 ) 47 Plus: Interest

expense, net 10 — 27 74 170 281 Income tax — — (6 ) — 27 21 Gain on

debt extinguishment — — — — (11 ) (11 ) Depreciation and

amortization 144 30 48 74 17 313 ARO Expense 9 — — 1 — 10

Amortization of contracts (2 ) 3 — 23 (3 ) 21 Amortization of

leases (12 ) — — —

— (12 )

EBITDA 340

183 29 174 (56 ) 670

Adjustment to reflect NRG share of adjusted EBITDA in

unconsolidated affiliates 9 — — 24 1 34 Reorganization costs 1 5 2

— 2 10 Deactivation costs 7 — — — — 7 Gain on sale of business (29

) — — — — (29 ) Other non recurring charges 2 1 3 — 3 9 Impairments

137 — — — 9 146 Mark to market (MtM) (gains)/losses on economic

hedges (1 ) (33 ) (1 ) —

— (35 )

Adjusted EBITDA

466 156 33

198 (41 )

812

First Quarter 2016 condensed financial

information by Operating Segment:

($ in millions) Generation Retail

Renewables NRG Yield Corp/Elim Total

Operating revenues 1,702 1,371 95 251 (201 ) 3,218 Cost of sales

666 1,025 2

16 (204 ) 1,505

Economic gross

margin 1,036 346 93 235 3

1,713 Operations & maintenance and other cost of

operations (a) 501 84 38 61 3 687 Selling, marketing, general &

administrative (b) 85 106 12 3 36 242 Other expense/(income) (c)

(16 ) — 10 (27 )

5 (28 )

Adjusted EBITDA

466 156 33

198 (41 )

812

(a) Excludes deactivation costs of $7 million.(b) Excludes

reorganization costs of $10 million.(c) Excludes impairments of

$146 million, gain on sale of business of $29 million and gain on

debt extinguishment of $11 million.

The following table reconciles the

condensed financial information to Adjusted EBITDA:

($ in millions) Condensed financial

information Interest, tax, depr., amort. MtM

Deactivation Other adj. Adjusted EBITDA Operating

revenues 3,229 15 (26 ) — — 3,218 Cost of operations

1,502 (6 ) 9 — —

1,505

Gross margin 1,727

21 (35 ) — — 1,713

Operations & maintenance and other cost of operations 692 2 —

(7 ) — 687 Selling, marketing, general & administrative (a) 252

— — — (10 ) 242 Other expense/(income) (b) 736

(649 ) — — (115 )

(28 )

Net Income 47

668 (35 ) 7

125 812

(a) Other adj. includes reorganization costs of $10 million.(b)

Other adj. includes impairments of $146 million, gain on sale of

business of $29 million and gain on debt extinguishment of $11

million.

Appendix Table A-3: 2017 and 2016 First

Quarter Adjusted Cash Flow from Operations Reconciliations

The following table summarizes the

calculation of adjusted cash flow operating activities providing a

reconciliation to net cash provided by operating activities:

Three Months Ended ($ in millions)

March 31, 2017 March 31, 2016 Net

Cash Provided by Operating Activities (68 )

554 Reclassifying of net receipts for

settlement of acquired derivatives that include financing elements

1 39 Sale of Land 8 — Merger, integration and cost-to-achieve

expenses (1) — 19 Return of capital from equity investments 14 5

Adjustment for change in collateral 74

(156 )

Adjusted Cash Flow from Operating Activities

29 461

Maintenance CapEx, net (2) (54 ) (91 ) Environmental CapEx, net (25

) (77 ) Preferred dividends — (2 ) Distributions to non-controlling

interests (46 ) (42 )

Free Cash Flow

Before Growth Investments (FCFbG) (96

) 249

(1) 2016 includes cost-to-achieve expenses associated with the

$150 million savings announced on September 2015 call.(2) Includes

insurance proceeds of $18 million and $4 million in 2017 and 2016,

respectively

Appendix Table A-4: First Quarter 2017

Regional Adjusted EBITDA Reconciliation for Generation

The following table summarizes the

calculation of Adjusted EBITDA and provides a reconciliation to net

income/(loss):

($ in millions) Gulf Coast East

West Other Total

Net Income/(Loss)

39 36 (7

) (1 ) 67 Plus:

Interest expense, net 1 19 — — 20 Depreciation and amortization 73

59 6 — 138 ARO Expense 4 6 3 — 13 Amortization of contracts 2 (5 )

(2 ) — (5 ) Amortization of leases —

(12 ) — — (12 )

EBITDA

119 103 — (1 ) 221

Adjustment to reflect NRG share of adjusted EBITDA in

unconsolidated affiliates 7 — 3 3 13 Deactivation costs — 1 2 — 3

Other non recurring charges — (2 ) 1 — (1 ) Market to market (MtM)

losses/(gains) on economic hedges (121 ) 3

(7 ) — (125 )

Adjusted

EBITDA 5 105

(1 ) 2 111

First Quarter 2017 condensed financial

information for Generation:

($ in millions) Gulf Coast East

West Other Elims. Total Operating revenues 528

626 51 6 (3 ) 1,208 Cost of sales 318

264 18 — —

600

Economic gross margin 210 362 33

6 (3 ) 608 Operations & maintenance

and other cost of operations (a) 169 220 28 — (3 ) 414 Selling,

marketing, general & administrative 34 36 6 6 — 82 Other

expense/(income) 2 1 —

(2 ) — 1

Adjusted EBITDA

5 105

(1 ) 2 —

111

(a) Excludes deactivation costs of $3 million.

The following table reconciles the

condensed financial information to Adjusted EBITDA:

($ in millions) Condensed financial

information Interest, tax, depr., amort. MtM

Deactivation Other adj. Adjusted EBITDA Operating

revenues 1,343 (3 ) (132 ) — — 1,208 Cost of operations

605 2 (7 ) —

— 600

Gross margin 738 (5

) (125 ) — — 608

Operations & maintenance and other cost of operations 418 (1 )

— (3 ) — 414 Selling, marketing, general & administrative 82 —

— — — 82 Other expense/(income) 171

(171 ) — — 1 1

Net Income 67 167

(125 ) 3 (1

)

111

Appendix Table A-5: First Quarter 2016

Regional Adjusted EBITDA Reconciliation for Generation

The following table summarizes the

calculation of Adjusted EBITDA and provides a reconciliation to net

income/(loss):

($ in millions) Gulf Coast East

West Other Total

Net Income/(Loss)

(125 ) 242

30 44 191

Plus: Interest expense, net — 10 — — 10 Depreciation and

amortization 76 53 15 — 144 ARO Expense 3 4 2 — 9 Amortization of

contracts 2 (5 ) 1 — (2 ) Amortization of leases (1 )

(11 ) — — (12 )

EBITDA (45 ) 293 48 44

340 Adjustment to reflect NRG share of adjusted EBITDA in

unconsolidated affiliates 3 — 2 4 9 Reorganization costs 1 — — — 1

Deactivation costs — 7 — — 7 Gain on sale of assets — (29 ) — — (29

) Other non recurring charges — — — 2 2 Impairments 137 — — — 137

Market to market (MtM) losses/(gains) on economic hedges

26 (30 ) 3 —

(1 )

Adjusted EBITDA 122

241 53 50

466

First Quarter 2016 condensed financial

information for Generation:

($ in millions) Gulf Coast East

West Other Elims. Total Operating revenues 602

946 117 41 (4 ) 1,702 Cost of sales 280

368 18 — —

666

Economic gross margin 322 578

99 41 (4 ) 1,036 Operations

& maintenance and other cost of operations (a) 170 295 40 — (4

) 501 Selling, marketing, general & administrative 30 41 7 7 —

85 Other expense/(income)(b) — 1

(1 ) (15 ) — (15 )

Adjusted

EBITDA 122 241

53 50 —

466

(a) Excludes deactivation costs of $7 million.(b) Excludes

impairments of $137 million.

The following table reconciles the

condensed financial information to Adjusted EBITDA:

($ in millions) Condensed financial

information Interest, tax, depr., amort. MtM

Deactivation Other adj. Adjusted EBITDA Operating

revenues 1,708 (3 ) (3 ) — — 1,702 Cost of operations

669 (1 ) (2 ) — —

666

Gross margin 1,039 (2

) (1 ) — — 1,036

Operations & maintenance and other cost of operations 505 3 —

(7 ) — 501 Selling, marketing, general & administrative 86 — —

— (1 ) 85 Other expense/(income) (a) 257

(163 ) — — (110 )

(16 )

Net Income 191

158 (1 ) 7

111 466

(a) Other adj. includes impairments of $137 million.

Appendix Table A-6: First Quarter 2017

Sources and Uses of Liquidity

The following table summarizes the sources

and uses of liquidity in the first quarter of 2017:

($ in millions)

Three Months Ended

March 31, 2017

Sources: Adjusted cash flow from operations 29 Asset sales 6

Issuance of Agua Caliente HoldCo debt 130 NYLD Equity Issuance 7

Tax Equity Proceeds 16 Increase in credit facility 147

Uses: Maintenance and environmental capex, net (1) (80 )

Debt Repayments, net of proceeds (146 ) Growth investments and

acquisitions, net (152 ) GENMA long-term deposit (130 ) Collateral

(74 ) Distributions to non-controlling interests (46 ) Nuclear

Decommissioning Trust (36 ) Common Stock Dividends (9 ) Other

Investing and Financing (24 )

Change in Total Liquidity

(362 )

(1) Includes insurance proceeds of $18 million.

Appendix Table A-7: 2017 Adjusted

EBITDA Guidance Reconciliation

The following table summarizes the

calculation of Adjusted EBITDA providing reconciliation to net

income:

2017 Adjusted EBITDA ($ in millions)

Low High GAAP Net Income 1 60

260 Income Tax 80 80 Interest Expense & Debt

Extinguishment Costs 1,155 1,155 Depreciation, Amortization,

Contract Amortization and ARO Expense 1,235 1,235 Adjustment to

reflect NRG share of adjusted EBITDA in unconsolidated affiliates

110 110 Other Costs 2 60 60

Adjusted EBITDA

2,700 2,900

(1) For purposes of guidance, fair value adjustments related to

derivatives are assumed to be zero.(2) Includes deactivation costs,

gain on sale of businesses, asset write-offs, impairments and other

non-recurring charges.

Appendix Table A-8: 2017 FCFbG Guidance

Reconciliation

The following table summarizes the

calculation of Free Cash Flow before Growth providing

reconciliation to Cash from Operations:

2017 ($ in millions)

Guidance Adjusted EBITDA $2,700

- $2,900 Cash Interest payments (1,065) Cash Income tax (40)

Collateral / working capital / other (240) Cash From Operations

$1,355 - $1,555 Adjustments: Acquired Derivatives, Cost-to-Achieve,

Return of Capital Dividends, Collateral and Other — Adjusted Cash

flow from operations $1,355 - $1,555 Maintenance capital

expenditures, net (280) - (310) Environmental capital expenditures,

net (40) - (60) Distributions to non-controlling interests (185) -

(205) Free Cash Flow - before Growth Investments $800 - $1,000

EBITDA and Adjusted EBITDA are non-GAAP financial measures.

These measurements are not recognized in accordance with GAAP and

should not be viewed as an alternative to GAAP measures of

performance. The presentation of Adjusted EBITDA should not be

construed as an inference that NRG’s future results will be

unaffected by unusual or non-recurring items.

EBITDA represents net income before interest (including loss on

debt extinguishment), taxes, depreciation and amortization. EBITDA

is presented because NRG considers it an important supplemental

measure of its performance and believes debt-holders frequently use

EBITDA to analyze operating performance and debt service capacity.

EBITDA has limitations as an analytical tool, and you should not

consider it in isolation, or as a substitute for analysis of our

operating results as reported under GAAP. Some of these limitations

are:

- EBITDA does not reflect cash

expenditures, or future requirements for capital expenditures, or

contractual commitments;

- EBITDA does not reflect changes in, or

cash requirements for, working capital needs;

- EBITDA does not reflect the significant

interest expense, or the cash requirements necessary to service

interest or principal payments, on debt or cash income tax

payments;

- Although depreciation and amortization

are non-cash charges, the assets being depreciated and amortized

will often have to be replaced in the future, and EBITDA does not

reflect any cash requirements for such replacements; and

- Other companies in this industry may

calculate EBITDA differently than NRG does, limiting its usefulness

as a comparative measure.

Because of these limitations, EBITDA should not be considered as

a measure of discretionary cash available to use to invest in the

growth of NRG’s business. NRG compensates for these limitations by

relying primarily on our GAAP results and using EBITDA and Adjusted

EBITDA only supplementally. See the statements of cash flow

included in the financial statements that are a part of this news

release.

Adjusted EBITDA is presented as a further supplemental measure

of operating performance. As NRG defines it, Adjusted EBITDA

represents EBITDA excluding impairment losses, gains or losses on

sales, dispositions or retirements of assets, any mark-to-market

gains or losses from accounting for derivatives, adjustments to

exclude the Adjusted EBITDA related to the non-controlling

interest, gains or losses on the repurchase, modification or

extinguishment of debt, the impact of restructuring and any

extraordinary, unusual or non-recurring items plus adjustments to

reflect the Adjusted EBITDA from our unconsolidated investments.

The reader is encouraged to evaluate each adjustment and the

reasons NRG considers it appropriate for supplemental analysis. As

an analytical tool, Adjusted EBITDA is subject to all of the

limitations applicable to EBITDA. In addition, in evaluating

Adjusted EBITDA, the reader should be aware that in the future NRG

may incur expenses similar to the adjustments in this news

release.

Management believes Adjusted EBITDA is useful to investors and

other users of NRG's financial statements in evaluating its

operating performance because it provides an additional tool to

compare business performance across companies and across periods

and adjusts for items that we do not consider indicative of NRG’s

future operating performance. This measure is widely used by

debt-holders to analyze operating performance and debt service

capacity and by equity investors to measure our operating

performance without regard to items such as interest expense,

taxes, depreciation and amortization, which can vary substantially

from company to company depending upon accounting methods and book

value of assets, capital structure and the method by which assets

were acquired. Management uses Adjusted EBITDA as a measure of

operating performance to assist in comparing performance from

period to period on a consistent basis and to readily view

operating trends, as a measure for planning and forecasting overall

expectations, and for evaluating actual results against such

expectations, and in communications with NRG's Board of Directors,

shareholders, creditors, analysts and investors concerning its

financial performance.

Adjusted cash flow from operating activities is a non-GAAP

measure NRG provides to show cash from operations with the

reclassification of net payments of derivative contracts acquired

in business combinations from financing to operating cash flow, as

well as the add back of merger, integration and related

restructuring costs. The Company provides the reader with this

alternative view of operating cash flow because the cash settlement

of these derivative contracts materially impact operating revenues

and cost of sales, while GAAP requires NRG to treat them as if

there was a financing activity associated with the contracts as of

the acquisition dates. The Company adds back merger, integration

related restructuring costs as they are one time and unique in

nature and do not reflect ongoing cash from operations and they are

fully disclosed to investors.

Free cash flow (before Growth Investments) is adjusted cash flow

from operations less maintenance and environmental capital

expenditures, net of funding, preferred stock dividends and

distributions to non-controlling interests and is used by NRG

predominantly as a forecasting tool to estimate cash available for

debt reduction and other capital allocation alternatives. The

reader is encouraged to evaluate each of these adjustments and the

reasons NRG considers them appropriate for supplemental analysis.

Because we have mandatory debt service requirements (and other

non-discretionary expenditures) investors should not rely on Free

Cash Flow before Growth Investments as a measure of cash available

for discretionary expenditures.

Free Cash Flow before Growth Investments is utilized by

Management in making decisions regarding the allocation of capital.

Free Cash Flow before Growth Investment is presented because the

Company believes it is a useful tool for assessing the financial

performance in the current period. In addition, NRG’s peers

evaluate cash available for allocation in a similar manner and

accordingly, it is a meaningful indicator for investors to

benchmark NRG's performance against its peers. Free Cash Flow

before Growth Investment is a performance measure and is not

intended to represent net income (loss), cash from operations (the

most directly comparable U.S. GAAP measure), or liquidity and is

not necessarily comparable to similarly titled measures reported by

other companies.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170502005806/en/

NRG Energy, Inc.Media:Marijke Shugrue,

609-524-5262orInvestors:Kevin L. Cole, CFA,

609-524-4526orLindsey Puchyr, 609-524-4527

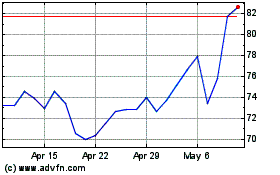

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Aug 2024 to Sep 2024

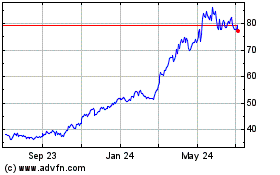

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Sep 2023 to Sep 2024