ServiceNow® (NYSE: NOW) today announced the financial results

for its first quarter 2017.

First Quarter 2017 GAAP Results:

- Subscription revenues of $376.1

million, representing 41% year-over-year growth.

- Professional services and other

revenues of $40.6 million, representing 6% year-over-year

growth.

- Total revenues of $416.8 million,

representing 36% year-over-year growth.

- Subscription gross profit of $305.8

million, representing 81% of subscription revenues.

- Professional services and other gross

loss of $5.4 million, representing negative 13% of professional

services and other revenues.

- Total gross profit of $300.3 million,

representing 72% of total revenues.

- Loss from operations of $42.5 million,

representing negative 10% of total revenues.

- Net loss of $40.7 million, or loss of

$0.24 per basic and diluted share.

- Net cash provided by operating

activities of $187.4 million, representing 45% of total

revenues.

First Quarter 2017 Non-GAAP Results:

We report non-GAAP financial measures in addition to, and not as

a substitute for, or superior to, financial measures calculated in

accordance with GAAP. For the following non-GAAP results, see the

section entitled “Statement Regarding Use of Non-GAAP Financial

Measures” for an explanation of non-GAAP measures and the

corresponding growth rates, and the table entitled "GAAP to

Non-GAAP Reconciliation” for a reconciliation of non-GAAP to GAAP

measures and corresponding growth rates.

- Subscription revenues of $382.7

million, representing 43% year-over-year growth adjusted for

constant currency.

- Professional services and other

revenues of $41.3 million, representing 8% year-over-year growth

adjusted for constant currency.

- Total revenues of $424.0 million,

representing 39% year-over-year growth adjusted for constant

currency.

- Subscription billings of $478.7

million, representing 44% year-over-year growth (or $466.2 million,

representing 41% year-over-year growth adjusted for constant

currency and constant billings duration).

- Professional services and other

billings of $50.5 million, representing 11% year-over-year growth

(or $51.2 million, representing 13% year-over-year growth adjusted

for constant currency).

- Total billings of $529.2 million,

representing 40% year-over-year growth (or $517.5 million,

representing 37% year-over-year growth adjusted for constant

currency and constant billings duration).

- Subscription gross profit of $317.3

million, representing 84% of subscription revenues.

- Professional services and other gross

profit of $1.5 million, representing 4% of professional services

and other revenues.

- Total gross profit of $318.8 million,

representing 76% of total revenues.

- Income from operations of $52.3

million, representing 13% of total revenues.

- Net income of $41.9 million, or

earnings of $0.25 per basic share and $0.24 per diluted share.

- Free cash flow of $154.2 million,

representing 37% of total revenues.

“We’re off to a strong start in Q1, continuing to diversify our

business mix,” said John Donahoe, president and chief

executive officer, ServiceNow. “Now 73 percent of all our customers

license more than one product up from 50 percent two years ago. As

Frank passes the torch, the company is well positioned to deliver

on its goals with loyal customers and a growing partner

ecosystem.”

“We continue to see success with our land and expand strategy,

adding 26 new Global 2000 customers in Q1, compared to 21 in the

same period last year,” said Michael Scarpelli, chief financial

officer, ServiceNow. “We now have 370 customers each paying us more

than $1 million in annualized contract value, an increase of 51

percent year-over-year.”

Financial Outlook

Our guidance is based on foreign exchange rates as of March 31,

2017. See the section entitled “Statement Regarding Use of Non-GAAP

Financial Measures” for an explanation of non-GAAP measures and the

corresponding growth rates, and the table entitled “Reconciliation

of Non-GAAP Financial Guidance” for a reconciliation of non-GAAP to

GAAP metrics and corresponding growth rates.

For the second quarter of 2017, we expect:

- GAAP subscription revenues between $400

and $404 million, representing 38% to 39% year-over-year growth (or

non-GAAP subscription revenues between $409 and $413 million,

representing 41% to 42% year-over-year growth adjusted for constant

currency).

- GAAP professional services and other

revenues between $58 and $59 million, representing 15% to 17%

year-over-year growth (or non-GAAP professional services and other

revenues between $60 and $61 million, representing 18% to 20%

year-over-year growth adjusted for constant currency).

- GAAP total revenues between $458 and

$463 million, representing 34% to 36% year-over-year growth (or

non-GAAP total revenues between $469 and $474 million, representing

37% to 39% year-over-year growth adjusted for constant

currency).

- Non-GAAP subscription billings between

$444 and $448 million, representing 33% to 35% year-over-year

growth (or between $460 and $464 million, representing 38% to 39%

year-over-year growth adjusted for constant currency and constant

billings duration).

- Non-GAAP professional services and

other billings between $47 and $48 million, representing 12% to 14%

year-over-year growth (or between $49 and $50 million, representing

16% to 19% year-over-year growth adjusted for constant

currency).

- Non-GAAP total billings between $491

and $496 million, representing 31% to 32% year-over-year growth (or

between $509 and $514 million, representing 36% to 37%

year-over-year growth adjusted for constant currency and constant

billings duration).

- Non-GAAP operating margin of 11%.

- Non-GAAP weighted average shares used

to compute diluted net income per share of approximately 179

million shares.

For the full year 2017, we expect:

- GAAP subscription revenues between

$1,670 and $1,685 million, representing 37% to 38% year-over-year

growth (or non-GAAP subscription revenues between $1,693 and $1,708

million, representing 39% to 40% year-over-year growth adjusted for

constant currency).

- GAAP professional services and other

revenues between $190 and $195 million, representing 13% to 15%

year-over-year growth (or non-GAAP professional services and other

revenues between $193 and $198 million, representing 14% to 17%

year-over-year growth adjusted for constant currency).

- GAAP total revenues between $1,860 and

$1,880 million, representing 34% to 35% year-over-year growth (or

non-GAAP total revenues between $1,886 and $1,906 million,

representing 36% to 37% year-over-year growth adjusted for constant

currency).

- Non-GAAP subscription billings between

$2,030 and $2,045 million, representing 34% to 35% year-over-year

growth (or between $2,064 and $2,079 million, representing 37% to

38% year-over-year growth adjusted for constant currency and

constant billings duration).

- Non-GAAP professional services and

other billings between $205 and $210 million, representing 14% to

17% year-over-year growth (or between $208 and $213 million,

representing 16% to 18% year-over-year growth adjusted for constant

currency).

- Non-GAAP total billings between $2,235

and $2,255 million, representing 32% to 33% year-over-year growth

(or between $2,272 and $2,292 million, representing 34% to 36%

year-over-year growth adjusted for constant currency and constant

billings duration).

- Non-GAAP subscription gross margin of

84%.

- Non-GAAP professional services and

other gross margin of 15%.

- Non-GAAP total gross margin of

77%.

- Non-GAAP operating margin of 16%.

- Non-GAAP free cash flow margin of

25%.

- Non-GAAP weighted average shares used

to compute diluted net income per share of approximately 179

million shares.

Conference Call Details

The conference call will begin at 2 p.m. Pacific Time (21:00

GMT) on Wednesday, April 26, 2017. Interested parties may listen to

the call by dialing 844.464.3153 (passcode: 95378330), or if

outside North America, by dialing +1.508.637.5575 (passcode:

95378330). Individuals may access the live teleconference from

the investor relations section of the ServiceNow website at

http://investors.servicenow.com.

An audio replay of the conference call and webcast will be

available two hours after its completion and will be accessible for

30 days. To hear the replay, interested parties may go to the

investor relations section of the ServiceNow website or dial

855.859.2056 (passcode: 95378330), or if outside North America, by

dialing +1.404.537.3406 (passcode: 95378330).

Investor Presentation Details

An investor presentation providing additional information and

analysis can be found at http://investors.servicenow.com.

Statement Regarding Use of Non-GAAP Financial

Measures

We report non-GAAP financial measures in addition to, and not as

a substitute for, or superior to, financial measures calculated in

accordance with GAAP.

We present revenues adjusted for constant currency and

corresponding growth rates to provide a framework for assessing how

our business performed excluding the effect of foreign currency

rate fluctuations. To present this information, current period

results for entities reporting in currencies other than U.S.

Dollars are converted into U.S. Dollars at the exchange rates in

effect during the prior period presented, rather than the actual

exchange rates in effect during the current period. We believe the

presentation of revenues adjusted for constant currency facilitates

the comparison of revenues year-over-year.

We believe billings is a useful leading indicator regarding the

performance of our business. We present subscription billings,

professional services and other billings, and total billings, and

corresponding growth rates, as the applicable revenue plus the

applicable change in deferred revenue as presented or derived from

the statement of cash flows. While we typically bill customers

annually for our subscription services, customers sometimes

request, and we accommodate, multi-year billings, which are

billings with durations in excess of the typical 12 month term.

Accordingly, to facilitate greater comparability in our billings

information, we further present billings adjusted for constant

billings duration, in addition to adjusting for constant currency.

To present this information, we adjust subscription billings and

total billings for constant currency as described above, and adjust

for constant duration by replacing the portion of multi-year

billings in excess of twelve months during the current period with

the portion of multi-year billings in excess of twelve months

during the prior period presented. We also present professional

services and other billings and corresponding growth rates adjusted

for constant currency as described above.

Our non-GAAP presentation of gross profit, income from

operations and net income measures exclude stock-based compensation

expense, amortization of debt discount and issuance costs related

to the convertible senior notes, amortization of purchased

intangibles, legal settlements, business combination and other

related costs, and the related income tax effect of these

adjustments. We believe the presentation of operating results that

exclude these non-cash or non-recurring items provides useful

supplemental information to investors and facilitates the analysis

of our operating results and comparison of operating results across

reporting periods.

Free cash flow, which is a non-GAAP financial measure, is

calculated as net cash provided by operating activities plus cash

paid for legal settlements, reduced by purchases of property and

equipment. Free cash flow margin is calculated as free cash flow as

a percentage of total revenues. We believe information regarding

free cash flow and free cash flow margin provides useful

information to investors because it is an indicator of the strength

and performance of our business operations. However, our

calculation of free cash flow and free cash flow margin may not be

comparable to similar measures used by other companies.

The company encourages investors to carefully consider its

results under GAAP, as well as its supplemental non-GAAP

information and the reconciliation between these presentations, to

more fully understand its business. Please see the tables included

at the end of this release for the reconciliation of GAAP and

non-GAAP results.

Use of Forward-Looking Statements

This release contains “forward-looking statements” regarding our

performance, including but not limited to the section entitled

“Financial Outlook.” Forward-looking statements are subject to

known and unknown risks and uncertainties and are based on

potentially inaccurate assumptions that could cause actual results

to differ materially from those expected or implied by the

forward-looking statements. If any such risks or uncertainties

materialize or if any of the assumptions prove incorrect, our

results could differ materially from the results expressed or

implied by the forward-looking statements we make.

Among the important factors that could cause actual results to

differ materially from those in any forward-looking statements

include: (i) errors, interruptions, delays, or security

breaches in or of our service or web hosting, (ii) our ability

to grow at our expected rate of growth, including our ability to

convert deferred revenue and backlog into revenue, add and retain

customers, sell additional subscriptions to existing customers and

enter new geographies and markets, (iii) our ability to

continue to release, and gain customer acceptance of, improved

versions of our services, (iv) our ability to develop and gain

customer acceptance of new products and services, including our

platform, and (v) our ability to compete successfully against

existing and new competitors.

Further information on these and other factors that could affect

our financial results are included in our Form 10-K for the year

ended December 31, 2016 and in other filings we make with the

Securities and Exchange Commission from time to time, including our

Form 10-Q that will be filed for the quarter ended March 31,

2017.

We undertake no obligation, and do not intend, to update these

forward-looking statements, to review or confirm analysts’

expectations, or to provide interim reports or updates on the

progress of the current financial quarter.

About ServiceNow

Your enterprise needs to move faster, but lack of process and

legacy tools hold you back. Every day, thousands of customer

requests, IT incidents, and HR cases follow their own paths—moving

back and forth between people, machines and departments.

Unstructured. Undocumented. Unimproved for years. With the

ServiceNow® System of Action™ you can replace these unstructured

work patterns of the past with intelligent workflows of the future.

Now every employee, customer and machine can make requests on a

single cloud platform. Every department working on these requests

can assign and prioritize, collaborate, get down to root cause

issues, gain real-time insights and drive to action. Your employees

are energized. Your service levels improve. And you realize

game-changing economics. Work at Lightspeed™. To find out how,

visit www.servicenow.com.

© 2017 ServiceNow, Inc. All rights reserved. ServiceNow, the

ServiceNow logo, and other ServiceNow marks are trademarks and/or

registered trademarks of ServiceNow, Inc., in the United States

and/or other countries. Other company and product names may be

trademarks of the respective companies with which they are

associated.

ServiceNow, Inc. Condensed Consolidated

Statements of Operations (in thousands, except share and per

share data) (unaudited)

Three Months Ended March 31, 2017 March 31,

2016 Revenues: Subscription $ 376,135 $ 267,422

Professional services and other 40,648 38,457

Total revenues 416,783 305,879

Cost of revenues (1): Subscription 70,375 52,781 Professional

services and other 46,072 41,479 Total

cost of revenues 116,447 94,260 Gross

profit 300,336 211,619 Operating

expenses (1): Sales and marketing 212,086 158,610 Research and

development 84,489 65,924 General and administrative 46,251 41,237

Legal settlement — 270,000 Total

operating expenses 342,826 535,771 Loss

from operations (42,490 ) (324,152 ) Interest expense (8,678 )

(8,109 ) Interest income and other income (expense), net

7,716 702 Loss before income taxes (43,452 )

(331,559 ) Provision for (benefit from) income taxes (2,790

) 1,773 Net loss $ (40,662 ) $ (333,332 ) Net loss

per share - basic and diluted $ (0.24 ) $ (2.06 ) Weighted-average

shares used to compute net loss per share - basic and diluted

168,742,366 162,067,108

(1)

Includes total stock-based compensation expense for stock-based

awards as follows:

Three Months Ended March 31, 2017

March 31, 2016 Cost of revenues: Subscription $ 7,938 $

6,607 Professional services and other 6,949 6,759 Sales and

marketing 38,401 30,998 Research and development 21,801 20,533

General and administrative 14,854 10,411

ServiceNow, Inc.

Condensed Consolidated Balance

Sheets

(in thousands)

(unaudited)

March 31, 2017 December 31, 2016 ASSETS

Current assets: Cash and cash equivalents $ 439,915 $ 401,238

Short-term investments 535,399 498,124 Accounts receivable, net

278,107 322,757 Current portion of deferred commissions 78,786

76,780 Prepaid expenses and other current assets 64,048

43,636 Total current assets 1,396,255 1,342,535 Deferred

commissions, less current portion 61,648 61,990 Long-term

investments 326,261 262,658 Property and equipment, net 189,659

181,620 Intangible assets, net 67,755 65,854 Goodwill 96,914 82,534

Other assets 31,771 36,576 Total assets $ 2,170,263 $

2,033,767

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities: Accounts payable $ 33,658 $ 38,080 Accrued

expenses and other current liabilities 144,594 171,636 Current

portion of deferred revenue 961,553 861,782 Total

current liabilities 1,139,805 1,071,498 Deferred revenue, less

current portion 50,440 33,319 Convertible senior notes, net 516,490

507,812 Other long-term liabilities 36,189 34,177 Stockholders’

equity 427,339 386,961

Total liabilities and stockholders’

equity

$ 2,170,263 $ 2,033,767

ServiceNow,

Inc. Condensed Consolidated Statements of Cash Flows

(in thousands) (unaudited)

Three Months Ended March 31, 2017

March 31, 2016 Cash flows from operating

activities: Net loss $ (40,662 ) $ (333,332 ) Adjustments to

reconcile net loss to net cash provided by operating activities:

Depreciation and amortization 25,226 17,452 Amortization of

premiums on investments 945 1,490 Amortization of deferred

commissions 26,180 18,033 Amortization of debt discount and

issuance costs 8,678 8,109 Stock-based compensation 89,943 75,308

Deferred income tax (3,291 ) — Other (2,218 ) (330 ) Changes in

operating assets and liabilities, net of effect of business

combinations: Accounts receivable 47,021 15,811 Deferred

commissions (27,195 ) (23,971 ) Prepaid expenses and other assets

(22,772 ) (19,808 ) Accounts payable 675 3,387 Deferred revenue

112,447 70,803 Accrued expenses and other liabilities

(27,553 ) 245,735 Net cash provided by operating

activities 187,424 78,687

Cash flows

from investing activities: Purchases of property and equipment

(33,186 ) (29,077 ) Business combinations, net of cash acquired

(15,035 ) (500 ) Purchase of other intangibles — (5,750 ) Purchases

of investments (222,596 ) (180,365 ) Purchase of strategic

investments (1,000 ) — Sales of investments 21,789 92,885

Maturities of investments 122,263 91,858 Restricted cash

(689 ) (457 ) Net cash used in investing activities

(128,454 ) (31,406 )

Cash flows from financing

activities: Proceeds from employee stock plans 34,807 19,873

Taxes paid related to net share settlement of equity awards (53,023

) (28,453 ) Payments on financing obligations (1,415 )

(110 ) Net cash used in financing activities (19,631

) (8,690 ) Foreign currency effect on cash and cash

equivalents (662 ) 2,554 Net increase in cash

and cash equivalents 38,677 41,145 Cash and cash equivalents at

beginning of period 401,238 412,305

Cash and cash equivalents at end of period $ 439,915 $

453,450

ServiceNow, Inc.

GAAP to Non-GAAP Reconciliation (in thousands, except

share and per share data) (unaudited)

Three Months Ended March 31, 2017 March 31,

2016 (3) Growth Rates Subscription

revenues: GAAP subscription revenues $ 376,135 $ 267,422 41%

Effects of foreign currency rate fluctuations 6,521 Non-GAAP

adjusted subscription revenues (1) $ 382,656 43%

Subscription billings: GAAP subscription revenues $ 376,135

$ 267,422 41% Increase in subscription deferred revenue

102,558 63,873 Non-GAAP subscription billings $ 478,693 $

331,295 44% Effects of foreign currency rate fluctuations 8,831

Effects of fluctuations in billings duration (21,302)

Non-GAAP adjusted subscription billings (2) $ 466,222 41%

Professional services and other revenues: GAAP professional

services and other revenues $ 40,648 $ 38,457 6% Effects of foreign

currency rate fluctuations 694 Non-GAAP adjusted

professional services and other revenues (1) $ 41,342 8%

Professional services and other billings: GAAP professional

services and other revenues $ 40,648 $ 38,457 6% Increase in

professional services and other deferred revenue 9,889

6,930 Non-GAAP professional services and other billings

50,537 45,387 11% Effects of foreign currency rate fluctuations

694 Non-GAAP adjusted professional services and other

billings (2) $ 51,231 13%

Total revenues: GAAP total

revenues $ 416,783 $ 305,879 36% Effects of foreign currency rate

fluctuations 7,215 Non-GAAP adjusted total revenues (1) $

423,998 39%

Total billings: GAAP total revenues $

416,783 $ 305,879 36% Increase in total deferred revenue from

condensed consolidated statements of cash flows 112,447

70,803 Non-GAAP total billings 529,230 376,682 40% Effects

of foreign currency rate fluctuations 9,525 Effects of fluctuations

in billings duration (21,302) Non-GAAP adjusted total

billings (2) $ 517,453 37%

Cost of revenues: GAAP

subscription cost of revenues $ 70,375 $ 52,781 Stock-based

compensation (7,938) (6,607) Amortization of purchased intangibles

(3,572) (2,768) Non-GAAP subscription cost of

revenues $ 58,865 $ 43,406 GAAP professional services and

other cost of revenues $ 46,072 $ 41,479 Stock-based compensation

(6,949) (6,759) Non-GAAP professional services and

other cost of revenues $ 39,123 $ 34,720

Gross profit

(loss):

GAAP subscription gross profit

$ 305,760 $ 214,641 Stock-based compensation 7,938 6,607

Amortization of purchased intangibles 3,572 2,768

Non-GAAP subscription gross profit $ 317,270 $ 224,016 GAAP

professional services and other gross loss $ (5,424) $ (3,022)

Stock-based compensation 6,949 6,759 Non-GAAP

professional services and other gross profit $ 1,525 $ 3,737

GAAP gross profit $ 300,336 $ 211,619 Stock-based compensation

14,887 13,366 Amortization of purchased intangibles 3,572

2,768 Non-GAAP gross profit $ 318,795 $ 227,753

Gross margin: GAAP subscription gross margin 81% 80%

Stock-based compensation as % of subscription revenues 2% 3%

Amortization of purchased intangibles as % of subscription revenues

1% 1% Non-GAAP subscription gross margin 84%

84% GAAP professional services and other gross margin

-13% -8% Stock-based compensation as % of professional services and

other revenues 17% 18% Non-GAAP professional services

and other gross margin 4% 10% GAAP gross

margin 72% 69% Stock-based compensation as % of total revenues 3%

4% Amortization of purchased intangibles as % of total revenues

1% 1% Non-GAAP gross margin 76% 74%

Operating expenses: GAAP sales and marketing expenses

$ 212,086 $ 158,610 Stock-based compensation (38,401) (30,998)

Amortization of purchased intangibles (117) (18)

Non-GAAP sales and marketing expenses $ 173,568 $ 127,594

GAAP research and development expenses $ 84,489 $ 65,924

Stock-based compensation (21,801) (20,533) Amortization of

purchased intangibles (455) - Non-GAAP research and

development expenses $ 62,233 $ 45,391 GAAP general and

administrative expenses $ 46,251 $ 41,237 Stock-based compensation

(14,854) (10,411) Amortization of purchased intangibles (525) (101)

Business combination and other related costs (219)

(311) Non-GAAP general and administrative expenses $ 30,653 $

30,414 GAAP legal settlements $ - $ 270,000 Legal

settlements - (270,000) Non-GAAP legal settlements $

- $ -

Income (loss) from operations: GAAP loss from

operations $ (42,490) $ (324,152) Stock-based compensation 89,943

75,308 Amortization of purchased intangibles 4,669 2,887 Business

combination and other related costs 219 311 Legal settlements

- 270,000 Non-GAAP income from operations $ 52,341 $

24,354

Operating margin: GAAP operating margin -10%

-106% Stock-based compensation as % of total revenues 22% 25%

Amortization of purchased intangibles as % of total revenues 1% 1%

Business combination and other related costs as % of total revenues

0% 0% Legal settlements as % of total revenues 0% 88%

Non-GAAP operating margin 13% 8%

Net income

(loss): GAAP net loss $ (40,662) $ (333,332) Stock-based

compensation 89,943 75,308 Amortization of purchased intangibles

4,669 2,887 Business combination and other related costs 219 311

Legal settlements - 270,000 Amortization of debt discount and

issuance costs for the convertible senior notes 8,678 8,109 Income

tax expense effects related to the above adjustments

(20,978) (8,803) Non-GAAP net income $ 41,869 $ 14,480

Net income (loss) per share - basic and diluted:

GAAP net loss per share - basic and

diluted

$ (0.24) $ (2.06)

Non-GAAP net income per share - basic

$ 0.25 $ 0.09 Non-GAAP net income per share - diluted $ 0.24 $ 0.09

Weighted-average shares used to compute net income (loss)

per share - basic 168,742,366 162,067,108 GAAP

weighted-average shares used to compute net loss per share -

diluted 168,742,366 162,067,108 Effect of dilutive securities

(stock options and restricted stock units) 8,389,294

8,265,897 Non-GAAP weighted-average shares used to compute net

income per share - diluted 177,131,660 170,333,005

Free cash flow: GAAP net cash provided by operating

activities $ 187,424 $ 78,687 Purchases of property and equipment

(33,186) (29,077) Cash paid for legal settlements -

17,500 Non-GAAP free cash flow $ 154,238 $ 67,110

Free

cash flow margin: GAAP net cash provided by operating

activities as % of total revenues 45% 26% Purchases of property and

equipment as % of total revenues -8% -10% Cash paid for legal

settlements as % of total revenues 0% 6% Non-GAAP

free cash flow margin 37% 22%

(1) Adjusted

revenues and the corresponding growth rates are derived by applying

the exchange rates in effect during the comparison period rather

than the actual exchange rates in effect during the current period.

(2) Adjusted billings and the corresponding growth rates are

derived by applying the exchange rates in effect during the

comparison period rather than the actual exchange rates in effect

during the current period, and by replacing the portion of

multi-year billings in excess of twelve months during the current

period with the portion of multi-year billings in excess of twelve

months during the comparison period. (3) Effects of foreign

currency rate fluctuations and fluctuations in billing durations

are not applicable for the comparison period.

ServiceNow, Inc.

Reconciliation of Non-GAAP Financial Guidance

The financial guidance provided

below is an estimate based on information available as of March 31,

2017. The company’s future performance and financial results are

subject to risks and uncertainties, and actual results could differ

materially from the guidance set forth below. Some of the factors

that could affect the company’s financial results are stated above

in this press release. More information on potential factors that

could affect the company’s financial results is included from time

to time in the company’s public reports filed with the SEC,

including the company's Annual Report on Form 10-K filed on

February 28, 2017, the company's Form 10-Q for the quarter ended

March 31, 2017 to be filed with SEC. The company assumes no

obligation to update any forward-looking statements or information,

which speak as of their respective dates.

Three Months

Ended Three Months Ended Growth rates June 30,

2017 June 30, 2016 (3) GAAP subscription

revenues $400 - $404 million $291 million 38% - 39% Effects

of foreign currency rate fluctuations 9 million Non-GAAP

adjusted subscription revenues (1) $409 - $413 million 41% - 42%

GAAP subscription revenues $400 - $404 million $291 million

38% - 39% Increase in subscription deferred revenue 44

million 42 million Non-GAAP subscription billings

$444 - $448 million $333 million 33% - 35% Effects of

foreign currency rate fluctuations 11 million Effects of

fluctuations in billings duration 5 million Non-GAAP

adjusted subscription billings (2) $460 - $464 million 38% - 39%

GAAP professional services and other revenues $58 - $59

million $51 million 15% - 17% Effects of foreign currency

rate fluctuations 2 million Non-GAAP adjusted professional

services and other revenues (1) $60 - $61 million 18% - 20%

GAAP professional services and other revenues $58 - $59 million $51

million 15% - 17% Decrease in professional services and

other deferred revenue (11) million (9) million

Non-GAAP professional services and other billings $47 - $48 million

$42 million 12% - 14% Effects of foreign currency rate

fluctuations 2 million Non-GAAP adjusted professional

services and other billings (2) $49 - $50 million 16% - 19%

GAAP total revenues $458 - $463 million $341 million 34% - 36%

Effects of foreign currency rate fluctuations 11 million

Non-GAAP adjusted total revenues (1) $469 - $474 million 37%

- 39% GAAP total revenues $458 - $463 million $341 million

34% - 36% Increase in total deferred revenue from condensed

consolidated statements of cash flows 33 million 34 million

Non-GAAP total billings $491 - $496 million $375 million 31%

- 32% Effects of foreign currency rate fluctuations 13

million Effects of fluctuations in billings duration 5

million Non-GAAP adjusted total billings (2) $509 - $514

million 36% - 37% GAAP operating margin (11%)

Stock-based compensation expense as % of total revenues 21%

Amortization of purchased intangibles as % of total revenues 1%

Non-GAAP operating margin 11% GAAP weighted-average

shares used to compute net loss per share - diluted 170 million

Effect of dilutive securities (stock options and restricted

stock units) 9 million Non-GAAP weighted-average shares used

to compute net income per share - diluted 179 million

Twelve Months Ended Twelve Months Ended Growth

rates December 31, 2017 December 31, 2016

(3) GAAP subscription revenues

$1,670 - $1,685 million

$1,222 million 37% - 38% Effects of foreign currency rate

fluctuations 23 million Non-GAAP adjusted subscription

revenues (1) $1,693 - $1,708 million 39% - 40% GAAP

subscription revenues $1,670 - $1,685 million $1,222 million 37% -

38% Increase in subscription deferred revenue 360 million

289 million Non-GAAP subscription billings $2,030 -

$2,045 million $1,511 million 34% - 35% Effects of foreign

currency rate fluctuations 28 million Effects of

fluctuations in billings duration 6 million Non-GAAP

adjusted subscription billings (2) $2,064 - $2,079 million 37% -

38% GAAP professional services and other revenues $190 -

$195 million $169 million 13% - 15% Effects of foreign

currency rate fluctuations 3 million Non-GAAP adjusted

professional services and other revenues (1) $193 - $198 million

14% - 17% GAAP professional services and other revenues $190

- $195 million $169 million 13% - 15% Increase in

professional services and other deferred revenue 15 million 11

million Non-GAAP professional services and other

billings $205 - $210 million $180 million 14% - 17% Effects

of foreign currency rate fluctuations 3 million Non-GAAP

adjusted professional services and other billings (2) $208 - $213

million 16% - 18% GAAP total revenues $1,860 - $1,880

million $1,391 million 34% - 35% Effects of foreign currency

rate fluctuations 26 million Non-GAAP adjusted total

revenues (1) $1,886 - $1,906 million 36% - 37% GAAP total

revenues $1,860 - $1,880 million $1,391 million 34% - 35%

Increase in total deferred revenue from condensed consolidated

statements of cash flows 375 million 300 million

Non-GAAP total billings $2,235 - $2,255 million $1,691 million 32%

- 33% Effects of foreign currency rate fluctuations 31

million Effects of fluctuations in billings duration 6

million Non-GAAP adjusted total billings (2) $2,272 - $2,292

million 34% - 36% GAAP subscription gross margin 81%

Stock-based compensation expense as % of subscription revenues 2%

Amortization of purchased intangibles as % of subscription

revenues 1% Non-GAAP subscription gross margin 84%

GAAP professional services and other gross margin 0%

Stock-based compensation expense as % of professional services and

other revenues 15% Non-GAAP professional services and other

gross margin 15% GAAP total gross margin 73%

Stock-based compensation expense as % of total revenues 3%

Amortization of purchased intangibles as % of total revenues 1%

Non-GAAP total gross margin 77% GAAP operating margin

(5%) Stock-based compensation expense as % of total revenues

20% Amortization of purchased intangibles as % of total

revenues 1% Non-GAAP operating margin 16% GAAP net

cash provided by operating activities as % of total revenues 32%

Purchases of property and equipment as % of total revenues

(7%) Non-GAAP free cash flow margin 25% GAAP

weighted-average shares used to compute net loss per share -

diluted 170 million Effect of dilutive securities (stock

options and restricted stock units) 9 million Non-GAAP

weighted-average shares used to compute net income per share -

diluted 179 million (1) Adjusted

revenues and the corresponding growth rates are derived by applying

the exchange rates in effect during the comparison period rather

than the forecasted exchange rates for the guidance period. (2)

Adjusted billings and the corresponding growth rates are derived by

applying the exchange rates in effect during the comparison period

rather than the forecasted exchange rates for the guidance period,

and by replacing the forecasted portion of multi-year billings in

excess of twelve months for the guidance period with the actual

portion of multi-year billings in excess of twelve months during

the comparison period. (3) Effects of foreign currency rate

fluctuations and fluctuations in billing durations are not

applicable for the comparison period.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170426006420/en/

ServiceNowMedia Contact:Joanne Blum,

310-489-7278press@servicenow.comorInvestor

Contact:ir@servicenow.com

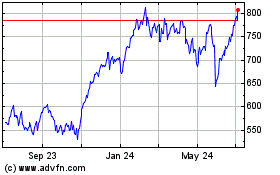

ServiceNow (NYSE:NOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

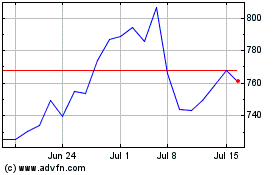

ServiceNow (NYSE:NOW)

Historical Stock Chart

From Apr 2023 to Apr 2024