M6 Métropole Télévision: First Quarter 2017

April 26 2017 - 12:45AM

Business Wire

Regulatory News:

M6 Métropole Télévision (Paris:MMT):

Advertising revenue: €210.2 million, up

5.7%

Profit from recurring operations (EBITA)

€47.1 million, up 2.9%

1st Quarter (in €m) 1

2017

2016 change Group advertising revenue

210.2 199.0 +5.7% - of which FTA channels'

advertising revenue

196.6 186.1 +5.6% - of which cab-sat

channels and other media advertising revenue

13.6

12.8 +6.4% Non advertising revenue

113.5 112.9 +0.5%

Consolidated

revenue 323.7 311.8 +3.8%

Over the first quarter of the 2017 financial year, M6 Group

posted consolidated revenue of €323.7 million, an increase of

3.8% in comparison with the first quarter of 2016.

The Group’s advertising revenue for the first three months

(free-to-air and pay channels, internet) grew 5.7%, reflecting

gains in free-to-air channels’ audience share and

buoyant internet audience figures.

Non-advertising revenue rose slightly, up 0.5%, with the decline

in the home shopping business and the expected fall in the

contribution from the M6 mobile by Orange contract being more than

offset by the integration of iGraal and the growth in TV rights

collected by F.C.G.B.

During the first quarter of the financial year, consolidated

profit from recurring operations (EBITA) reached €47.1 million, an

increase of 2.9% in relation to the €45.8 million achieved in the

first quarter of 2016.

(in €m)

1st Quarter 2017

2016 change Consolidated revenue

211.8 201.0

+5.4% o.w. FTA channels' advertising revenue

196.6 186.1

+5.6%

The individual television viewing time over the first

quarter of 2017 was stable and, for people aged four and

over, reached 3 hours 52 minutes.

1 The information provided is intended to highlight the

breakdown of consolidated revenue between advertising and

non-advertising revenue. Group advertising revenues include the

revenues of the free-to-air channels M6, W9 and 6ter, the

advertising portion of revenues from pay channels and the

advertising portion of revenues generated by diversification

activities (mainly internet).

M6 Group confirmed its growth across all audiences with

an average audience share of 13.9% for its free-to-air channels (an

increase of 0.3 percentage points vs. Q1 2016, source -

Médiamétrie), and among women under 50 responsible for

purchases, with an average audience share of 22.2% (up 0.4

points vs. Q1 2016):

- The M6 channel maintained its

2nd placed position amongst the under 50s across

the entire day;

- W9 achieved year-on-year growth both

across audiences as a whole (up 0.2 points) and on the commercial

target (up 0.3 points);

- 6ter remained the top ranked of the

new DTT channels on the commercial target, achieving the

highest year-on-year growth of the new DTT channels on this target

(up 0.5 points).

M6 Group’s free-to-air channels were able to capitalise on their

solid 2016 and early 2017 audience figures to continue to

gain advertising market share and record a 5.6% increase in

advertising revenue in what remained a cautious market.

Moreover, M6 Group’s pay channels consolidated their position

amongst the leading pay channels. With 11.2 million viewers each

month, Paris Première was the most watched pay channel.

Téva was the top ranked pay channel on the commercial target

(source: Médiamétrie Médiamat Thématik, from 29 August 2016 to 12

February 2017).

-

PRODUCTION & AUDIOVISUAL RIGHTS

(in €m)

1st Quarter 2017

2016 change Consolidated revenue

31.5 30.5

+3.5%

At 31 March 2017, revenue from Production & Audiovisual

Rights activities increased €1.0 million (up 3.5%) mainly due

to a busy cinema release schedule for SND (4.6 million cinema

admissions) and to the latter’s buoyant rights selling business,

especially on international markets.

The first quarter of 2017 was marked by the cinema release of La

La Land (2.7 million admissions) and Lion (1.8 million).

(in €m)

1st Quarter 2017

2016 change Consolidated revenue

80.3 80.2

+0.1%

Diversification revenue was stable over the first quarter of the

financial year, primarily due to:

- M6 Web, whose revenue grew by

€1.4 million (up 5.6%). The effects of the integration of iGraal,

the cashback company acquired in November 2016, and the advertising

performance of 6play, whose number of registered users now exceeds

16 million, were mitigated by the fall in the contribution of M6

mobile by Orange as provided for in the protocol agreement signed

with Orange in 2016;

- F.C.G.B, whose revenue grew €1.8

million (up 13.4%), as a result of the revaluation of the

Ligue 1 TV rights at the start of the current season;

- Ventadis, which saw its sales

fall €5.5 million or 14.0%, notably as a result of the ongoing

restructuring of the home shopping business following the CSA’s

refusal of its application to become a free-to-air DTT

channel.

- FINANCIAL POSITION

At 31 March 2017, Group equity totalled €642.5 million (€616.3

million at 31 December 2016) with a net cash position of €221.1

million (€176.4 million at 31 December 2016).

For the first quarter of the financial year, consolidated

profit from recurring operations (EBITA)2 reached

€47.1 million, compared with €45.8 million for the three months

to 31 March 2016. The increase in the contribution of TV

activities, together with the growth in advertising revenues, was

partially offset by the higher programming cost, reflecting the

Group’s desire to pursue its investments in order to maintain the

audience momentum of its channels.

- DIVIDEND AND ANNUAL GENERAL

MEETING

The Combined General Meeting convened today will be asked to

approve the payment3 of a dividend of €0.85 per

share in respect of the 2016 financial year, unchanged from the

previous year, corresponding to a yield of 4.8% based on the 2016

closing price.

Next release: Half-year financial information

on 25 July 2017 after close of tradingM6 Métropole Télévision is

listed on Euronext Paris, Compartment ATicker: MMT, ISIN Code:

FR0000053225

2 Profit from recurring operations (EBITA) is

defined as operating profit (EBIT) before amortisation and

impairment of intangible assets(excluding audiovisual rights)

related to acquisitions and capital gains and losses on the

disposal of financial assets and subsidiaries.

3 Last trading day with dividend rights: 16 May

2017 - Ex-dividend date: 17 May 2017 - Payment date: 19 May

2017

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170425006441/en/

M6 Métropole TélévisionINVESTOR RELATIONSEric Ghestemme, +33

(0)1 41 92 59 53eric.ghestemme@m6.frorPRESSAdélaïde Stella, +33

(0)1 41 92 61 36adelaide.stella@m6.fr

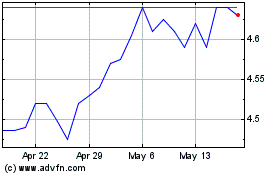

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Apr 2023 to Apr 2024