Additional Proxy Soliciting Materials (definitive) (defa14a)

April 17 2017 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

x

|

Soliciting Material under §240.14a-12

|

|

|

|

SONUS NETWORKS, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

Beginning April 17, 2017,

Sonus Networks, Inc., a Delaware corporation (“Sonus”), provided the materials contained in this Schedule 14A in communications to certain of its stockholders. The materials are filed herewith pursuant to Rule 14a-12.

Important Additional Information and Where to Find It

Sonus intends to file a definitive proxy statement (the “2017 Proxy Statement”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its 2017 annual meeting of stockholders (the “2017 Annual Meeting”). Stockholders are urged to read the 2017 Proxy Statement carefully when it becomes available, before making any voting decisions, because it contains important information. Stockholders will be able to obtain the 2017 Proxy Statement, any amendments or supplements thereto and other documents filed by Sonus with the SEC free of charge at the SEC’s website at

www.sec.gov or at Sonus’ own website at http://investors.sonusnet.com.

Participants in Solicitation

Sonus and its directors and executive officers may be deemed to be participants in any solicitation of proxies from Sonus stockholders in connection with the matters to be considered at the 2017 Annual Meeting. Information about Sonus’ directors and executive officers is available in Sonus’ 2016 proxy statement, filed with the SEC on April 28, 2016 (the “2016 Proxy Statement”), in connection with its 2016 annual meeting of stockholders. To the extent holdings of Sonus’ securities by Sonus’ directors and executive officers have changed since the amounts stated in the 2016 Proxy Statement, such changes have been reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC.

Important Information Regarding Forward-Looking Statements

This Schedule 14A contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, which are subject to a number of risks and uncertainties. All statements other than statements of historical facts contained in this Schedule 14A, including statements in the “Financial Results Driven by Cost Management” section of the presentation, and statements regarding Sonus’ future results of operations and financial position, industry developments, business strategy, plans and objectives of management for future operations and plans for future cost reductions are forward-looking statements. Without limiting the foregoing, the words “anticipates”, “believes”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “seeks” and other similar language, whether in the negative or affirmative, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are based on Sonus’ current expectations and assumptions regarding ‘its business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Sonus’ actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to: the timing of customer purchasing decisions and Sonus’ recognition of revenues; economic conditions; Sonus’ ability to recruit and retain key personnel; difficulties supporting Sonus’ strategic focus on channel sales; difficulties retaining and expanding Sonus’ customer base; difficulties leveraging market opportunities; the impact of restructuring and cost-containment activities; Sonus’ ability to realize benefits from the Taqua, LLC (“Taqua”) acquisition and the Treq Labs, Inc. (“Treq”) asset acquisition; the effects of disruption from the Taqua and Treq transactions, making it more difficult to maintain relationships with employees, customers, business partners or government entities; the success implementing the integration strategies of Taqua and Treq assets; litigation and the ongoing SEC inquiry; actions taken by significant stockholders; difficulties providing solutions that meet the needs of customers; market acceptance of Sonus’ products and services; rapid technological and market change; Sonus’ ability to protect its intellectual property rights; Sonus’ ability to maintain partner, reseller, distribution and vendor support and supply relationships; higher risks in international operations and markets; the impact of increased competition; currency fluctuations; changes in the market price of Sonus’ common stock; and/or failure or circumvention of Sonus’ controls and procedures. Important factors that could cause actual results to differ materially from those in these forward-looking statements are discussed in the “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and “Quantitative and Qualitative Disclosures About Market Risk” sections in Sonus’ filings with the SEC. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Sonus’ actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking

statements. Sonus therefore cautions you against relying on any of these forward-looking statements. Also, any forward-looking statement made by Sonus in this Schedule 14A speaks only as of the date of this Schedule 14A. Factors or events that could cause Sonus’ actual results to differ may emerge from time to time, and it is not possible for Sonus to predict all of them. Sonus undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Stockholder Communication and Slide Presentation

Beginning April 17, 2017, Sonus sent the following form of communication, including the accompanying slide presentation, to certain of its stockholders

:

Dear [Name]: Attached are a few slides highlighting Sonus Networks’ pay for performance strategy, in general, and our incentive compensation tools and metrics, in particular. We know this is a particularly busy time, but we would appreciate the opportunity to schedule a call with you and one of our Compensation Committee members to explain the progress the company has made towards the goals it has set, and to hear any comments, questions or suggestions you may have. Thank you in advance for your consideration. Sincerely, Jeff Snider, Chief Administrative Officer

Sonus Networks, Inc. Compensation Practices Update Spring 2017

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, which are subject to a number of risks and uncertainties. All statements other than statements of historical facts contained in this presentation, including statements in the section “Financial Results Driven by Cost Management”, and statements regarding our future results of operations and financial position, industry developments, business strategy, plans and objectives of management for future operations and plans for future cost reductions are forward-looking statements. Without limiting the foregoing, the words “anticipates”, “believes”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “seeks” and other similar language, whether in the negative or affirmative, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to: the timing of customer purchasing decisions and our recognition of revenues; economic conditions; our ability to recruit and retain key personnel; difficulties supporting our strategic focus on channel sales; difficulties retaining and expanding our customer base; difficulties leveraging market opportunities; the impact of restructuring and cost-containment activities; our ability to realize benefits from the Taqua, LLC (“Taqua”) acquisition and the Treq Labs, Inc. (“Treq”) asset acquisition; the effects of disruption from the Taqua and Treq transactions, making it more difficult to maintain relationships with employees, customers, business partners or government entities; the success implementing the integration strategies of Taqua and Treq assets; litigation and the ongoing SEC inquiry; actions taken by significant stockholders; difficulties providing solutions that meet the needs of customers; market acceptance of our products and services; rapid technological and market change; our ability to protect our intellectual property rights; our ability to maintain partner, reseller, distribution and vendor support and supply relationships; higher risks in international operations and markets; the impact of increased competition; currency fluctuations; changes in the market price of our common stock; and/or failure or circumvention of our controls and procedures. Important factors that could cause actual results to differ materially from those in these forward-looking statements are discussed in the “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and “Quantitative and Qualitative Disclosures About Market Risk” sections in our filings with the SEC. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We therefore caution you against relying on any of these forward-looking statements. Also, any forward-looking statement made by us in this presentation speaks only as of the date of this presentation. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Financial Results Driven by Cost Management 1 Refer to Appendix A for an explanation and reconciliation of non-GAAP financial measures. The Company experienced modest revenue growth in 2016, but significantly improved profitability through margin expansion and cost cutting Improved profitability will be used to drive our revenue growth strategies for providing security for real-time internet-based communications 1.4% Growth $249.0 $252.6 $200 $210 $220 $230 $240 $250 $260 2015 2016 Top Line Growth Revenue ($M) - $0.02 $0.33 - $0.64 - $0.28 -$0.80 -$0.60 -$0.40 -$0.20 $0.00 $0.20 $0.40 2015 2016 Bottom Line Growth GAAP & Non - GAAP EPS 1 Non-GAAP EPS GAAP EPS

Compensation Practices – Program Design Senior Management Cash Incentive Plan (“SMCIP”) emphasizes profitability and revenue, which are critical to long-term success Annual Incentives Our incentive programs are designed to support our long-term business strategy Relative total shareholder return metric as part of the vesting calculation of performance-based restricted stock units (“PSUs”) rewards executives for success toward long-term goals, as reflected in stock price Long-Term Incentives Profitability 60% Revenue 40% Time - Based Restricted Shares 75% PSUs 25%

Compensation Practices – 2016 Achievement Variable compensation payouts tied to 2016 performance were below target, demonstrating alignment of Company performance and compensation * The percentages represent the number of shares of Sonus common stock that vested for the 2016 performance period in connection with the performance-based restricted stock units (“PSUs”) granted on March 16, 2015 (“2015 Tranche II”) and April 1, 2016 (“2016 Tranche I”), respectively. The PSUs relating to the 2015 Tranche II vested at 90.4% of target for the 2016 performance period. The PSUs relating to the 2016 Tranche I vested at 76% of target for the 2016 performance period. Performance for these awards during such award’s 2016 performance period was measured based on the Company’s total shareholder return (“TSR”) compared to pre-established relative TSR goals, based on the TSR of the NASDAQ Telecommunications Index, that were set by the Compensation Committee of the Company’s Board of Directors. Payout Achievement Based on 2016 Performance 93% 90.4% 76% 0% 50% 100% 150% 200% SMCIP 2015 Tranche II 2016 Tranche I PSUs *

Pay and Performance: CEO Pay Opportunity vs. Current Realizable Value From 12/31/12 to 12/31/16 From 12/31/13 to 12/31/16 From 12/31/14 to 12/31/16 From 12/31/15 to 12/31/16 TSR -26% -60% -68% -12% Realizable Value as a % of CEO Pay Opp. -55% -53% -51% -13% Methodology and Assumptions: - “CEO Pay Opportunity” means the sum of the base salary, target bonus and grant date fair value of long-term incentive awards of the CEO for the applicable year - “Realizable Value” means the sum of the base salary and target bonus the CEO received for that applicable year plus the value of the long-term incentive awards at December 31, 2016 - “TSR” means total shareholder return - FY14 salary and FY13-14 SMCIP opportunity reflect impact of stock-for-cash election premium - FY13 and FY14 realizable base salary reflects the value of stock-for-salary at the respective fiscal year end prices - FY13 and FY14 realizable SMCIP reflects value on date of vesting - FY14 base salary includes $29,167 which was cash paid to CEO in connection with raise - Outstanding PSUs valued at target Bonus and performance-based equity payouts commensurate with absolute and relative company performance result in alignment of pay and performance $2,768 $1,254 $5,609 $2,659 $5,211 $2,552 $2,328 $2,030 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Pay Opp. Realizable Value Pay Opp. Realizable Value Pay Opp. Realizable Value Pay Opp. Realizable Value 2013 2014 2015 2016 Thousands CEO Pay Opportunity vs. Realizable Value at 12/31/16 Salary SMCIP LTI Target Total Direct

Compensation Practices Other Factors to Consider CEO’s Behavior Closely Aligned with Interests of Shareholders CEO purchased over $6M of stock in the open market Streamlined Executive Team Has Resulted in Decreased Aggregate Compensation Expense $3,755 $3,080 $2,748 $- $1,000 $2,000 $3,000 $4,000 2014 2015 2016 Thousands Target Total Cash Compensation (Excl. CEO) Finance Technology Engineering CAO CIO Sales Services Business Development

Responsiveness to Shareholder Feedback Established fixed financial metrics for our cash bonus plans, based on revenue and profitability Added performance awards to our equity incentive compensation mix Instituted share ownership guidelines for our executives and board members Adopted a formal clawback policy with respect to our incentive compensation plans What We Did in Response to Shareholder Feedback Independent compensation consultant Annual market-based review of compensation levels Annual risk assessment of compensation plans and policies What We’ve Always Done

Responsiveness to Shareholder Feedback We did not exercise discretion to enhance bonus achievement –discretion exercised only to reduce cash bonus payouts We did not exercise discretion in determining achievement of performance-based equity awards What We Stopped Doing in Response to Shareholder Feedback No gross-up provisions No pension plans or other post-employment benefit plans No severance multipliers in excess of two times pay No multi-year guaranteed incentive awards for executives What We’ve Never Done

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC Sonus Networks, Inc. (“Sonus”) intends to file a definitive proxy statement (the “2017 Proxy Statement”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its 2017 annual meeting of stockholders (the “2017 Annual Meeting”). Stockholders are urged to read the 2017 Proxy Statement carefully when it becomes available, before making any voting decisions, because it contains important information. Stockholders will be able to obtain the 2017 Proxy Statement, any amendments or supplements thereto and other documents filed by Sonus with the SEC free of charge at the SEC’s website at www.sec.gov or at Sonus’ own website at http://investors.sonusnet.com. Sonus and its directors and executive officers may be deemed to be participants in any solicitation of proxies from Sonus stockholders in connection with the matters to be considered at the 2017 Annual Meeting. Information about Sonus’ directors and executive officers is available in Sonus’ 2016 proxy statement, filed with the SEC on April 28, 2016 (the “2016 Proxy Statement”), in connection with its 2016 annual meeting of stockholders. To the extent holdings of Sonus’ securities by Sonus’ directors and executive officers have changed since the amounts stated in the 2016 Proxy Statement, such changes have been reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC.

Appendix A – Discussion of Non-GAAP Financial Measures

Appendix A – Discussion of Non-GAAP Financial Measures (continued)

Appendix A – Discussion of Non-GAAP Financial Measures (continued)

Appendix A – Discussion of Non-GAAP Financial Measures (continued)

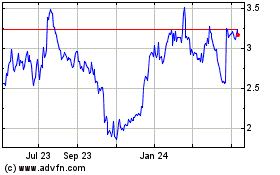

Ribbon Communications (NASDAQ:RBBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

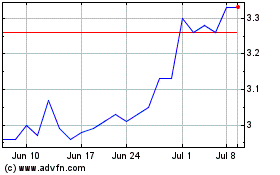

Ribbon Communications (NASDAQ:RBBN)

Historical Stock Chart

From Apr 2023 to Apr 2024